Why do companies conduct IPOs: Pros and Cons

In the past few years, the topic of IPO has been widely discussed on the Internet - a company’s listing on the stock exchange is often seen as confirmation of its success. Despite the fact that this often happens, getting an IPO has both its obvious advantages and certain disadvantages and difficulties for the company - today we will consider this issue in more detail.

What is an IPO?

IPO (Initial Public Offering) is the initial public offering of a company’s shares (issue). This means that the company for the first time launches its shares on the market so that investors who were originally unrelated to it could buy them. After entering the exchange, the status of the company changes - from private (that is, anyone who can’t buy shares - for this, the buyer only needs to conclude an agreement with a brokerage company, you can work on the Moscow Exchange through ITinvest ), it becomes public, and its shares are free traded on the exchange and can be bought by anyone.

Why is it necessary

There are several main reasons why a company may seek to become public. Among them:

- Maximizing the value of shares of shareholders - if the company's management is confident in its good prospects in the market, then entering an IPO may be more beneficial for shareholders than selling the business of another company. The price of shares after the start of trading may increase, and the value of shares in the company of its original shareholders will increase accordingly.

- Raising money on more favorable terms - IPO allows management to raise larger amounts of money than they could get from private investors, and the overall assessment of the business is higher. The rating of a business in the case of a company freely traded on the stock exchange is usually higher, because anyone can buy its shares, which is not so in the case of a private company - the liquidity of publicly traded shares is higher, the investor can always sell them or buy more.

- Getting a tool to pay for absorbed companies - quite often companies grow due to the purchase of competitors and interesting, but smaller, companies - this approach, for example, is common among technology companies in the USA. Google and Facebook buy new startups every year. And as a rule, one of the forms of payment during the takeover is not only money, but also the shares of the “parent” company. For example, when Facebook boughtWhatsApp messenger for $ 19 billion, then only about $ 4 billion was paid in money, and the rest was made up of shares. The shares of private companies are not so valuable to the founders of the acquired projects, since they cannot easily sell them. The same plus applies to simply hiring qualified employees - they can be offered not only money, but also shares as compensation.

- Awareness raising - a fact remains a fact; access to an IPO is a big event that attracts the attention of the press and the public. It is not always possible to achieve such attention with conventional marketing and PR methods. In addition, getting on the list of the largest world exchanges such as NYSE, Nasdaq or LSE is simply prestigious.

In addition, for the company's early investors and some of its founders, an IPO can be a good “exit strategy” - by raising funds on the exchange, they cover their initial investments and earn.

Openness issues

But not everything is so smooth, and obtaining the status of a public company entails a number of difficulties. One of the main ones is the need to disclose information about the company. Public companies are required to periodically publish financial statements that show the success or failure of its activities and can seriously affect the price of shares traded on the stock exchange.

In order to meet the various requirements of regulatory authorities and successfully pass regular audits, companies need to make serious efforts, the costs of which may be too substantial for not the largest business.

In addition, the expectations of the public and shareholders who are interested in increasing the value of shares may fall heavily on the shoulders of company management. This can lead to the fact that managers will begin to work on achieving short-term goals, and not on solving problems that contribute to long-term growth.

How to prepare an IPO

The process of preparing for an IPO is not an easy task, which takes from several months to a year and costs the company serious funds. It is quite difficult for the business to organize the process on its own, so there is a need to hire an investment bank (or several banks) that will be engaged in pre-financing. Such banks are called IPO underwriters.

After choosing a bank, representatives of the financial institution and company management agree on the parameters of the future placement: the price of shares to be issued for free circulation, their type, the total amount of funds to be raised.

Following the results of negotiations, an agreement is signed. After that, the underwriter transfers the investment memorandum to the regulatory body of the country, on the exchange platform of which the shares will be placed. In the USA it is the Securities Commission (SEC), and in our country it is the Bank of Russia. This memorandum contains detailed information about the proposal and the company - financial reporting, management biographies, existing legal problems of the organization, a list of current shareholders and the purpose of attracting financing. After that, the submitted data is checked, if necessary, additional information is requested. If everything is correct, an IPO date is assigned.

Who else benefits from an IPO

Underwriters are not only preparing an IPO, but they are also one of the first players to benefit from this entire process. They invest their own funds in the preparation of the placement, in return getting the opportunity to “buy” the company’s shares before they officially get on the exchange list. At the same time, the price at which the underwriter buys the shares under the terms of the agreement with the company is usually lower than the final price set for the IPO - the bank earns this difference. Therefore, in the case of a promising company, the competition among potential underwriters for the right to conduct its placement can be extremely serious.

In order to maximize their profits, underwriter banks also invest in promoting the upcoming placement - for this, in particular, special road shows are organized, during which information about companies is provided to large and promising investors, sometimes from different countries. They are also offered to buy shares before the start of trading (allocation). For example, such cities are advised by Moscow Exchange experts to visit the management of Russian companies seeking IPOs with a road show:

It is advantageous to conduct an IPO on the exchanges themselves - the placement of large and promising companies can increase the overall liquidity and trading volume, and therefore earn more on commissions. Therefore, among the exchange platforms there is also serious competition for promising IPOs - representatives of the platforms speak to the management of companies, explaining the advantages of placing shares with them.

Where do Russian companies conduct IPOs

The largest Russian exchange is Moscow, and companies from our country periodically conduct their own placements there. Placing on the Moscow stock exchange was carried out by a variety of industries - such as financial , leasing , grain retailers and technology companies (for example, in the summer of 2014 additional placement of shares it held "Yandex").

At the same time, it is possible to conduct an offering with the so-called “international component” - in this case, the company organizes the placement not only on the Moscow Exchange, but also offers shares on a foreign platform. The legal aspects of conducting an IPO on the Moscow Exchange are presented in this document .

В 2012 году Московская биржа публиковала подготовленную аналитиками Sberbank CIB статистику, иллюстрирующую географический состав инвесторов в IPO российских компаний:

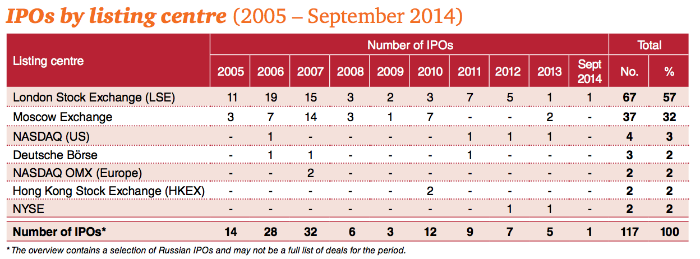

При этом большая часть размещений акций российских компаний все же происходит за рубежом. По данным аналитической компании PWC, в период с 2005 по 2014 год, российские компании провели 117 IPO, при этом только 37 из них пришлись на Московскую биржу. Больше всего первичных размещений (67) было осуществлено на Лондонской бирже (LSE), примерно одинаковый интерес российских компаний в этот период вызывали биржи Nasdaq, Deutsche Börse, NYSE и Hong Kong Stock Exchange:

Заключение

An IPO is a working tool that allows companies to raise money for serious development on more favorable terms than private investors could offer. However, the placement of shares on the exchange carries not only advantages, but also disadvantages, it gives not only a positive PR, but can also cause waves of criticism if the price of shares eventually falls below the start level of trading.

It is the last point that is often called the reason that technology companies in the USA are less likely to start an IPO (the number of such placements is now at the lowest level since 2008) - the leadership of such organizations frightens off the experience of their predecessors, who carried out IPO with great fanfare, and then their shares during the bidding did not show good results.

As a result, the leaders of many companies prefer to remain in a private format and not become public, writes The Wall Street Journal. In such circumstances, it may be more profitable for the initial investors of companies to find a buyer on their own, rather than open a sale for anyone.

All cases are unique, and it often happens that it is more profitable for a company to “sell out” to a larger organization in order to benefit from the synergy with it, rather than remain independent and try to grow with the help of money raised through an IPO. It was the first path that ultimately was chosen by the already mentioned WhatsApp founders, who chose to sell their Facebook business for $ 19 billion rather than go public.

Teaser Image: Getty images