Payment systems and our best choice

Andrey Prudko, founder of an online platform for linguistic freelancers (translators, tutors, copywriters, guides) shared his experience in choosing the right payment system for his startup.

Since Polyglot is international and brings together language specialists from all over the world, accordingly, for a startup we needed to choose a universal option that would suit all parameters, including availability in most countries of the world and acceptable commissions. Earlier we wrote about the registration of a legal entity abroad , now we talk about options for making payments.

Initially, we considered several payment systems: Mangopay , ePayService , TransferWise ,Scrill , PayPal and Payoneer . But as often happens, one ideal option does not exist, everything has its advantages and disadvantages.

Mangopay refused to cooperate with us at all, justifying this with the fact that they do not work with Ukrainian platforms.

Mangopay refused to cooperate with us at all, justifying this with the fact that they do not work with Ukrainian platforms.

ePayService takes a very large commission - about $ 30 per transaction. In addition, their representative worked as a true sales manager on the principle of “money in the morning - chairs in the evening”, that is, first he invited to cooperate, and only after that to find out what their commissions were.

ePayService takes a very large commission - about $ 30 per transaction. In addition, their representative worked as a true sales manager on the principle of “money in the morning - chairs in the evening”, that is, first he invited to cooperate, and only after that to find out what their commissions were.

TransferWise and ScrillThey work directly with bank accounts, which does not allow us to implement our special option “Safe Transaction”, designed to protect the customer’s money from fraudulent activities, and to guarantee the freelancer payment for the work performed. It implies the reservation of funds in the account until the customer confirms the fulfillment of the order by the freelancer or until the specified deadline for the transaction without making claims, then payment is made automatically. And these two payment systems send funds directly to the client’s bank account within one to seven days, but we don’t want to deprive our users of the opportunity to choose their own withdrawal methods.

TransferWise and ScrillThey work directly with bank accounts, which does not allow us to implement our special option “Safe Transaction”, designed to protect the customer’s money from fraudulent activities, and to guarantee the freelancer payment for the work performed. It implies the reservation of funds in the account until the customer confirms the fulfillment of the order by the freelancer or until the specified deadline for the transaction without making claims, then payment is made automatically. And these two payment systems send funds directly to the client’s bank account within one to seven days, but we don’t want to deprive our users of the opportunity to choose their own withdrawal methods.

Scrill, in addition, additionally charges a monthly fee for using their service from corporate accounts in the amount of the final addition of those transactions of the previous month that were less than 10 EUR, as well as an additional fee for converting to different currencies in the amount of 3.99% to 4.99%.

Scrill, in addition, additionally charges a monthly fee for using their service from corporate accounts in the amount of the final addition of those transactions of the previous month that were less than 10 EUR, as well as an additional fee for converting to different currencies in the amount of 3.99% to 4.99%.

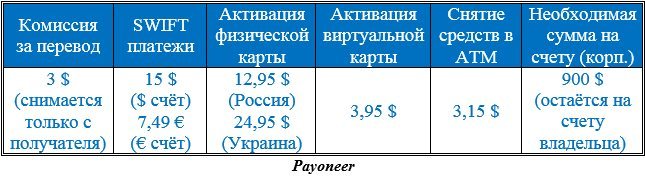

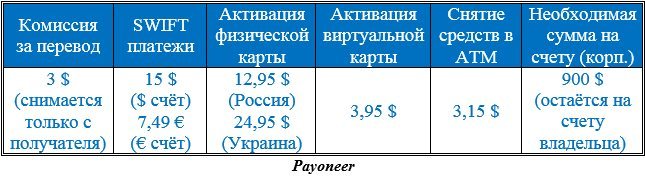

Comparing the capabilities of different payment systems and their fees, considering options for Polyglot, we still settled on the last two - PayPal and Payoneer . These systems have their own separate accounts on which you can store money and withdraw them at any convenient time. Of course, the commission in them is not the lowest, but quite acceptable.

Transaction fee:

• PayPal has 3.4% + 0.3 USD,

• Payoneer only 3 USD.

But here there were some pitfalls.

In Payoneer , for corporate accounts, if the amount of payments made per month is less than 5000 USD, the additional monthly payment will be 90 USD.

In Payoneer , for corporate accounts, if the amount of payments made per month is less than 5000 USD, the additional monthly payment will be 90 USD.

And with PayPal the situation is even more complicated: in Ukraine there is no way to withdraw money from the payment system to a bank account. Although in Russia in national currency this can be done without problems and even for free:

And with PayPal the situation is even more complicated: in Ukraine there is no way to withdraw money from the payment system to a bank account. Although in Russia in national currency this can be done without problems and even for free:

in Ukraine Payoneer will help to withdraw money to a bank account :

But there is good news. Most recently, the National Bank of Ukraine adopted a number of resolutions that will finally remove the restrictions on withdrawing money from a PayPal account in Ukraine. In addition, the Ministry of Economy and the NBU invited the payment system to formally cooperate. Therefore, following the news, we decided to play, so to speak, ahead of favorable events.

The list of documents required to create a corporate account in PayPal and Payoneer is almost identical:

It is worth saying here that when choosing a payment system to receive payments from users there are many options. For example, such systems as: LiqPay , Yandex.Money , Webmoney , Wallet One, Qiwi and others. You can use ready-made solutions, such as Robokassa or Interkassa , Monexy , iPay and others, but they have more commissions than working directly with electronic money. If you work in the CIS, then the availability of payment acceptance via LiqPay , Yandex.Money , Webmoney will satisfy almost all of your users.

But when accepting payments from other countries, as well as to send money to users, difficulties already arise. Few people know what Webmoney or Yandex.Money is abroad.. And the problem of sending money to other users is connected both with the financial side, and often with legislative aspects.

In conclusion, I express the hope that our experience in creating an international service for Polyglot language freelancers will help domestic startups decide on such a difficult choice of electronic payment system for online businesses.

Since Polyglot is international and brings together language specialists from all over the world, accordingly, for a startup we needed to choose a universal option that would suit all parameters, including availability in most countries of the world and acceptable commissions. Earlier we wrote about the registration of a legal entity abroad , now we talk about options for making payments.

Initially, we considered several payment systems: Mangopay , ePayService , TransferWise ,Scrill , PayPal and Payoneer . But as often happens, one ideal option does not exist, everything has its advantages and disadvantages.

Mangopay refused to cooperate with us at all, justifying this with the fact that they do not work with Ukrainian platforms.

Mangopay refused to cooperate with us at all, justifying this with the fact that they do not work with Ukrainian platforms.  ePayService takes a very large commission - about $ 30 per transaction. In addition, their representative worked as a true sales manager on the principle of “money in the morning - chairs in the evening”, that is, first he invited to cooperate, and only after that to find out what their commissions were.

ePayService takes a very large commission - about $ 30 per transaction. In addition, their representative worked as a true sales manager on the principle of “money in the morning - chairs in the evening”, that is, first he invited to cooperate, and only after that to find out what their commissions were.  TransferWise and ScrillThey work directly with bank accounts, which does not allow us to implement our special option “Safe Transaction”, designed to protect the customer’s money from fraudulent activities, and to guarantee the freelancer payment for the work performed. It implies the reservation of funds in the account until the customer confirms the fulfillment of the order by the freelancer or until the specified deadline for the transaction without making claims, then payment is made automatically. And these two payment systems send funds directly to the client’s bank account within one to seven days, but we don’t want to deprive our users of the opportunity to choose their own withdrawal methods.

TransferWise and ScrillThey work directly with bank accounts, which does not allow us to implement our special option “Safe Transaction”, designed to protect the customer’s money from fraudulent activities, and to guarantee the freelancer payment for the work performed. It implies the reservation of funds in the account until the customer confirms the fulfillment of the order by the freelancer or until the specified deadline for the transaction without making claims, then payment is made automatically. And these two payment systems send funds directly to the client’s bank account within one to seven days, but we don’t want to deprive our users of the opportunity to choose their own withdrawal methods.  Scrill, in addition, additionally charges a monthly fee for using their service from corporate accounts in the amount of the final addition of those transactions of the previous month that were less than 10 EUR, as well as an additional fee for converting to different currencies in the amount of 3.99% to 4.99%.

Scrill, in addition, additionally charges a monthly fee for using their service from corporate accounts in the amount of the final addition of those transactions of the previous month that were less than 10 EUR, as well as an additional fee for converting to different currencies in the amount of 3.99% to 4.99%.

Comparing the capabilities of different payment systems and their fees, considering options for Polyglot, we still settled on the last two - PayPal and Payoneer . These systems have their own separate accounts on which you can store money and withdraw them at any convenient time. Of course, the commission in them is not the lowest, but quite acceptable.

Transaction fee:

• PayPal has 3.4% + 0.3 USD,

• Payoneer only 3 USD.

But here there were some pitfalls.

In Payoneer , for corporate accounts, if the amount of payments made per month is less than 5000 USD, the additional monthly payment will be 90 USD.

In Payoneer , for corporate accounts, if the amount of payments made per month is less than 5000 USD, the additional monthly payment will be 90 USD.  And with PayPal the situation is even more complicated: in Ukraine there is no way to withdraw money from the payment system to a bank account. Although in Russia in national currency this can be done without problems and even for free:

And with PayPal the situation is even more complicated: in Ukraine there is no way to withdraw money from the payment system to a bank account. Although in Russia in national currency this can be done without problems and even for free:

in Ukraine Payoneer will help to withdraw money to a bank account :

But there is good news. Most recently, the National Bank of Ukraine adopted a number of resolutions that will finally remove the restrictions on withdrawing money from a PayPal account in Ukraine. In addition, the Ministry of Economy and the NBU invited the payment system to formally cooperate. Therefore, following the news, we decided to play, so to speak, ahead of favorable events.

The list of documents required to create a corporate account in PayPal and Payoneer is almost identical:

It is worth saying here that when choosing a payment system to receive payments from users there are many options. For example, such systems as: LiqPay , Yandex.Money , Webmoney , Wallet One, Qiwi and others. You can use ready-made solutions, such as Robokassa or Interkassa , Monexy , iPay and others, but they have more commissions than working directly with electronic money. If you work in the CIS, then the availability of payment acceptance via LiqPay , Yandex.Money , Webmoney will satisfy almost all of your users.

But when accepting payments from other countries, as well as to send money to users, difficulties already arise. Few people know what Webmoney or Yandex.Money is abroad.. And the problem of sending money to other users is connected both with the financial side, and often with legislative aspects.

In conclusion, I express the hope that our experience in creating an international service for Polyglot language freelancers will help domestic startups decide on such a difficult choice of electronic payment system for online businesses.