Why you should not completely trust the best-to-do lists or statistics is a stubborn thing

In the Twitter subscription, I was always more concerned not with the quantity, but with the quality of the subscriptions. Therefore, the number of subscribers of a character worried me a little, except perhaps a little. That's who the person is following, has always been of paramount importance to me. If you are interested in a certain character, and his authority in your eyes is very great, then the people on whom he is signed should be of perhaps more interest to you. Since you agree with the authority of the character, then the opinion of those people on whom he is signed is confirmed by him. Of course, because if a person is following someone, by definition he considers him to be at least equal to himself. Sometimes even surpassing oneself beloved in anything. Is it logical? After all, no one subscribes to a person whose opinion does not matter to you.

Some people, when they see articles of such a plan, subscribe in bulk to everything. Others start to choose. Since by mindset and education, I wasnot lucky to be an engineer, I chose a completely different approach to business. I hate the stupid subscription approach for everyone, then there’s such a mess in the tape that you won’t figure it out, and anyway, it’s not clear who makes these lists, and from what premises it comes from, etc. Maybe someone forgot to enter this list, or maybe there is someone extra?

What can be done with this?

You can manually check each. Engineer's consciousness is modulated by logic, precise methods, and what is really lazy to hide. As a result, I developed my own approach. It’s new, it’s kind of invented by myself, but I can’t vouch that before me no one had suffered like that.

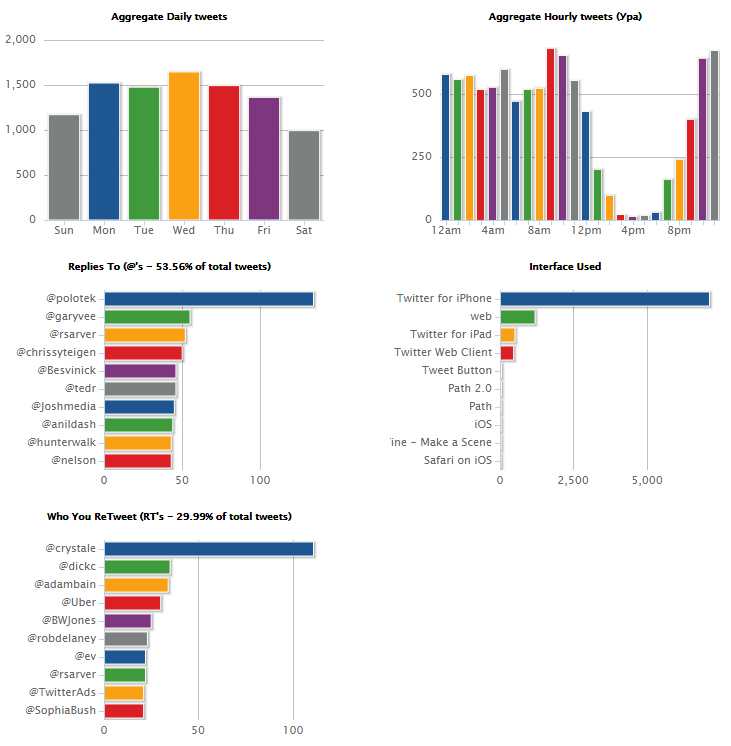

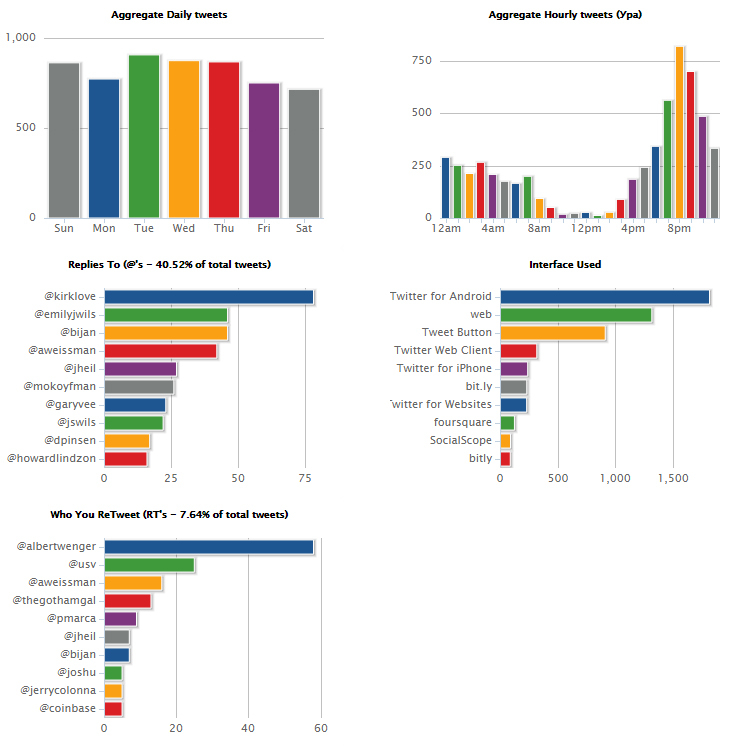

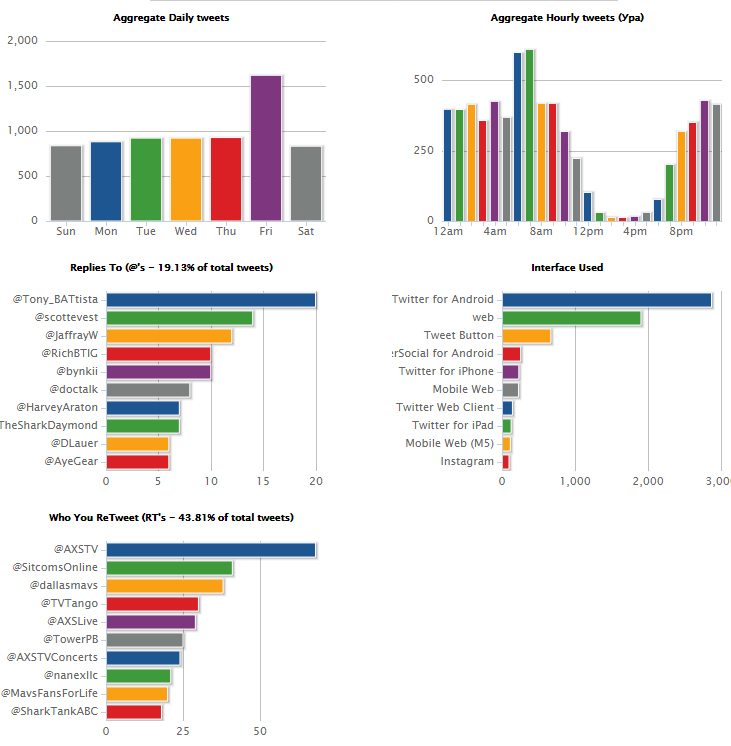

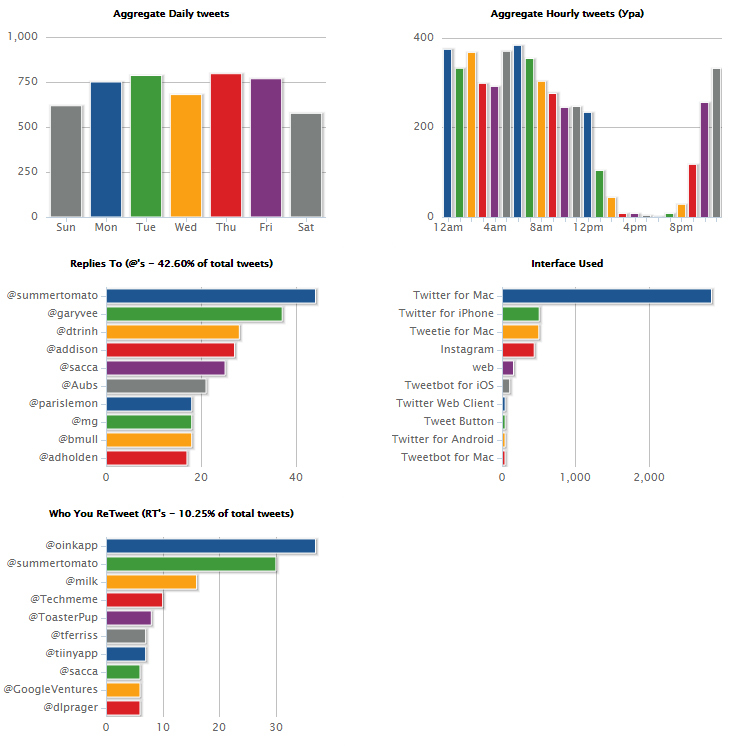

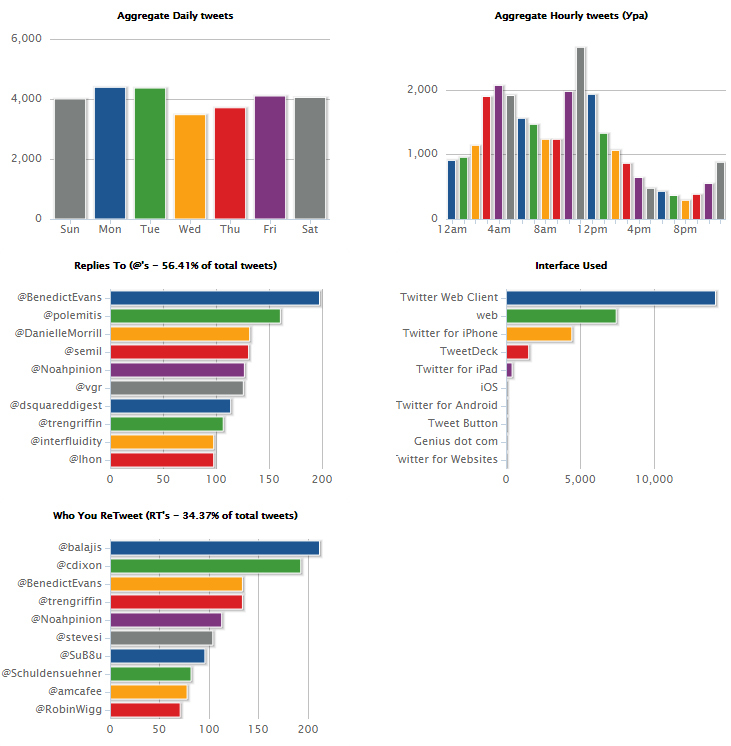

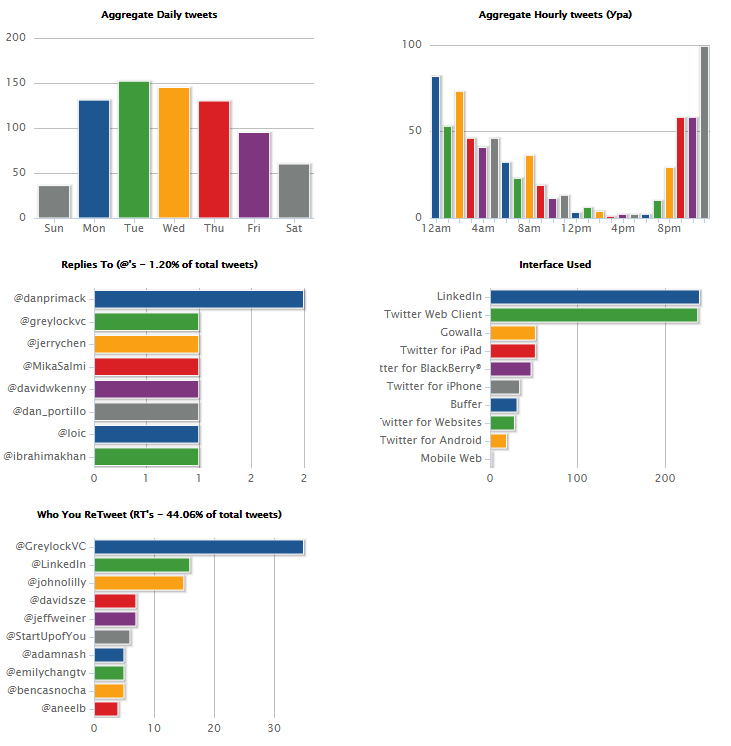

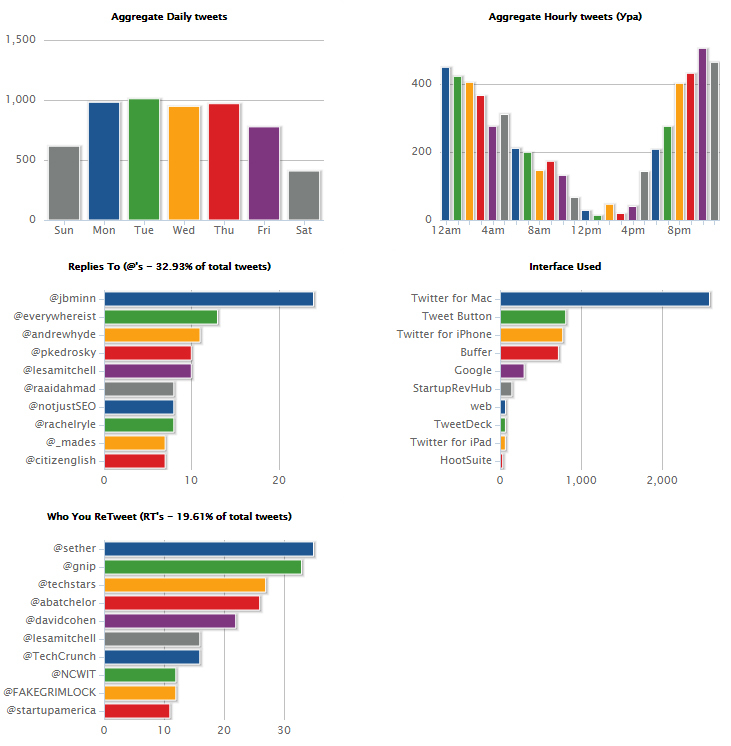

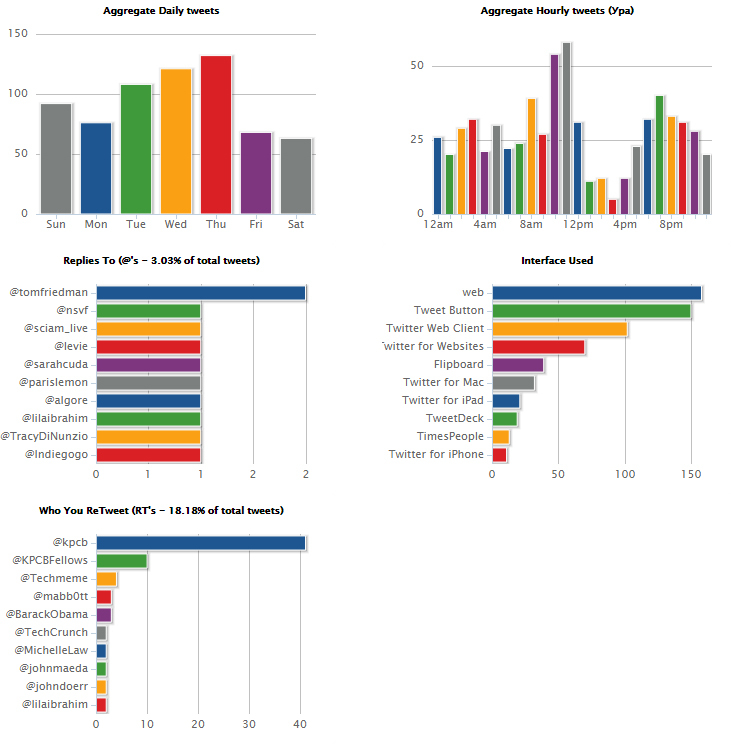

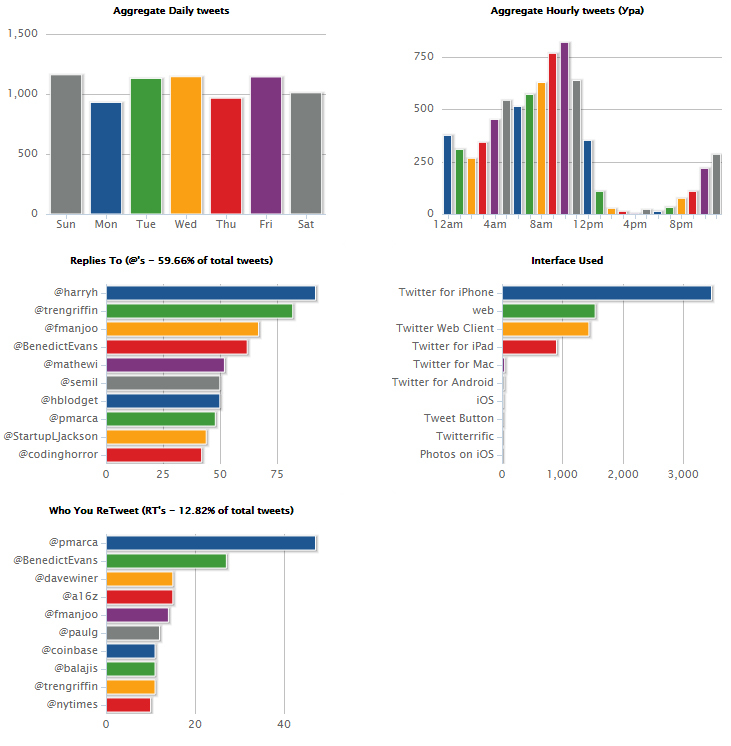

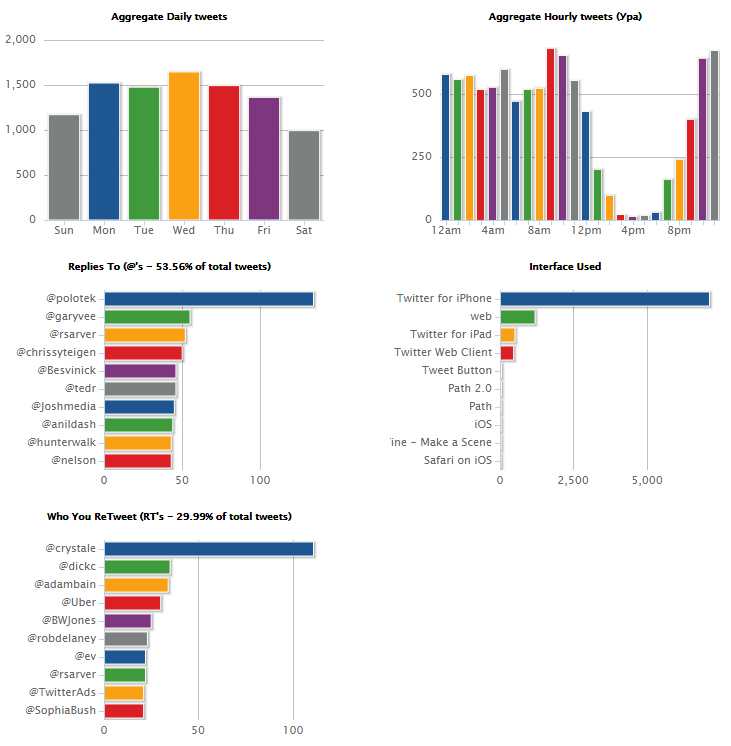

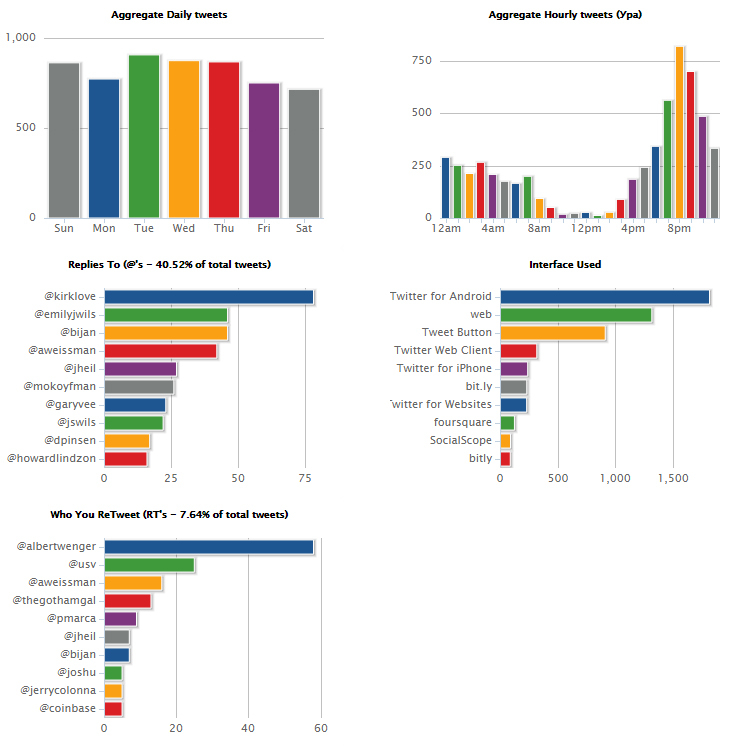

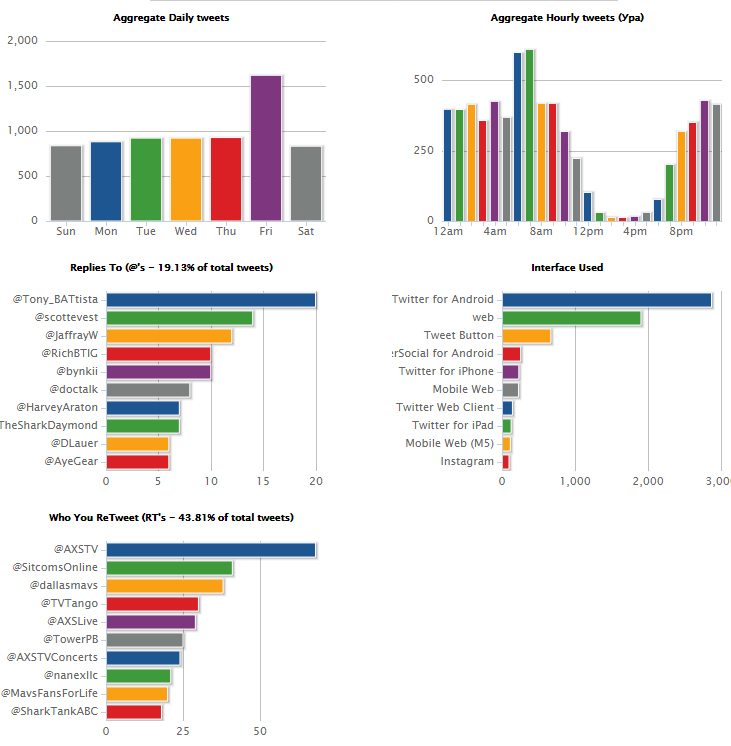

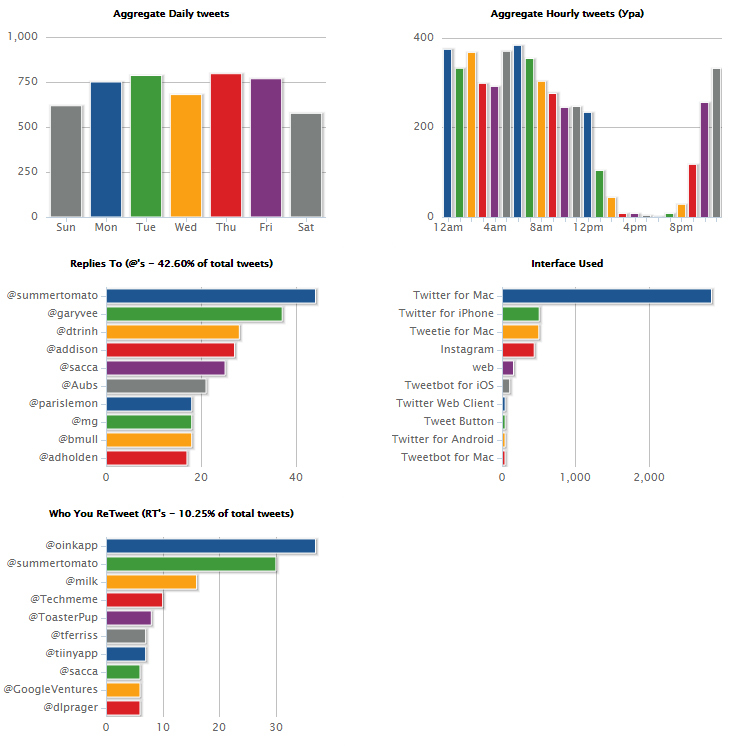

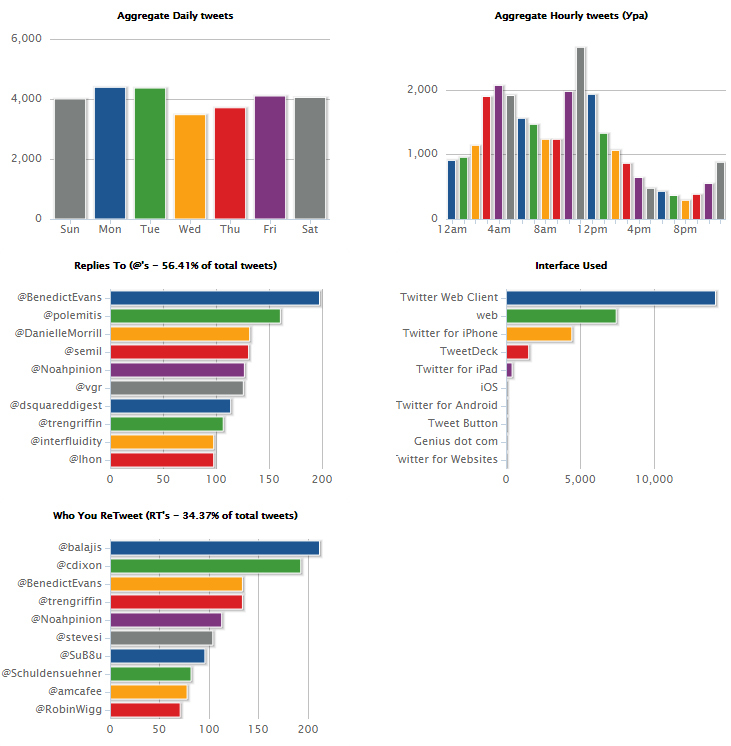

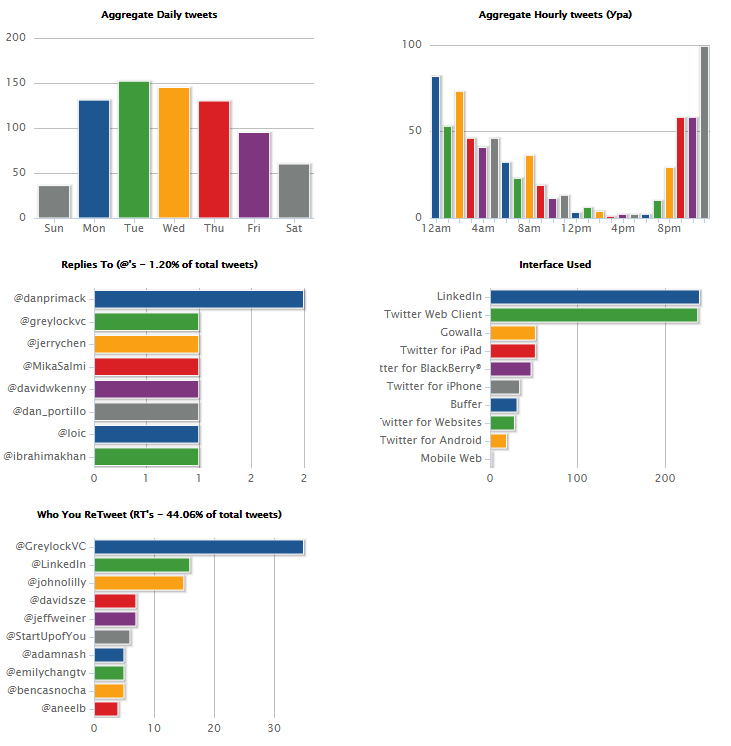

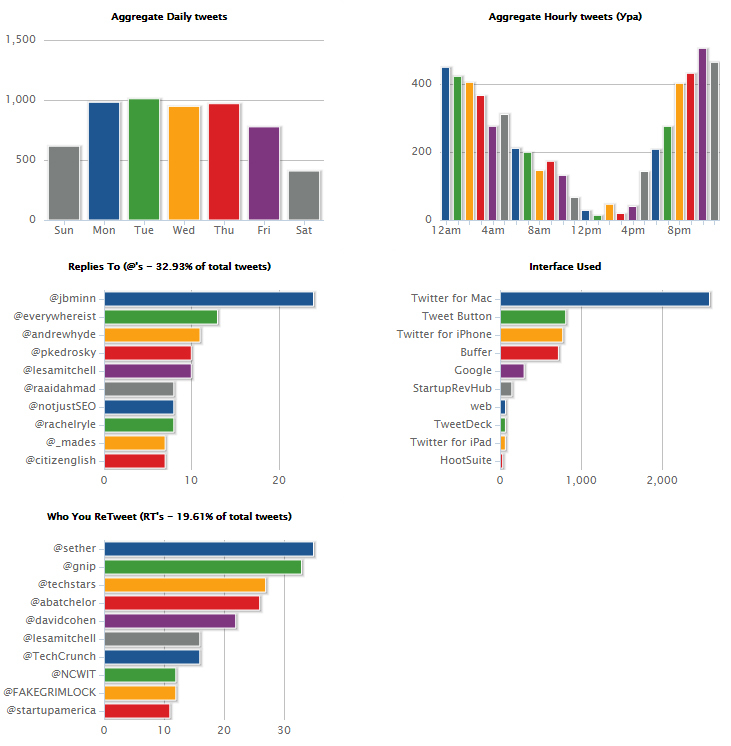

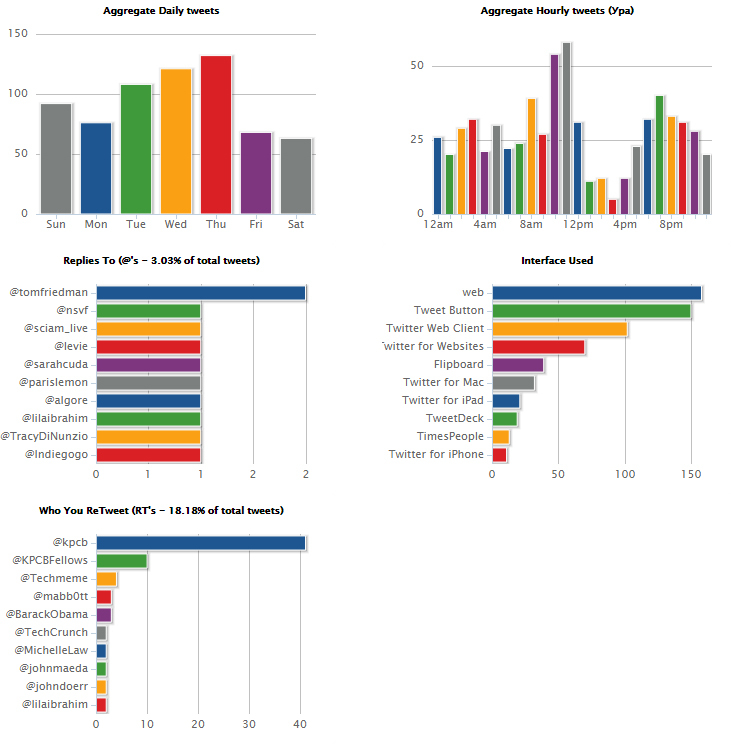

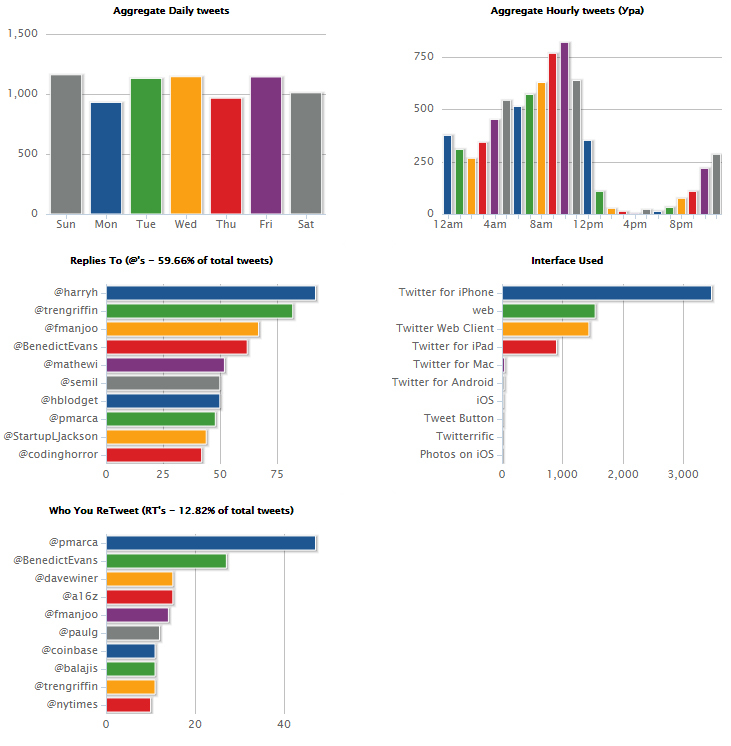

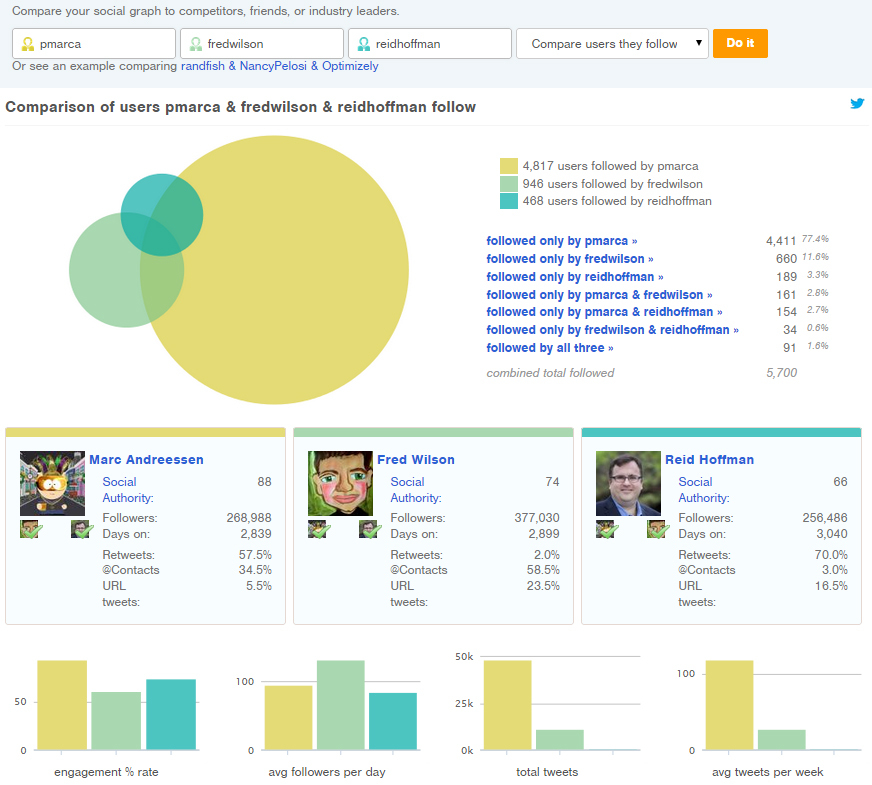

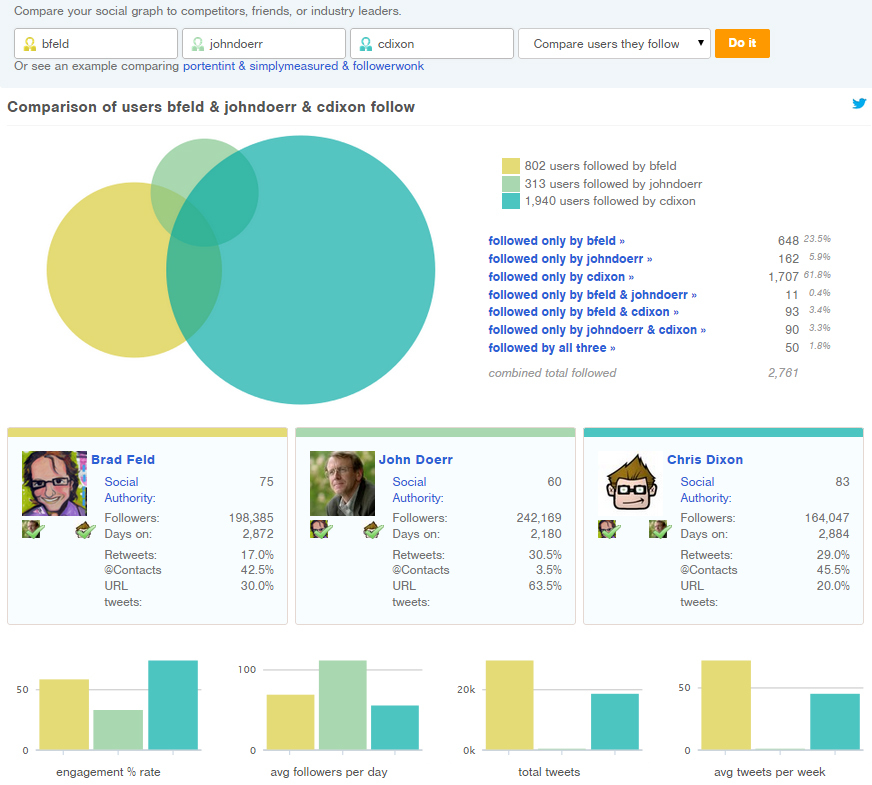

To begin with, from the three lists I selected nine people, almost by the method of scientific poking. After that, using statistical services sharpened for twitter, I received the following data:

Chris manages a portfolio of over 50 Lowercase Capital startups . Previously, he held various posts, including the adviser to the notorious 2008 US presidential candidate, Comrade Obama, and the head of special initiatives at Google. Chris regularly retweets relevant information. A few years ago he participated in investing Twitter, recently, he invested in Turntable.fm and often writes about this startup. As new companies and technologies emerge, investors such as Chris often notice great prospects before they become widespread. In general, they keep their finger on the pulse of the market.

Fred Wilson is a venture capitalist since 1986, worked with Euclid Partners from 1987 to 1996. He became one of the founders of the Flatiron Partners investment fund in 1996 and closed it in 2001 after the explosion of the Dotcom bubble. Wilson is co-founder of Union Square Ventures in 2004 and is still a partner of the firm. Union Square Ventures' portfolio includes Twitter, Tumblr, SoundCloud, Etsy, del.icio.us, FeedBurner, Heyzap, Indeed.com, Tacoda, Oddcast, Disqus, Zemanta. Fred holds an MIT and an MBA from the Wharton Business School. Most of Fred’s tweets are links to his blog .

American entrepreneur. Basketball team owner Dallas Mavericks, owner of Landmark Theaters, CEO of HDNet and the HDTV cable network. The state of Kyuban is estimated at 2.3 billion dollars. A bit shocking character. In 1999, Yahoo! bought Broadcast.com from him for $ 5.9 billion. Member of the reality show about business, marketing, investment Shark Tank. Executive producer of a whole bunch of films.

Google Ventures partner and Digg founder Kevin Rose is a bit of an Internet expert. Kevin acted as an interviewer for the Foundation video cycle, in which he interviewed many startup founders and successful entrepreneurs.

Mark is an American engineer, investor, entrepreneur and an extremely famous person in our circles. He played a key role in creating the NCSA Mosaic browser, became one of the co-founders of Netscape Communications Corporation. In 2009, Andrissen and his business partner Ben Horowitz founded the Andreessen Horowitz venture capital fund, which invests in IT companies. In 2011, they took first place in the ranking of the most influential investors from CNET. Despite all this, his tweets are often humorous in nature.

Working at SocialNet, Hoffman served on the board of directors of the newly formed PayPal. Following the sale of PayPal eBay, Hoffman became one of Silicon Valley's most successful business angels. He invested in 80 technology companies, initially investing in such well-known projects as Facebook, Digg, Zynga, Ning, Flickr, Last.fm, Six Apart. In 2010, Hoffman joined the Greylock Partners fund and manages the $ 20 million of their Discovery Fund. Hoffman organized the first meeting of Mark Zuckerberg and Peter Thiel, as a result Thiel invested the first $ 500,000 in the company. He wrote a book co-authored with Ben Kasnoch, “Life as a Startup. Build a career according to the laws of Silicon Valley. " Included in the legendary PayPal mafia.

Brad is a venture capitalist at Foundry Group. His tweets always contain the most relevant topics in the world of venture capital. He has a popular blog about startups and VC. He started investing in the early 1990s, first as an angel and then as an institutional investor. Feld was one of the first investors in Harmonix, Zynga, MakerBot, and Fitbit. In 2006, David Cohen helped found TechStars, a venture capital fund and startup accelerator. He writes business books.

John is an American venture capitalist at Kleiner Perkins Caufield & Byers. Member of the Presidential Economic Recovery Advisory Board. He began his career at Intel, still has several technology patents. He has a master's degree in electrical engineering and an MBA from Harvard University. If you calculate the total capital of the companies invested by him, you get some astronomical figure. Funded by Compaq, Netscape, Symantec, Sun Microsystems, drugstore.com, Amazon.com, Intuit, Macromedia, Google and many others.

Chris Dixon is an American Internet entrepreneur and investor. He is one of the founders of SiteAdvisor and Hunch (acquired by eBay). He received a bachelor's and master's degree from Columbia University, majoring in philosophy, and has an MBA from Harvard Business School. Currently a partner of the Andreessen Horowitz Foundation. He personally invested in Kickstarter, Foursquare, Codecademy, Pinterest and Skype.

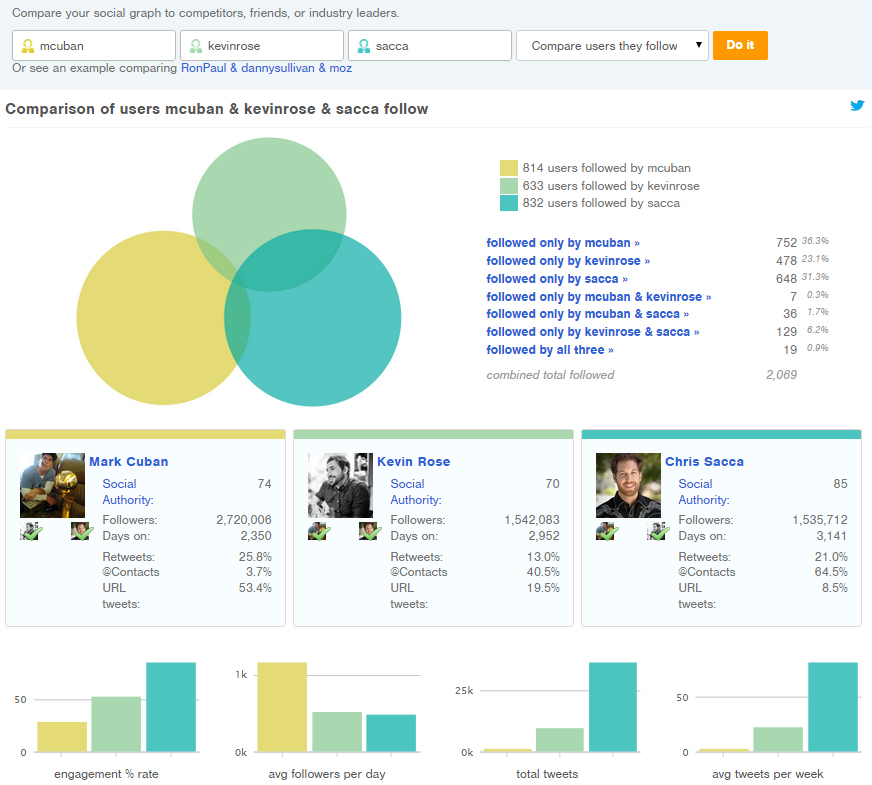

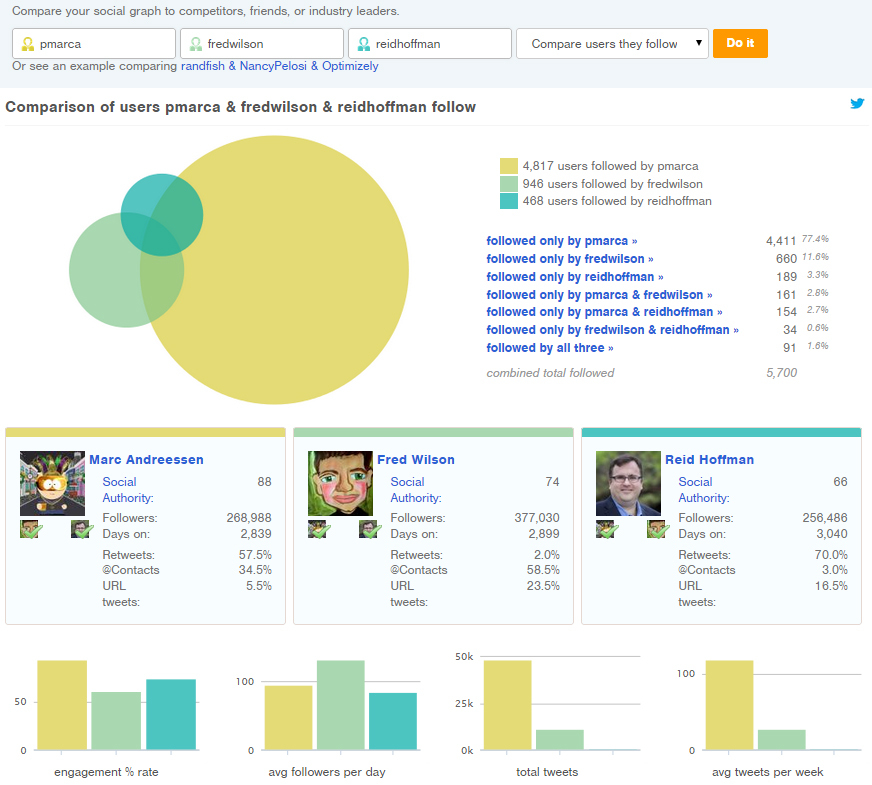

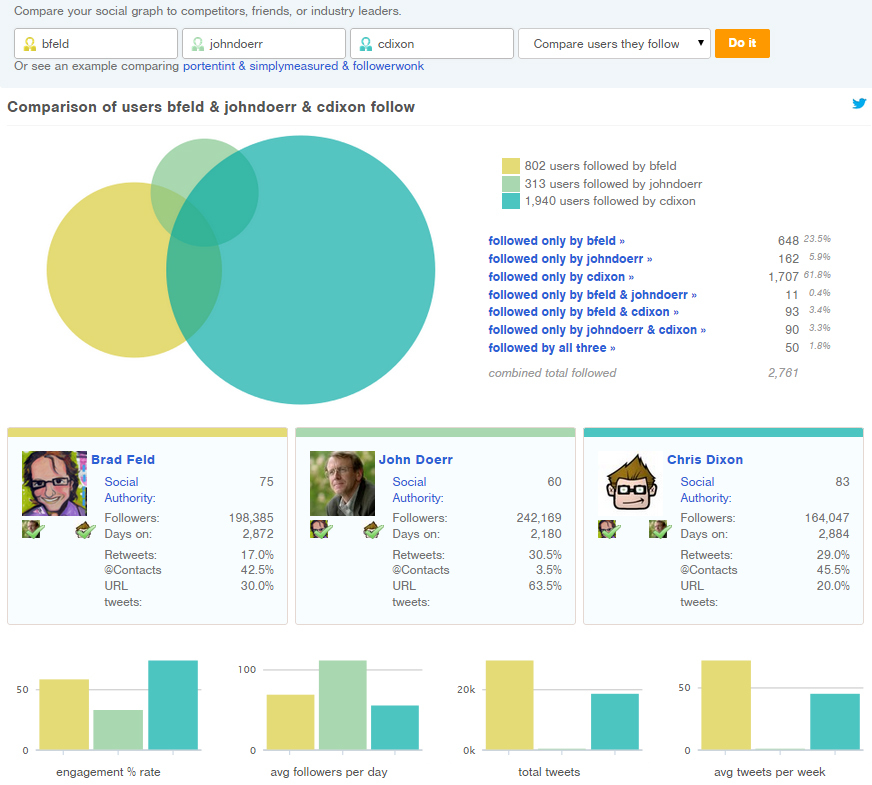

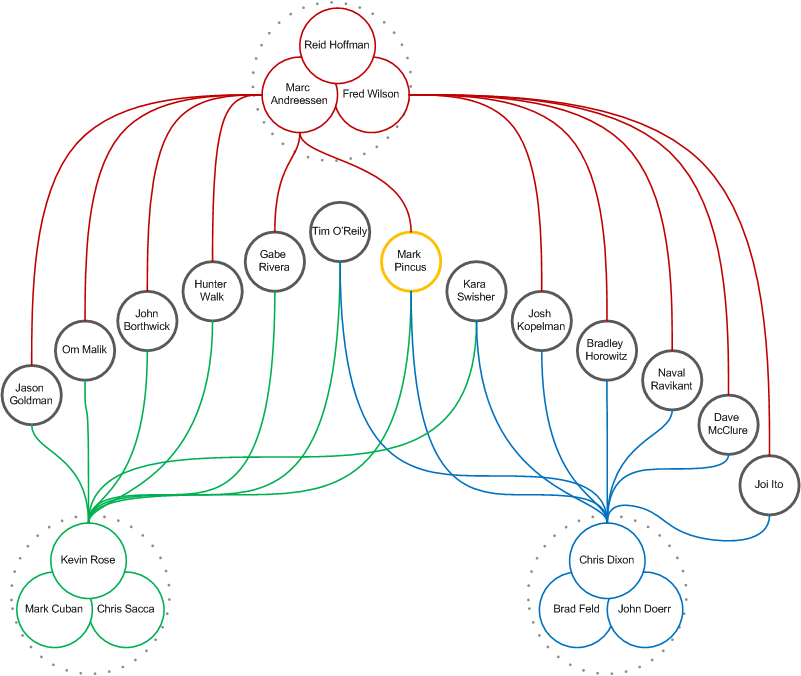

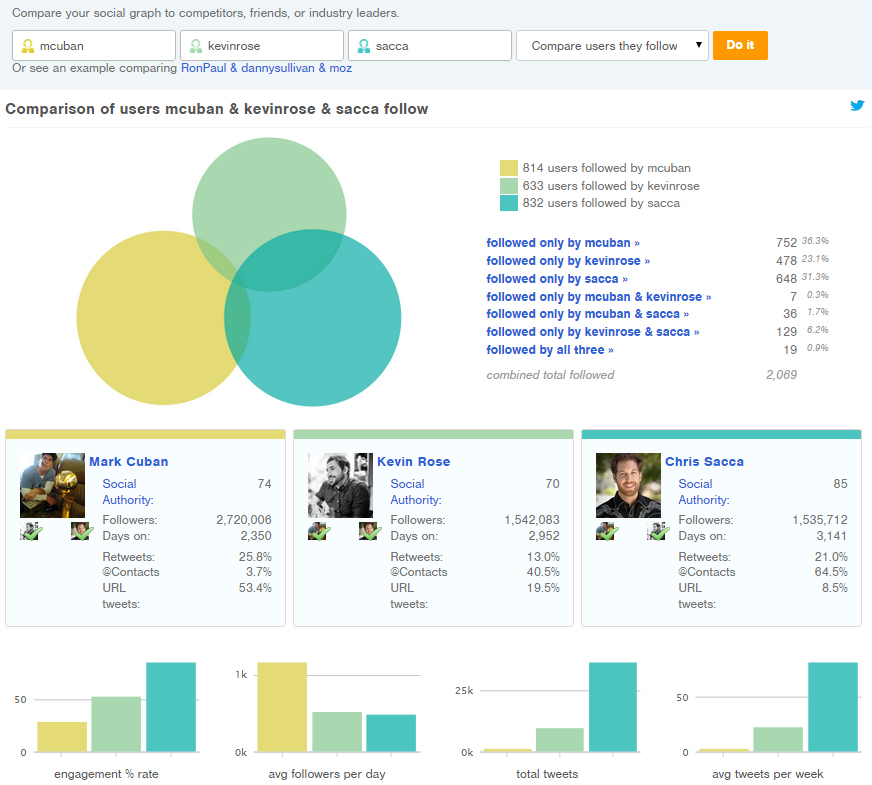

Next, I divided the participants into three groups according to the number of subscribers. After comparing accounts, it turned out:

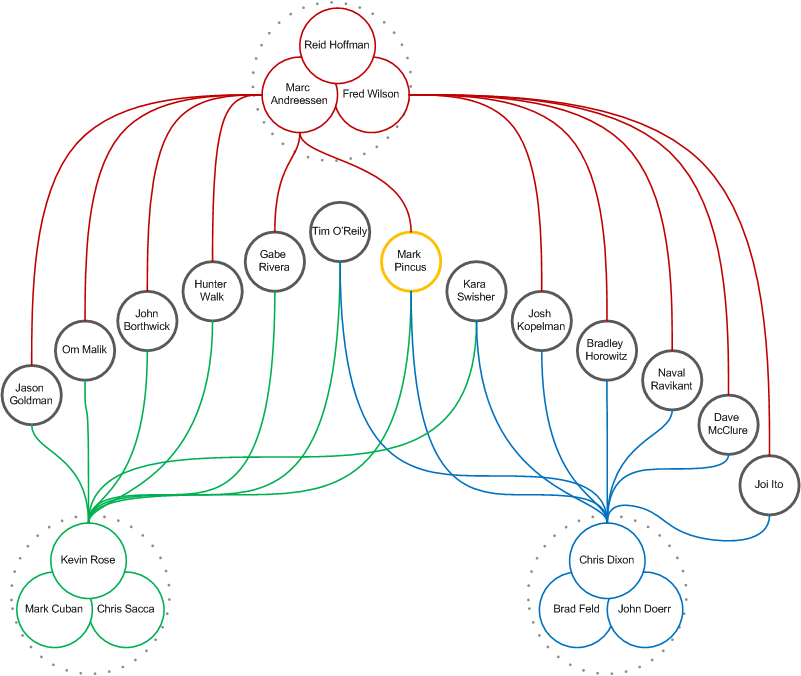

Immediately make a reservation that due to the unequal number of general subscriptions, the list gravitated to a smaller number. After analyzing the relationships, the following scheme turned out:

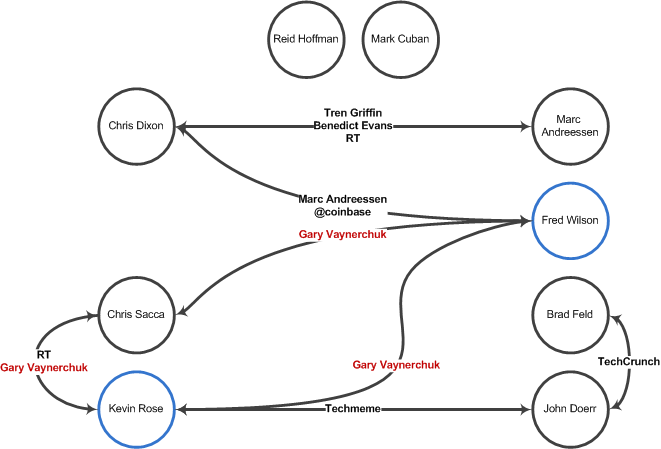

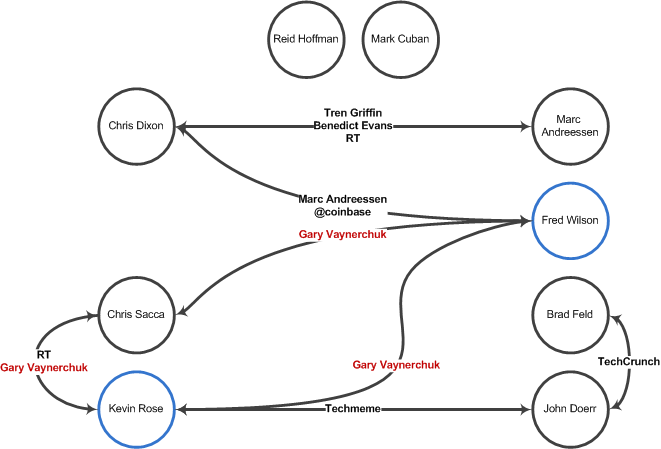

Next, we will analyze the statistics of the accounts. Based on the data on the answers and retweets left, let us trace the relationships between the participants in this study. Users appearing in only one monitored account are rejected. The result is already reflected in this diagram:

As you can see, in the first case, the groups of participants were covered by several links, while the names that met once inside the group were rejected. Mark Pincus became the absolute link, which was not in any proposed in the articles list. We check the semantics, and voila, it turns out that Mark is one of the founders of Zynga, as well as Freeloader Inc., Tribe Networks and Support.com, although it seems to be not VC. Here is the first candidate for must-follow. Applause in the studio!

In the second case, the situation is somewhat different. The selection is limited by the statistical capabilities of the service . Only 10 responded and retweeted users are displayed. Here, Fred Wilson and Kevin Rose became the absolute leaders in connectivity, while Reid Hoffman and Mark Cuban were generally out of work. Gary Vaynerchuk became the record holder for communications. Since it does not belong to the VC number, the result can be ignored, and Fred and Kevin should be recorded on the must-follow, but having figured out who he is in more detail, we also include him in this list.

As a result of the study, 2 participants and 2 outsiders were included in the must-follow list. Of course, I know that during the research I made some serious simplifications, but for the first pancake, I think this one is quite edible. I hope that I have drawn some attention to statistical methods. Not so boring, in fact, these statistics!

Applause to the studio again and thank you for your attention!

The 10 twitter accounts you should follow as a startup investor

18 must-follow venture capitalist twitter accounts

9 Twitter Accounts Every Startup Investor Should Follow

Some people, when they see articles of such a plan, subscribe in bulk to everything. Others start to choose. Since by mindset and education, I was

What can be done with this?

You can manually check each. Engineer's consciousness is modulated by logic, precise methods, and what is really lazy to hide. As a result, I developed my own approach. It’s new, it’s kind of invented by myself, but I can’t vouch that before me no one had suffered like that.

To begin with, from the three lists I selected nine people, almost by the method of scientific poking. After that, using statistical services sharpened for twitter, I received the following data:

Statistical Services:

followerwonk

twittercounter

tweetstats

Chris sacca

Chris manages a portfolio of over 50 Lowercase Capital startups . Previously, he held various posts, including the adviser to the notorious 2008 US presidential candidate, Comrade Obama, and the head of special initiatives at Google. Chris regularly retweets relevant information. A few years ago he participated in investing Twitter, recently, he invested in Turntable.fm and often writes about this startup. As new companies and technologies emerge, investors such as Chris often notice great prospects before they become widespread. In general, they keep their finger on the pulse of the market.

Fred wilson

Fred Wilson is a venture capitalist since 1986, worked with Euclid Partners from 1987 to 1996. He became one of the founders of the Flatiron Partners investment fund in 1996 and closed it in 2001 after the explosion of the Dotcom bubble. Wilson is co-founder of Union Square Ventures in 2004 and is still a partner of the firm. Union Square Ventures' portfolio includes Twitter, Tumblr, SoundCloud, Etsy, del.icio.us, FeedBurner, Heyzap, Indeed.com, Tacoda, Oddcast, Disqus, Zemanta. Fred holds an MIT and an MBA from the Wharton Business School. Most of Fred’s tweets are links to his blog .

Mark cuban

American entrepreneur. Basketball team owner Dallas Mavericks, owner of Landmark Theaters, CEO of HDNet and the HDTV cable network. The state of Kyuban is estimated at 2.3 billion dollars. A bit shocking character. In 1999, Yahoo! bought Broadcast.com from him for $ 5.9 billion. Member of the reality show about business, marketing, investment Shark Tank. Executive producer of a whole bunch of films.

Kevin rose

Google Ventures partner and Digg founder Kevin Rose is a bit of an Internet expert. Kevin acted as an interviewer for the Foundation video cycle, in which he interviewed many startup founders and successful entrepreneurs.

Marc Andreessen

Mark is an American engineer, investor, entrepreneur and an extremely famous person in our circles. He played a key role in creating the NCSA Mosaic browser, became one of the co-founders of Netscape Communications Corporation. In 2009, Andrissen and his business partner Ben Horowitz founded the Andreessen Horowitz venture capital fund, which invests in IT companies. In 2011, they took first place in the ranking of the most influential investors from CNET. Despite all this, his tweets are often humorous in nature.

Reid hoffman

Working at SocialNet, Hoffman served on the board of directors of the newly formed PayPal. Following the sale of PayPal eBay, Hoffman became one of Silicon Valley's most successful business angels. He invested in 80 technology companies, initially investing in such well-known projects as Facebook, Digg, Zynga, Ning, Flickr, Last.fm, Six Apart. In 2010, Hoffman joined the Greylock Partners fund and manages the $ 20 million of their Discovery Fund. Hoffman organized the first meeting of Mark Zuckerberg and Peter Thiel, as a result Thiel invested the first $ 500,000 in the company. He wrote a book co-authored with Ben Kasnoch, “Life as a Startup. Build a career according to the laws of Silicon Valley. " Included in the legendary PayPal mafia.

Brad feld

Brad is a venture capitalist at Foundry Group. His tweets always contain the most relevant topics in the world of venture capital. He has a popular blog about startups and VC. He started investing in the early 1990s, first as an angel and then as an institutional investor. Feld was one of the first investors in Harmonix, Zynga, MakerBot, and Fitbit. In 2006, David Cohen helped found TechStars, a venture capital fund and startup accelerator. He writes business books.

John doerr

John is an American venture capitalist at Kleiner Perkins Caufield & Byers. Member of the Presidential Economic Recovery Advisory Board. He began his career at Intel, still has several technology patents. He has a master's degree in electrical engineering and an MBA from Harvard University. If you calculate the total capital of the companies invested by him, you get some astronomical figure. Funded by Compaq, Netscape, Symantec, Sun Microsystems, drugstore.com, Amazon.com, Intuit, Macromedia, Google and many others.

Chris dixon

Chris Dixon is an American Internet entrepreneur and investor. He is one of the founders of SiteAdvisor and Hunch (acquired by eBay). He received a bachelor's and master's degree from Columbia University, majoring in philosophy, and has an MBA from Harvard Business School. Currently a partner of the Andreessen Horowitz Foundation. He personally invested in Kickstarter, Foursquare, Codecademy, Pinterest and Skype.

Next, I divided the participants into three groups according to the number of subscribers. After comparing accounts, it turned out:

1. Mark Cuban, Chris Sacca, Kevin Rose - 19 common subscriptions

2. Marc Andreessen, Fred Wilson, Reid Hoffman - 91 General Subscriptions

3. Brad Feld, John Doerr, Chris Dixon - 50 Common Subscriptions

Immediately make a reservation that due to the unequal number of general subscriptions, the list gravitated to a smaller number. After analyzing the relationships, the following scheme turned out:

Next, we will analyze the statistics of the accounts. Based on the data on the answers and retweets left, let us trace the relationships between the participants in this study. Users appearing in only one monitored account are rejected. The result is already reflected in this diagram:

As you can see, in the first case, the groups of participants were covered by several links, while the names that met once inside the group were rejected. Mark Pincus became the absolute link, which was not in any proposed in the articles list. We check the semantics, and voila, it turns out that Mark is one of the founders of Zynga, as well as Freeloader Inc., Tribe Networks and Support.com, although it seems to be not VC. Here is the first candidate for must-follow. Applause in the studio!

In the second case, the situation is somewhat different. The selection is limited by the statistical capabilities of the service . Only 10 responded and retweeted users are displayed. Here, Fred Wilson and Kevin Rose became the absolute leaders in connectivity, while Reid Hoffman and Mark Cuban were generally out of work. Gary Vaynerchuk became the record holder for communications. Since it does not belong to the VC number, the result can be ignored, and Fred and Kevin should be recorded on the must-follow, but having figured out who he is in more detail, we also include him in this list.

As a result of the study, 2 participants and 2 outsiders were included in the must-follow list. Of course, I know that during the research I made some serious simplifications, but for the first pancake, I think this one is quite edible. I hope that I have drawn some attention to statistical methods. Not so boring, in fact, these statistics!

Applause to the studio again and thank you for your attention!