Exchange, let me steer

The crisis time in the economy should be considered in two ways. On the one hand, this is a period of losses and depreciation of a number of assets, on the other - an excellent prospect to capitalize on volatility. In particular, the ruble volatility - fluctuations in the ruble / euro and ruble / dollar currency pairs. Of course, these are risky operations and the stronger the fluctuations, the lower the stability of the market and the higher the risk. Such operations concern a wide range of money holders: these are banks, companies closing foreign currency transactions, and ordinary citizens who want to capitalize on currency fluctuations. However, to carry out currency transactions with profit or at least without losses is not as simple as it seems at first glance: you have to take into account market and political factors, be familiar with at least the general theory and have access to trading on the exchange.

Justice in the modern world sometimes takes the most bizarre forms. On the foreign exchange market, the measure of justice, perhaps, is the bigmac that is familiar all over the world. The Big Mac Index was invented and introduced by The Economist magazine for an informal assessment of the exchange rate based on the theory of purchasing power parity: in the long run, exchange rates should be set so that the prices for the same set of goods in any two countries are equal. For example, bigmak in the USA costs $ 4.79 in 2015, and in Russia - 107 rubles ($ 1.57 at the time of writing). That is, the ruble is underestimated by 62% and the dollar should be (1 - 0.62) * 68.15 = 25.90 p. It turns out that the exchange rate does not coincide much with currency parity. Something went wrong?

The national currency exchange rate against the currencies of other countries today is influenced by many factors, some of which lie outside the economic sphere: this is the political situation, the geopolitical situation, and some positive or negative events within the countries participating in the currency exchange. After the gold exchange standard was canceled, the price of the currency ceased to be tied to this precious metal and a free-floating exchange rate regime was established when quotes are formed on the basis of supply and demand, that is, speculatively.

Many of us are accustomed to the fact that the word “speculation” carries a negative connotation and is even associated with an offense. However, in economic theory, speculation is any operation aimed at making a profit by changing the cost of buying and selling an asset (securities, currency, metals, antiques, etc.). That is, the benefit is acquired through the acquisition of some materially valuable goods, and through trade as such.

Over the last calendar year, in each branch of the bank, you could see twice the lines of ordinary citizens who want to exchange currency - in other words, buy rapidly growing dollars and euros, so that at the end of growth you can sell them and buy rubles, making you rich. As a matter of fact, this is a simplified trading model - a trader, on his own initiative, makes transactions on the purchase and sale of currency in order to earn money based on data analysis. So why almost none of those standing in line can be called a successful trader?

Let's try to be our own traders, turn to the annual history of the dollar and play on the market. Suppose two amateurs with a starting capital of 100,000 rubles each decided to earn extra money on fluctuations in the exchange rate of the ruble / dollar pair. They started on October 10, 2014, having caught the attractive trend of the dollar strengthening. They ended at the peak value on August 25, 2015, but sometimes they made deals with a difference of a couple of days. All our virtual actions will be listed on the tablet.

In the first table, we summarize two strategies that were implemented by customers of a top commercial bank.

In the first scenario, we earned 218,924 rubles, in the second - 178,546 rubles. If you are a “trader” from the lineup, then your income is almost always random, as it is based not on professional analytics, but on the news and courses of banks.

In the second pair of tables, the situation of the performance of currency transactions by a broker on the Moscow Exchange is simulated .

If our virtual entities made their foreign exchange transactions through a broker, in the first case the amount would increase to 243,418 rubles (an increase of 24,494 rubles compared to a commercial bank), and in the second - up to 252,260 rubles (an increase of 73,714 rubles compared to a commercial bank). In this case, the broker's commission would be only 0.034% of the daily turnover (about 35 rubles). The broker's function in this case is to provide the opportunity to conduct operations on the exchange at quotes close to Central Bank rates, without commercial margin. The broker earns a commission on turnover and does not have access to the money of his clients.

Why is there such a loss of money in the case of a commercial bank? Currency exchange is a profitable business for the bank, mainly due to the difference between the purchase and sale prices. This is the same speculative model, which essentially does not imply any fraud - only legitimate profit. The exchange rate at which banks exchange dollars and euros exceeds the official rate of the Central Bank of the Russian Federation by an average of 2%, and during periods of exchange rate instability, as in December 2014, the difference can reach 5% or more! Even when special conditions are established on the basis of long-term trusting relations between the bank and the client, a financial institution, as a rule, provides itself with a rather high margin on exchange operations.

Here's how it goes. Consider another situation, one-time. Suppose that the client has $ 20,000 in stock and he decided on September 17, 2015 to exchange them for rubles to buy a car. If he had an operation through a broker (for example, BCS) on the Moscow Exchange, you would receive 1,309,554 rubles, and in one of the commercial banks - 1,290,000 rubles, 19,554 rubles less, which is somewhere around 500 liters of gasoline. The fact is that the purchase price from BCS is 65.4777 rubles / $, and from the bank - 64.50. It is more profitable for a bank to set the purchase price of a currency below the Central Bank of the Russian Federation rate, and the sale price - above, so it ensures its margin, since it buys and sells currency on the exchange at a brokerage price. In addition, commercial banks buy currency at the price of TOM (tomorrow) and pay for it tomorrow. Banks are chasing not only profitability, but also seek to reduce risk, so the retail exchange rate is formed, among other things, based on the forecast of a rise in the price of foreign currency.

So why not yourself make one-time or permanent currency transactions with maximum benefit?

The exchange does not seek to obtain super-profits, its purpose is to determine the exchange rate, the value of foreign currencies in relation to the national (ruble). In Russia, the Moscow Exchange plays an important role in foreign exchange. Trading is conducted by a number of foreign currencies, including the US dollar (USD), euro (EUR), Chinese yuan (CNY), British pound (GBP), Hong Kong dollar (HKD) and so on. The Moscow Exchange is a platform on which a currency exchange takes place with the participation of all banks in Russia, which must enter the exchange in order to service applications of their customers for the purchase or sale of currency, as well as other legal entities and participants entitled to participate in tenders.

Also, the exchange calculates the value of a dual-currency basket. A trading unit is an instrument that can be designated, for example, as USDRUR_TOD. This combination reads as "trading the dollar against the ruble with the execution of the transaction today (TODay)." However, the key is considered the price of TOM (TOMorrow), which underlies the determination of the official exchange rate. The TOM price is formed as a weighted average value during the course of trading based on supply and demand. Thus, the value of the dollar / ruble pair is formed, which is used by the Central Bank of the Russian Federation to determine the official exchange rate of the American currency.

Our story with two strategies of homegrown traders concerned small amounts. Obviously, with large volumes, such an "amateur" currency turnover becomes difficult and high-risk. A professional participant of the foreign exchange market - a broker - a company (for example, BCS ) that provides direct access to individuals and organizations to the currency section of the Moscow Exchange, where dollars or euros can be purchased at the very rate based on which it is formed, comes to the aid of those who want to earn on foreign exchange transactions. official rate of the Central Bank of the Russian Federation.

The United Russian Exchange opened wide access to trading on the foreign exchange market in February 2012. For the first time in modern Russian history, not only accredited banks, but also investment companies and their clients, individuals and legal entities, were allowed to exchange currency trading. Today with the help of professional participants such as BCS Broker, you can buy and sell currency on the interbank exchange market through a special program by opening an individual brokerage account. In fact, you can constantly perform currency transactions without leaving your home and without paying the rate set by a commercial bank. Moreover, registration, opening an account and installing software for clients of BCS Broker are free. The average brokerage commission is 0.013% of the turnover. Another 0.0015% of the transaction amount is taken by the exchange as a commission. As a result, the client of the brokerage system, making transactions with currency on the Moscow Exchange, pays as a commission only a tiny fraction of a percent of the turnover.

Why is it advantageous to gain access to trading on the exchange, and not work with some familiar commercial bank?

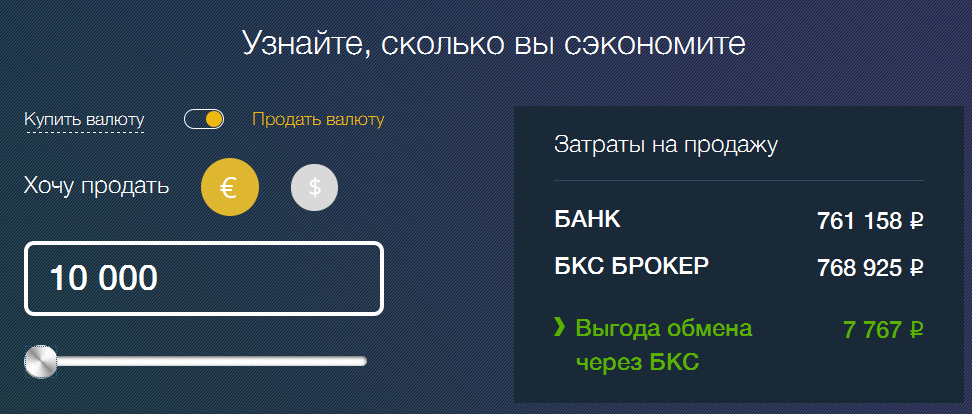

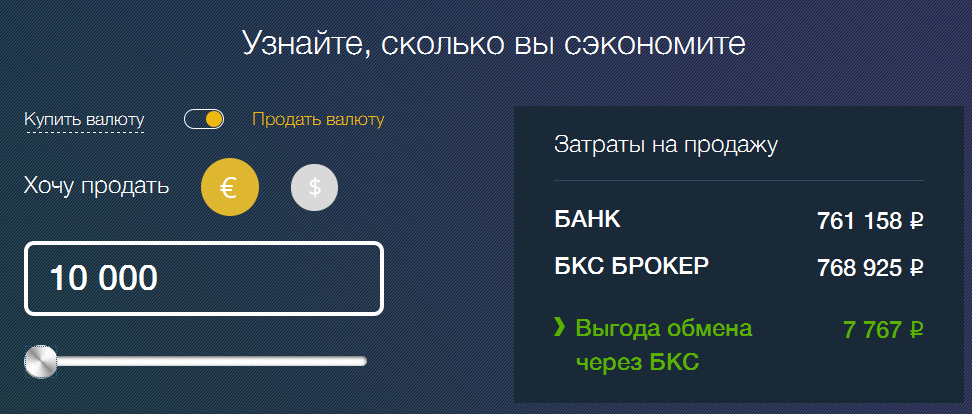

Each of us can act as an expert in the economy and has the right to manage our money at our discretion. However, not everything is so simple: the day of a successful trader begins with building complex charts and calculating profit and risk points, developing a strategy. This is by no means an amateurish approach, but the painstaking work of an analyst, economist and mathematician, multiplied by a changing coefficient of luck. Over the years, we have gathered knowledge and invested it in our specialized programs for clients who want to make money on sharp and not very changes in the exchange rate. We offer you to try yourself in business. You can start with a calculator (available by clicking on the picture), on which you can estimate your benefit. PS:

We opened our blog, because we know for sure - we have something to share with our subscribers. Soon we will continue to dive into the stock market reality and talk about securities, stock indices, stock market analysis methods, risky and safe strategies and software that allows you to conveniently carry out operations on the stock exchange without leaving your home.

Exchange rate laws

Justice in the modern world sometimes takes the most bizarre forms. On the foreign exchange market, the measure of justice, perhaps, is the bigmac that is familiar all over the world. The Big Mac Index was invented and introduced by The Economist magazine for an informal assessment of the exchange rate based on the theory of purchasing power parity: in the long run, exchange rates should be set so that the prices for the same set of goods in any two countries are equal. For example, bigmak in the USA costs $ 4.79 in 2015, and in Russia - 107 rubles ($ 1.57 at the time of writing). That is, the ruble is underestimated by 62% and the dollar should be (1 - 0.62) * 68.15 = 25.90 p. It turns out that the exchange rate does not coincide much with currency parity. Something went wrong?

The national currency exchange rate against the currencies of other countries today is influenced by many factors, some of which lie outside the economic sphere: this is the political situation, the geopolitical situation, and some positive or negative events within the countries participating in the currency exchange. After the gold exchange standard was canceled, the price of the currency ceased to be tied to this precious metal and a free-floating exchange rate regime was established when quotes are formed on the basis of supply and demand, that is, speculatively.

Many of us are accustomed to the fact that the word “speculation” carries a negative connotation and is even associated with an offense. However, in economic theory, speculation is any operation aimed at making a profit by changing the cost of buying and selling an asset (securities, currency, metals, antiques, etc.). That is, the benefit is acquired through the acquisition of some materially valuable goods, and through trade as such.

Hostages of the likelihood and greed of banks

Over the last calendar year, in each branch of the bank, you could see twice the lines of ordinary citizens who want to exchange currency - in other words, buy rapidly growing dollars and euros, so that at the end of growth you can sell them and buy rubles, making you rich. As a matter of fact, this is a simplified trading model - a trader, on his own initiative, makes transactions on the purchase and sale of currency in order to earn money based on data analysis. So why almost none of those standing in line can be called a successful trader?

Let's try to be our own traders, turn to the annual history of the dollar and play on the market. Suppose two amateurs with a starting capital of 100,000 rubles each decided to earn extra money on fluctuations in the exchange rate of the ruble / dollar pair. They started on October 10, 2014, having caught the attractive trend of the dollar strengthening. They ended at the peak value on August 25, 2015, but sometimes they made deals with a difference of a couple of days. All our virtual actions will be listed on the tablet.

In the first table, we summarize two strategies that were implemented by customers of a top commercial bank.

In the first scenario, we earned 218,924 rubles, in the second - 178,546 rubles. If you are a “trader” from the lineup, then your income is almost always random, as it is based not on professional analytics, but on the news and courses of banks.

In the second pair of tables, the situation of the performance of currency transactions by a broker on the Moscow Exchange is simulated .

If our virtual entities made their foreign exchange transactions through a broker, in the first case the amount would increase to 243,418 rubles (an increase of 24,494 rubles compared to a commercial bank), and in the second - up to 252,260 rubles (an increase of 73,714 rubles compared to a commercial bank). In this case, the broker's commission would be only 0.034% of the daily turnover (about 35 rubles). The broker's function in this case is to provide the opportunity to conduct operations on the exchange at quotes close to Central Bank rates, without commercial margin. The broker earns a commission on turnover and does not have access to the money of his clients.

Why is there such a loss of money in the case of a commercial bank? Currency exchange is a profitable business for the bank, mainly due to the difference between the purchase and sale prices. This is the same speculative model, which essentially does not imply any fraud - only legitimate profit. The exchange rate at which banks exchange dollars and euros exceeds the official rate of the Central Bank of the Russian Federation by an average of 2%, and during periods of exchange rate instability, as in December 2014, the difference can reach 5% or more! Even when special conditions are established on the basis of long-term trusting relations between the bank and the client, a financial institution, as a rule, provides itself with a rather high margin on exchange operations.

Here's how it goes. Consider another situation, one-time. Suppose that the client has $ 20,000 in stock and he decided on September 17, 2015 to exchange them for rubles to buy a car. If he had an operation through a broker (for example, BCS) on the Moscow Exchange, you would receive 1,309,554 rubles, and in one of the commercial banks - 1,290,000 rubles, 19,554 rubles less, which is somewhere around 500 liters of gasoline. The fact is that the purchase price from BCS is 65.4777 rubles / $, and from the bank - 64.50. It is more profitable for a bank to set the purchase price of a currency below the Central Bank of the Russian Federation rate, and the sale price - above, so it ensures its margin, since it buys and sells currency on the exchange at a brokerage price. In addition, commercial banks buy currency at the price of TOM (tomorrow) and pay for it tomorrow. Banks are chasing not only profitability, but also seek to reduce risk, so the retail exchange rate is formed, among other things, based on the forecast of a rise in the price of foreign currency.

So why not yourself make one-time or permanent currency transactions with maximum benefit?

Exchange or bank?

The exchange does not seek to obtain super-profits, its purpose is to determine the exchange rate, the value of foreign currencies in relation to the national (ruble). In Russia, the Moscow Exchange plays an important role in foreign exchange. Trading is conducted by a number of foreign currencies, including the US dollar (USD), euro (EUR), Chinese yuan (CNY), British pound (GBP), Hong Kong dollar (HKD) and so on. The Moscow Exchange is a platform on which a currency exchange takes place with the participation of all banks in Russia, which must enter the exchange in order to service applications of their customers for the purchase or sale of currency, as well as other legal entities and participants entitled to participate in tenders.

Also, the exchange calculates the value of a dual-currency basket. A trading unit is an instrument that can be designated, for example, as USDRUR_TOD. This combination reads as "trading the dollar against the ruble with the execution of the transaction today (TODay)." However, the key is considered the price of TOM (TOMorrow), which underlies the determination of the official exchange rate. The TOM price is formed as a weighted average value during the course of trading based on supply and demand. Thus, the value of the dollar / ruble pair is formed, which is used by the Central Bank of the Russian Federation to determine the official exchange rate of the American currency.

Our story with two strategies of homegrown traders concerned small amounts. Obviously, with large volumes, such an "amateur" currency turnover becomes difficult and high-risk. A professional participant of the foreign exchange market - a broker - a company (for example, BCS ) that provides direct access to individuals and organizations to the currency section of the Moscow Exchange, where dollars or euros can be purchased at the very rate based on which it is formed, comes to the aid of those who want to earn on foreign exchange transactions. official rate of the Central Bank of the Russian Federation.

The United Russian Exchange opened wide access to trading on the foreign exchange market in February 2012. For the first time in modern Russian history, not only accredited banks, but also investment companies and their clients, individuals and legal entities, were allowed to exchange currency trading. Today with the help of professional participants such as BCS Broker, you can buy and sell currency on the interbank exchange market through a special program by opening an individual brokerage account. In fact, you can constantly perform currency transactions without leaving your home and without paying the rate set by a commercial bank. Moreover, registration, opening an account and installing software for clients of BCS Broker are free. The average brokerage commission is 0.013% of the turnover. Another 0.0015% of the transaction amount is taken by the exchange as a commission. As a result, the client of the brokerage system, making transactions with currency on the Moscow Exchange, pays as a commission only a tiny fraction of a percent of the turnover.

Why is it advantageous to gain access to trading on the exchange, and not work with some familiar commercial bank?

- The commission from the turnover of transactions is much lower - with a large turnover, the savings can amount to tens of thousands of dollars per year.

- You can make currency transactions at any convenient time without leaving your computer. So the client gets the opportunity to use the most profitable moments of exchange in real time.

- Received income can be saved in a bank account.

- Also, the income received from foreign exchange transactions can be reinvested in stocks or precious metals - and a step to professional trading, more risky, but also more profitable transactions.

- Entrepreneurs can insure their foreign exchange earnings from unexpected changes in the exchange rate and thereby maintain a balanced company budget. This need is due to the fact that often settlements on concluded transactions with foreign counterparties occur with some lag from the actual moment of conclusion of the transaction.

- From a security point of view, buying a currency on the exchange is one of the most reliable options. All transactions conducted within the MICEX currency section are necessarily registered on the exchange, and the trading process is regulated in detail by the rules of the exchange, which in turn are consistent with the Central Bank of the Russian Federation.

Each of us can act as an expert in the economy and has the right to manage our money at our discretion. However, not everything is so simple: the day of a successful trader begins with building complex charts and calculating profit and risk points, developing a strategy. This is by no means an amateurish approach, but the painstaking work of an analyst, economist and mathematician, multiplied by a changing coefficient of luck. Over the years, we have gathered knowledge and invested it in our specialized programs for clients who want to make money on sharp and not very changes in the exchange rate. We offer you to try yourself in business. You can start with a calculator (available by clicking on the picture), on which you can estimate your benefit. PS:

We opened our blog, because we know for sure - we have something to share with our subscribers. Soon we will continue to dive into the stock market reality and talk about securities, stock indices, stock market analysis methods, risky and safe strategies and software that allows you to conveniently carry out operations on the stock exchange without leaving your home.

Disclaimer

LLC “BCS Company”. License of a professional participant in the securities market for brokering No. 154-04434-100000, issued by the Federal Service for Financial Markets on 10.01.2001 (without limitation of validity).

NRA assigned BKS Company LLC an individual AAA rating (maximum reliability). Verified April 12, 2013. Available at www.ra-national.ru

Вывод рублей комиссией не облагается. Комиссия за вывод средств в валюте составляет 0,0708% (для сумм до 300 млн в рублевом эквиваленте), 0,0295% (для сумм от 300 млн до 1 млрд в рублевом эквиваленте), 0,01416% (для сумм свыше 1 млрд в рублевом эквиваленте). При выводе средств на счета во все банки (за исключением ОАО «БКС Банк») клиентом дополнительно к вышеуказанному тарифу оплачивается вывод иностранной валюты по тарифам ОАО «БКС Банк»: 15 долларов США (для долларов США) или 30 евро (для евро). Услуги оказывает ОАО «БКС Банк», Генеральная лицензия ЦБ РФ № 101 от 15.12.2014 г.

Средневзвешенный показатель тарифной сетки «БКС – Валютный старт». Для сумм в размере менее 3 млн рублей комиссия составляет 0,034%, от 3 млн до 5 млн рублей – 0,028%, от 5 млн до 10 млн рублей – 0,022%, от 10 млн до 25 млн рублей – 0,0055%, от 25 млн до 50 млн рублей – 0,0045%, от 50 млн до 100 млн рублей – 0,0035%, от 100 млн рублей до 200 млн рублей – 0, 0025%, свыше 200 млн рублей – 0,002% (НДС не включен).

NRA assigned BKS Company LLC an individual AAA rating (maximum reliability). Verified April 12, 2013. Available at www.ra-national.ru

Вывод рублей комиссией не облагается. Комиссия за вывод средств в валюте составляет 0,0708% (для сумм до 300 млн в рублевом эквиваленте), 0,0295% (для сумм от 300 млн до 1 млрд в рублевом эквиваленте), 0,01416% (для сумм свыше 1 млрд в рублевом эквиваленте). При выводе средств на счета во все банки (за исключением ОАО «БКС Банк») клиентом дополнительно к вышеуказанному тарифу оплачивается вывод иностранной валюты по тарифам ОАО «БКС Банк»: 15 долларов США (для долларов США) или 30 евро (для евро). Услуги оказывает ОАО «БКС Банк», Генеральная лицензия ЦБ РФ № 101 от 15.12.2014 г.

Средневзвешенный показатель тарифной сетки «БКС – Валютный старт». Для сумм в размере менее 3 млн рублей комиссия составляет 0,034%, от 3 млн до 5 млн рублей – 0,028%, от 5 млн до 10 млн рублей – 0,022%, от 10 млн до 25 млн рублей – 0,0055%, от 25 млн до 50 млн рублей – 0,0045%, от 50 млн до 100 млн рублей – 0,0035%, от 100 млн рублей до 200 млн рублей – 0, 0025%, свыше 200 млн рублей – 0,002% (НДС не включен).