Investing for Dummies

Many of the readers of Habré make good money (I hope) and have the opportunity to cover not only current expenses, but also spend money on something promising. Again, many of us are thinking about how to save money for the future so that they don’t “burn out” over time (minimum task) and how to make money make money (

Many of the readers of Habré make good money (I hope) and have the opportunity to cover not only current expenses, but also spend money on something promising. Again, many of us are thinking about how to save money for the future so that they don’t “burn out” over time (minimum task) and how to make money make money ( I became interested in these issues about two years ago. As it turned out, the problem is maximally solved, and the dream of spending free time up to 60 years is quite real. Moreover, the asset allocation approach is popular in the West, which allows you to spend up to an hour a year on the issue of investing and have output comparable to professional investors. Moreover, it is only necessary to thoroughly understand the basic information and not plunge into the abyss of technical and fundamental analysis.

As it turned out, this approach is available in our country, in our reality. I want to share the results of the study with you. Yes, so far only research ... In 30 years I’ll tell you about the results of the practice.

Now I see that if I thought about it ten years ago, I would be halfway to my dream! It’s a pity that I then only thought about computers (well ... not only about them, but I certainly didn’t think about finances!) ... However, it’s better later than very, very later.

PSWhy do it yourself? Because you yourself can save yourself good money - you, not banks, a pension fund or financial companies!

UPD PPS My thoughts are based on the article by Sergey Spirin, “The portfolio is bedridden, or how to increase capital by 118 times in 12 years . ” Actually, I learned from him about this investment strategy. I am an IT professional, not a financier. Therefore, for details from the expert - to him !

The first stage of the search - forex-schmoreks

Since childhood, I loved mathematics and programming. And, when my colleague in the 5th year of IT University told me about Forex , showed its mathematical essence, I became interested in this matter. And when I saw mathematics at the heart of the graphs, I was fascinated and submissive. The only thing - I did not want to meditate for hours in front of the monitor and frantically catch the moments of entry and exit from the transaction. When I learned about the opportunity to create my own trading strategies, that is, programs that work without my constant presence, I seriously began to research.

Since childhood, I loved mathematics and programming. And, when my colleague in the 5th year of IT University told me about Forex , showed its mathematical essence, I became interested in this matter. And when I saw mathematics at the heart of the graphs, I was fascinated and submissive. The only thing - I did not want to meditate for hours in front of the monitor and frantically catch the moments of entry and exit from the transaction. When I learned about the opportunity to create my own trading strategies, that is, programs that work without my constant presence, I seriously began to research.Months of labor were spent on various strategies for catching a sharp change in trend (on a virtual account, the result was amazing ... but once in a few months of testing). Then, more sophisticated systems based on neural networks went into business (it turned out that for a real result, networks should study and learn ...). Further there were plans to take up the optimization of the training of neural networks with genetic algorithms.

I decided to conclude a contract. Yes, I didn’t have hundreds of dollars. But I was joyfully given the opportunity to work with at least ten dollars. When I concluded a real contract, two points in it unpleasantly cut me:

- all my positions are bets on this or that event;

- values of quotes and in general all data can be only those that this broker provides me. Data from other forex offices are not considered.

The first implied that I ended up in a casino. The second implied that I was forced to believe only what the croupier told me at my table.

How so??? Forex is a global market for the exchange of various currencies! All brokers should have the same pictures (as this happens, by the way, on the stock market)! And what else is this - “bets”? I buy and sell currency, where does the bid?

Further careful study of the issue led me to very disappointing conclusions:

- real forex opens with a minimum account of $ 500, or better, a few thousand;

- the rest of the mini-, micro-, nano-forex is just an illusion of forex. Your money does not go beyond the organization that provides Forex services. This organization redistributes money between its customers and its account. Your gain is a loss for the organization. Your loss is a profit for the organization;

- quotes that come to your computer are issued by the organization that provides Forex services. She is quite entitled (technically and legally) to expose you any picture;

- Another unpleasant addition to the previous moment - you wrote your ingenious strategy, launched MetaTrader (or Quik or something else), the strategy opens a deal, and you are waiting for its happy ending. The program is written cunningly, provided for everything and everyone. Class! .. But

on the other side of the barricadesin the organization that supplies you the information, professional programmers are seated. 90% can be sure that they knowyour program. Why? Because her - your strategy - knows MetaTrader / Quik / .... They may well pass its compiled or source code. Knowing your strategy, you can palm off such quotes for just one second, which immediately causes a margin call ... I know what I'm talking about, since I kept statistics on quotes for more than a year for 15 currency pairs (a database of millions of records). And I have often seen such here Wonderful s e sharp jerks for a split second, which completely destroy your score - thanks leverage; - by the way about marging call - if at the training stage leverage 1: 1000 seemed good, then in practice it is a nightmare that does not leave you any chances with minor unsuccessful market fluctuations;

- studies of this Forex have shown that the mathematical expectation of the movement of a pair of currencies in the long term is close to 50% and amounts to 51% ... 54%. Consequently, in the short term, currency movements can be considered random;

- Real Forex earnings are possible either for professional speculators or for fanatical scalpers .

There is another option of clairvoyance.Both that and another implies serious and long work on self-education, psychology and sitting in front of the monitor.

All! I did not have a free thousand dollars, there was no desire to sit for hours in front of the monitor. I could forget about Forex.

However, like alchemists, I did not waste a lot of time in vain - I studied neural networks in detail, had a good understanding of statistics, the MetaTrader programming language, working with MySQL, and also “side-by-side” studied many questions from the world of finance.

My path, however, lay further.

Anti-Kiyosaki: diversification

Of course, I studied Kiyosaki up and down. From it I learned a lot of useful things, including a terrible dislike for diversification . But from the institute I also took out critical thinking and the lack of blind faith in authorities. Why is Kiyosaki against diversification? Why is she bad?

Of course, I studied Kiyosaki up and down. From it I learned a lot of useful things, including a terrible dislike for diversification . But from the institute I also took out critical thinking and the lack of blind faith in authorities. Why is Kiyosaki against diversification? Why is she bad? I was very interested in this question, since I was faced with the fact that real investors widely use diversification. In the end, I came to this conclusion: diversification greatly reduces your gain. But it also reduces risk. If you are a professional and clearly confident in your financial instrument (and this is precisely the case of Kiyosaki), and you consider the risk to be tending to zero, then there really is no point in throwing yourself at various financial instruments.

But I am a simple computer technician who is poorly versed in all the instruments of the New York Stock Exchange. Moreover - I do not want to understand them much.

Somewhere at the same time, I began to study a little portfolio theory, which states: the sum of the tools can give a better result than the individual tools that make up its composition.

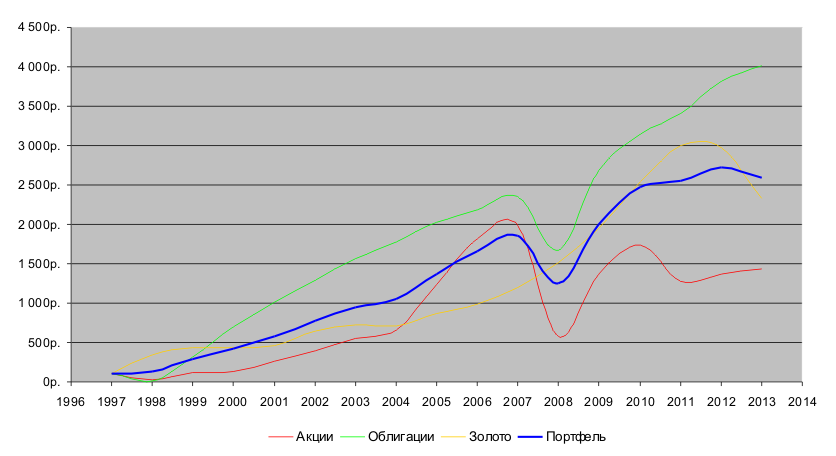

Then I decided to do such a thought experiment: let's say now is the end of 1997. I own 100 rubles. I have access to 3 instruments: 1) Dobrynya Nikitich equity fund , 2) Ilya Muromets bond fund, and 3) gold. Consider the fourth option, when I first divided 100 p. between all these tools equally. Such are the investments. Let's see how these 4 investments will change over time:

| Year | Stocks | Bonds | Gold | Together | |||

|---|---|---|---|---|---|---|---|

| Unit value | Amount | Unit value | Amount | Unit value | Amount | Amount | |

| 1997 | 475,50 RUB | 100 rub | 584.21 rubles | 100 rub | 54.40 r. | 100 rub | 100 rub |

| 1998 | 137,03 r. | 29 RUR | 91.95 RUR | 16 p. | 187.25 RUB | 344 r. | 130 RUR |

| 1999 | 540,08 r. | 114 RUR | 1 818,18 RUB | 311 RUR | 238.62 RUB | 439 RUR | 288 r. |

| 2000 | 606,52 RUB | 128 RUB | 4 107,58 RUB | 703 r. | 233.30 r. | 429 RUR | 420 RUR |

| 2001 | 1 253,94 RUB | 264 r. | 5 897,85 RUB | 1 010 r. | $ 253.17 | 465 r. | 580 RUR |

| 2002 | 1 851,79 RUB | 389 RUR | RR 7,569.17 | 1 296 r. | 348.50 rub. | 641 RUR | 775 RUR |

| 2003 | 2 607,48 rub. | 548 r. | 9 159.94 RUR | 1 568 r. | 393.15 r. | 723 RUR | 946 RUR |

| 2004 | 3 116,65 RUB | 655 r. | 10 397,10 rub. | 1 780 RUB. | 388.80 r. | 715 RUR | 1 050 rub. |

| 2005 | 5 854,48 RUB | 1 231 RUR | RR 11,821.31 | 2 023 RUB. | 472,35 RUB | 868 RUR | 1 374 RUB |

| 2006 | 8 651,54 RUR | 1 819 RUB | 12 782,30 r. | 2 188 RUB | 535.47 RUB | 984 RUR | 1 664 RUB |

| 2007 | 9 458.50 rub. | 1 989 RUR | $ 13,796.38 | 2 362 r. | 654.69 r. | 1 203 r. | 1 851 rub. |

| 2008 | RR 2,738.07 | 576 r. | 9 726,63 RUB | 1 665 rub. | $ 8.21 | 1 511 RUB | 1 250 rub. |

| 2009 | RUR 6,510.21 | 1 369 r. | 15 676,50 RUB | 2 683 r. | RUR 1,062.32 | 1 953 RUR | 2 002 r. |

| 2010 | 8 258,51 RUB | 1 737 RUB | 18 367.32 p. | 3 144 RUR | 1 383,06 r. | 2 542 r. | 2 474 r. |

| 2011 | RR 6 041.56 | 1 271 r. | $ 19,926.27 | 3 411 RUB. | 1 629,81 RUB | 2 996 r. | 2 559 r. |

| 2012 | RR 6,483.72 | 1 364 r. | 22 323,24 r. | 3 821 RUR | 1 618,56 RUB | 2 975 RUR | 2 720 r. |

| 2013 | 6 843.69 r. | 1 439 RUR | 23 455,99 rub. | 4 015 RUR | RUB 1,264.30 | 2 324 r. | 2 593 r. |

Well ... If I were a

But I am neither the one nor the other case. I do not want to guess and spend a lot of effort in order to understand where I better invest my money. I want to put them on the account and do more interesting things. And what can I tell you - a portfolio in this business would help me a lot! Yes, not stars from the sky, but quite a confident average result.

However, the average is poorly said! Over 16 years, the amount increased by 26 times, the average annual yield was 23%, the maximum drawdown of the account was 32%.

What would I do all these years as part of my investment activities? Nothing . The only thing is that I had to endure 1998, 2008 with iron nerves, since my portfolio sagged really well there. Can you imagine a speculator, much less a scalper, who would have an annual income of 23%, who would withstand a drawdown of his account of 32%? If so, compare his time spent and mine. And remember that nerve cells do not recover.

So I don’t understand why diversification is bad for me, a teapot in finances.

Portfolio theory

Traveling further through the expanses of the Internet, I came across the book by William Bernstein, "The Reasonable Distribution of Assets . " There I first got acquainted with the portfolio theory of Markowitz . The essence and its mathematics for a teapot like me can be expressed in simple language (in fact, this is what asset allocation does ).

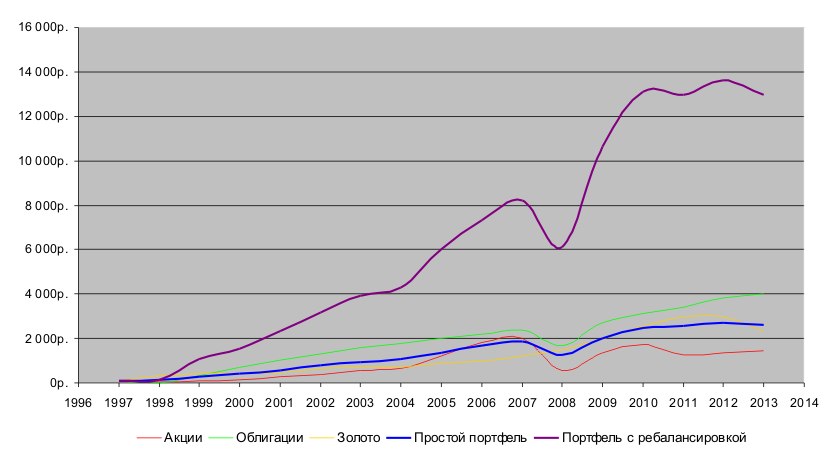

Traveling further through the expanses of the Internet, I came across the book by William Bernstein, "The Reasonable Distribution of Assets . " There I first got acquainted with the portfolio theory of Markowitz . The essence and its mathematics for a teapot like me can be expressed in simple language (in fact, this is what asset allocation does ). Do you remember the good result of our portfolio of stocks, bonds and gold? So, the result can be significantly improved, as well as reduced risk sensitivity at the cost of very simple efforts - once a year to change the distribution of money (more precisely, assets) in this portfolio. In science, this is called "rebalancing." See the result:

| Year | Stocks | Bonds | Gold | Simple briefcase | Rebalanced Briefcase |

|---|---|---|---|---|---|

| 1997 | 100,00 rub. | 100,00 rub. | 100,00 rub. | 100,00 rub. | 100,00 rub. |

| 1998 | R28.82 | 15.74 RUR | 344.21 r. | $ 129.59 | $ 129.59 |

| 1999 | 113.58 RUB | R 311.22 | 438,64 RUB | RUR287.81 | RUR 1,068.65 |

| 2000 | $ 127.55 | 703,10 rub. | 428.86 r. | RUR 419.84 | 1 537,53 RUB |

| 2001 | RUR 263.71 | 1 009,54 RUB | 465,39 RUB | RUR 579.55 | 2 328,12 RUB |

| 2002 | 389,44 RUB | 1 295,62 RUB | $ 640.63 | 775,23 r. | RR 3,178.14 |

| 2003 | RUR 548.37 | 1 567,92 RUB | RUR 722.70 | 946,33 RUB | 3 929,14 RUR |

| 2004 | 655,45 RUB | 1 779,69 r. | R 714.71 | 1 049,95 RUB | 4 303,82 RUB |

| 2005 | 1 231,23 r. | RUR 2,023.47 | 868,29 r. | 1 374,33 RUB | R 6,008.17 |

| 2006 | 1 819,46 r. | 2 187,96 r. | R 984.32 | 1 663,91 RUR | RR 7 321,47 |

| 2007 | 1 989,17 RUB | 2 361,54 RUB | 1 203,47 RUB | 1 851,40 r. | RR 8,203.22 |

| 2008 | 575.83 RUB | 1 664,92 RUB | 1 510,66 r. | 1 250,47 RUB | RR 6,090.21 |

| 2009 | 1 369,13 r. | RUR 2,683.37 | 1 952,79 RUB | R201,76. | RR 10 615.69 |

| 2010 | 1 736,81 RUB | 3 143,96 r. | 2 542,39 RUB | 2 474,38 RUB | 13 109.30 r. |

| 2011 | 1 270,57 RUB | 3 410,81 RUB | 2 995,97 RUB | 2 559,12 r. | 12 955,89 RUB |

| 2012 | 1 363,56 r. | 3 821,10 rub. | 2 975,29 r. | 2 719,98 RUB | 13 624,03 r. |

| 2013 | 1 439,26 r. | 4 014,99 rub. | 2 324,08 r. | 2 592,78 RUB | 12 981,49 RUB |

Over 16 years, the amount increased 130 times, the average annual yield was 36%, and the maximum drawdown was 26%.

Effort - once a year to calculate according to simple formulas that where (10 minutes), give an order to the broker (another 15 minutes) - and that’s all. You see the result yourself. What else can I say? Only the fact that so many years have passed by, for which it would be great to increase capital ... However, life is not over yet (I hope), there is still much that can be done (I hope even more). So emotions aside.

How did it happen? What is the magic?

The magic is that periodically the composition of the portfolio changes in order to buy cheaper assets, sell more expensive. This allows you to reduce the overall risk of the portfolio and, as you see, increase its profitability.

The technique here is simple. Initially, we decided to invest one third in stocks, one third in bonds, and the remainder in gold. Let’s take, let’s say, the end of 1997 - 33.33 rubles on shares, 33.33 rubles on bonds and 33.33 rubles on gold. A year passed, and now our stocks have fallen in price - now there is 9.61 rubles, bonds fell even steeper - 5.25 rubles, but gold rose - 114.74 rubles. Our portfolio, in spite of everything, has grown slightly - now it is 129.59 rubles. What does common sense require? Throw out cheaper assets, buy more expensive gold. This is what the majority does

We will do exactly the opposite. We will continue to adhere to the rule of 1/3 for each asset. 129.59r / 3 = 43.19r (I’m slightly sacrificing the accuracy of the lower digits, because there are a lot of decimal places). So, on the account of each asset should be 43.19 rubles. How to achieve this? Sell gold in the amount of 71.55 rubles (114.74 rubles - 71.55 rubles = 43.19 rubles). Then add 33.59 rubles to shares (9.61 rubles + 33.59 rubles = 43.19 rubles) and add bonds to 37.95 rubles (5.25 rubles + 37.95 rubles = 43.19 rubles). If you would have told your friends about this in those days, they would have quickly hid you to hell! But as early as next year, they would have bitten themselves everything that could be ...

That's how simple it is! In theory…

... and her practice

What is rebalancing? When and how? What assets to recruit? What kind...? What do you need...? Where ...?

What is rebalancing? When and how? What assets to recruit? What kind...? What do you need...? Where ...? In general, it is time to collect specific information. Bernstein, Markowitz, Kiyosaki - this is good, but it is the wild West. How to apply this knowledge in our civilized East?

Here now I’m stomping around. More precisely, I am accumulating funds and studying the theory in detail.

Where to get the funds for all this activity? I really liked this lecture . Or rather, the section "Simple Mathematics". It shows simple calculations of how an investment of $ 100 grows with 20% profit per year (as you saw, this is more than real). After 51 years, this amount will exceed $ 1 million. And if this amount is increased annually by additional infusions ( those same 10% of the salary), then it will take much less time. Personally, after reading this first lecture, I immediately ran to the bank and opened several deposits (at that time I did not yet have a portfolio theory). As I become smarter - I will invest in more serious financial instruments.

How often do rebalancing? Most sources advise doing it once a year - no more and no less.

In what proportion to collect assets?

There is a sea of mathematics ... The formulas are simple - in particular, we recall the mathematical expectation, variance of a random variable and covariance. Excel and the like allow you to perform all complex calculations easily and quickly, in all kinds of combinations.

The mathematical expectation of annual profit (expressed in%) will give us "profitability", the variance of annual profit (I turn it into the standard deviation - it is somehow more obvious to me ...) - "risk", covariance (according to monthly data) - the dependence of tools on each other. Those instruments that show high dependence are not suitable for portfolio theory. It is better not to consider them at all.

For those interested and ready for calculations. Take the tools you are interested in (those that I took, for example). Download data to a spreadsheet. Calculate the arithmetic mean and variance from them. Then you form all kinds of combinations - for example, 10% gold, 50% bonds and 40% shares. For each such combination, consider profitability and risk.

Finally, you can choose what you need. As a rule, high profitability is accompanied by high risk. You find the combination that is most comfortable for you. And for this proportion, you start to work.

It is necessary to take into account that portfolio theory works for long periods (ten years is not enough). This means that the selected proportion will have to be respected throughout this period.

It must also be remembered that future combinations are loosely related to history. It must also be kept in mind.

In general, here for me the most questions. I try, drive different models, study ... If there are interesting results and interest from the readership, I will write in some detail.

And the main question is how wide should diversification be? Different fin. instruments? Yes, but it needs to be wider. There should be tools not only in our country, but also abroad - remember the year 1917? Before him, it was necessary to invest in the assets of the St. Petersburg Exchange. Only in a year all your money would have evaporated ... This could happen now. For example, YUKOS shares are the same asset that could destroy your portfolio. So his advice - the wider the better.

Conclusion

I went the following way:

- I refused consumer loans - it was not difficult for me, because I did not have time to “get hooked” on them, and my second loan turned out to me in such a penny that I am now afraid of them like fire. However, fire is also useful. Therefore, my attitude to loans is this: credit is a powerful, but very dangerous financial tool, and should be used with great skill . As well as antibiotics - their competent use saves, and if they "shyrivat", they will destroy you;

- I began to save 10% of the profit - I already wrote about this and mentioned earlier . In a nutshell - with every profit (except for the donated money) I save 10% in the piggy bank. I get more than one salary per year. This money is inviolable and is used only for investment purposes (or at first some reserve amount is collected, then everything is only for investment). So you can periodically, without noticeable damage to your finances replenish investments;

- invested in several deposits - put money in several banks at high interest rates for an average (9 months) period. Why different banks? Because deposits are risky - there is a possibility that not all money can be withdrawn (this, however, has not happened yet);

- I’m conducting a financial report - it’s already in my habit. In the evening I write down everything in detail. As a result, I found small financial holes. Now I clearly know how much and what I need money for. Along the way, made friends with statistics. Useful!

- I raise my theoretical level - I spend time and money on the study of financial theories. I also study financial instruments that I plan to use;

- I do research - I try, I drive different models. For deposits are good (low risk), but weak (low yield). In fact, this is a reserve for me; I am preparing for more serious investments;

- constantly designing my global goals - an important point! Why save money? How much do I need them? How do I plan to withdraw accumulated funds? Will I continue to invest after retirement? When will this happen? What if some assets burn out?

At present I have a level of deposits and deferred “urgent” funds. For the future I plan to accumulate funds for investing in more serious instruments. By that moment I hope to confidently navigate all the necessary issues.

I am very sorry that so much time has passed. I am even more glad that there is much more time ahead!

I wish you financial success!