Taxer - concluding an online tax agreement

Ukrainian legislation has taken another step towards the automation of tax reporting. As we wrote in a previous publication , you must complete 2 steps before the tax office will gladly accept your reports electronically:

Moscow tax specialists are already eager for progress and, referring to the indicated STA letter, refuse to accept paper contracts. All the more valuable should be this announcement of a new feature of our service. Now, using Taxer, you can create and send an agreement on the recognition of digital signatures online .

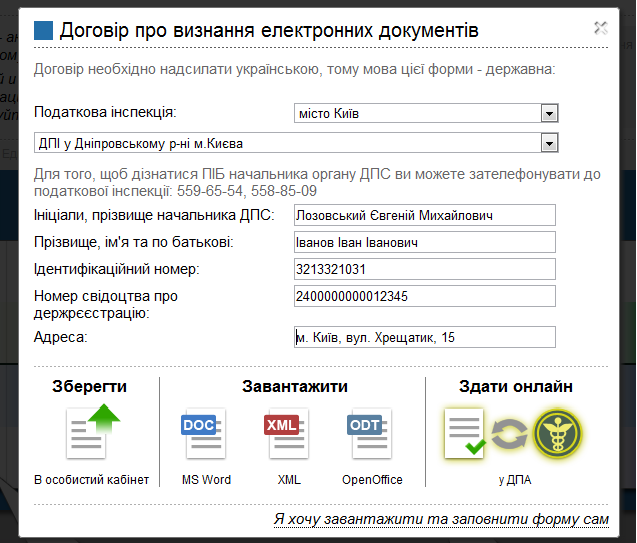

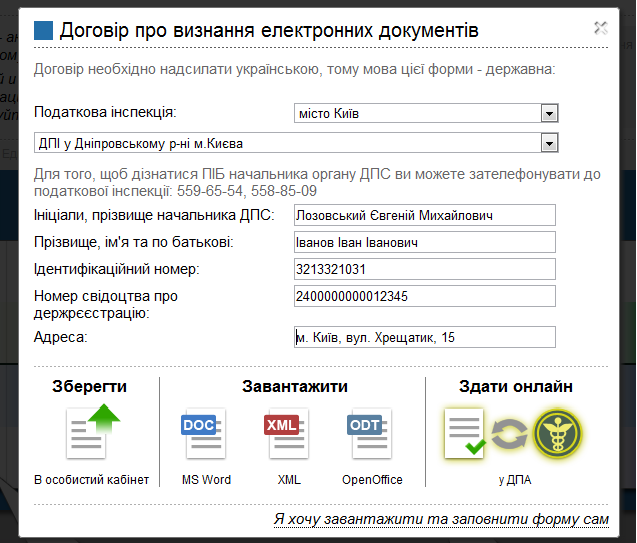

By opening a direct link to the generation of the contract , you will see this form. Fields are few and their names speak for themselves. The only caveat: the initials of the head of your tax office. We show the phone numbers of the selected inspection, by which it is not difficult to find out the necessary information.

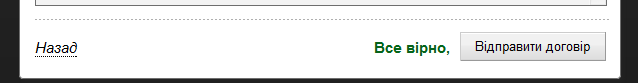

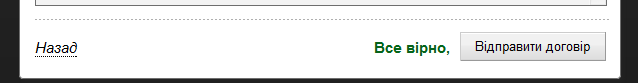

After filling in all the fields, click the “Submit online” button. A preview of the document opens. After making sure that everything is correct, proceed to signing the contract.

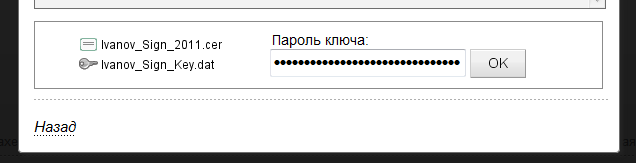

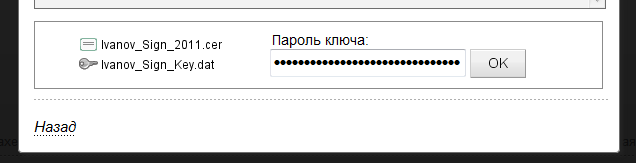

In order to put your digital signature, you need to drag the certificate and key files into the designated area of the applet and enter the password. Files, and even more so the password, are not transferred to the server, all cryptographic conversions occur locally.

If you have a digital signature of the print, then it must also be imposed on the signed document. The EDS recognition agreement also serves to deliver your public certificates to the tax server. Therefore, it is important to sign it with all available keys. If you have only a digital signature with a personal signature, then proceed to the last verification step.

When applying an electronic signature, the correspondence of the data entered in filling out the contract and built into the certificate is checked. This eliminates the sending of incorrect documents.

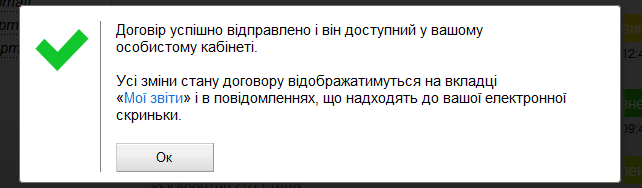

After clicking the “Send contract” button, it will be immediately sent to the STA's mailing address.

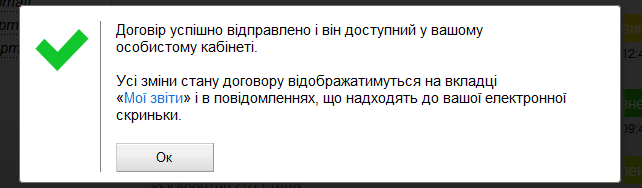

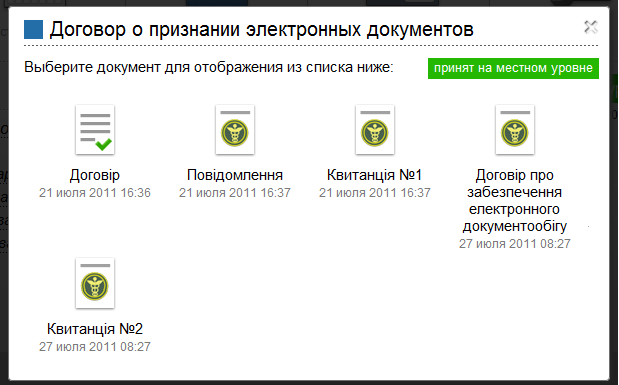

Replies in the form of tax receipts will be received and analyzed automatically. You will receive a notification on each email receipt on your email inbox.

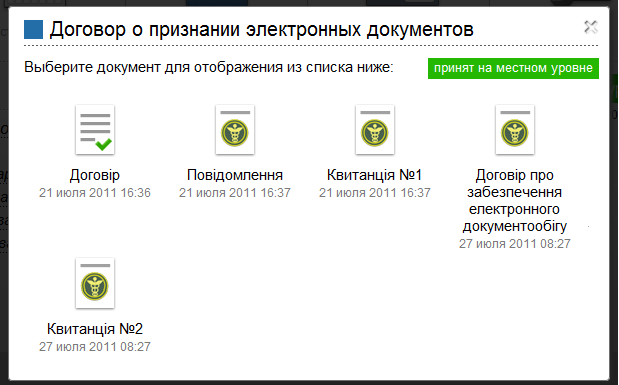

Typically, the tax responds with four notifications:

The first two notifications usually arrive within 5 minutes after sending the document - these are automatic reports. The last two notifications are sent only after a manual check by the operator. The time to receive them depends on your tax office. In Kiev, you will most likely receive them on the same day (if you sent the contract during business hours). In other cities, signing a contract may take several days.

Receiving receipt No. 2 and a signed agreement means that you are now ready to submit reports online and are almost completely free from the need to visit the tax office. We wish you to simplify your reporting as soon as possible and as much as possible!

- get EDS keys

- conclude an EDS recognition agreement with the local tax office

Moscow tax specialists are already eager for progress and, referring to the indicated STA letter, refuse to accept paper contracts. All the more valuable should be this announcement of a new feature of our service. Now, using Taxer, you can create and send an agreement on the recognition of digital signatures online .

By opening a direct link to the generation of the contract , you will see this form. Fields are few and their names speak for themselves. The only caveat: the initials of the head of your tax office. We show the phone numbers of the selected inspection, by which it is not difficult to find out the necessary information.

After filling in all the fields, click the “Submit online” button. A preview of the document opens. After making sure that everything is correct, proceed to signing the contract.

In order to put your digital signature, you need to drag the certificate and key files into the designated area of the applet and enter the password. Files, and even more so the password, are not transferred to the server, all cryptographic conversions occur locally.

If you have a digital signature of the print, then it must also be imposed on the signed document. The EDS recognition agreement also serves to deliver your public certificates to the tax server. Therefore, it is important to sign it with all available keys. If you have only a digital signature with a personal signature, then proceed to the last verification step.

When applying an electronic signature, the correspondence of the data entered in filling out the contract and built into the certificate is checked. This eliminates the sending of incorrect documents.

After clicking the “Send contract” button, it will be immediately sent to the STA's mailing address.

Replies in the form of tax receipts will be received and analyzed automatically. You will receive a notification on each email receipt on your email inbox.

Typically, the tax responds with four notifications:

- notice that the contract has been delivered to the central gateway

- receipt No. 1: the agreement was accepted at the central level (the document passed an automatic check and was sent to the local tax office)

- receipt No. 2: the agreement was adopted at the local level (the document was successfully accepted and signed)

- the contract itself, signed by the tax keys

The first two notifications usually arrive within 5 minutes after sending the document - these are automatic reports. The last two notifications are sent only after a manual check by the operator. The time to receive them depends on your tax office. In Kiev, you will most likely receive them on the same day (if you sent the contract during business hours). In other cities, signing a contract may take several days.

Receiving receipt No. 2 and a signed agreement means that you are now ready to submit reports online and are almost completely free from the need to visit the tax office. We wish you to simplify your reporting as soon as possible and as much as possible!