A few accounting tips

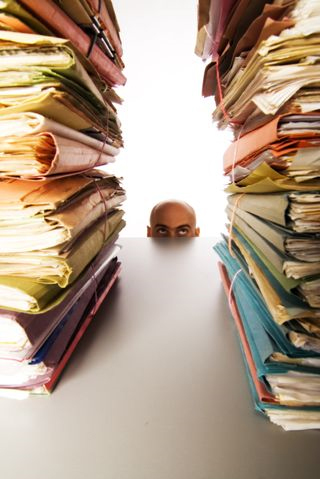

For entrepreneurs and business owners, documentation is usually not the most exciting part of the job. It can be difficult for paperwork to find the time, especially at the very beginning, before your business moves on to a solid foundation. However, paper gimp is very important. Having scored on accounting and financial documents today, you run the risk of running into trouble tomorrow.

For entrepreneurs and business owners, documentation is usually not the most exciting part of the job. It can be difficult for paperwork to find the time, especially at the very beginning, before your business moves on to a solid foundation. However, paper gimp is very important. Having scored on accounting and financial documents today, you run the risk of running into trouble tomorrow.In our country, this problem is very relevant and more significant than in the west. Given bureaucratic traditions and disregard for small business as a whole, ignoring this part of doing business can lead to extremely unpleasant consequences. The confusion in the financial documentation brought small and medium-sized businesses much more problems than any other troubles. Bookkeeping is an absolutely unbearable "lady", and when she experiences a lack of attention, the business begins to experience many problems of a very different nature.

In this article I would like to give some recommendations for aspiring entrepreneurs.

Plan all expenses

Any large expenses, as a rule, can be planned long before their implementation. So in no case should you neglect budget planning. Most often, you don’t need to hire a separate specialist for this, but in your diary on the first page there should be records of planned capital costs and all your decisions and actions should take them into account. Most companies need to update their information infrastructure at least once every five years. For workers in the industry more often, for all others - less often. A schedule of these costs should be drawn up at least a year in advance, and a gradual implementation plan is highly desirable (this month we will buy new uninterruptible power supplies, and in the next one we may replace the server). This approach allows you not to get into a forced update situation.. Even if no infrastructure costs are planned for the current period, funds must be planned and accumulated.

If you are concerned about the temptation to spend the accumulated money, try to collect these funds in a separate account, which will not constantly be an eyesore for you. The less you see him, the less temptation. The same can be done with other obligatory recurring expenses.

Separate work and personal accounts

This advice may seem obvious simple, but for a new business, it can be difficult to implement, at least to the extent of habit. It seems like you are the owner and all your funds are yours, but nothing will lead your business to collapse faster than a mixture of personal and business expenses (climbed into the cash desk - stole from you). In any case, maintaining business records is easier to carry out separately, you can sell or lose a business, and you won’t sell or lose personal accounts.

As a business owner, you will encounter a situation where your personal life will try to invade your work. A working car is very easy to track mileage and technical costs, but if you often use work vehicles for personal purposes, the calculation is much more complicated. In such cases, try to use the experience of bureaucratic state "monsters", record each trip separately. Today, there are 100,500 ways to do this, from the simplest use of online maps to specialized applications.

Do not brake, paper is not everything

Use the advantages of modern technology - do not be shy. If there is even the slightest opportunity to automate something, automate it.

Set up individual accounts

In addition to the advice on separating work and personal accounts, you can also separate some of your work accounts. The practice of separating an account for payroll and a savings account for the next planned capital expenditures proved to be not bad. It would be nice to have a separate account for daily expenses, and if possible, one emergency savings account in case of unforeseen troubles.

Schedule time for bookkeeping

How to avoid accounting disaster? Just add this work to your schedule. Most often, entrepreneurs leave such work at the end of the week or at the beginning of a new payment period.

Nobody likes bookkeeping. A special dislike for this worthy craft is distinguished by “techies” who sometimes forget about the exceptional importance of well-functioning bookkeeping for businesses of all sizes. If you do not want to deal with her, find a third-party specialist. The trouble is that an intelligent accountant can cost completely obscene money, so for small companies it makes sense to independently study and apply this skill. I hope these few tips will be useful for beginners. Thanks for attention!