Bitcoin Economic News Digest

Unexpectedly for many this year, bitokin became a bulwark of stability amid social and economic surprises. A variety of factors have led to a significant increase in the value of bitcoin this year. One of the first reasons was the instability of Chinese markets, in connection with which Bitcoin has acquired a new hypostasis for itself - a quiet haven in the stormy ocean of fiat finance. The recent Brexit has only strengthened the position of Bitcoin in a new status.

However, there are other, not so obvious reasons, pushing the price of bitcoin up, which, according to Forbes , can lead to a threefold increase in the cost of bitcoin transactions in the current year.

Forbes refers to the report of the British company Juniper Research, which specializes in identifying and supporting fast-growing market segments, which forecasts that the total cost of bitcoin transactions will exceed $ 92 billion by the end of the year, this will indicate an increase of 240% compared with 2015 years, when the turnover of bitcoin was estimated at 27 billion.

At the time of the referendum on Brexit, its value reached $ 780. The decision of the UK to leave the EU knocked markets out of the rut, pushing alternative assets to growth. Analysts at the British broker IG Group suggest that by December the value of bitcoin could rise to $ 900. Chris Bush, the head of the analytic department at IG Group and analyst Josh Mahoney, consider the scenario in which bitcoin will grow by 35-40% compared to today's figures quite likely.

According to Bloomberg news agency, last week the pound's volatility exceeded for some timeBitcoin volatility. Against the background of the British pound, which this year showed the most negative dynamics against the dollar among 31 world currencies. Bitcoin may well be considered a reliable investment.

However, economic shocks, with a high degree of probability, will affect not only European currencies. According to analysts voiced by the BBC, Trump's possible victory in the presidential election will be like an earthquake for the entire global economy and will significantly increase political and currency risks for the United States. According to experts' forecasts, Trump’s rise to power will have significantly more serious consequences than Britain’s withdrawal from the European Union or military clashes in the South China Sea. The US Department of Economic Development estimated the consequences of Trump’s victory in the elections as 12 out of 25 possible, on the scale of risks of economic destabilization - the same number of points according to their estimates were received by ISIS attacks. However, in order not to be too alarmist-minded, we note that the chances of Trump's victory in themselves are much lower. This study only shows that there are no invulnerable currencies - both the pound and the dollar under certain circumstances can greatly disappoint.

Bitcoin has just gone through halving, which means that the number of bitcoins issued has decreased by half, thereby reducing the growth rate of foreign exchange reserves within the system. This trend is the exact opposite of what happens with fiat currencies, in pairs with which Bitcoin is traded, as a result of which many Bitcoin enthusiasts expect Bitcoin to grow in value relative to fiats.

In the first six months of 2016, bitcoin trading volumes on Brazil's cryptocurrency exchanges exceeded those of cash gold on the São Paulo Stock Exchange (BM&F BOVESPA). According to Fee.org, for the first half of 2016 on specialized cryptocurrency exchanges, the volume of trading in bitcoin exceeded 164 million reais (about 47 million US dollars), while the total amount of registered contracts for the purchase of gold on the Sao Paulo Stock Exchange, the largest exchange Latin America, amounted to about 153 million reais (about 44 million American).

At the same time, in June, bitcoin trading volumes at least doubled the contracts for precious metals, confirming an unprecedented interest in cryptocurrency in Brazil.

Despite the fact that, on a global scale, gold trading volumes still significantly exceed Bitcoin, the situation in Brazil, however, suggests that bitcoin is increasingly seen by investors as an attractive option for placing assets.

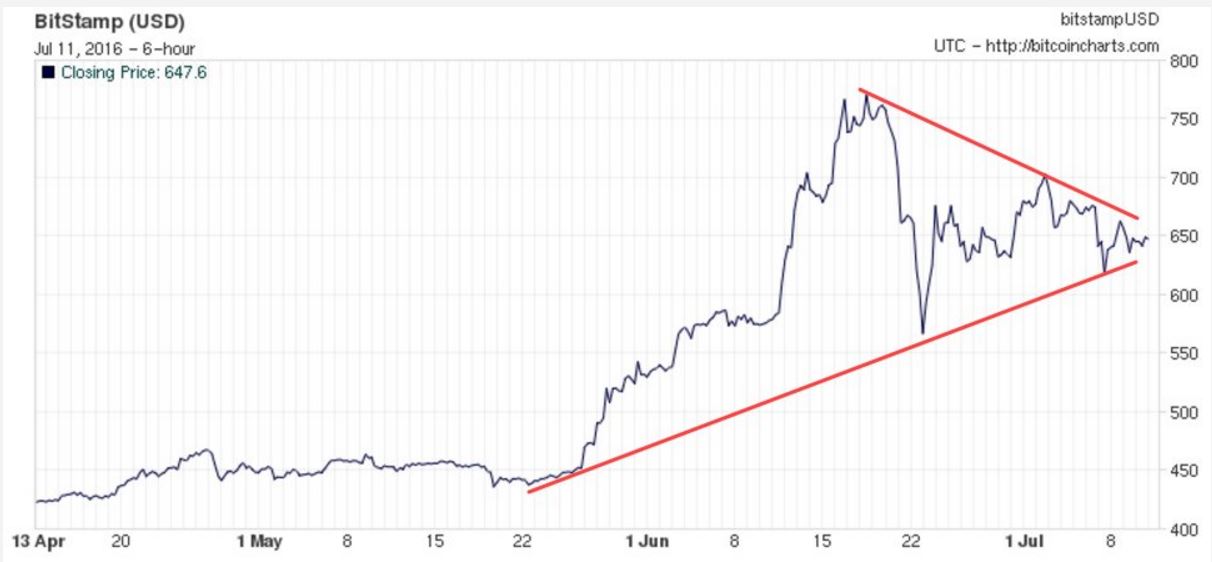

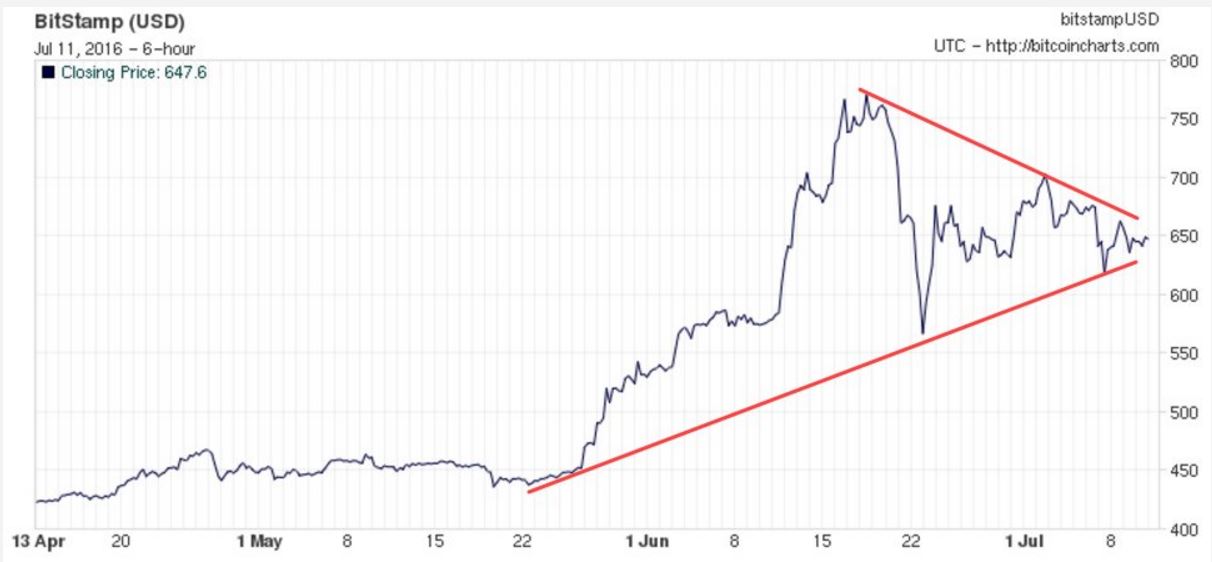

MarketWatch analytics company recently released a report, the essence of which is that 2016 was a good year for bitcoin bulls, and cryptocurrency again reached growth indicators two years ago. The technical analysis of the growth charts is encouraging and, according to experts, indicates that the cost growth is likely to continue. According to MKM chief market analyst Jonathan Krinsky, the current pattern is a consequence and a logical continuation of a long consolidation period and promises to be a long-term trend, not a one-time leap. The graph shows the approaching moment of a breakthrough, and taking into account the current state of technical indicators, the chances of moving up are much higher, according to Marketwatch analysts.

The foreign exchange market reflects reality and is currently the best indicator of economic realities. Nobody knows for sure what indicators Bitcoin can achieve this time, given all the uncertainties that are not subject to rigorous mathematical calculations, however, the halving that has taken place, global trends and technical analysis of the exchange rate make it possible to assume that we are at the beginning of an upward wave. At the time of publication, cryptocurrency is being traded in the region of 675 US dollars .

It's not too late to mine:

However, there are other, not so obvious reasons, pushing the price of bitcoin up, which, according to Forbes , can lead to a threefold increase in the cost of bitcoin transactions in the current year.

Forbes refers to the report of the British company Juniper Research, which specializes in identifying and supporting fast-growing market segments, which forecasts that the total cost of bitcoin transactions will exceed $ 92 billion by the end of the year, this will indicate an increase of 240% compared with 2015 years, when the turnover of bitcoin was estimated at 27 billion.

Trump, Brexit and other shocks

At the time of the referendum on Brexit, its value reached $ 780. The decision of the UK to leave the EU knocked markets out of the rut, pushing alternative assets to growth. Analysts at the British broker IG Group suggest that by December the value of bitcoin could rise to $ 900. Chris Bush, the head of the analytic department at IG Group and analyst Josh Mahoney, consider the scenario in which bitcoin will grow by 35-40% compared to today's figures quite likely.

According to Bloomberg news agency, last week the pound's volatility exceeded for some timeBitcoin volatility. Against the background of the British pound, which this year showed the most negative dynamics against the dollar among 31 world currencies. Bitcoin may well be considered a reliable investment.

However, economic shocks, with a high degree of probability, will affect not only European currencies. According to analysts voiced by the BBC, Trump's possible victory in the presidential election will be like an earthquake for the entire global economy and will significantly increase political and currency risks for the United States. According to experts' forecasts, Trump’s rise to power will have significantly more serious consequences than Britain’s withdrawal from the European Union or military clashes in the South China Sea. The US Department of Economic Development estimated the consequences of Trump’s victory in the elections as 12 out of 25 possible, on the scale of risks of economic destabilization - the same number of points according to their estimates were received by ISIS attacks. However, in order not to be too alarmist-minded, we note that the chances of Trump's victory in themselves are much lower. This study only shows that there are no invulnerable currencies - both the pound and the dollar under certain circumstances can greatly disappoint.

Bitcoin Halfing and Course

Bitcoin has just gone through halving, which means that the number of bitcoins issued has decreased by half, thereby reducing the growth rate of foreign exchange reserves within the system. This trend is the exact opposite of what happens with fiat currencies, in pairs with which Bitcoin is traded, as a result of which many Bitcoin enthusiasts expect Bitcoin to grow in value relative to fiats.

Brazilian Gold and Bitcoin

In the first six months of 2016, bitcoin trading volumes on Brazil's cryptocurrency exchanges exceeded those of cash gold on the São Paulo Stock Exchange (BM&F BOVESPA). According to Fee.org, for the first half of 2016 on specialized cryptocurrency exchanges, the volume of trading in bitcoin exceeded 164 million reais (about 47 million US dollars), while the total amount of registered contracts for the purchase of gold on the Sao Paulo Stock Exchange, the largest exchange Latin America, amounted to about 153 million reais (about 44 million American).

At the same time, in June, bitcoin trading volumes at least doubled the contracts for precious metals, confirming an unprecedented interest in cryptocurrency in Brazil.

Despite the fact that, on a global scale, gold trading volumes still significantly exceed Bitcoin, the situation in Brazil, however, suggests that bitcoin is increasingly seen by investors as an attractive option for placing assets.

Chart analysis promises rapid growth

MarketWatch analytics company recently released a report, the essence of which is that 2016 was a good year for bitcoin bulls, and cryptocurrency again reached growth indicators two years ago. The technical analysis of the growth charts is encouraging and, according to experts, indicates that the cost growth is likely to continue. According to MKM chief market analyst Jonathan Krinsky, the current pattern is a consequence and a logical continuation of a long consolidation period and promises to be a long-term trend, not a one-time leap. The graph shows the approaching moment of a breakthrough, and taking into account the current state of technical indicators, the chances of moving up are much higher, according to Marketwatch analysts.

The foreign exchange market reflects reality and is currently the best indicator of economic realities. Nobody knows for sure what indicators Bitcoin can achieve this time, given all the uncertainties that are not subject to rigorous mathematical calculations, however, the halving that has taken place, global trends and technical analysis of the exchange rate make it possible to assume that we are at the beginning of an upward wave. At the time of publication, cryptocurrency is being traded in the region of 675 US dollars .

It's not too late to mine: