Destroy in 9 seconds. How an unknown algorithm destroyed IPO BATS

BATS Global Markets owns two electronic exchanges where stocks and options are traded. These exchanges operate on the principle of electronic communications networks (ECN).

BATS stands for Vetter Alternative Trading System, which means "Best Alternative Trading System." The company is a platform that competes with other exchanges, primarily the NYSE and NASDAQ trading systems. The BATS exchange was launched in January 2006. At the moment it is the third largest exchange in the United States, its turnover is 12% of the total turnover of the country. Two years after the founding of BATS Global Markets came to self-sufficiency. About three hundred brokerage and dealerships from around the world are currently cooperating with this exchange. Over time, such giants as Bank of America, Merrill Lynch, Citi, Credit Suisse, Deutsche Bank and others joined the co-owners of the company. The main difference between BATS and other platforms is the creation of favorable conditions for trading: very low fees compared to other exchanges. The BATS exchange is a kind of discounter for traders, such as the WalMart store in the USA. However, BATS ambitions are impressive. The exchange plans to create alternative listings and conduct an IPO.

From the very beginning of its foundation, BATS was not focused on ordinary stock trading, but on providing services to large high-frequency traders, its electronic platforms were optimized for trading using robots. This choice is not surprising, since the founder of BATS, Dave Cumings, is the owner of Tradebot Systems, which accounts for about 5% of the daily turnover of the entire US stock market on certain days. The current first person of the BATS, Joe Ratterman, also comes from this company.

On May 6, 2010, $ 862 billion evaporated from the US stock market in 20 minutes. The Dow Jones index hit a thousand points (the largest drop in history), trading stopped, the financial life of the entire planet in the literal sense of the word was in limbo.

The culprit was found almost immediately: the enraged US Securities and Exchange Commission (SEC) poked a finger at HFT - computerized trading algorithms that now provide over 70% of the exchange's turnover.

But after a “thorough investigation” the anger gave way to mercy: the lightning depreciation of the stock market was officially blamed on the annoying mistake made by the modest and unknown futures broker Waddell & Reed in trading. The “crime” committed by W&R consisted in the sale of 75 thousand contracts for futures E-mini S&P. The volume, of course, is not the smallest, but not even close enough to even seriously affect the market, much less to completely collapse it.

W&R at first vigorously denied any guilt, and then somehow went limp, quiet and dived back to where he had been taken for a few moments by a capricious fate: into a crowd of other unknown and unimportant participants of exchange trading. Meticulous financial journalists then fumbled for a long time, trying to figure out the size of the “compensation” that W&R received in exchange for agreeing to play the role of a universal scapegoat.

As for the true culprit of the market collapse - HFT, he was still a little patted on the sidelines of Congress and the Senate, intimidating by almost a legislative ban, and betrayed to public oblivion.

Why betrayed - it is clear: the main figures of high-frequency trading in America are Goldman Sachs, Morgan Stanley and a dozen of the largest banks - they provide 70% of the daily exchange turnover.

For almost two years no one remembered the HFT, and the events of March 6, 2010 were preserved in the collective memory as an unfortunate technical error or someone’s oversight. And recently, on March 23, 2012, an event took place that clearly demonstrated: a “technical error” quietly evolved into a weapon of such destructive power that it seems to have been borrowed from the arsenals of the fantastic Star Wars of the future.

The event in question did not have an impressive effect (the lightning-fast collapse of the market by a thousand points is a completely different calico!), Therefore, it was noticed only by narrow professionals of exchange trading. And in vain did the public give him so little attention! In terms of its far-reaching consequences and potential, the March 23, 2012 incident is an order of magnitude superior to the HFT pranks of two years ago.

We are talking about the failed attempt of the American company BATS Global Markets to conduct an IPO. The attempt to bring the shares to the stock exchange lasted exactly ... 9 seconds, during which the company's securities literally depreciated practically to zero, trading on them was suspended, and after a while the company management embarrassedly announced a complete refusal to go to the stock exchange in the foreseeable future.

BATS IPO was "killed" by a computer hft-algorithm launched from the terminals of an unidentified trader. when traders were able to start trading “from the street”, they saw on their monitors a quote of 4 cents as a starting transaction - and not $ 16-18, as the organizers of the placement planned

The blame, like two years earlier, was officially blamed on the “software failure”, but the trouble of the SEC and all the structures involved in the drama was found by a random witness who not only recorded the incident up to a millisecond, but also analyzed each of the 567 exchange transactions completed in 9 seconds with BATS Securities. From the analysis it was clear that there was no “software failure” at all, and the collapse of the IPO was the result of a hidden malignant computer algorithm launched from the terminals of an unidentified company with direct access to the NASDAQ electronic exchange. An algorithm that purposefully performed its clear task: destroy IPO BATS!

It was not by chance that I said that the potential of the incident exceeds the pranks of the HFT two years ago by an order of magnitude. In Fatty Finger, I showed readers how high-frequency trading can cause total turmoil on stock exchanges due to the nature of its own trading algorithms. So, the collapse of May 6, 2010 was caused by a simple shutdown of several key HFT terminals, as a result of which the market lost the lion's share of its usual liquidity and plunged into the abyss of imbalance between supply and demand. At least, it seemed then.

The BATS IPO incident demonstrated that, in addition to passive “shutdown”, HFT algorithms are also able to “turn on” and act at the right time and in the right place so that any security can be destroyed in seconds! In other words, technological monsters escaped from Pandora’s box and turned into a deadly weapon, perfect for the upcoming cyber war!

Why did I suddenly start talking about cyber warfare? Are there many IPOs in America every year by unknown companies? One more, one less ... The fact of the matter is that BATS is not at all an ordinary business in itself, but - what is there to be modest about! - The third largest exchange in the United States!

Surprised? Everyone knows about the NYSE, NASDAQ is on everyone’s lips, but BATS? What kind of bats? Where did she come from? I think when readers get acquainted with the dossiers of this company, they will be able to appreciate the exchange sabotage carried out against the company on March 23.

Paradise for HFT

So, BATS Global Markets was established in 2005 by David Cummings in Kansas City, Missouri. BATS stands for Better Alternative Trading System (“Advanced Alternative Trading System”) - a name that speaks for itself. BATS is the so-called second generation electronic communication network (ECN), that is, a platform for conducting exchange trading, an alternative to the system NYSE and NASDAQ.

BATS was created by players of high-frequency trading to meet their own needs, in particular to qualitatively reduce commission deductions, which, when interacting with system exchanges and taking into account the enormous volume of transactions, are cast into almost unbearable amounts.

High-frequency traders not only create liquidity in the market, but also represent their beloved “cash” cow of exchange platforms, since they regularly provide them with high milk yield in the form of commissions.

Creating BATS in 2005, traders set themselves the obvious task: to get out of the control of system exchanges and transfer operations to their own platform, more convenient for high-frequency trading. The main investors of BATS were Lehman Brothers, Getco, Wedbush, Lime and Deutsche Bank.

The names are all sonorous - what are the only deceased Lehman brothers! - however, united by sad stigma: losers! Of course, in the context of the financial elite of the planet, it is difficult to talk about failure in principle, but the absence of genuine favorites - companies that really determine global financial policy - catches the eye.

Citibank, Credit Suisse, Morgan Stanley and JPMorgan joined the main underwriters when listing BATS shares on the stock exchange, but even the extended list lacks at least one name, which in itself completely outweighs the rest: Goldman Sachs.

This detail is a trifle, only information for reflection, which, nevertheless, will help the reader more objectively evaluate subsequent events.

The high-frequency traders' self-reliance rate was fully justified: on January 27, 2006, BATS opened up for the implementation of “high-speed, high-volume, anonymous algorithmic trading” and, thanks to dumping commissions, pulled over 10% of the total exchange volume of America in just a few months (more than 50 million transactions daily )! Trading on BATS was transferred to more than 270 brokerage and dealerships, not only from the United States, but also from Europe and Asia.

Two years after the opening of BATS Global Markets, which by then had already managed three platforms (two for shares and one for options), it reached net profit.

The company's managerial model has crystallized: founding father David Cummings modestly resigned as CEO and chairman of the board of directors, handing over the reins to his former CEO Joe Ratterman. And he himself headed the private investment firm Tradebot Systems, which developed trading complexes and algorithms, and then transferred BATS for licensed use.

The purely commercial success of an alternative exchange platform for high-frequency trading ultimately predetermined the decision of the founding fathers to make the company public. The highlight of the IPO BATS was that the underwriters decided to send the company’s shares on a big float through its own trading platform! Not through traditional NYSE and NASDAQ, but your BZX Exchange and BYX Exchange3.

The reasons for the decision were weighty. First, in the event of a successful IPO, BATS gained full control over its own securities, at least avoiding hypothetical manipulations and tricks from its direct competitors and fierce rivals - NYSE and NASDAQ. Secondly, BATS securities were provided with the highest possible liquidity, since according to SEC statistics, trades on BZX are available to traders 99.94% of the time, and BYX - 99.998%.

These figures are also indicative of the fact that BATS sites have historically demonstrated exceptional reliability. In addition, before listing its shares on the stock exchange, the company conducted field trials and test simulations for six months. Everything went without a hitch, at the highest technological level, which can only be expected from the latest generation trading platform.

High frequency shock

In the light of the said event, March 23, 2012 looks unbelievable to the most unscientific fiction. Meanwhile, the fact remains: the placement of BATS securities began at 11 hours 14 minutes 18 seconds and ended at 11 hours 14 minutes 27 seconds. 9 seconds of bidding - and complete failure!

BATS GLOBAL MARKETS - NOT AN ATTITUDE AMERICAN COMPANY DECIDING TO GO ON IPO. THIS IS THE THIRD US EXCHANGE TURNOVER OPERATOR (AFTER NYSE AND NASDAQ), which, since 2006, has managed to delay 10% of America’s stock exchange

Reconstructing the dramatic events helped Nanex (the very random witness!) - the largest US provider of highly accurate stock information. Nanex tracks, captures, and then sells to traders the entire chronography of America’s exchange life to the nearest hundredths and thousandths of a second. Within a few days after the incident, the company's analysts conducted their own investigation, which showed that there was no “software failure”!

It turned out that BATS shares destroyed 567 transactions that came within 9 seconds from the same terminal, moreover, connected not with the BATS exchange, but with the platform of its competitor - NASDAQ.

How it was? Let's start with a general chronology

So, on March 23, 2012, BATS, having received all the necessary permissions from the SEC in advance, makes a decision on listing its own shares on the stock exchange. The first tranche consisted of 6.3 million Class A securities, of which nearly half came from Lehman Brothers Holdings Inc. holdings. (the heiress of the deceased Lehman Brothers), and another 1.1 million - from Getco.

It was planned to start trading in the range between 16 and 18 dollars apiece, depending on the level of demand prevailing at the time of opening.

When the placement started, the first quote that appeared on the monitors - $ 15.25 - turned out to be 5% lower than originally planned. As BATS managers later recalled, their price upset them, but not very much. Everyone hoped, if not for the rush demand from the job, then at least for the interest recorded at the level of preliminary surveys, that is, in the range of 16-18 dollars .

According to the first transaction conducted on the site of BATS itself, the lion's share of shares passed - 1 million 200 thousand shares. Further events developed as follows:

- in the first thousandths of a second, starting from the second, the quotation rises to 15.75 - there is an exchange of 800 shares, which is already being carried out on the NASDAQ exchange;

- further in the range of seconds there passes a chain of successive falls, one after the other: $ 14 - $ 13 - $ 10.23 - $ 8.03 - $ 5.79 - $ 4.17 - $ 3.01. Some unfortunate seven orders, and the IPO is almost out of the game! Each of the killer trades was executed on a minimum lot of 100 shares - these are the so-called flash orders of the IOC type (Immediate Or Cancel - “execute immediately or cancel”), which are the “trademark” sign of the high-frequency trading algorithm. All transactions are conducted on NASDAQ;

- in the second second of life, the IPO BATS continued to fall: $ 2.17 - $ 1.15 - $ 0.76 - $ 0,0002 (two hundredths of a cent!). A total of 444 trades were made at $ 100 each, and all transactions went through the NASDAQ;

- there is a pause for a second, then at 11 hours 14 minutes 21 seconds a fixing transaction at 3 cents per share BATS;

- at 11 hours 14 minutes 27 seconds, the price rises to 4 cents, and it is this figure that first appears as a starting transaction on the monitors of most computers with ordinary traders from the street (which, as you might guess, the majority);

- at 11 hours 14 minutes 33 seconds on all boards the inscription “Halted” 4 lights up: exchange breakers are switched on, which automatically stop trading on the stock if its quotation changes above the permitted limit. In the case of BATS, a drop from $ 16

- up to 4 cents in 9 seconds generally falls outside the scope of the possible;

- after a few minutes of pause, the IPO BAT price was returned on the quote tape to a technically meaningless value - $ 15.25 apiece. It makes no sense, since no sane trader would ever think to buy paper for that kind of money if he knows that a few seconds ago it cost 4 cents!

- BATS Management Announces IPO Withdrawal

After an overwhelming embarrassment, the CEO and President of the company, Joe Ratterman, made a public appeal to investors, in which he apologized for the disaster and - sic! - completely blamed the “software glitch”: “This is a terrible shame,” Joe Ratterman sobbed virtually on the shoulder of the affected investors. “We feel terrible.” All responsibility lies with our company. We take responsibility. There were no external influences from the outside. ”

The last sentence looks very juicy, since if an outsider Nanex easily detected killer orders from NASDAQ terminals, BATS engineers could do this even faster by analyzing the internal traffic from transactions with shares of their own company. And certainly found. However, BATS chose not to inflate the scandal, and even refused to re-conduct the IPO, fixing essentially multi-million losses for its shareholders and underwriters! Why is BATS so scared?

Fingerprints

Analyzing the transactions that destroyed the IPO BATS, Nanex discovered the mysterious "failures" that accompanied the work of the malignant computer killer algorithm. Moreover, these "failures" did not occur on the NASDAQ, but directly on the BATS sites, which in terms of technology used to have a reputation as practically bullet-proof - "bulletproof".

So, a quarter of an hour before the 9-second massacre in BATS electronic networks, another strange malfunction occurred, which brought down quotes for Apple, the most actively traded paper on US exchanges, as a result of which it was necessary to stop trading on all sites in the country. Three days earlier, Apple's quotes for the same BATS also unexpectedly fell by $ 20, after which again a stoppage of trading followed. Finally, a second before the withdrawal of BATS shares from trading, after the attack, the deal on Apple shares was 54 dollars lower than current quotes. And again, trading on securities of the stock exchange darling was stopped for five minutes.

The choice of Apple as a companion victim, in my opinion, is not accidental precisely because of the cult status of America's favorite: as a result of the 9-second diversion, not only the BATS shares were discredited, but its ability to control the situation on its own platform was questioned. Who of the resourceful "tweeters" will now want to trade on the exchange, which manages to collapse the paper itself Apple ?!

An analysis of the operation of the malignant algorithm shows that there was some kind of almost direct relationship and dependence between the bidding for Apple and BATS, however, Nanex did not dare to take responsibility for such a statement.

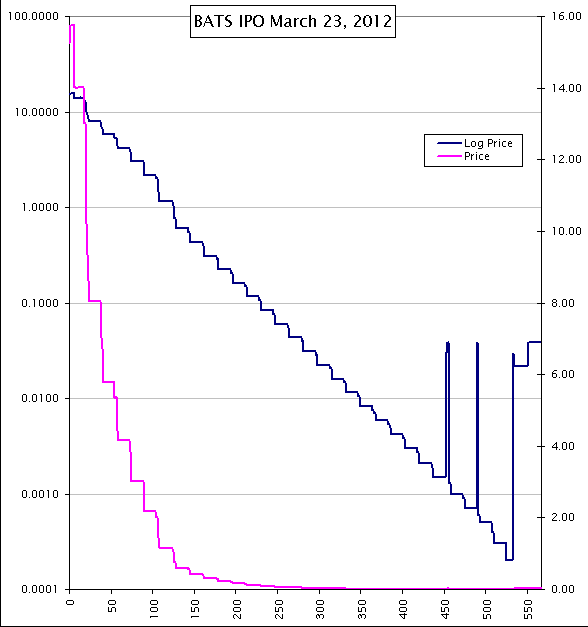

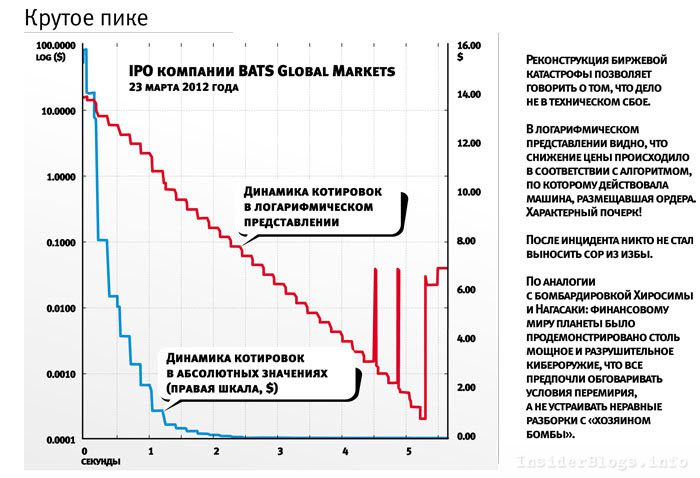

Why is it the killer algorithm and not the software crash? Nanex provides several evidence in his analysis report, the most illustrative of which is the graph that I put here.

The chart shows all 567 transactions with IPO BATS, which are presented in two scales. The blue line reflects the decline in the value of BATS shares in absolute terms, the red line is taken on a logarithmic scale. In the absolute dimension, we observe a chaotic free fall, while in the logarithmic representation the price reduction does not occur randomly, but in strict accordance with the given algorithm by which the machine that placed the orders acted. In other words, the attacker's handwriting is obvious: BATS stocks did not depreciate “by mistake” or as a result of “failure”, but were systematically “killed”!

A Nanex analysis revealed a direct correlation between the collapse of Apple and BATS, but Nanex itself did not take the responsibility to make a final statement. Nevertheless, in its analytical report, this company said that it was a certain killer algorithm. The most obvious example is a chart showing transactions with paper (see. Fig.). The graph shows two lines of falling prices: absolute and logarithmic scales. It is the logarithmic scale that produces the very algorithm: the price drop in this scale was carried out not randomly, as usually happens in real market conditions, but sequentially. The step-by-step graph shows that stocks fell not as a result of a failure, but as a result of someone's systematic “trampling into the ground”. On the one hand, this is only a beautiful version, but there are obvious companies for which this situation was beneficial. Of course, the first thing that comes to mind is the main competitors - NYSE and NASDAQ, who do not really like their declining share in the total trading volume due to the development of BATS. And even more so, they are not ready to share such a niche as conducting an IPO with another player.

Will the SEC ever name the “killer” IPO BATS? You can be sure that you will not call. If only because all the participants in the drama - and BATS in the first place - have known this name for a long time! If the injured company itself chose to take the blame upon itself, refusing to take dirty linen out of the hut, there are clearly weighty arguments to preserve the default figure.

What arguments can we talk about? In my opinion, there are two of them.

The first argument: the weight category of the IPO BATS killer in the financial world is such that the alternative platform simply does not see any prospects for itself in any form of open confrontation. To the domestic reader, the situation should remotely resemble army hazing: exactly the case when it is more reasonable for the “young” to swallow an insult and humbly go to wash the “grandfather's” footcloths will be healthier.

The second argument: the story of March 23, 2012 can be presented in the form of an analogy with the bombing of Hiroshima and Nagasaki. Such a powerful and destructive cyber weapon was demonstrated to the financial world of the planet that everyone preferred to discuss the terms of the ceasefire, rather than arrange unequal showdowns and clarifications with the "master of the bomb."

Now the most important thing. What lesson can ordinary mortals learn from the story told - street traders and just the inhabitants of our sad planet? The lesson is obvious: to play by the rules created in their own interests by modern dinosaurs - the financial elite, furry mammals can not do. Therefore, it remains either to sit quietly in respectful estrangement, by no means agreeing to play on someone else's playground, which was created in such a way as to deliberately beat any outsider, or to break the rules of dinosaurs!