What is really going on in the mobile market

Squeezing facts about the market : why the phone will become a multi-passport, where the competition will be concentrated, and how many people get into stress without a phone.

Pirates and warming . Comparison of prices for bread, milk, gasoline, a ticket on the subway and a minute on the cell phone.

In 2011, the subscriber base in Russia amounted to approximately 4.6% of the total number of mobile communication users in the world. The Big Three controls over 82% of the market.

As of December 31, 2010, the penetration of cellular services in Russia (the number of SIM cards per 100 residents of the Russian Federation) amounted to 166.3% according to the Federal State Statistics Service and the Ministry of Communications. For comparison, on average in Europe this indicator is 128%, in the CIS - 122%.

In 2006, the penetration rate of mobile communications in Russia exceeded the 100% mark (for comparison, in 2002 there were only two countries with this level, in 2010 - more than a hundred). After that, the process of saturation of the mobile communications market began, and, as a result, a decrease in annual growth. In the period from 2008 to 2011, the growth rate slowed down and amounted to 7-8% compared to the previous year. Moreover, the growth is determined by the low-coverage regions and new connections of subscribers who already have one or more SIM-cards.

Thus, the active growth of the subscriber base in 2010 in Russia actually ended, having reached a value that is ahead of similar indicators in the European Union (128%) and the CIS countries (122%). Most of the current sales of contracts is a consequence of the transition of subscribers or short-term connections (for example, for the duration of a subscriber’s stay outside his “home” region).

It is expected that the Russian mobile communications market will finally stabilize at a penetration level of 170% -175% (this is approximately 244 million SIMs in total and approximately 124 million active SIM cards).

To assess the level of development of mobile communications, another indicator is used - the actual penetration - the proportion of citizens with at least one SIM card. For Russia, this indicator, according to various estimates, ranges from 85% to 90%.

From 2000 to 2010, the average volume of minutes consumed by a subscriber more than tripled from 90 to 300 minutes, respectively (source: MForum analitics).

According to the annual statements of operators on the results of operations in 2010 in Russia, profit is distributed as follows: MTS - 32%, MegaFon - 28.1%, Vimpelcom - 28%.

The volume of the mobile phone market in 2010 in comparison with 1997 grew 205 times.

The number of phones sold in retail over the entire period of the existence of mobile communications in Russia is about 290 million units.

Acquisitions and mergers gradually lead to the emergence of universal telecom operators providing a full range of information and telecommunication services for both corporate and private subscribers, including mobile and fixed-line telephony, broadband Internet access, digital cable TV, as well as all related services .

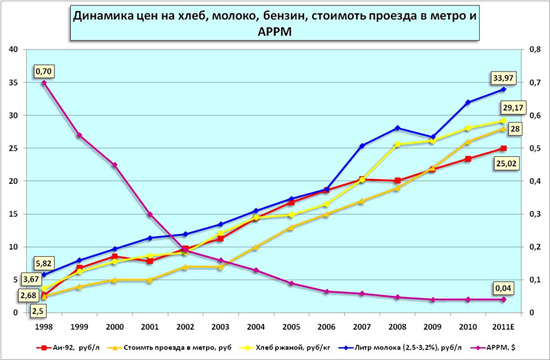

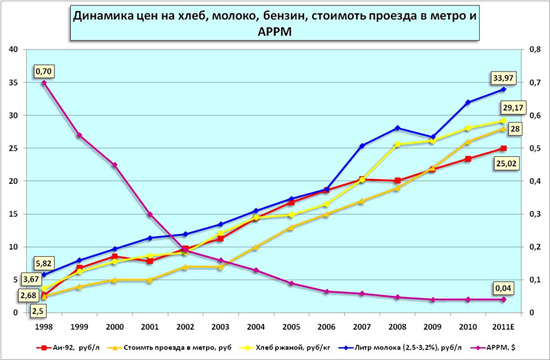

In the period from 1998 to 2011, the cost of the most mass goods and services increased as follows:

At the same time, the cost of the average minute of talking on a mobile phone decreased by 17 times.

From polls:

What if you forget your phone at home? The answer options were clearly divided: a third of users will return home for the phone, a third will be nervous and will find an alternative solution. Only 34% believe that nothing will happen, and can do without a phone during the day. Moreover, 50% believe that they have become addicted to the phone, but do not see anything wrong with that.

The material was prepared on the basis of the analytical report of Evgeny Solomatin.

Introductory

In 2011, the subscriber base in Russia amounted to approximately 4.6% of the total number of mobile communication users in the world. The Big Three controls over 82% of the market.

As of December 31, 2010, the penetration of cellular services in Russia (the number of SIM cards per 100 residents of the Russian Federation) amounted to 166.3% according to the Federal State Statistics Service and the Ministry of Communications. For comparison, on average in Europe this indicator is 128%, in the CIS - 122%.

In 2006, the penetration rate of mobile communications in Russia exceeded the 100% mark (for comparison, in 2002 there were only two countries with this level, in 2010 - more than a hundred). After that, the process of saturation of the mobile communications market began, and, as a result, a decrease in annual growth. In the period from 2008 to 2011, the growth rate slowed down and amounted to 7-8% compared to the previous year. Moreover, the growth is determined by the low-coverage regions and new connections of subscribers who already have one or more SIM-cards.

Thus, the active growth of the subscriber base in 2010 in Russia actually ended, having reached a value that is ahead of similar indicators in the European Union (128%) and the CIS countries (122%). Most of the current sales of contracts is a consequence of the transition of subscribers or short-term connections (for example, for the duration of a subscriber’s stay outside his “home” region).

It is expected that the Russian mobile communications market will finally stabilize at a penetration level of 170% -175% (this is approximately 244 million SIMs in total and approximately 124 million active SIM cards).

To assess the level of development of mobile communications, another indicator is used - the actual penetration - the proportion of citizens with at least one SIM card. For Russia, this indicator, according to various estimates, ranges from 85% to 90%.

From 2000 to 2010, the average volume of minutes consumed by a subscriber more than tripled from 90 to 300 minutes, respectively (source: MForum analitics).

According to the annual statements of operators on the results of operations in 2010 in Russia, profit is distributed as follows: MTS - 32%, MegaFon - 28.1%, Vimpelcom - 28%.

The volume of the mobile phone market in 2010 in comparison with 1997 grew 205 times.

The number of phones sold in retail over the entire period of the existence of mobile communications in Russia is about 290 million units.

Acquisitions and mergers gradually lead to the emergence of universal telecom operators providing a full range of information and telecommunication services for both corporate and private subscribers, including mobile and fixed-line telephony, broadband Internet access, digital cable TV, as well as all related services .

About phones

- A telephone from a communication facility becomes a personal identifier and a billing center.

- Phone today is a full-fledged camera, navigator, player.

- Unlimited tariffs are used to “tie” a subscriber to a player and to displace fixed communications. For example, in Europe, the proportion of households without a fixed line connection is in principle about 30%.

- In the future, the phone will also become a diagnostic center, a training tool, a storage of personal data.

- According to ITU estimates, more than half of new Internet users in developing countries first accessed the Network from a mobile phone, and not from a personal computer (which are still expensive and too complicated to use for the bulk of the population of developing countries). In our country, thanks to the free "zero zones" Beeline (like 0.vkontakte.ru), up to 30% of new users began to use mobile Internet.

- The development of subscriber terminals determines the development of the mobile communications market. Currently, more than 87% of all mobile terminals owned by Russian users support GPRS technology, 63% EDGE technology. (Source: J&P Consulting).

- Phones are getting cheaper on average, which affects their availability.

Main trends

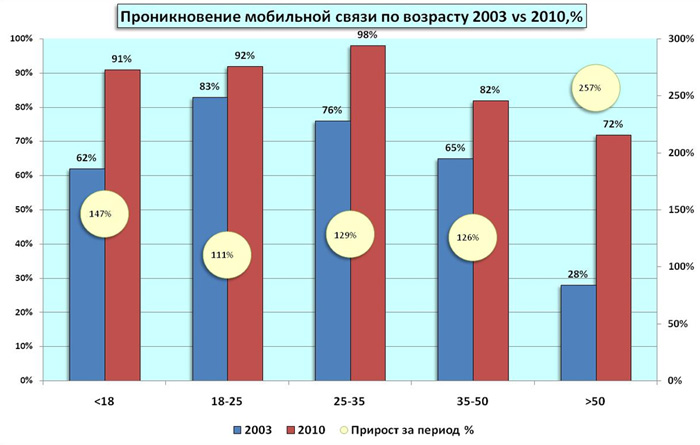

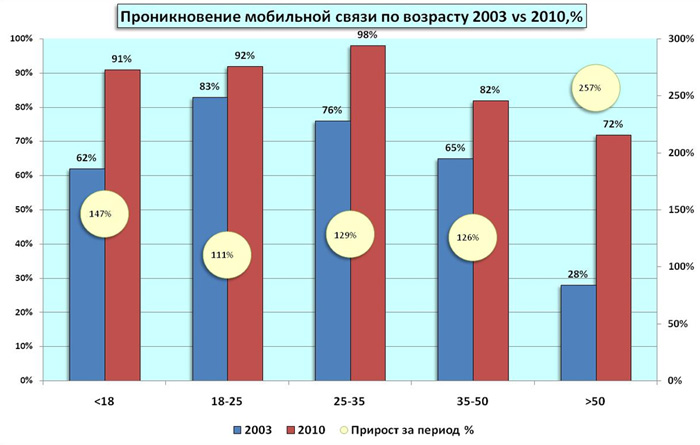

- Penetration is growing due to the elderly and young people: the middle age segment is almost completely covered (98%).

- The growth of revenues in the industry is due to the growth of revenue per subscriber, this is about 2% per quarter in 2010-2011.

- The growth of the “average check” per subscriber is driven by the availability of mobile Internet and additional services, while the share of voice traffic in revenue is falling.

- In 2011, the total amount of data transmitted via mobile Internet increased by more than 2.5 times compared to 2010 and amounted to 95 Pbytes. (ComNews Research)

- For 570 rubles, it was possible to buy a tariff plan for 1 Mbit / s in 2010, a year later for the same money - for 7 Mbit / s. The penetration rate of mobile broadband by 2015 will be up to 41% (forecast).

- The main technical trend is the willingness to switch to a new generation of packet communications - LTE. According to J'son & Partners Consulting, the first year of operation of LTE networks in Russia will bring up to 300 thousand subscribers, and by the end of 2015 they will already be 9 million. According to estimates by Informa Telecoms & Media, by 2015 there will be 273 million LTE subscribers, with the share of mobile WiMAX amounting to just over 1%.

- The competition of operators is focused on the development of additional services. In recent years, the share of mobile Internet in the structure of revenue from VAS services has increased significantly, pushing SMS revenues into the background, which in 2009 amounted to about 49%.

- The direction of FMC is promising (convergence of fixed and mobile communications, here is the topic ).

- According to iKS-Consulting, the volume of the content services market in 2002 was only $ 20 million, and by 2011 it had grown more than 70 times and amounted to $ 1.5 billion.

- M2M (machine-to-machine) technology is developing very actively, with a wide range of applications, ranging from telemetry and telematics in various industries (transmission of measurement data, any parameters with a certain frequency, from industrial, transport and other objects, weather monitoring, data collection from utility meters), before using M2M in a segment of the population - for health monitoring, in protection and monitoring systems of the home. Before the advent of mobile communications, telemetry information collection technologies were very expensive for stationary objects (due to the need to lay a separate line to each sensor) and impossible for moving objects. About M2M and implementation features there will be a separate topic.

- The volume of the mobile advertising market in 2011 will be about $ 12 million, in 2012 this figure will increase by 70% (source: J'son & Partners Consulting).

Communication prices

In the period from 1998 to 2011, the cost of the most mass goods and services increased as follows:

- Bread - the price increased 8 times;

- Milk - the price has increased 6 times;

- 92nd gasoline - the price increased 9 times;

- Directions to the Metro - the price has increased 11 times.

At the same time, the cost of the average minute of talking on a mobile phone decreased by 17 times.

Loyalty

From polls:

- Once the phone was a sign of status. Now emotional motivation is at the level of 15%, that is, mobile communication has ceased to be a way of highlighting an individual in society. High value of the phone for doing business - more than 50%. The statement “to be in touch always and everywhere” acts as a functional motivation and has the highest percentage of positive answers - more than 90%.

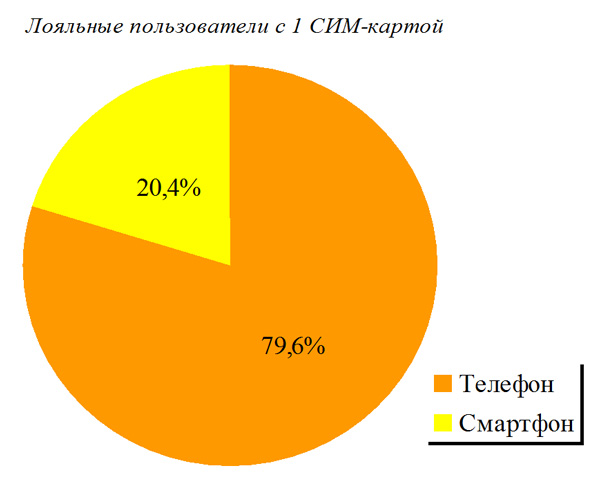

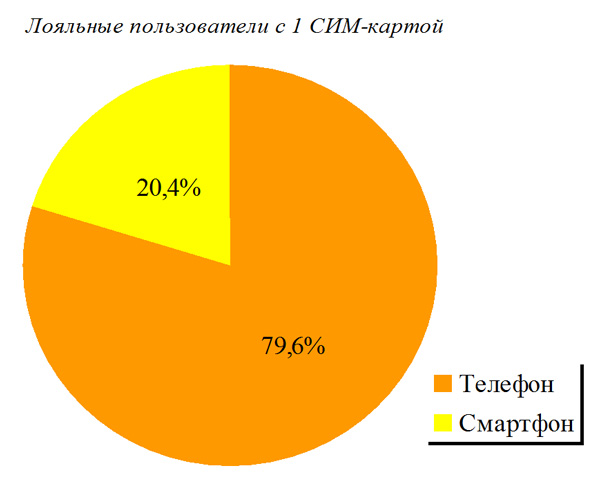

- Compared to “disloyal” users, “loyal” users (one operator all their lives) communicate on social networks by 40%, pay less for goods and services, use information services 40% less, use phone for entertainment 30% less . They need 40% less access to mobile Internet, they are 45% less likely to use mobile communications for business purposes.

- Thus, “loyal” users who have a single operator all their lives (having only one SIM card) are more conservative, the functionality of mobile communications is less important for them, they consume less services, but they are more emotional. At the same time, we can make a paradoxical conclusion that the user's affection and his emotionality do not bring profit to the operator. Those who switched from another operator will be more cynical and functional, demand more from the operator, but also pay more.

- Users with multiple SIM cards are 60% higher than the average for the sample, attach importance to the image and prestige of the phone, compared to users with a single SIM card.

- Only 15% consider it important to have a “beautiful” phone number,

- Only 12% consider it important to use the services of the same operator as friends and acquaintances from their circle of friends. For 45% it doesn’t matter which operator use the services.

Smartphone owners versus regular handset owners

- 30% more (28% and 18%) communicate on social networks.

- Twice as often (48% and 27%) use a smartphone for entertainment.

- 2.2 times more often (55% and 23%) use information services.

- 2.3 times more often (60% and 26%) access the Internet.

- 30% more active (72% and 58%) are used for business purposes.

Gender factors

- There are no significant differences in the consumption of services by men and women in most services. There is a higher activity of consumption of navigation services by men. Men are 10% less likely than women to send SMS, 20% less likely to send MMS and pictures, but they are almost twice as likely to use navigation services and 30% more information, 50% more likely to pay for services and goods.

- There are significant consumption by age groups. The level of consumption of technological services in the group “over 50” for almost all services does not exceed 10%. For example, for the Internet access service it is only 9%, while among the group 15-25 the penetration rate of mobile Internet reaches 70%.

- The group of 15-25 years is the most active with a share of 50% for sending MMS. Men in this group are twice as likely as women to use navigation services (which, most likely, reflects the gender structure of car drivers).

Phone attachment

What if you forget your phone at home? The answer options were clearly divided: a third of users will return home for the phone, a third will be nervous and will find an alternative solution. Only 34% believe that nothing will happen, and can do without a phone during the day. Moreover, 50% believe that they have become addicted to the phone, but do not see anything wrong with that.

Speech

The material was prepared on the basis of the analytical report of Evgeny Solomatin.