Money loves the bill: how cars sort bills

For many years we have been receiving salaries on bank cards, paying for utility bills through the Internet bank and transferring money from card to card using a mobile application. Only in this digital picture of the new cashless world there is one nuance: the turnover of cash does not decrease, but only grows from year to year. And together with it the sphere of service of cash payments grows. Therefore, still sorting and accounting of banknotes remains a popular direction in the banking sector. Is there room for innovation? We read our new post under the cut.

In October 2017, the Swiss Bank for International Settlements (BIS) issued a surprising report for many , in which it provided data on the cash circulation segment in 23 major economies of the world, including Russia. According to him, from 2012 to 2016, the share of cash payments in the countries' GDP after a slight decrease resumed growth. A notable exception was Sweden, where the refusal of cash is supported by the banking sector.

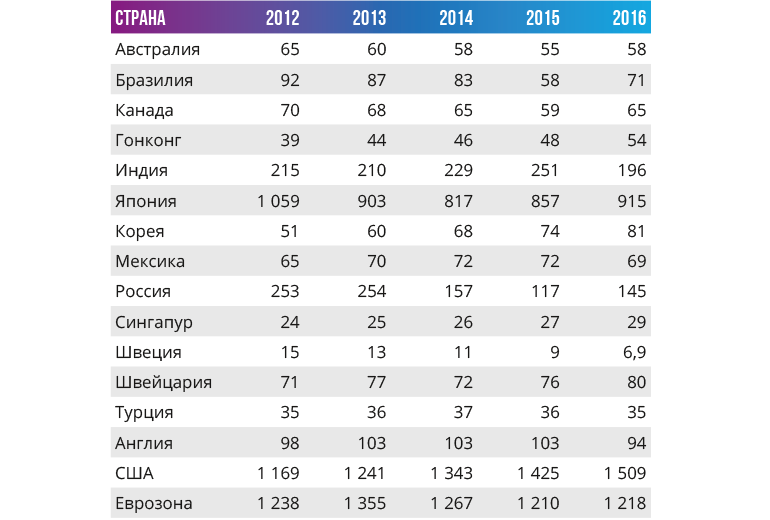

The volume of cash in circulation in countries, billions of US dollars

Source: PLUS

The reasons for the popularity of cash in the world are quite prosaic: incomplete security of retail terminals for receiving cards, the surcharge for non-cash in a number of countries and the conservatism of buyers. So, dreams about the imminent transition of the global financial system to a total blockchain and electronic payments will not soon be realized.

This means that banks and other organizations need to process cash quickly and efficiently. Take for example a bank serving a network of popular retail stores. After collection and receipt of a huge mass of cash, the bank needs to recount it, check all banknotes for authenticity, credit the funds to the client’s account, and send the excess money supply to the vault or securities. To make such a complex operation every day will require a huge staff of very attentive people. Or a few automated cash handling systems.

Banknote path: back and forth

As of July 2018, the amount of cash in circulation in Russia amounted to 5.99 billion banknotes (in pieces, not rubles) - that is, not counting 66 billion coins. Almost all of this money is constantly circulating through banks, briefly lingering in the hands of individuals.

After you pay with a banknote in a store, it is sent with a collection to a bank serving a retail outlet. There the money is recalculated, sorted and sent to the bank vault. As cash accumulates in vaults, private banks send it to the Central Bank of Russia, where the funds received are credited to banks' correspondent accounts. When private banks once again need to replenish their cash reserves, they "withdraw" them from their account through the Central Bank, receiving bills with collectors.

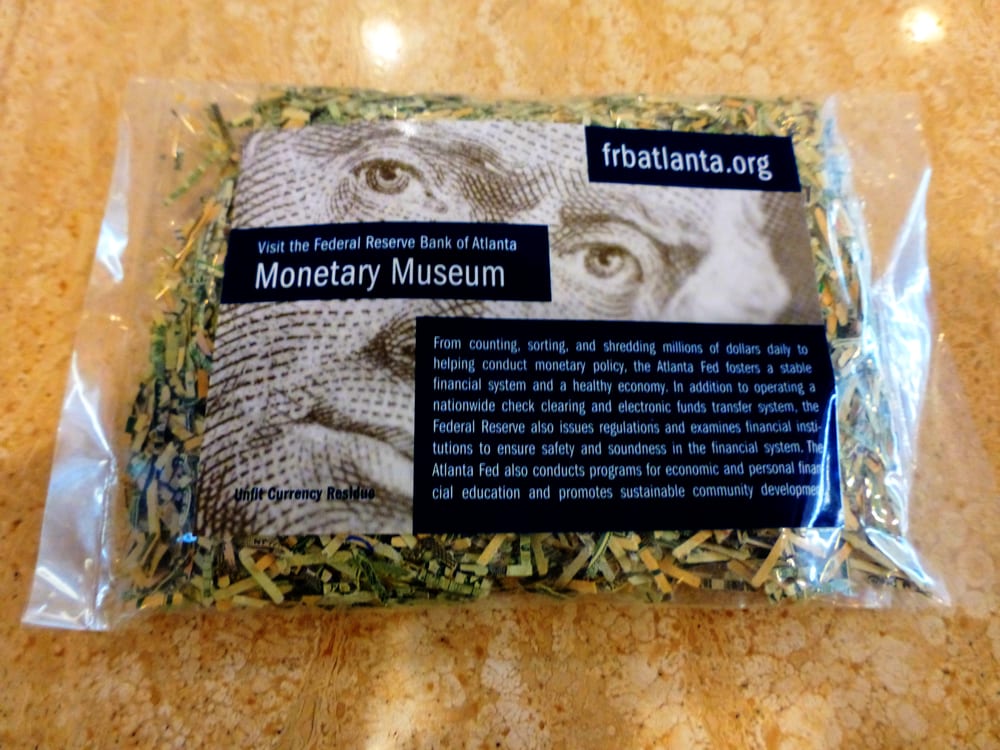

Central Bank is the alpha and omega of the economy. The Central Bank is engaged in the issuance of banknotes, and it also controls the entire money supply in the country, removing old notes from circulation and introducing new ones. Receiving cash from banks, the Central Bank sorts it according to the degree of depreciation, sending old banknotes for processing. In exchange, new banknotes are introduced into circulation. That is why Russia does not meet worn and torn banknotes ( excellent report from The Village on this topic). After sorting, the money supply is packaged and sent to storage or distributed to banks. From there, bundles of money tied up with ribbons of 100 bills, called “roots” in the banking language, diverge at banks' cash desks, ATMs and retail outlets. Source: Michael W. / yelp.com

In the museums of the US Federal Reserve, you can buy a souvenir pack of cash scraps left over from the disposal of dilapidated dollars.

A Brief History of Money Sorting

Until the 1920s, even the largest amounts of money were considered manually - by the employees of banks. For example, the US Federal Reserve System Cash Accounting Centers were dark rooms with bars on the windows, where employees, sitting at large wooden tables close to each other, were manually counted and checked the authenticity of incoming banknotes. It was necessary to make sure that in each received bundle of money exactly 100 bills of the same denomination, and checking for authenticity was carried out by eye in the truest sense of the word - a suspicious banknote was sent to a simple device, where it was carefully compared with a genuine sample on the grid, assessing the coincidence of the pattern.

Rare Porter counterfeit detector, in which a suspicious grid bill was compared with a real bill.

A source:Heritage Auctions Inc.

In the 1920s, the first automatic bill sorting machine made by the Federal Bill Counter Company appeared. The device laid out a stack of bills in bundles of 100 banknotes. As soon as in one of the output trays a hundred were gathered, the machine stopped, and the operator separated the finished pack with a wooden partition and started sorting again. And although the car was sometimes wrong, its accuracy was much higher than that of professional sorters.

One of the first machines for counting money. No authentication or sorting - just counting the number of bills.

Source: kkm74.ru

The first sorting device operated in the US Federal Reserve System with little or no change in design until the late 1960s. Together with the mechanisms in the cash centers of the Fed continued to work people-sorters. A newbie in this position handled about 15 bags of one-dollar bills per day. As experience gained, a person gained access to large denomination notes that required special attention when checking for authenticity. For example, 55 sorters worked at the Federal Reserve Bank of Philadelphia, of which only a few people were allowed to work with $ 50 and $ 100 bills.

The cost and inefficiency of human labor was obvious, but the technologies of that time did not allow people to be completely replaced in sorting and checking money. In order to speed up the process somehow, the calculation of small denomination bills (up to $ 20) was started by weighing - the weight of a bundle of 100 banknotes with a tape was compared with a reference bundle. This method, although it accelerated the sorting, but had a number of serious drawbacks: the stage of checking out worn out and torn banknotes, requiring replacement, fell out of the sorting process.

During the hyperinflation of 1923 in the Weimar Republic (Germany), money was also considered weighing, only there it was not the bank employees who were engaged, but ordinary people.

Somewhere in the world today as well Source: historydaily.org

In the early 1970s, Japan invented a counting machine of new design, which quickly gained popularity and became the standard for all calculating and sorting devices. This design is well known to everyone who has ever seen counting machines at the banks' cash desks: notes are separated from the stack with the help of rollers one by one and quickly fed into the counting unit. Each banknote passing through it closes a control contact, thus counting the past bills.

In 1981, together with the beginning of digitalization of everything and everything, a revolutionary REI High-Speed counter appears in banks, capable of sorting banknotes by nominal value and checking their authenticity. And all this with a fantastic speed of up to 72 thousand bills per hour. This machine has become the progenitor of all modern sorting devices of the full cycle - in fact, the newest machines repeat the functionality of REI High-Speed, featuring greater accuracy, speed and additional features.

Recycling - autonomous sorting

One of the new trends in the banking sector, which is still not widespread in Russia, is cash-recycling - the turnover of cash deposited in an ATM. ATMs with the function of receiving money installed in the branches of many banks. Through such devices, you can either withdraw funds from a card or deposit cash into an account. The money in such ATMs is divided into two independent masses: the bank is filled with banknotes for issue in one cassette, banknotes sent by customers are sent to another cassette. Contrary to the stereotypes made through cash-in, the money goes to the bank and is not given out to other people when cash is withdrawn.

Cash machines with cash recycling function make it possible to issue deposited money to other customers. But for this it is not enough just to combine the cassettes - you need to install a compact counting and sorting machine with the authenticity of banknotes in the ATM. Recycling ATMs in the same way as large machines in banks, select bills according to the degree of wear, sending in a separate tray those that are unsuitable for further issuance by ATM. If among the deposited funds there are suspicious notes, they are also withdrawn by the ATM from further circulation, and the data of the card used is recorded.

By the way, it is quite simple to distinguish cash-in and recycling-ATM: for cash recycling, a single tray of receiving and issuing bills is used, whereas a regular cash-in device has two - one for depositing and one for issuing.

Tinkoff Bank also uses only cash recycling ATMs - they reduce the number of cash collections and do not go beyond the dimensions of conventional ATMs.

Source: Tinkoff.ru / habr.com company blog.

The cash recycling benefits for banks are obvious, because self-sufficient cash machines reduce the collection rate. If it is necessary to maintain a network of thousands of ATMs, an impressive savings result from recycling. For example, in China, recycling has reduced the cost of handling cash turnover by 70%. In Russia, the gradual commissioning of cash-recycling ATMs has already begun, and Pochta Bank (formerly Summer Bank) uses only recycling devices. A total of 203,000 ATMs operate in Russia., half of which has the function of receiving money. Their gradual replacement with recycling devices will provide huge savings on the logistics of cash.

Trust issue

One of the main tasks when working with cash is to check their authenticity. If the cash desk of a small store has enough simple detectors that are well known to everyone, then on the scale of banks, sophisticated detectors are needed that check banknotes for all machine-readable features. What signs are we talking about?

Banknotes have dozens of signs to check their authenticity, some of which can be checked with their own eyes using a magnifying glass, and some can only be read by special scanners. Human readable features include, for example, metallized tape, microprinting, hologram, embossed printing, perforation, and so on. The machine-readable images include images visible in infrared and ultraviolet rays, magnetic marks, special elements with phosphorescent and light-absorbing paint, and even secret signs that nobody knows about except the banknote issuer, that is, the Central Bank.

Rubles are very entertaining to study all degrees of protection. On the website of the Central Bank of the Russian Federation you can learn about the signs of authenticity - most of them check the counting and sorting machines.

Source: Central Bank of the Russian Federation

The unmistakable recognition of counterfeit banknotes of the highest quality is a very difficult task for sorting machines. For use in Russian banks are allowed only those machines that have passed complex tests in the Central Bank . The list of sorting machines permitted by the Central Bank is small, but among them is the Toshiba IBS-1000.

How does the counting sorting machine

Modern banknote sorting machine is the most complex device with the simplest interface. For example, with a high-speed sorter Toshiba IBS-1000 any person will cope after a short twenty-minute training, since all control of the device occurs through the touch screen and a very concise interface.

Toshiba IBS-1000 with two modules - advanced sorting / facialization and module banding. The whole construction is placed on a wide office desk.

Copyright: Toshiba Corporation

Money placed in the receiving tray. The IBS-1000 boot pocket holds 2000 bills of any denomination — a stack about 25 cm high. Just imagine such a lot of money and think for how long it will take one person to recount and decompose it into nominal values. Moreover, after a manual account, it would be nice to count such a pile of money - even when counting hundreds of bills, it is easy to make a mistake.

The most productive banknote sorters become heroes of YouTube videos, but in reality they lose to machines in speed and counting accuracy.

A non-professional will be able to flip through banknotes at a speed of 3 sheets per second. Five-finger account wizards scroll through 7-8 banknotes per second. Toshiba IBS-1000 correctly processes more than 16 bills per second, counting, turning and sorting them at face value and degree of wear. The latter is very important, since banknotes have three degrees of wear: “ATM” (excellent condition, suitable for ATMs), “suitable for issue through banks' cash desks” and “dilapidated”, sent for disposal in shredders. Sorting statistics for accounting is saved to the server.

Demonstration of the IBS-1000

IBS-1000 in the database has six pockets, into which it distributes bills of different denominations, checking them in IR, UV rays, as well as scanning the visible image and magnetic marks. If you want to weed out all the old notes, the machine will look for banknotes with stains, physical damage and tape.

For two minutes, the machine will sort 2000 banknotes. An expansion module and a banding module can be connected to the IBS-1000. The first device has four additional pockets, as well as a facial module or, in simple terms, turning over bills with the right side. This is necessary to get neat packs, ready to be wrapped and loaded into ATMs.

And what is banding? So in the banking language is called stapling of 100 banknotes with a tape indicating the denomination of bills, the amount of money and details of the bank. With this Toshiba IBS-1000 expansion module, it doesn’t just sort the money, but provides ready-tied bundles of banknotes - the “roots”. The machine will accurately make the work of the whole department in just a few minutes, while it fits on the same table, and one operator can control it.

So far, cash is not in a hurry to disappear from circulation, which means that counting and sorting machines remain in demand in all countries where they use paper or plastic money. Even in Sweden.