25 most expensive American startups who died in 2018

- Transfer

Even well-established private companies are constantly at risk of failure, as evidenced by some start-ups that have ceased operations this year. PitchBook collected data on the 25 most expensive startups that failed in 2018; three of these companies have existed for over 20 years and still had to close down.

We present a list of the 25 most expensive startups that failed in 2018.

Year of foundation : 2004

Maximum valuation : 48 million dollars

Amount raised : 26 million dollars

The main activity of SDCmaterials was the creation of nanomaterials for automotive catalysts in order to minimize harmful emissions into the environment by the automotive industry. SDC developed and patented the fabrication and integration processes of catalytic materials, which provided step-by-step improvements in the performance of their underlying platinum-group precious metals, which are key to controlling emissions.

The company has invested such giants auto industry as GM, BASF, Volvo.

Foundation year : 2010

Maximum valuation : $ 52 million

Amount attracted : $ 13 million

Senzari developed data processing solutions for the media and entertainment industry. Their product, MusicGraph, was a platform for listening to music and watching movies, which analyzed user preferences and made recommendations in real time.

MusicGraph gave access to various data about artists, albums and tracks; allowed to create applications using its API; and keep track of the latest social trends and popularity in the musical universe. MusicGraph API is also used to search for various musical facts and relationships.

Founded : 2003

Maximum valuation : $ 58 million

Amount raised : $ 41 million

Industrial Origami patented a manufacturing process that reduces energy consumption and material consumption. By punching metal sheets and certain types of plastics, Industrial Origami was able to stack them into inexpensive, heavy-duty structures.

Year of foundation : 2013

Maximum assessment : 60 million dollars

Attracted amounts a: 39 million dollars

Developer of genetic tests for pediatrics and hereditary diseases. The company most likely closed due to a mismatch between the goals of the investors in the laboratory, which many considered successful.

Founded : 2007

Maximum valuation : $ 90 million

Amount raised : $ 56 million

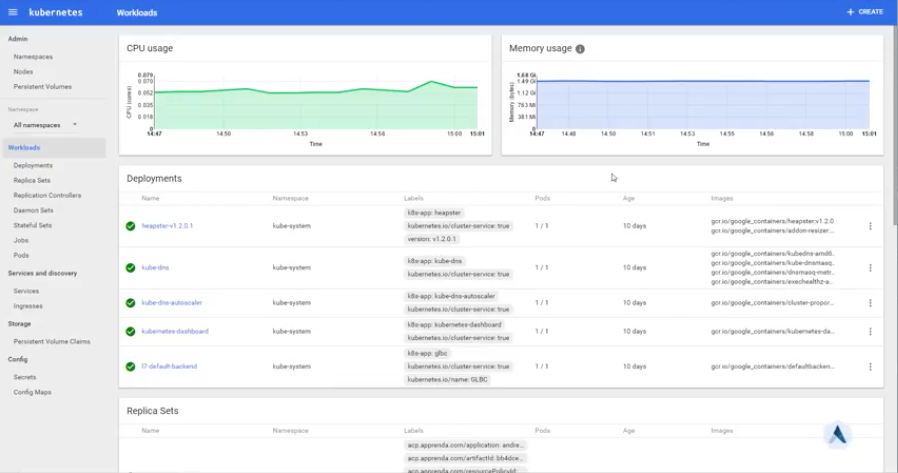

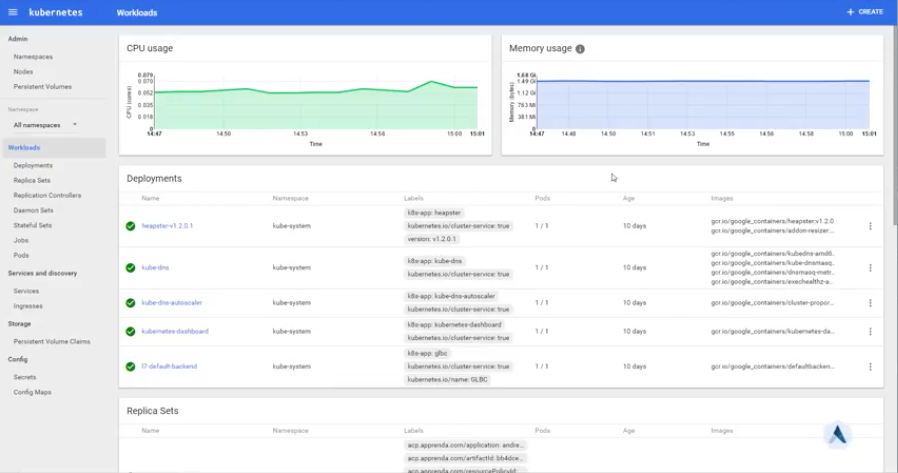

Apprenda created the Apprenda Cloud Platform software platform. This is a comprehensive platform with support for Kubernetes, which other companies have used to develop new software and connect it to their existing internal programs. Her clients included banks such as JPMorgan Chase, and medical companies such as AmerisourceBergen, which have large IT and computer programming departments.

Since 2013, venture company Safeguard Scientifics has invested $ 22.1 million in Apprenda and owned a 29 percent stake in the company. When asked what caused the cessation of the company's operations, Safeguard CEO and President Brian Cisco said that the company was "disappointed ... that in the end we did not succeed with Apprenda".

Founded : 2011

Maximum valuation : $ 94 million

Amount raised : $ 12 million

Innovari created a technology platform that would help utilities manage and deliver reliable and affordable energy in real time. The company's Interactive Energy Platform (IEP) used artificial intelligence, big data analytics, proprietary optimization procedures, and insider knowledge of utilities to provide capacity and address demand variables.

The solution worked as a virtual power plant, connecting additional capacity for utilities when it was necessary, during bad weather, storms, etc.

Founded : 2012

Maximum estimate : $ 96 million

Amount raised : $ 24 million The

startup advanced the RTS (real-time streaming) platform, which included a platform called Apoxi. Apoxi provided, in addition to streaming, including storage and playback features that allowed users to perform past event analysis.

According to the company's president, Guy Churchward, during the closing of the company they could not monetize their platform, the market is more inclined to free products with support.

Year of foundation : 2009

Maximum valuation : 99 million dollars

Amount attracted : 69 million dollars

Rennovia Inc. - a specialized chemical company specialized in the production of chemicals from renewable raw materials.

The company ceased operations after it failed to attract sufficient funding from investors.

Year of foundation : 2012

Maximum valuation : $ 100 million

Amount attracted : $ 80 million The

startup was launched on a crowdfunding website in 2014, earning more than a million dollars in the first week. However, since then the situation has changed a lot.

The company has become known for its projector Navdy, which displays information on the windshield using a translucent display (Head-Up Display (HUD)), where you can follow the navigation, read messages or view mail.

Instead of using Google Maps or another navigation system, Navdy organized his own navigation service. This strategy has let down the owners of the devices, because the company has been liquidated, now it is impossible to extend the subscription to the service. Currently there is no way to change Navdy to use another free application, so all projectors are blocked and useless.

Year of foundation : 2014

Maximum valuation : $ 102 million

Amount attracted : $ 20 million

The company provided maintenance and home improvement services in the United States and abroad. They offered home and yard care services, including lawn care services, such as lawn mowing, trimming edges, trimming lawns, and installing fences; cleaning services such as cleaning and weeding. In addition, clients could manage weekly tasks for their gardeners using a mobile app.

Founded : 2007

Maximum valuation : $ 115 million

Amount raised : $ 77 million

The company developed the Winx System, which is a device for treating obstructive sleep apnea, using oral pressure therapy (OPT). The system is equipped with a soft and flexible mouthpiece, a thin tube and a quiet, compact console. The flexible mouthpiece should be in the mouth during sleep. It attaches to a thin tube that is connected to a compact console, which allows you to breathe naturally from any position of the body.

Founded : 2009

Maximum valuation : 118 million dollars

Amount attracted : 78 million dollars

The company developed a system for recovering heat energy and turning it into electricity.

In 2014, Alphabet Energy introduced the world's first E1 industrial thermoelectric generator. E1 receives heat from exhaust gases from large industrial engines and turns it into electricity. As a result, the engine needs less fuel to provide the same power. The E1 was optimized for engines up to 1,400 kW and worked on any engine or exhaust source.

The company is also known for selling the PowerModule product, which was able to turn excess heat generated by server hardware inside the data center into electricity. For this, the so-called thermoelectric effect was used.

The PowerModule was a liquid-cooled solid-state electric generator that converted heat into electricity using the proprietary thermoelectric materials PowerBlocks. It was stated that with their help PowerModule directly converted the heat of heated air and other gases with a temperature in the range from 350 ° C to 600 ° C into a constant electric current, providing power up to 850 W.

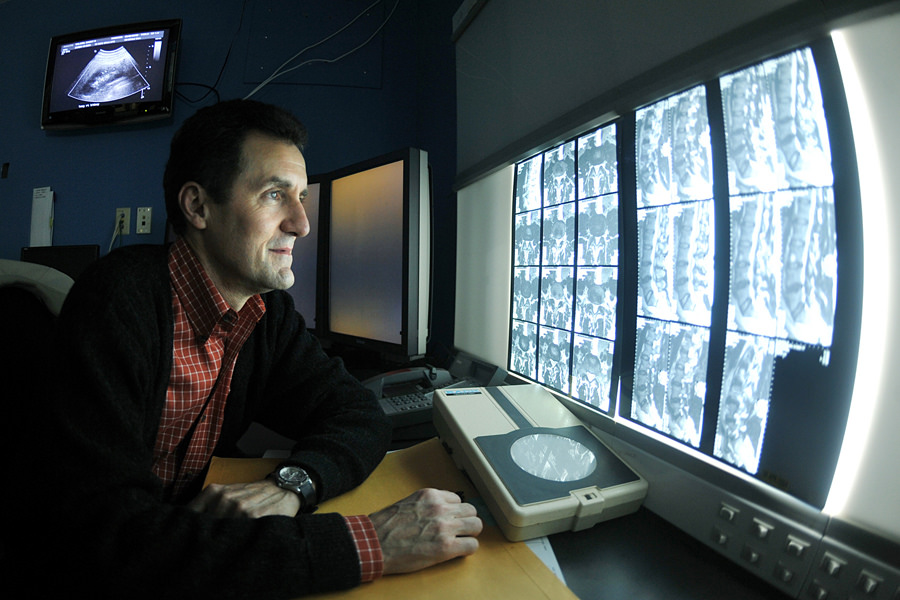

Year of foundation : 2000

Maximum estimate : $ 136 million

Amount attracted : $ 34 million

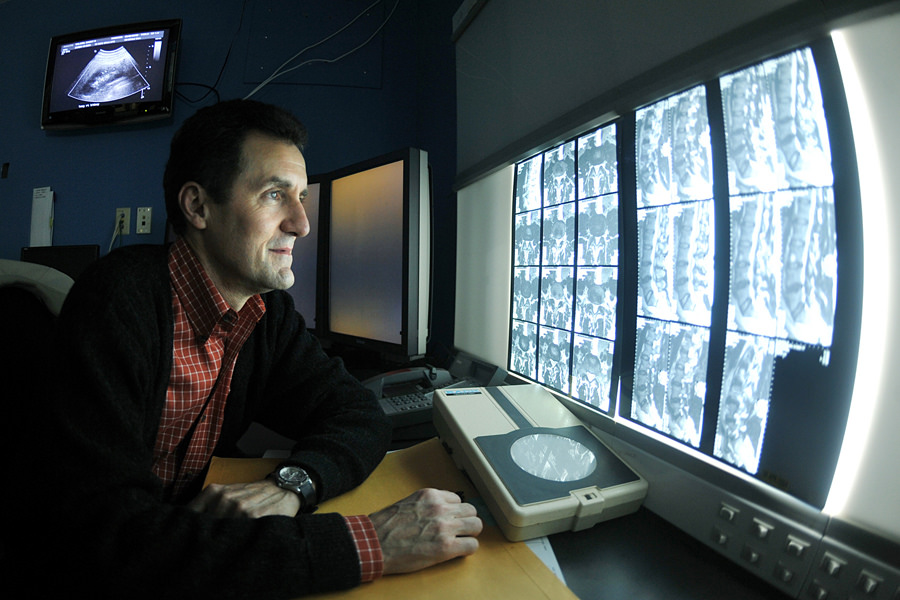

Paieon Inc. - The company was engaged in medical imaging, provided image analysis for cardiovascular interventional procedures. The following services were offered by CardiOp-B, a three-dimensional (3D) system for the reconstruction and analysis of the cardiovascular system. IC-PRO is a visualization workstation that provides assistance at various stages of the catheterization procedure, such as diagnostics, procedure planning, treatment, post-deployment analysis, and reports and archiving.

Founded : 2009

Maximum estimate : $ 145 million

Amount raised : $ 94 million

The company is a developer of cloud radiology software that improves accuracy and speed, reducing the cost of diagnostics.

Founded : 2013

Maximum valuation : $ 150 million

Amount raised : $ 89 million

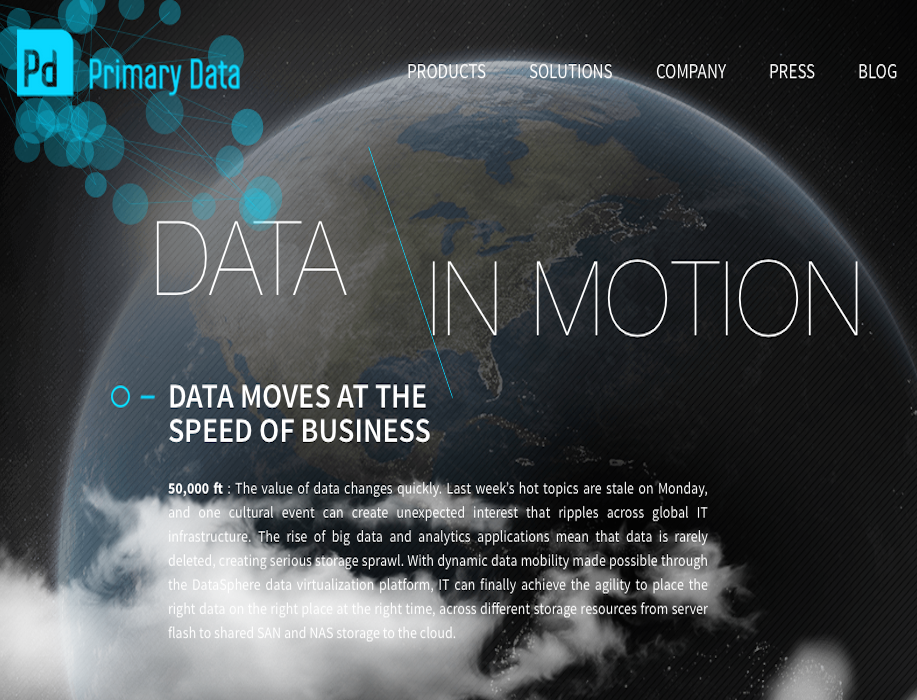

Primary Data developed software for analyzing and automating corporate data management in the local IT infrastructure and in the cloud. Its DataSphere platform integrated metadata management and machine learning to move the right data to the right place at the right time in the global namespace, automatically and without applications.

Founded : 1998

Maximum valuation : $ 169 million

Amount attracted : $ 171 million

The company is known for inventing NuVinci, a continuously variable planetary hub with balls for bicycles based on continuously variable transmission (CVT). In December 2006, the first NuVinci bike was introduced in the Netherlands and the USA.

Gears are not used in the Nuvinci CVP hub - instead of them, balls are used to change the gear ratio. Nuvinci bushing belongs to the class of variators. The abbreviation of the word variator in English sounds like a CVP or CVT, which is reflected in the title of the sleeve.

NuVinci CVP technology has also been introduced for wind turbines, electric cars, etc.

In March of this year, Fallbrook Technologies filed for bankruptcy. As a result of the bankruptcy procedure, the company was divided into 2 divisions. The division of bicycles under the brand Enviolo, will continue the further development of technology NuVinci. And the licensing department that provides NuVinci technology to “industry leaders,” such as Allison Transmission, Dana Limited, TEAM Industries, and Conti Temic microelectronics.

Founded : 1996

Maximum valuation : $ 183 million

Amount raised : $ 175 million

ReVision Optics developed Raindrop melee incrustation for presbyopia correction. The Food and Drug Administration has approved corneal inlay in June 2016.

In April 2017, ReVision announced that during the seven months since launch, 1,000 Raindrop operations were performed. Although many patients and surgeons were pleased with the work of inlay, this business was difficult for ReVision, the board of directors and investors decided to close it. Raindrop incrustation was discontinued in January 2018.

Founded : 1998

Maximum valuation : $ 194 million

Amount raised : $ 55 million

Medical Simulation Corporation offers products for modeling and training programs supported by doctors, including Compass All Terrain - a tool for training and sales that provides high portable modeling; customized applications for sales professionals, doctors and patients; Simantha - endovascular modeling system that helps in the training of medical workers; and Mobile Simulation Lab is a platform that facilitates the clinical support of hospitals in the prevention and early detection of various disease states.

Founded : 2011

Maximum valuation : $ 59 million

Amount raised : $ 104 million

Airware offered in-flight drones management and monitoring software and cloud services for storing and managing information gathered by drones for industries such as mining, insurance and construction. Programs checked equipment for damage, were used to collect and analyze aerial photographs. This allowed companies to not use expensive helicopters or dangerous rigs with people on hangers to conduct inspections and evaluate progress.

The startup is overmoney after trying to make their own equipment, which could not compete with large manufacturers of drones, such as the Chinese DJI. At some point 140 employees worked in the company, and all of them are now out of work.

Founded : 2008

Maximum valuation : $ 243 million

Amount raised : $ 41 million

ItsOn was the first company to develop and commercialize the Network Functions Virtualization Platform (NFV), which replaced the traditional 3GPP hardware control panel. ItsOn cloud software has enabled users to purchase mobile services of operators in real time directly from their devices.

ItsOn has also developed a cloud platform to improve the performance of mobile networks. The company's real-time telecommunications platform monitored voice, text, and data services, optimizing subscriber traffic control.

According to Former employees poor management led to the closure of the company.

Year of foundation : 2013

Maximum valuation : 275 million dollars

Amount attracted : 62 million dollars

Shyp was launched in 2014 and was designed to simplify sending parcels to US residents. The company collected, packaged and shipped goods through USPS and other major carriers.

Following the explosive growth, followed by a series of failures. The initial business model of $ 5 for shipping for individuals allowed to maximize the geography of supply. Geography in the United States compared them with UBER, but a series of losses forced the company to reorient to the wholesale market and leave only delivery to San Francisco. These measures did not help to save the company; the errors of explosive growth led to the closure of the company.

Founded : 2008

Maximum valuation : $ 291 million.

Amount raised : $ 150 million

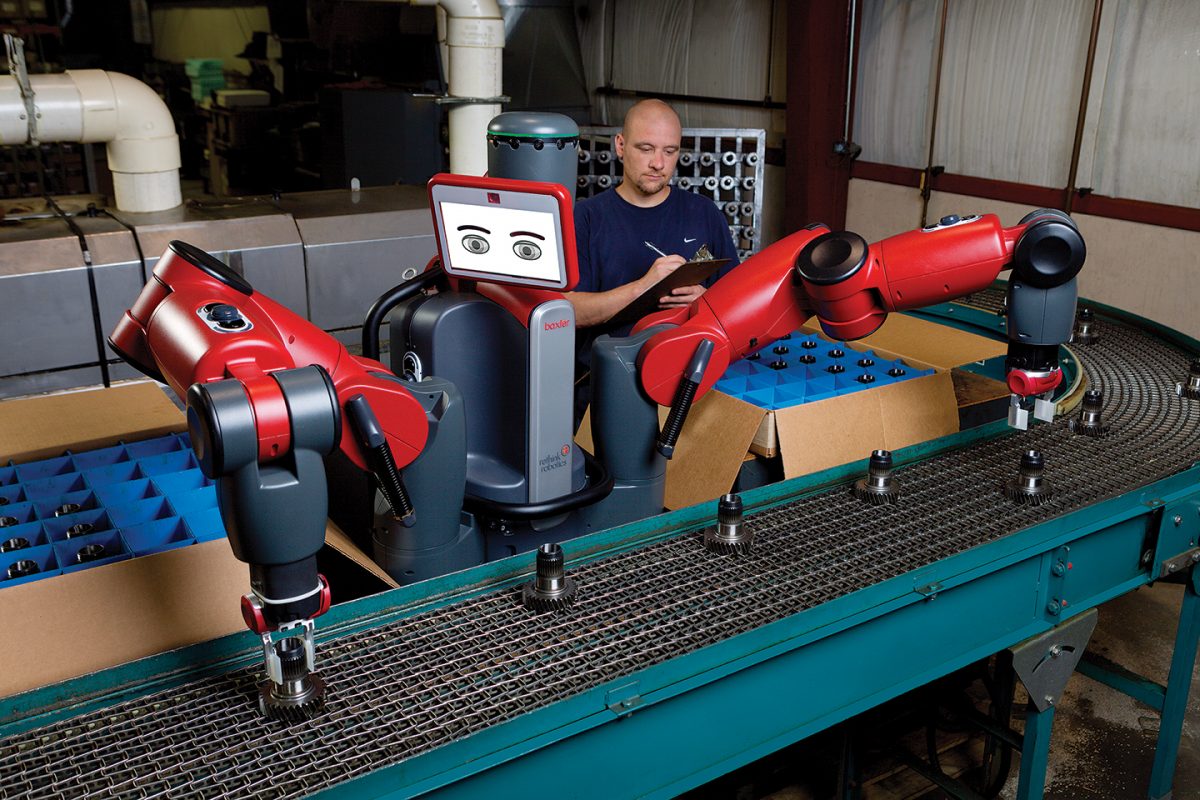

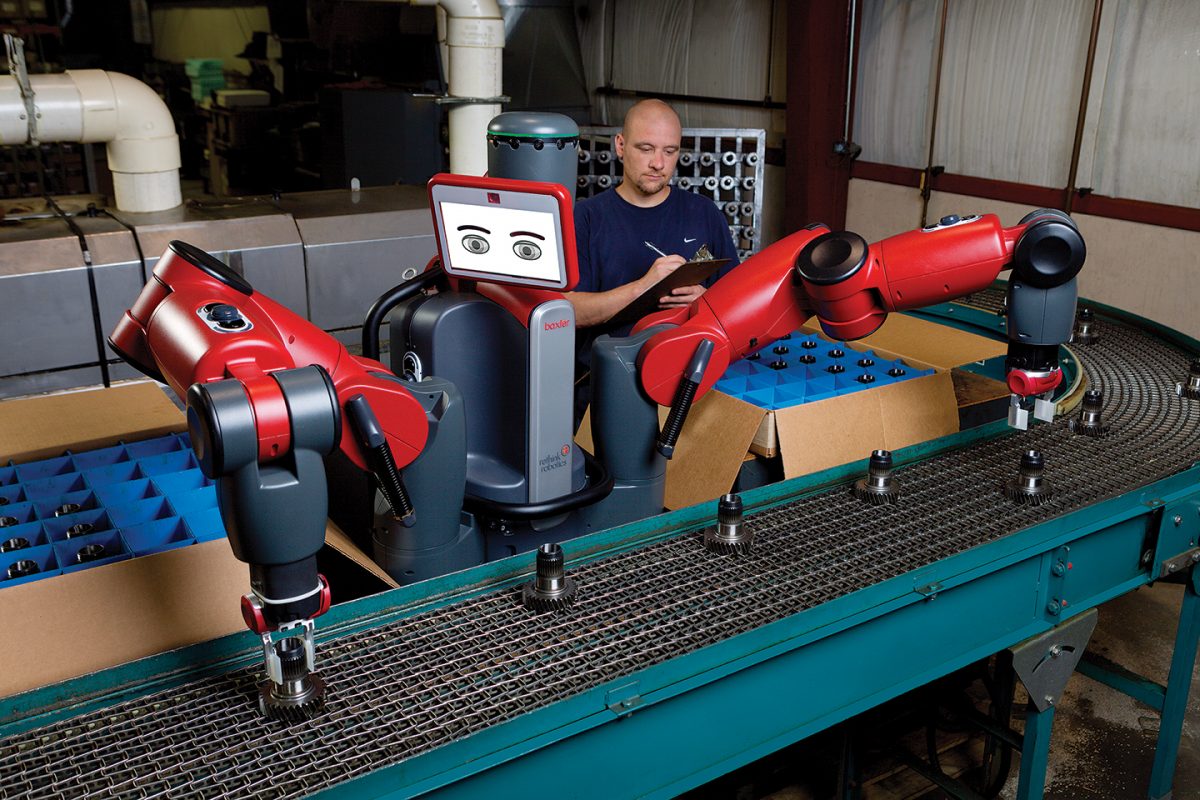

Rethink Robotics was a robotic company offering robotic arms for various types of industries. Robots were engaged in loading and unloading, packing, testing, checking, and also processed metal and exchanged information with other IoT devices.

Rethink robotics closed on October 3, 2018, and assets and intellectual property were acquired by the HAHN Group on October 25, 2018.

Founded : 2007

Maximum valuation : $ 311 million

Amount raised : $ 233 million

Videology, founded by former owner of Advertising.com Scott Ferber, develops programs that help advertisers target video ads to specific demographic groups, websites, and applications for smartphones.

Videology also collects information about online consumers to help advertisers get the most out of television advertising.

Last year, the company was actively looking for a buyer, in May of this year filed for bankruptcy and protection from creditors. The company reported a debt of 100 to 500 million dollars. Amobee, a Californian plate sales organization owned by Singapore Telecommunications Ltd. or Singtel, became the main participant in the purchase of Videology assets, and paid $ 20 million for the company's assets.

Founded : 2006

Maximum valuation : $ 360 million

Amount attracted : $ 202 million

The company became known for its digital camera Lytro Light Field Camera. This is a digital camera based on the theory of the light field, according to which the camera sensor records not only information about the color and intensity of light, but also vector information about the direction of light at each point in the image, thereby obtaining more complete information about the subject being shot. than an ordinary camera.

A key feature of the camera was the ability to adjust the focus of the image after the picture was taken.

Despite the fact that last year Lytro acquired Limitless VR-animation company for $ 60 million, in March 2018, Google swallowed Lytro for $ 25– $ 40 million. The team will be distributed across several divisions and will not continue Lytro’s previous work. Google acquired the assets of Lytro, but without direct plans to integrate them into existing projects.

Founded : 2003

Maximum valuation : 9 billion dollars

Amount attracted : 910 million dollars

In 2015, Forbes magazine announced Elizabeth Holmes the youngest billionaire woman who made her own fortune by relying on Theranos market value, which at that time was estimated at $ 9 billion Holmes owned half of startup shares.

Theranos argued that, thanks to an innovative method developed by its experts, just a few drops of blood are sufficient for accurate and inexpensive analysis.

However, within a few months after that, accusations of fraud were poured into the corporation: it turned out that the portable device for blood analysis offered by Theranos had too many errors and the company carried out parallel analyzes using traditional methods to compensate for errors.

On June 15, 2018, Theranos founder and former operating director were charged with fraud. According to the prosecution, Holmes and Balvani cited obviously false facts in presentations for investors and releases for the press, as well as in demonstrating the company's products. In this way, Theranos tried to convince investors of the revolutionary nature of its key product - a portable blood analyzer - due to its ability to carry out the entire spectrum of analyzes on a drop of blood from a finger.

In the past year, the biggest resonance was caused by the closure of Theranos, a medical technology company that collected almost $ 1 billion. Many companies do not advertise the real reasons for closing. It remains only to guess what went wrong in a particular company. The main result can be considered only the fact that millions of dollars invested by venture capitalists are not the guarantor of the longevity of a startup.

We present a list of the 25 most expensive startups that failed in 2018.

25. SDCmaterials - Automotive Nanotechnology

Year of foundation : 2004

Maximum valuation : 48 million dollars

Amount raised : 26 million dollars

The main activity of SDCmaterials was the creation of nanomaterials for automotive catalysts in order to minimize harmful emissions into the environment by the automotive industry. SDC developed and patented the fabrication and integration processes of catalytic materials, which provided step-by-step improvements in the performance of their underlying platinum-group precious metals, which are key to controlling emissions.

The company has invested such giants auto industry as GM, BASF, Volvo.

24. Senzari - musical data processing

Foundation year : 2010

Maximum valuation : $ 52 million

Amount attracted : $ 13 million

Senzari developed data processing solutions for the media and entertainment industry. Their product, MusicGraph, was a platform for listening to music and watching movies, which analyzed user preferences and made recommendations in real time.

MusicGraph gave access to various data about artists, albums and tracks; allowed to create applications using its API; and keep track of the latest social trends and popularity in the musical universe. MusicGraph API is also used to search for various musical facts and relationships.

23. Industrial Origami - a manufacturer of industrial materials

Founded : 2003

Maximum valuation : $ 58 million

Amount raised : $ 41 million

Industrial Origami patented a manufacturing process that reduces energy consumption and material consumption. By punching metal sheets and certain types of plastics, Industrial Origami was able to stack them into inexpensive, heavy-duty structures.

22. Claritas Genomics - Pediatric Genetic Testing

Year of foundation : 2013

Maximum assessment : 60 million dollars

Attracted amounts a: 39 million dollars

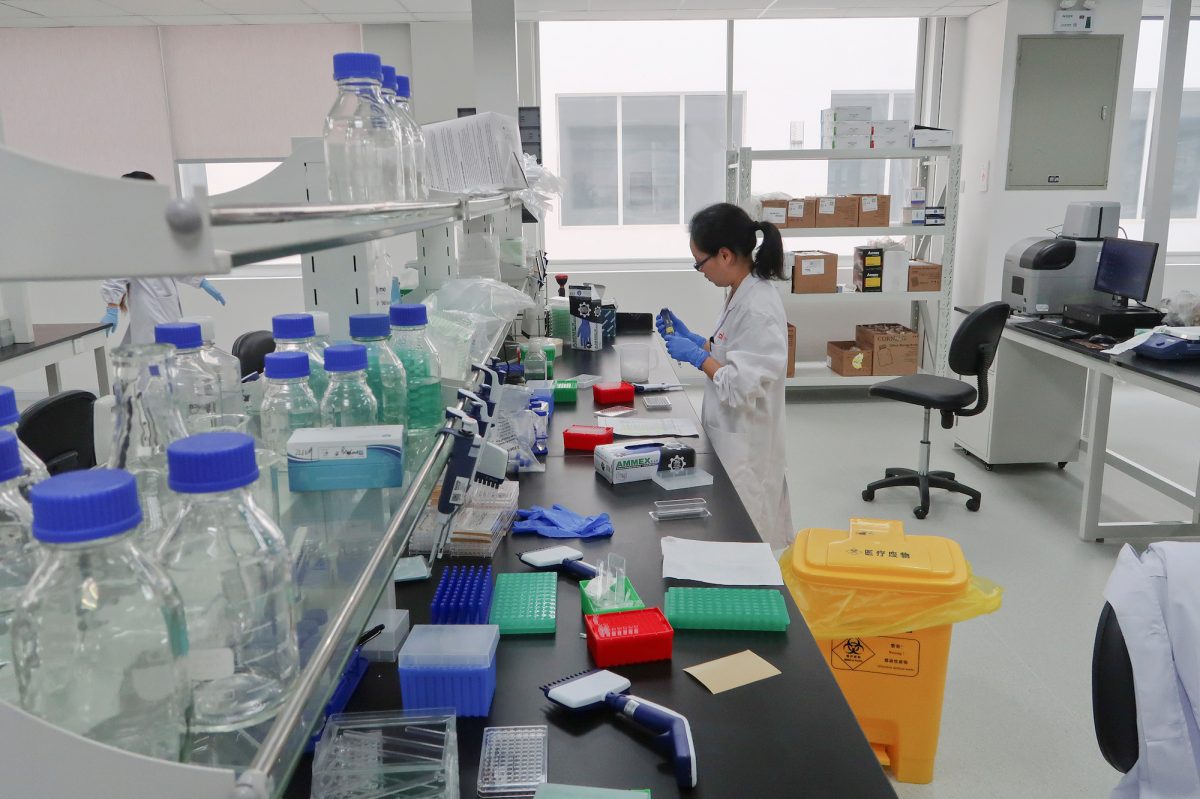

Developer of genetic tests for pediatrics and hereditary diseases. The company most likely closed due to a mismatch between the goals of the investors in the laboratory, which many considered successful.

21. Apprenda - cloud software for developers

Founded : 2007

Maximum valuation : $ 90 million

Amount raised : $ 56 million

Apprenda created the Apprenda Cloud Platform software platform. This is a comprehensive platform with support for Kubernetes, which other companies have used to develop new software and connect it to their existing internal programs. Her clients included banks such as JPMorgan Chase, and medical companies such as AmerisourceBergen, which have large IT and computer programming departments.

Since 2013, venture company Safeguard Scientifics has invested $ 22.1 million in Apprenda and owned a 29 percent stake in the company. When asked what caused the cessation of the company's operations, Safeguard CEO and President Brian Cisco said that the company was "disappointed ... that in the end we did not succeed with Apprenda".

20. Innovari - an interactive energy platform for public utilities

Founded : 2011

Maximum valuation : $ 94 million

Amount raised : $ 12 million

Innovari created a technology platform that would help utilities manage and deliver reliable and affordable energy in real time. The company's Interactive Energy Platform (IEP) used artificial intelligence, big data analytics, proprietary optimization procedures, and insider knowledge of utilities to provide capacity and address demand variables.

The solution worked as a virtual power plant, connecting additional capacity for utilities when it was necessary, during bad weather, storms, etc.

19. DataTorrent - a streaming data platform

Founded : 2012

Maximum estimate : $ 96 million

Amount raised : $ 24 million The

startup advanced the RTS (real-time streaming) platform, which included a platform called Apoxi. Apoxi provided, in addition to streaming, including storage and playback features that allowed users to perform past event analysis.

According to the company's president, Guy Churchward, during the closing of the company they could not monetize their platform, the market is more inclined to free products with support.

18. Rennovia - biochemical production

Year of foundation : 2009

Maximum valuation : 99 million dollars

Amount attracted : 69 million dollars

Rennovia Inc. - a specialized chemical company specialized in the production of chemicals from renewable raw materials.

The company ceased operations after it failed to attract sufficient funding from investors.

17. Navdy - Heads-Up Displays for Vehicles

Year of foundation : 2012

Maximum valuation : $ 100 million

Amount attracted : $ 80 million The

startup was launched on a crowdfunding website in 2014, earning more than a million dollars in the first week. However, since then the situation has changed a lot.

The company has become known for its projector Navdy, which displays information on the windshield using a translucent display (Head-Up Display (HUD)), where you can follow the navigation, read messages or view mail.

Instead of using Google Maps or another navigation system, Navdy organized his own navigation service. This strategy has let down the owners of the devices, because the company has been liquidated, now it is impossible to extend the subscription to the service. Currently there is no way to change Navdy to use another free application, so all projectors are blocked and useless.

16. EZhome - lawn care services by subscription

Year of foundation : 2014

Maximum valuation : $ 102 million

Amount attracted : $ 20 million

The company provided maintenance and home improvement services in the United States and abroad. They offered home and yard care services, including lawn care services, such as lawn mowing, trimming edges, trimming lawns, and installing fences; cleaning services such as cleaning and weeding. In addition, clients could manage weekly tasks for their gardeners using a mobile app.

15. Winx - the system of sleep therapy

Founded : 2007

Maximum valuation : $ 115 million

Amount raised : $ 77 million

The company developed the Winx System, which is a device for treating obstructive sleep apnea, using oral pressure therapy (OPT). The system is equipped with a soft and flexible mouthpiece, a thin tube and a quiet, compact console. The flexible mouthpiece should be in the mouth during sleep. It attaches to a thin tube that is connected to a compact console, which allows you to breathe naturally from any position of the body.

14. Alphabet Energy - thermoelectric generators

Founded : 2009

Maximum valuation : 118 million dollars

Amount attracted : 78 million dollars

The company developed a system for recovering heat energy and turning it into electricity.

In 2014, Alphabet Energy introduced the world's first E1 industrial thermoelectric generator. E1 receives heat from exhaust gases from large industrial engines and turns it into electricity. As a result, the engine needs less fuel to provide the same power. The E1 was optimized for engines up to 1,400 kW and worked on any engine or exhaust source.

The company is also known for selling the PowerModule product, which was able to turn excess heat generated by server hardware inside the data center into electricity. For this, the so-called thermoelectric effect was used.

The PowerModule was a liquid-cooled solid-state electric generator that converted heat into electricity using the proprietary thermoelectric materials PowerBlocks. It was stated that with their help PowerModule directly converted the heat of heated air and other gases with a temperature in the range from 350 ° C to 600 ° C into a constant electric current, providing power up to 850 W.

13. Paieon - Medical Imaging Technology

Year of foundation : 2000

Maximum estimate : $ 136 million

Amount attracted : $ 34 million

Paieon Inc. - The company was engaged in medical imaging, provided image analysis for cardiovascular interventional procedures. The following services were offered by CardiOp-B, a three-dimensional (3D) system for the reconstruction and analysis of the cardiovascular system. IC-PRO is a visualization workstation that provides assistance at various stages of the catheterization procedure, such as diagnostics, procedure planning, treatment, post-deployment analysis, and reports and archiving.

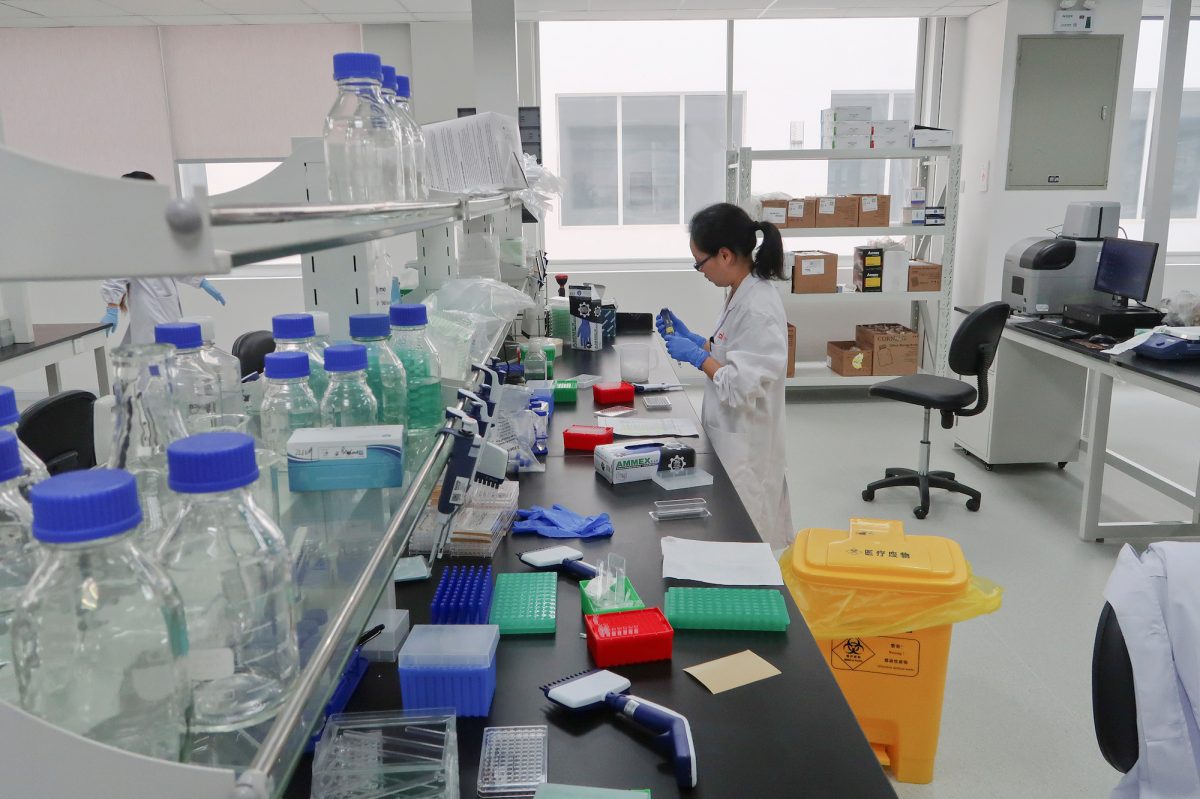

12. Candescent Health - radiological software

Founded : 2009

Maximum estimate : $ 145 million

Amount raised : $ 94 million

The company is a developer of cloud radiology software that improves accuracy and speed, reducing the cost of diagnostics.

11. PRIMARY DATA - automation software platform

Founded : 2013

Maximum valuation : $ 150 million

Amount raised : $ 89 million

Primary Data developed software for analyzing and automating corporate data management in the local IT infrastructure and in the cloud. Its DataSphere platform integrated metadata management and machine learning to move the right data to the right place at the right time in the global namespace, automatically and without applications.

10. Fallbrook Technologies - Automatic Transmission Technology for Bicycles

Founded : 1998

Maximum valuation : $ 169 million

Amount attracted : $ 171 million

The company is known for inventing NuVinci, a continuously variable planetary hub with balls for bicycles based on continuously variable transmission (CVT). In December 2006, the first NuVinci bike was introduced in the Netherlands and the USA.

Gears are not used in the Nuvinci CVP hub - instead of them, balls are used to change the gear ratio. Nuvinci bushing belongs to the class of variators. The abbreviation of the word variator in English sounds like a CVP or CVT, which is reflected in the title of the sleeve.

NuVinci CVP technology has also been introduced for wind turbines, electric cars, etc.

In March of this year, Fallbrook Technologies filed for bankruptcy. As a result of the bankruptcy procedure, the company was divided into 2 divisions. The division of bicycles under the brand Enviolo, will continue the further development of technology NuVinci. And the licensing department that provides NuVinci technology to “industry leaders,” such as Allison Transmission, Dana Limited, TEAM Industries, and Conti Temic microelectronics.

9. ReVision Optics - surgical implants for improving vision

Founded : 1996

Maximum valuation : $ 183 million

Amount raised : $ 175 million

ReVision Optics developed Raindrop melee incrustation for presbyopia correction. The Food and Drug Administration has approved corneal inlay in June 2016.

In April 2017, ReVision announced that during the seven months since launch, 1,000 Raindrop operations were performed. Although many patients and surgeons were pleased with the work of inlay, this business was difficult for ReVision, the board of directors and investors decided to close it. Raindrop incrustation was discontinued in January 2018.

8. Medical Simulation - simulation products for medical training

Founded : 1998

Maximum valuation : $ 194 million

Amount raised : $ 55 million

Medical Simulation Corporation offers products for modeling and training programs supported by doctors, including Compass All Terrain - a tool for training and sales that provides high portable modeling; customized applications for sales professionals, doctors and patients; Simantha - endovascular modeling system that helps in the training of medical workers; and Mobile Simulation Lab is a platform that facilitates the clinical support of hospitals in the prevention and early detection of various disease states.

7. Airware - unmanned analytics

Founded : 2011

Maximum valuation : $ 59 million

Amount raised : $ 104 million

Airware offered in-flight drones management and monitoring software and cloud services for storing and managing information gathered by drones for industries such as mining, insurance and construction. Programs checked equipment for damage, were used to collect and analyze aerial photographs. This allowed companies to not use expensive helicopters or dangerous rigs with people on hangers to conduct inspections and evaluate progress.

The startup is overmoney after trying to make their own equipment, which could not compete with large manufacturers of drones, such as the Chinese DJI. At some point 140 employees worked in the company, and all of them are now out of work.

6. ItsOn is a cloud platform for smart mobile services.

Founded : 2008

Maximum valuation : $ 243 million

Amount raised : $ 41 million

ItsOn was the first company to develop and commercialize the Network Functions Virtualization Platform (NFV), which replaced the traditional 3GPP hardware control panel. ItsOn cloud software has enabled users to purchase mobile services of operators in real time directly from their devices.

ItsOn has also developed a cloud platform to improve the performance of mobile networks. The company's real-time telecommunications platform monitored voice, text, and data services, optimizing subscriber traffic control.

According to Former employees poor management led to the closure of the company.

5. Shyp - on-demand delivery platform

Year of foundation : 2013

Maximum valuation : 275 million dollars

Amount attracted : 62 million dollars

Shyp was launched in 2014 and was designed to simplify sending parcels to US residents. The company collected, packaged and shipped goods through USPS and other major carriers.

Following the explosive growth, followed by a series of failures. The initial business model of $ 5 for shipping for individuals allowed to maximize the geography of supply. Geography in the United States compared them with UBER, but a series of losses forced the company to reorient to the wholesale market and leave only delivery to San Francisco. These measures did not help to save the company; the errors of explosive growth led to the closure of the company.

4. Rethink Robotics - manufacturing robots

Founded : 2008

Maximum valuation : $ 291 million.

Amount raised : $ 150 million

Rethink Robotics was a robotic company offering robotic arms for various types of industries. Robots were engaged in loading and unloading, packing, testing, checking, and also processed metal and exchanged information with other IoT devices.

Rethink robotics closed on October 3, 2018, and assets and intellectual property were acquired by the HAHN Group on October 25, 2018.

3. Videology- software for television and video advertising

Founded : 2007

Maximum valuation : $ 311 million

Amount raised : $ 233 million

Videology, founded by former owner of Advertising.com Scott Ferber, develops programs that help advertisers target video ads to specific demographic groups, websites, and applications for smartphones.

Videology also collects information about online consumers to help advertisers get the most out of television advertising.

Last year, the company was actively looking for a buyer, in May of this year filed for bankruptcy and protection from creditors. The company reported a debt of 100 to 500 million dollars. Amobee, a Californian plate sales organization owned by Singapore Telecommunications Ltd. or Singtel, became the main participant in the purchase of Videology assets, and paid $ 20 million for the company's assets.

2. Lytro - cameras with a full spectrum light field

Founded : 2006

Maximum valuation : $ 360 million

Amount attracted : $ 202 million

The company became known for its digital camera Lytro Light Field Camera. This is a digital camera based on the theory of the light field, according to which the camera sensor records not only information about the color and intensity of light, but also vector information about the direction of light at each point in the image, thereby obtaining more complete information about the subject being shot. than an ordinary camera.

A key feature of the camera was the ability to adjust the focus of the image after the picture was taken.

Despite the fact that last year Lytro acquired Limitless VR-animation company for $ 60 million, in March 2018, Google swallowed Lytro for $ 25– $ 40 million. The team will be distributed across several divisions and will not continue Lytro’s previous work. Google acquired the assets of Lytro, but without direct plans to integrate them into existing projects.

1. Theranos - blood test technology

Founded : 2003

Maximum valuation : 9 billion dollars

Amount attracted : 910 million dollars

In 2015, Forbes magazine announced Elizabeth Holmes the youngest billionaire woman who made her own fortune by relying on Theranos market value, which at that time was estimated at $ 9 billion Holmes owned half of startup shares.

Theranos argued that, thanks to an innovative method developed by its experts, just a few drops of blood are sufficient for accurate and inexpensive analysis.

However, within a few months after that, accusations of fraud were poured into the corporation: it turned out that the portable device for blood analysis offered by Theranos had too many errors and the company carried out parallel analyzes using traditional methods to compensate for errors.

On June 15, 2018, Theranos founder and former operating director were charged with fraud. According to the prosecution, Holmes and Balvani cited obviously false facts in presentations for investors and releases for the press, as well as in demonstrating the company's products. In this way, Theranos tried to convince investors of the revolutionary nature of its key product - a portable blood analyzer - due to its ability to carry out the entire spectrum of analyzes on a drop of blood from a finger.

Results

In the past year, the biggest resonance was caused by the closure of Theranos, a medical technology company that collected almost $ 1 billion. Many companies do not advertise the real reasons for closing. It remains only to guess what went wrong in a particular company. The main result can be considered only the fact that millions of dollars invested by venture capitalists are not the guarantor of the longevity of a startup.