Voronezhets signed a contract with the bank, making his own changes, and is going to sue 24 million rubles

Probably, there is no person who would not be annoyed that the most important points in contracts are always written in small print.

Probably, there is no person who would not be annoyed that the most important points in contracts are always written in small print. But, knowing this, time after time, many people sign papers without having read them carefully, and pay commissions that they did not know about.

A 42-year-old resident of Voronezh has found a witty way to turn this feature to his advantage, and now, using the carelessness of bankers, he is going to sue them for 24 million rubles.

In 2008, a resident of the regional center received a letter from CJSC Tinkoff Credit Systems offering to use a credit card. For its execution, it was necessary to fill out an application form and send it to the specified address.

Voronezh rescanned the form and changed the conditions proposed by the bank, in that very part with a small print. He pointed out that the interest rate for using a loan and the commission for issuing cash are 0%, and "the client has the right not to pay all fees and fees provided by the tariffs." In addition, instead of the bank’s address www.tcsbank.ru, the Voronezh citizen indicated his website www.tcsbank.at.ua , confirming that he’s familiarized with the current General Terms and Tariffs posted on the Internet. In other words, he prescribed for himself an unlimited and interest-free loan.

Separately, the contract on his website provided for cases if the bank violated the terms of the document. “The Bank does not have the right to amend or amend these General Terms and Conditions unilaterally. In case of a change, addition, replacement of the General Terms and Conditions unilaterally by the Bank, the Bank shall pay compensation to the Client in the amount of 3,000,000 (three million) rubles for each subsequent change, addition, replacement of the General Conditions, ”the client indicated. Compensation from the bank upon termination of the contract unilaterally was set at 6 million rubles.

Soon, a legally savvy client received from the bank an approved copy of the application form and a credit card. This meant that the bank agreed to the proposed conditions. Apparently, the bankers signed the document without reading, and without knowing that the client offered them their conditions.

The bank terminated the agreement with Voronezh in April 2010, since, according to the TCS, the client began to allow delays in paying the minimum payment. Two years later, Tinkoff Credit Systems CJSC went to court to recover standard delays, commissions and fines from a former client. Voronezh, having paid only the amount of the principal debt, filed his lawsuit, demanding compensation from the bank 24 million rubles for violation of clauses of the loan agreement concluded on its terms.

Now the Voronezh has a good chance of winning a lawsuit against the bank. If only because earlier the court recognized the contract that the parties concluded as legal. According to this decision, the contract drawn up by the client is recognized as legal.

So,% username%, always read carefully in small print. Even if you are a bank :)

[ from here ]

Upd 1: Link to the forum where the issue is discussed.

The comments prompted a link to a forum where the question is discussed:

Good afternoon, colleagues. I propose a discussion on the topic: is it realistic to recover the amount indicated in the header from the bank. The claim has already been sent to the bank. Situation: a client receives by mail from a company affiliated with the bank an application form (offer), which indicates the conditions for issuing a credit card. the client does not agree with such conditions by sending his conditions to the company - 0% per annum, no commissions, fines, penalties, sets unlimited, indicates that the return period is not set, etc. etc. The client also creates a website where he places the General Conditions and Tariffs, including clauses on the ban on the bank unilaterally changing, replacing, supplementing the General Conditions and Tariffs, providing for these actions compensation in a fixed amount of 3,000,000 rubles for each change, replacement, Addition of General Terms and Tariffs. Sends an application form to the company, it sends it to the bank. The bank issues a credit card with a specified limit in the name of the client, i.e. Accepts the offer with the help of relevant actions. The client activates the card and uses it, periodically depositing money into the card account. After some time, the bank filed a lawsuit against the client to terminate the loan agreement, recover the amount of debt, interest, penalties, fines, etc. And in court, the above moment is clarified. The court in the decision indicates that the contract was concluded on the terms of the client, not the bank. The decision passes the appeal and enters into legal force, and a claim is sent to the Bank for payment of compensation for violations of the General Terms and Tariffs. The client activates the card and uses it, periodically depositing money into the card account. After some time, the bank filed a lawsuit against the client to terminate the loan agreement, recover the amount of debt, interest, penalties, fines, etc. And in court, the above moment is clarified. The court in the decision indicates that the contract was concluded on the terms of the client, not the bank. The decision passes the appeal and enters into legal force, and a claim is sent to the Bank for payment of compensation for violations of the General Terms and Tariffs. The client activates the card and uses it, periodically depositing money into the card account. After some time, the bank filed a lawsuit against the client to terminate the loan agreement, recover the amount of debt, interest, penalties, fines, etc. And in court, the above moment is clarified. The court in the decision indicates that the contract was concluded on the terms of the client, not the bank. The decision passes the appeal and enters into legal force, and a claim is sent to the Bank for payment of compensation for violations of the General Terms and Tariffs. that the contract was concluded on the terms of the client, not the bank. The decision passes the appeal and enters into legal force, and a claim is sent to the Bank for payment of compensation for violations of the General Terms and Tariffs. that the contract was concluded on the terms of the client, not the bank. The decision passes the appeal and enters into legal force, and a claim is sent to the Bank for payment of compensation for violations of the General Terms and Tariffs.

As you colleagues understand, it is useless to seek practice in such matters. So the question is: what are the weaknesses in this matter? I must say right away that 159 of the Criminal Code is not even close. On the application form, the seal of the bank and the signature of the official. Can a court apply 333 Civil Code, even though the legal nature of the penalty does not fall under the wording of compensation. We will be very grateful for specific thoughts.

Upd 2: Tinkoff reaction.

Upd 3: Article with expert comments.

Article with expert comments in Vedomosti:

“The case is curious, but an isolated one, there are no others, and there won’t be any, since all documents received by the bank are subject to multiple checks,” insisted the representative of TCS Bank Oleg Anisimov, explaining what happened in 2008 as a “one-time technical failure”. He did not discuss the lawsuit and the name of the plaintiff. But later, a bank representative said that the amount of the claim is 900,000 rubles. “The client regularly received statements and paid interest at our rates, and not at their own rates. We terminated the contract because it ceased to fulfill its obligations under our contract, ”says Anisimov. “People who falsify bank documents are very at risk of being prosecuted,” he warns. “There are signs of fraud in the actions of the borrower, we are communicating with law enforcement agencies in this regard.”

Experts consider these threats empty. The chief lawyer of Renaissance Credit, Sergey Korolev, has never heard of such cases: “The bank apparently did not check the documents that it receives from the client, although banks usually have a special service that checks all the documents received from the borrower.” According to the Civil Code, fines and penalties are levied for breach of contractual relations, but in this case, the bank only exercised the right to terminate the contract and amend the tariffs, and Korolev is inclined to believe that the court should not satisfy such a claim. And he cites the example of the situation in 2004, when Alfa-Bank introduced a commission for early termination of the deposit agreement: “Then many customers sued the commission for this reason.” The Bank may also declare that the borrower is also abusing his right, and this is prohibited in our country, he adds. But, in his opinion, the bank has little prospect of returning interest from the bank: “The maximum that he can try to get from a client through a court is compensation for using money at the Central Bank rate.”

“A change in a loan agreement by a client is an interesting judicial precedent, but in this case the likelihood of a decision in favor of the client is low,” says Yevgeny Tutkevich, first deputy chairman of the Trust Bank. - Usually, the powers of the director of a branch and, especially, an ordinary employee of a bank are limited to signing only standard loan agreements. At the site of the TCS, I would challenge the authority of a bank employee who signed such an agreement outside of their authority and demanded that the agreement itself be declared invalid by the court.

Upd 4: Interview with the hero of the occasion.

Upd 5: Opinions of lawyers in the case.

Opinions of lawyers in the case:

Lawyer, St. Petersburg

Lawyer, Orenburg

Lawyer, Yaroslavl

Hello, wonderful case, the texts of the articles indicate that they don’t look, especially knowing that they write their nasty conditions in small print and that most do not read them.Malykhin Vladimir Viktorovich

Bravo, great action.

Apparently the bank will only have to say about 333 about the disproportion of fines.

there is no cheating, the text is changed, i.e. just the editorial staff, but the carelessness of the bank is no longer the problem of the borrower.

Lawyer, St. Petersburg

Alexey, hello!Vadim A. Popov

In general, everything turned out gorgeous, I applaud standing for this person!

As for specific issues, there was no legal substitution of the contract; there was a new offer by the citizen to the bank.

443 of the Civil Code of the Russian Federation

An answer to consent to conclude an agreement on conditions other than that proposed in the offer is not an acceptance.

Such a response is recognized as a refusal of acceptance and, at the same time, as a new offer.

Everything else is already a bank problem, it turns out that they themselves did not control. The

prospect of collection is rather vague. On the one hand, there is a prejudicial act, and on the other hand, the statute of limitations has expired in this case. Therefore, we must look, but I can say 100% that there are not even the smallest chances.

Lawyer, Orenburg

good afternoon!Trifonova Julia

truly unique case!

firstly, there really was no substitution of the contract, the citizen offered his conditions on which he was ready to conclude the contract, and the Bank accepted such conditions. A contract substitution would be if he forged a contract that already had the signature of a Bank employee. And so, in accordance with Article 421 of the Civil Code of the Russian Federation, the parties are free to conclude contracts.

As for the chances of recovering 24 million, it will depend on the discretion of the court.

According to Article 200 of the Civil Code of the Russian Federation, the limitation period begins from the moment when the person found out or should have known about the violation of his right.

The Bank assures that it terminated the contract on April 19, 2010, which was notified to the consumer on May 6, therefore, it believes that the statute of limitations has expired.

As I believe, in accordance with Article 450 of the Civil Code of the Russian Federation, only the court can terminate the contract due to violation of the terms of the contract by the other party, and accordingly, the statute of limitations should be calculated from the moment the justice of the peace decides on September 6, 2012, which entered into force in December 2012, therefore, the statute of limitations has not been missed, and accordingly there are chances of recovery. The Bank can be saved only by Article 333 of the Civil Code of the Russian Federation on non-compliance of the amount of the penalty with the violation of the obligation.

Lawyer, Yaroslavl

Upd 6: Topic of the Voronezh himself.

Here , probably, the topic of the Voronezh himself:

In principle, everything is simple, having passed the lessons with a credit card with their credit card, he sent me an offer by mail saying they’ll fill in, send us the money (though we’ve thought of immediately not putting the card into the envelope like a quick coupler), but we have a free country and considering that their conditions I am not happy with the offers; I registered my own, filled out a questionnaire with my requirements, the conditions on which I was ready to use their service, signed it and sent it to the master (not even hoping that they would answer and all the more agree) but it wasn’t there, THE CARD came! !! Well, of course, I was delighted to use the denyuzhku (and hell not to use if I prescribed it in the conditions of 0% and also prudently saw that if they change our conditions, then they pay me a forfeit in the amount of 3 lemons, Well, there he further prescribed all sorts of goodies, indicated the address of the site on which I posted MY contract with the Tinkov bank. Also, in my statement to them (on the issue of a card in my name), I indicated that they have the right not to conclude an agreement on the conditions I specified, but they sent the card, so my conditions arranged them.

In connection with the violation of the concluded conditions of the contract, I want to sue them and get a penalty and fines.

I ask for help, since in my city there is no branch, can someone tell me in Moscow a competent, not very greedy lawyer? as well as a natarius who can certify the printed version of the contract from a specific address of the Internet site. Our natarians say that they do not do this, in the notary chamber of the city they said that they do it only in Moscow.

As the backstory of the tinkoff wrote a court order in my name, which I successfully canceled, according to the judge, the representative of the tinkoff died a bit ... ate reading my signed statement (that is, they never even read it)

Upd 7: Voronezh is ready to sue for fraud charges.

Meanwhile:

Voronezhets is ready to sue the bank for fraud charges.

Tinkov continues to be rude to people on Twitter.

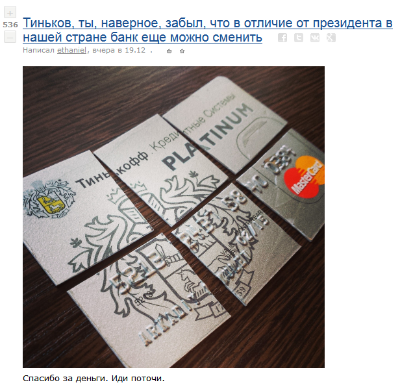

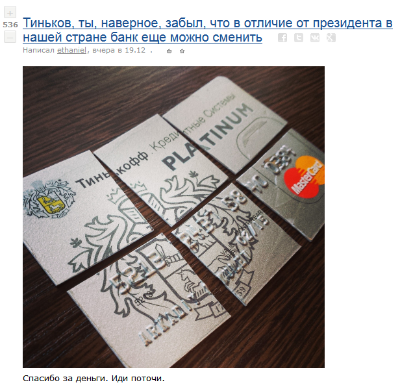

Some customers refuse TKS cards due to Tinkov’s reaction .

Voronezhets is ready to sue the bank for fraud charges.

Tinkov continues to be rude to people on Twitter.

Some customers refuse TKS cards due to Tinkov’s reaction .

Upd 8: Voronezhets leaves Russia due to Tinkoff threats.

Outsmarting TKS-Bank Voronezh announced emigration

“Last night he came home, lawyers phoned me and spoke about Tinkov’s statements with threats. This is a man with his connections, money, directly says that I will sit for four years. And I have a question: why four years, not one, not two and not three? That is, the person has already talked with someone, gave something to someone, and they promised him to imprison me for four years? .. I apologize, but from today I will no longer be in the Russian Federation, ”Slon said in an interview resident of Voronezh.

Upd 9:

“The conflict is not constructive, so we decided to end it in a gentlemanly way by removing mutual claims,” says Oliver Hughes, president of Tinkoff Credit Systems Bank.

[ source ]