Why I stopped angel investing (and why you should never start). Part 2

- Transfer

Everything that was described in the first part of the article relates to my personal reasons for leaving angel investing. They may turn out to be valid for you or vice versa. In any case, you should NOT engage in angelic investment. That's why:

- The angel investing economy works against everyone but a handful

- Angel investing structure works against everyone but a handful

1. The angel investing economy works against everyone but a handful

If you do not understand this phrase, then you NEVER SHOULD invest money in a start-up, unless it is money that you agree to burn or throw out of the window, because this is exactly what you do by investing in a young company.

Peter Thiel gives a long explanation of the exponential law (or Pareto distribution ), but for Sam Altman it is easier and faster:

“Everyone claims to understand the exponential law in angel investing, but only a few people use it. I think the reason for this is the difficulty in representing the difference between 3x and 300x (or 3000x) revenue. Often you will earn more money by investing in one of the best projects than with all the others combined. The consequence of this is that they are not paying attention to the real risk of this investment. ”

He continues, explaining the details:

“Do not try to find good deals involving potentially profitable companies, in the hope that their value will increase to 20-30 million, and you can then resell the shares at the highest price. Do not do this, because too many things can go awry. And if you look at people who were really successful angel investors, you will see that they relied on the founders and ideas that they believed had great potential, and then often readily lost their money. ”

This means two very specific things. The only way to be a truly successful investor is:

1. Invest in a ton of startups, calmly watch how most of them burn out.

and

2. Have enough money for both initial investments and subsequent serious rounds of investment (at least if we are talking about proportional financing).

It seems clear to you, but most likely you are mistaken. Paul Graham explains :

“In startups, the success rate of big winners is measured by how much the price fluctuation has exceeded initial expectations. "I don’t know, these expectations are subconscious or based on knowledge, but, in any case, we are simply not ready for a thousandfold increase in investment in startups."

The Y Combinator project understands this well, that's why they designed their program in such a way as to look for potentially top-notch companies, and obviously select them, not based on the high probability of success at the lower level, but on who has the potential to become one of their mega winners. This means that they reduce the percentage of all their success for the sake of increasing the percentage of those projects from which investors receive large profits in a short time.

Well, let's say that you really understand the exponential law, and you have a ton of money, so you would like to invest a five-figure sum in 100 companies in order to be sure to get on the project that will repeat the success of Uber and provide you with a large profit. Well, congratulations - this is just the starting bet with which you enter the game.. You have yet to face the main problem.

2. The angel investing structure works against everyone but a handful

The problem is that during the year, at best, only a few projects are formed that bring really large profits to investors. Do you think you can predict which projects out of thousands of startups annually launched will become truly successful?

Many people think so. Almost everyone is mistaken.

But the most confusing part of business angel investing is that even if you carefully select the winners and have some confidence in the success, you may still be defeated.

Why? Probably because you simply cannot break into the ranks of the winners.

This is due to the fact that the best companies are identified in the early stages (at least in Silicon Valley) and, as a result, many people want to invest in them. And even in order to be able to lay out your money, you should have access to projects, which means only one thing:

Almost always, you need to have social connections that will help you invest in companies at very early stages.

In order for you to have a very clear idea of this, I can only say that I got all my cool deals thanks to my connections. . Just because. And for no other reason. This (mainly) can be said of all other investors. You win through your connections.

And this means that only people of a certain type can be truly successful in business angel investing. Here are some examples of those types of people who always make a profit (and big profit) from angel investing:

- Paige Craig

- Chris Sacca

- Elizabeth Kraus

- Kevin Colleran

- Shervin Pishevar

- Gary Vaynerchuk

- Scott and Cyan Bannister

What sets them apart from everyone else?

- They have an impeccable reputation (created over 10 years or even more) of great people who work hard for those companies in which they invested.

- They have an amazing network of strong connections in their respective startup-related fields, which was created by providing thousands of services to other people (or through meeting with former founders or employees of high-tech companies).

- They have so much money that they can double and triple their contributions to selected companies and then wait 10 years for them to profit.

- And one more key thing that I did not take into account: they are influential people in society and therefore can not be afraid that they will be trampled down by venture investors and literally taken out of investment. Yes, imagine that even big players have to worry about it.

Do you possess all this? Keep in mind that your competitors already have all this.

Seriously, at least read this post about what Chris Sachcha does for his companies. Or read about all the things that Page Craig did just to get into the very first round of AirBnb investing. Paige does this for dozens of companies, and that’s why he is a very popular angel that the best companies want. (For the sake of completeness, it’s worth adding that I know Page well. He helped me so many times, I could calmly write him a letter of declaration of love).

You may not be able to do everything that these investors do. If you could compete with them in this, then perhaps you are right, and business angel investment is for you. But think about the fact that thousands of people read the same thing as you, and now they are taking special training courses on the features of investing.

You are not alone in your aspirations, and you are left far behind. Now it is becoming increasingly difficult to build the necessary network of contacts and gain the necessary knowledge, and more and more capital is pursuing a thinning handful of capable entrepreneurs.

To be honest, since we have already talked about fashion trends in the modern world (see firstpart of the translation - approx. translator), it seems to me that a real boom should be sought in a growing number of investors.

I bet you saw a post posted by AirBnb CEO Brian Chesky some time ago. In it, he published seven rejection letters that he received, collecting the first investment for the project. Several people forwarded this link to me with the words "Oh, I should have known that this company would take off, it was worth investing in them." Maybe.

But you don’t know the whole story: these letters were sent only to a handful of people who were already authoritative angels / venture investors. They were not sent to a wide circle of people. The best companies never do this. And if you cannot be the type of person to whom Brian Chesky would send a letter, then perhaps you should not be an angel investor.

That is why I advise you not to engage in angel investing. Its entire structure and economy does not work for investors. Benefit only to those people who, like Liam Neeson in The Hostage, have a “unique set of skills” and make investing their top priority, which they always focus on.

If you still decide to invest, how to do it right?

The best way to invest in startups is to become a “limited partner” (LP) in a venture capital fund managed by someone who can do it. You pay 2% commission and 20% of revenue. And for this you buy all these skills and connections. And this is exactly what I’m doing now (probably the funds that I invested in will bring me the most profit)

But this is also dangerous. Why? Because most venture capital funds lose money .

You need to know those with whom you invest, and then hope that you choose a good fund. And in order to do this, you need connections, thanks to which you can get into the best funds, because they can choose their “limited partners” ... and now you are returning to the same problem with connections, which I already mentioned above.

Is there another way to invest in startups that avoids most of these problems?

At the moment, I see only one way for an ordinary mortal to get reliable and (relatively) secure access to high-level investor transactions:

Use AngelList syndicates .

This is the safest and most trustworthy way for a short time, allowing investors to get serious deals without any connections. AngelList does an amazing job in the field of angel investing, nor does he receive the publicity he deserves. This project has enormous potential, which can change for the better the world of investing in startups.

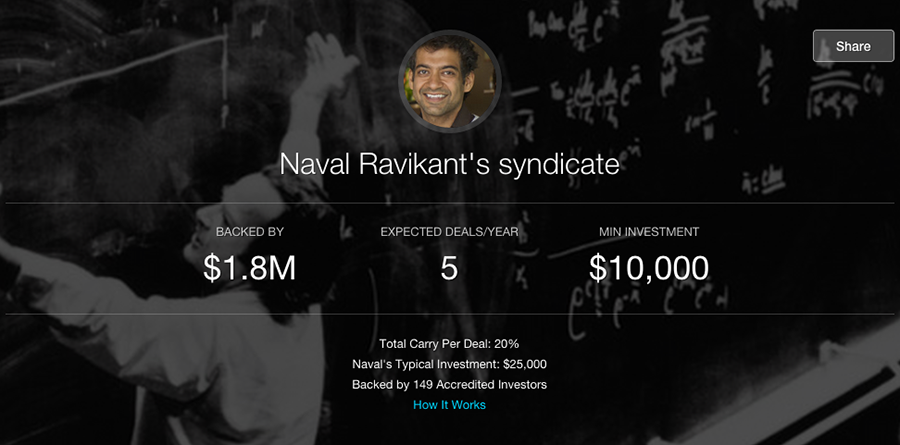

Most business angels that I mentioned above use syndicates. You can find even more names here . Tim Ferriss and Naval Ravikant are also good syndicates worth joining. No, no, I won’t get anything if you join their projects. And yes - I also have a syndicate, and I didn’t submit a link to it because I never used it, and I don’t advise you to join it.

If you want to invest in angel investing, then most likely this will be the best option for you. But you should carefully read about it before you invest. There is a real risk.

How about crowdfunding share capital allocation?

I used to think that this kind of crowdfunding is great. I was an ardent supporter of this. And I still think it will be great ... someday.

But at the moment, I consider this a bad idea and recommend that most avoid this type of fundraising.

There are many reasons for this. I could tell you a story about how they threw me on what was supposed to be a terrific sale of investments, because the platform could not normally establish an adequate liquidity preference.

But it seems to me that this “storm of tweets” (and the story) from Jason Calacanis can serve as an excellent summary of the reasons why the effective implementation of crowdfunding with the distribution of equity shares is now very problematic:

What he describes is a typical Pump & Dump exchange fraud scheme ( according to which insiders promote a certain share, spreading false rumors in the hope of making a quick profit - translator comment ), and in the near future we will see a huge number of swindlers and deceived people in the field of this type of crowdfunding ha.

The sad truth is that people are ALREADY caught by crooks in crowdfunding with the distribution of a share of capital, and they do not even realize this. And you don’t hear about it, because NOBODY IS INTERESTED in revealing the whole truth.

Why?

Because everyone makes money - everything except small investors who use crowdfunding platforms.

Personally, I would currently bypass the tenth expensive ALL models using a similar reward scheme. Let others take risks, lose, get nuts, and in the end the balance of the system will be found. Someday, crowdfunding with the distribution of the share capital will be wonderful and worth the investment. But not now.

Conclusion: In order to earn money, do not engage in angelic investment, but instead build your own companies.

I made money on angel investing. Not so much. And I had a ton of benefits that you may not have. And I leave this niche with confidence, because I know that so many successes were pure luck.

If you want to invest in startups, then choose syndicates from AngelList.

If you seriously want to become a business angel, then be prepared to work hard, give your best 100%, and devote all your time to it, otherwise you will condemn yourself to failure.

For most people, it would be better to spend their time and money learning new skills and creating their own company. Better yet, join a great company at an early stage of development and help them on this journey into the cruel world of business: it is safer and still gives you the opportunity to earn a ton of money.

The best opportunities for most people are to create, not invest. Kevin Kelly very successfully described this, saying that we are at the dawn of incredible changes, and most of the best ideas will be come up with.

Find your idea and bring it to life, as I do.

About the Author: Tucker Max, Book In A Box CEO and most successful New York Times writer.