“Withdraw money” - on Visa cards of six countries

The advantages of using electronic money are more or less known to users of the Runet. No need to leave the house, no need to stand in line, no need to perform any extra actions.

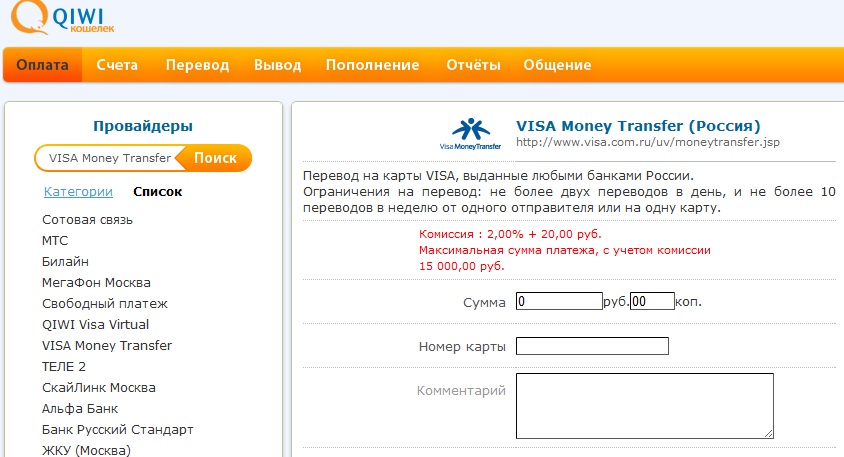

The advantages of using electronic money are more or less known to users of the Runet. No need to leave the house, no need to stand in line, no need to perform any extra actions. However, when choosing the most convenient of these systems, the user (especially the freelancer) often asks the question: "How can I" withdraw "money"? .. Users of different electronic money have different options for converting them into real ones. For example, QIWI Wallet users can “withdraw” money with Unistream and Contact transfers, as well as make transfers to bank cards of the largest Russian banks.

And what about cardholders of those card issuing banks that are not on the list of our providers?

For this case, the option is suitable: Visa Money Transfer. Now “withdrawal” is possible on Visa bank cards issued by any bank of the following countries: Russia, Kazakhstan, Tajikistan, Ukraine, Uzbekistan, Georgia - “withdraw” funds to any card:

- regardless of bank

- regardless of type of Visa card

This is a good way to “withdraw” money also because it is carried out on acceptable conditions:

- “Withdrawal” to Visa cards of neighboring countries: 2% + 40 rubles

- “Withdrawal” to Visa cards of Russia: 2% +20 rubles

Time for receipt of funds: from several hours to 2 days (depending on the efficiency of your bank).

Remember that your bank may impose restrictions on such transfers. The most common restriction is no more than 30,000 rubles per day per card / account number. The weekly limit is usually 150,000 rubles.

Anticipating possible questions, I’ll immediately say that while the replenishment of QIWI Visa Virtual is not possible.

So, now accepting payments to your QIWI Wallet anywhere in the world, you can easily withdraw money to any Visa bank card if it is issued in one of the following countries: Russia, Kazakhstan, Tajikistan, Ukraine, Uzbekistan and Georgia.

The results of tests on the rate of enrollment surprised us somewhat. Kazkommerts (Kazakhstan) turned out to be the record holder - the money was on the card in less than an hour!

Send us data on the speed of crediting money to your Visa cards - we, together with the international payment system, will actively work on improving the service.

Thanks.