What is the reason for the growing popularity of Internet and mobile payments in China

- Transfer

The popularity of digital social networks in China can be explained by several factors:

- A large number of people are moving to urban centers in pursuit of employment, and this trend has led to the geographical separation of many families. The ability to easily communicate remotely using audio, video calls and other communication tools is an effective and convenient solution. In this sense, China has much in common with other regions undergoing similar demographic changes and urban growth.

- Relatively cheap and full-featured smartphonesAvailable in China everywhere. Thanks to the efforts of a number of local manufacturers, Chinese devices are much cheaper - at least $ 50 lower than their counterparts around the world. (However, in recent years, prices have risen due to the popularity of the iPhone, whose average retail price is much higher). This factor significantly accelerated the ubiquity of smartphones: this figure in China is 20% higher than the global average. Mobile traffic here is also cheaper. For example, a 2-gigabyte package can be purchased from China Mobile for 120 yuan ($ 17.4). A similar package from T-mobile in the US will cost $ 20.50. Chinese smartphones are perfectly compatible with the 4G telecommunications network, the coverage area of which allows serving 76% of the population. The latter indicator is comparable to the same indicator in the USA (81%).

- Chinese millennials use mobile phones especially actively . For many of them, the smartphone is the first and often the only channel for accessing the Internet. Smartphones are cheap and simplify network access. In 2015, only 49.6% of Chinese families had a personal computer, while in the United States 87.3% of families had computers. Chinese users like to keep in touch with each other through online communication. This feature also brings China together with other regions with high mobile penetration and low computer prevalence.

However, besides these supporting factors, there is also one significant obstacle that needs to be considered in the context of the spread of digital payments and financial services: lack of trust.

The Transition to Digital: Case Studies of Confidence and Growth

The key factor underlying any transaction involving money is trust. This includes trust in the medium of exchange, security of the payment mechanism, the opposite side, and in the regulatory environment as a whole. A thorough check at all of these levels ensures that consumers are protected and that the necessary regulatory channels are available when, in the opinion of one of the parties, an error or violation occurs.

As soon as the issue is resolved with confidence, another serious problem arises - achieving the necessary scale. The experience of recent years shows that digital payments, if properly positioned in the market, can help achieve scale and build trust with consumers.

Alipay: massive growth and building trust

Alipay is one of China's largest digital payment services. Alibaba Group launched its first e-commerce platform in 1998 in Hangzhou, China. The website was originally conceived as a B2B platform, allowing overseas buyers to establish business relationships with Chinese sellers. In 2003, the company launched Taobao, a C2C platform that was a huge success.

Taobao is an e-commerce platform where ordinary people or small traders could create their own storefront and sell products. At Taobao, the company did not sell any products, instead providing the merchants with marketplace infrastructure, including technology, payment and logistics mechanisms.

Five years later, in 2008, Alibaba launched Taobao Mall (now known as Tmall), a B2C platform that has achieved similar levels of growth and popularity. Like the Alibaba service, Tmall is also a platform for merchants, serving, however, larger customers in terms of customer sales, providing them with more infrastructure services and support for a large commission.

These two platforms quickly became China's largest e-commerce sites.

Transitioning e-commerce from cash to digital

Most of the operations in the early days of Taobao and Tmall worked on a post-delivery payment scheme, as cash was the preferred and more trusted medium of exchange at that time. The client made the order and paid it to the courier upon receipt. This scheme was not the most effective, but it worked as it should. At the same time, already in those years, there were online payment services, most of which consumers used to pay bills and replenish their mobile balance. These services were not focused on e-commerce services. A consumer could conduct an online transaction, but was not able to go anywhere in the event of fraud. Funds were debited and transferred instantly,

As a result, in 2004, Alibaba decided to create its own payment product. With Alipay, users can keep money in a digital wallet, replenishing it with any debit card, physical prepaid cards attached to it, or by direct transfer of money as part of a P2P or B2C transaction.

After that, Alibaba integrated Alipay with Taobao, which has already managed to gain popularity with the platform. Buyers on Taobao got the opportunity to create an Alipay account and use its balance instead of cash during the checkout and payment process. The old cash payment method during delivery also continued to work. This allowed Alipay to instantly gain a large base of potential users, which helped the company solve the problem of scaling a payment service. In order to gain trust from users and potential users, Alipay was developed as an interim storage system: the merchant could not receive payment until the client confirmed that he was satisfied with the purchase.

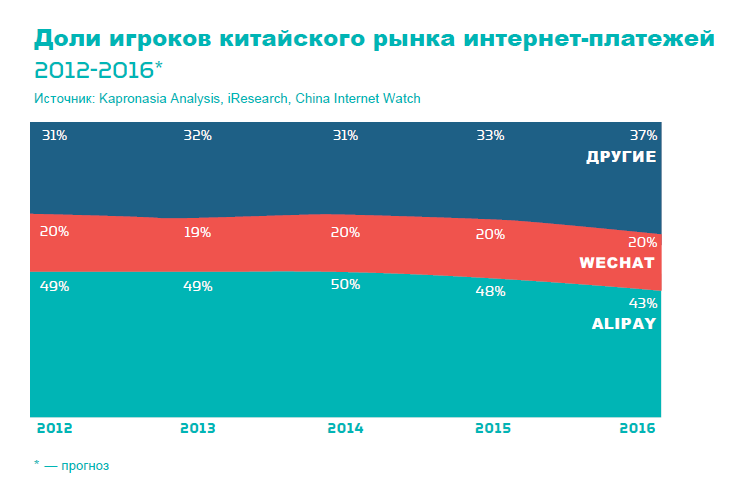

Such organization of the service and its linkage to the previously established e-commerce platform allowed Alibaba to solve key problems of the payment industry - trust and scale - giving consumers greater confidence in conducting money relations with vendors that are thousands of kilometers away from them. The payment service quickly gained popularity and even when its market share somewhat decreased in 2015, even at that time 50% of all Internet payments in China were still used with it.

The first version of Alipay, launched in 2004, existed as a web application. The mobile application was launched in 2009. By 2016, Alipay was processing 175 million transactions per day, 60% of which were sent from smartphones.

Tencent: another beginning, a similar result

Another popular payment service in the country was created by Tencent, a company based in the southern Chinese city of Shenzhen, in 1998. The company has two main social applications - QQ and Weixin, or WeChat in English. As of the 3rd quarter of 2016, the total number of application users has reached 846 million people.

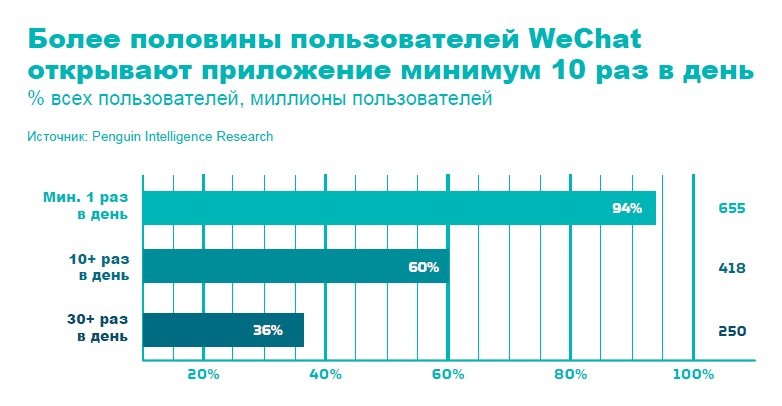

QQ is an online communication platform that offers both chat functionality and the ability to send e-mails and retains its popularity despite the launch of WeChat. WeChat is somewhat similar to Facebook and WhatsApp, popular social apps launched in the United States a few years before its introduction. WeChat allows two users to communicate with each other through messages, audio or video. In addition, the application simplifies communication between large groups of people and has built-in functionality called Moments, similar to Timeline on Facebook. Moments allows subscribers to post images, thoughts, popular new articles and other materials available for viewing to a limited circle of people. Most users spend a significant amount of time in the application, opening it many times a day,

Despite the fact that Tencent created one of the largest and most visited mobile social networks in the world, the introduction of payment functionality in WeChat made it truly stand out from the general mass of analogues. In 2005, Tencent developed a digital payment application called Tenpay, launched nine months after Alipay. Tenpay allowed users to pay for Tencent's products and services, such as online games and music available in QQ, and was also compatible with some other digital commerce platforms (with the exception of Taobao or Tmall, Alibaba's competitor brands).

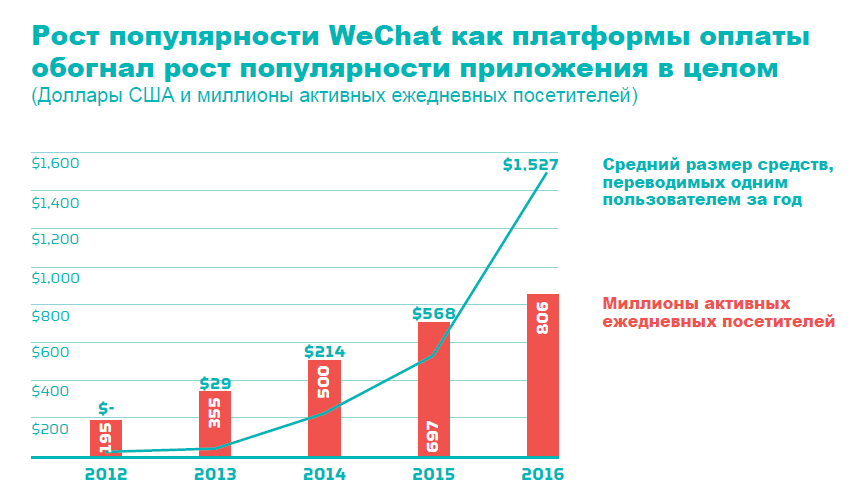

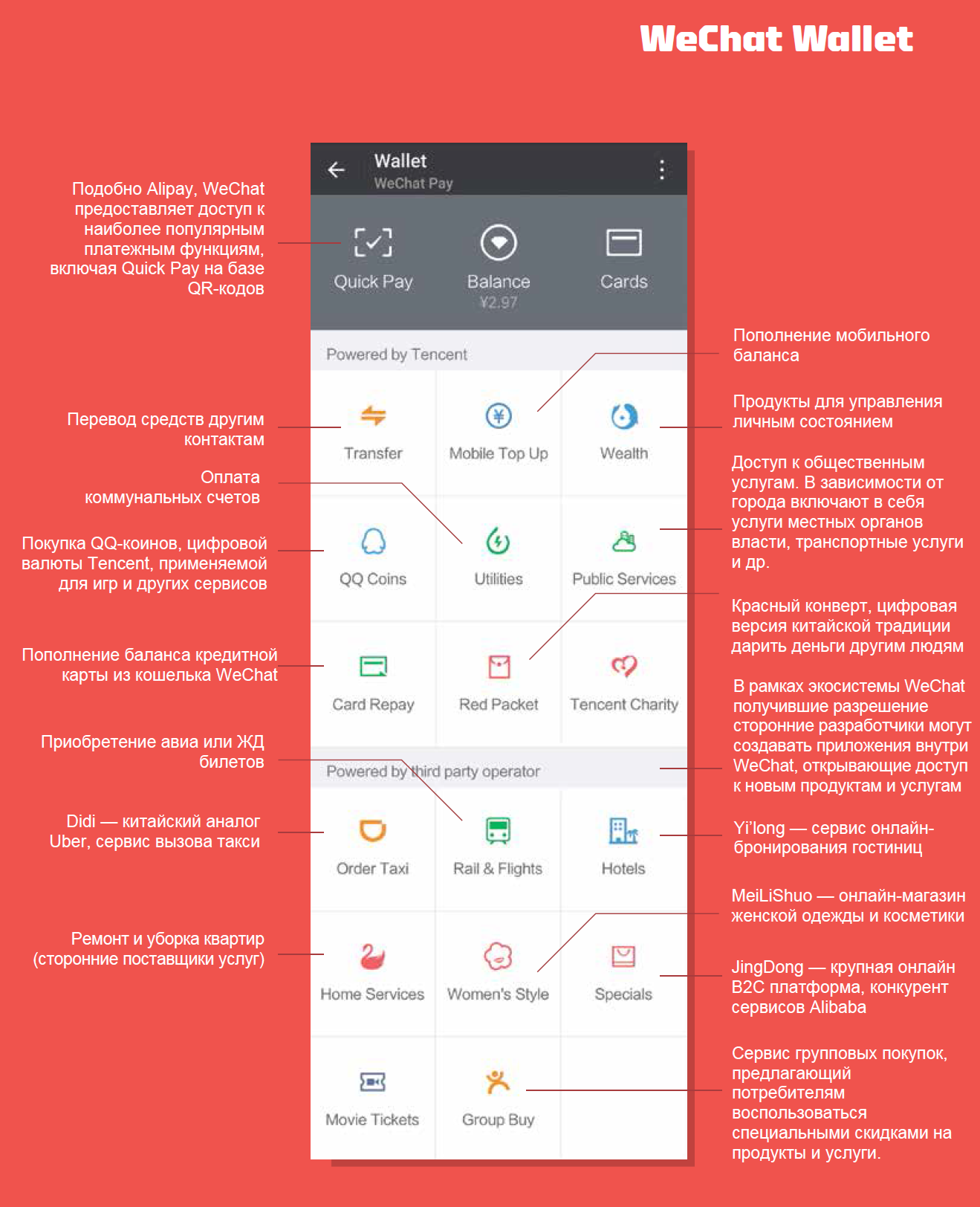

In 2013, Tencent integrated Tenpay functionality into WeChat. This part of the application was called WeChat Pay and allowed users to open a digital wallet directly in the WeChat application and gain access to a wide variety of payment solutions. Linking a debit or credit card to a wallet allowed transferring funds to other WeChat Pay users and storing money for their subsequent use.

Less obvious at that time was the fact that digital payments allowed Tencent and Alibaba to enter the financial services market. Thus, the companies laid the foundation for the emergence of even greater business opportunities to offer additional products and services to create fully-functional financial services systems.

The growth and development of digital payment ecosystems

Using existing e-commerce platforms and social networks as a basis for accelerating the development of digital financial services

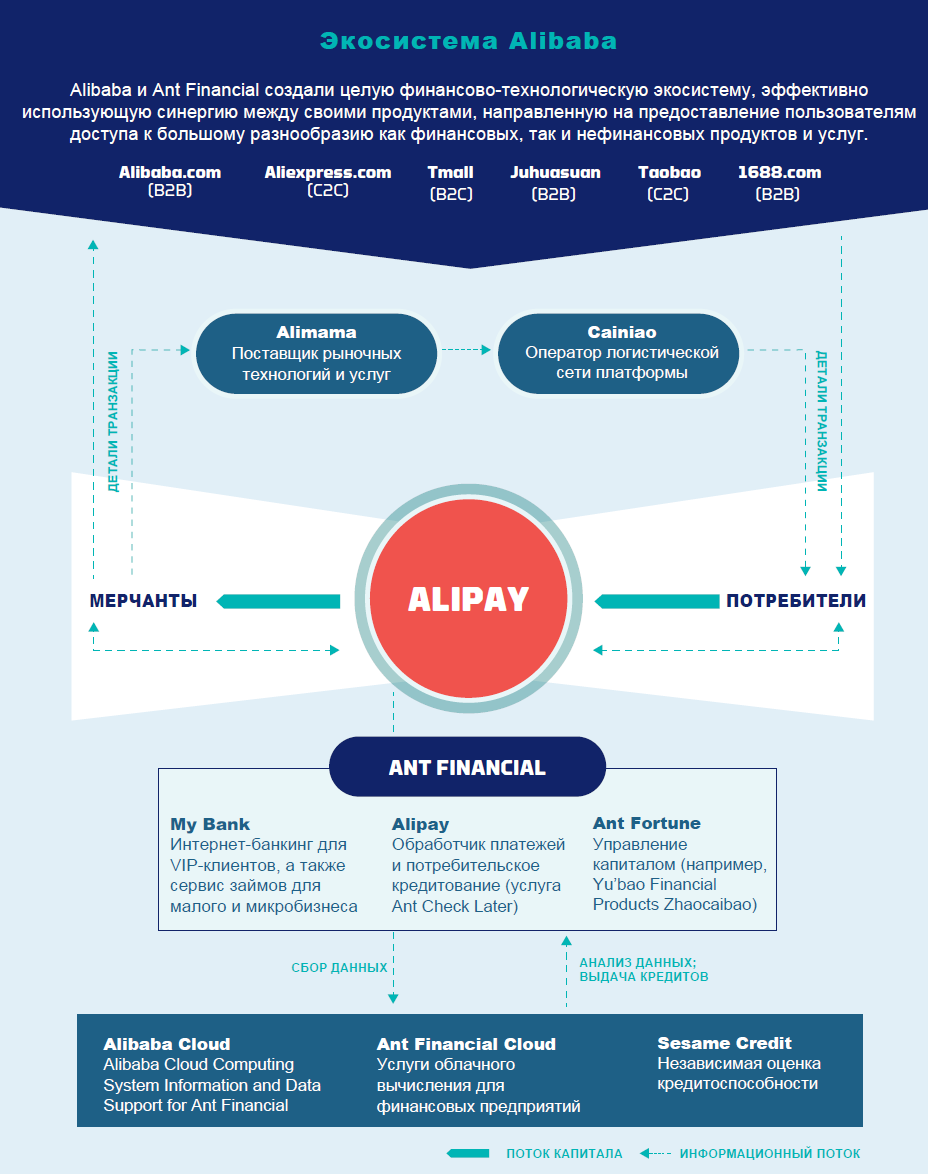

The initial success of Alibaba and Tencent payment products was a significant early step to accelerate the growth of digital financial services in China. However, even more significant advantages appeared when both companies used the power of existing e-commerce platforms and social networks. This combination has enabled millions of users to access previously unavailable financial services and products.

Social finance

Tencent has also taken notable steps in developing a wide range of products to improve its payment ecosystem and increase the demand for services. The company quickly realized that simply integrating payment functionality with social networks is not enough to stimulate users' interest in services (Western social networks like Facebook are struggling with this task, in particular. Tencent understood: for consumers to want to start using services and they have developed a certain loyalty, they need effective motivation and demonstration of the usefulness of the services offered.

How WeChat Used Social Media to Drive Payments

WeChat approached this challenge creatively. In 2014, Tencent presented to the public a new campaign called Red Envelopes. It was a digital version of an old Chinese custom of giving small amounts of money to friends and family in red envelopes during the Chinese New Year.

Using digital payments to send cash gifts at that time was no longer a novelty. However, WeChat has given this tradition a playful form, allowing users to compile a list of recipients and form a total amount for sending. After that, the computer randomly distributed the money among the people on the list.

So there appeared “Happy Envelopes”. Nevertheless, in order to receive his reward, the lucky one needed to have a WeChat account tied to a bank account. Naturally, initially few recipients met this requirement, but the submission had an instant effect on the growth in the number of users. During the first week of the action, 8 million people used the service, and the sharp increase in the number of new bank accounts connected to WeChat was measured in millions. Over the course of the week, WeChat users sent “happy envelopes” worth 400 million yuan ($ 58 million).

To further attract users, WeChat, like AliPay, subsidizes most of its payment functionality, making the replenishment of the application wallet and the payments made with it free. Initially, even the withdrawal of money from the application was free, but today both WeChat and Alipay charge a commission of 0.1% of the amount of funds withdrawn - an indicator significantly lower compared to commissions for similar interbank transfers. All this encourages users to keep funds inside WeChat or AliPay payment systems.

The ability to easily and cheaply transfer funds to friends or other WeChat users who have connected to the payment functionality can be very useful. This is especially true for people who regularly receive remittances from long-distance family members. The last point may find even wider application in other countries and markets.

Ecosystem creation

Gradually, Tencent continued to increase its appeal in the eyes of consumers, introducing new services built into WeChat. Over time, users have the opportunity to purchase movie or plane tickets, book a hotel room, or gain access to city services to pay utility bills or request a service. Now they can also call and pay for a taxi, order food delivery and pay the courier, purchase things online. Tencent has established relationships with vendors and merchants and some of them have offered promotions using WeChat in physical stores.

Relatively recently, Tencent began to expand its presence in the international market. The company has entered into a partnership agreement with Western Union, allowing WeChat users to make low-cost money transfers using a mobile application in more than 200 countries. Now, for many small firms, it has become the norm to start a business right on WeChat, without having to spend time and money on traditional websites or a commercial backend. Tencent greatly simplifies the creation of a direct sales channel and distribution network, as well as the opening of a virtual storefront, product promotion and payment acceptance from the very first day of business.

WeChat API: many applications within one

Recently, WeChat has also released a set of tools for developers - the so-called APIs that allow startups to create applications for WeChat itself, expanding its capabilities. Today, mobile app developers have to create an iOS version of iPhone apps and an Android version for Android phones. The use of the Tencent API eliminates the need to think about operating system support, as their use places the application inside WeChat.

Alipay's first steps on social networks

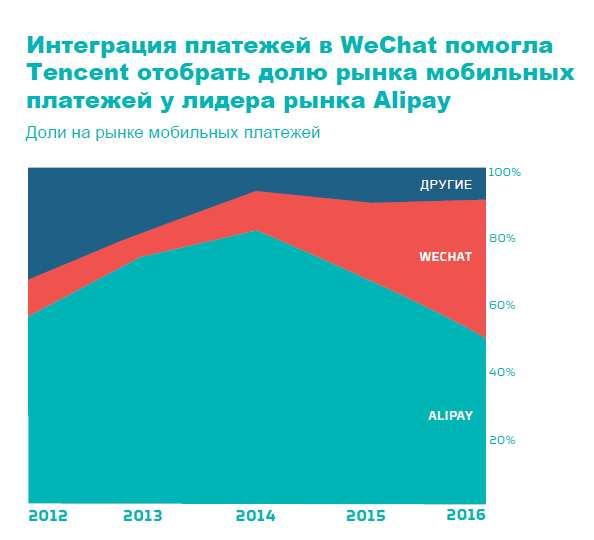

In 2014, Alibay's Alipay service occupied 82.3% of the Chinese digital payment market, while WeChat Pay controlled only 10.6%. By 2016, however, this ratio has changed significantly: Alipay's share fell to 68.4%, and WeChat Pay grew to 20.6%. The popularity of the growing payment ecosystem WeChat Pay, which is actively using its social network to expand, has allowed it to quickly take away part of the market from AliPay.

Realizing what Tencent raids through its chat and social network, Alipay made a number of changes to its own product, including the addition of some features similar to those available on WeChat.

For example, Alipay has added the ability to create online communities with enhanced functionality of social networks, including Record my life - an analogue of WeChat Moments and Facebook Timeline. The company actually seeks to turn the wallet into a social network application with payment functionality.

Some applications in developed countries have also introduced functionality similar to innovations in the WeChat network. For example, WhatsApp introduced voice and video calls, while Facebook introduced the function of making payments. Time will tell whether international services will be able to repeat WeChat’s path towards becoming a complex ecosystem, thereby stimulating its popularity growth and retaining relevance.

Comparison of key metrics for mobile apps

Instead of the conclusion, we cite statistics illustrating the competition between the largest American and Chinese applications working at the intersection of communication and payments.

| The number of active visitors (million people / month, 2015) | The amount of processed mobile payments ($ bn, 2015) | |||||

|---|---|---|---|---|---|---|

| January 2011 | July 2012 | July 2012 | August 2013 | 697 | 396 | |

| Paypal | 1998 | Not | Not | 1998 | 179 | about 50 |

| Alipay | 2004 | Not | Not | 2004 | 450 | 1,316 |

| 2009 | April 2015 | November 2016 | Not | 1,000 | Not applicable | |

| Facebook messenger | August 2011 | April 2013 | April 2015 | March 2015 | 1,000 | Not applicable |