We look at the charts: estimates and forecasts for the cloud computing market, data in 2018

- Transfer

Cloud platforms and applications today are widely used in the economy and have become the driver of IT infrastructure development, creating new opportunities for business digitalization. Below we take a look at the review of forecasts and estimates of the cloud technology market, which reflects the state of the global cloud services market.

CIOs rely on cloud platforms as a growth catalyst and architecture that will allow new business initiatives to be successful. It's time for strategic IT management. On the findings that may be useful to you, we will describe below.

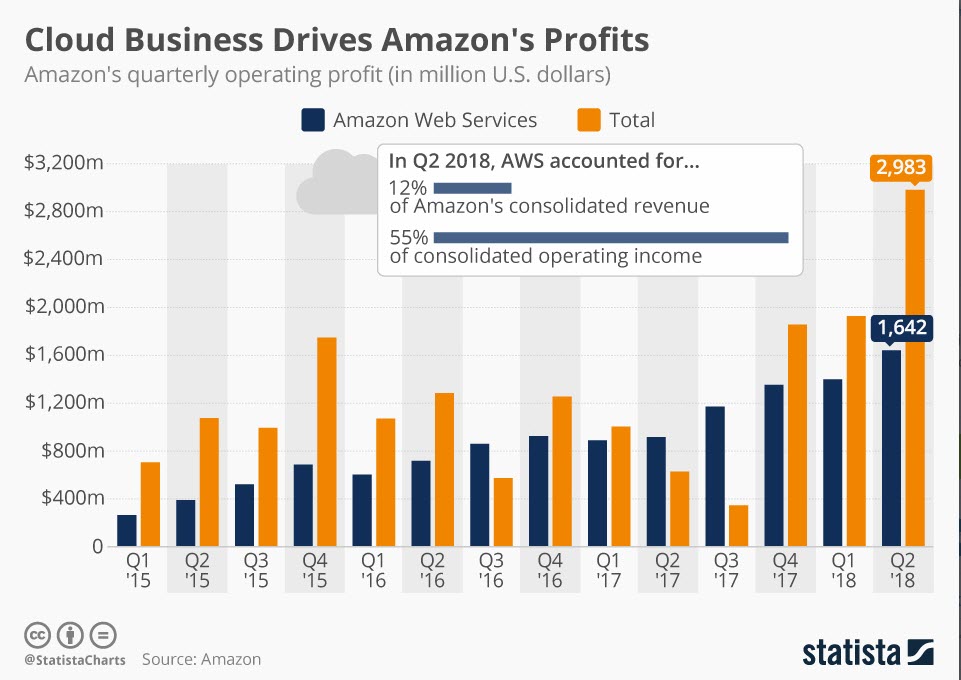

In the second quarter of 2018, the share of Amazon Web Services (AWS) accounted for 55% of the company's operating profit, while the share of AWS in the company's net sales was only 12%

In the first quarter of 2018, services accounted for 40% of revenue, which is 26% more than three years ago. Source: Business Drives Amazon's Profits, Statista, July 27, 2018.

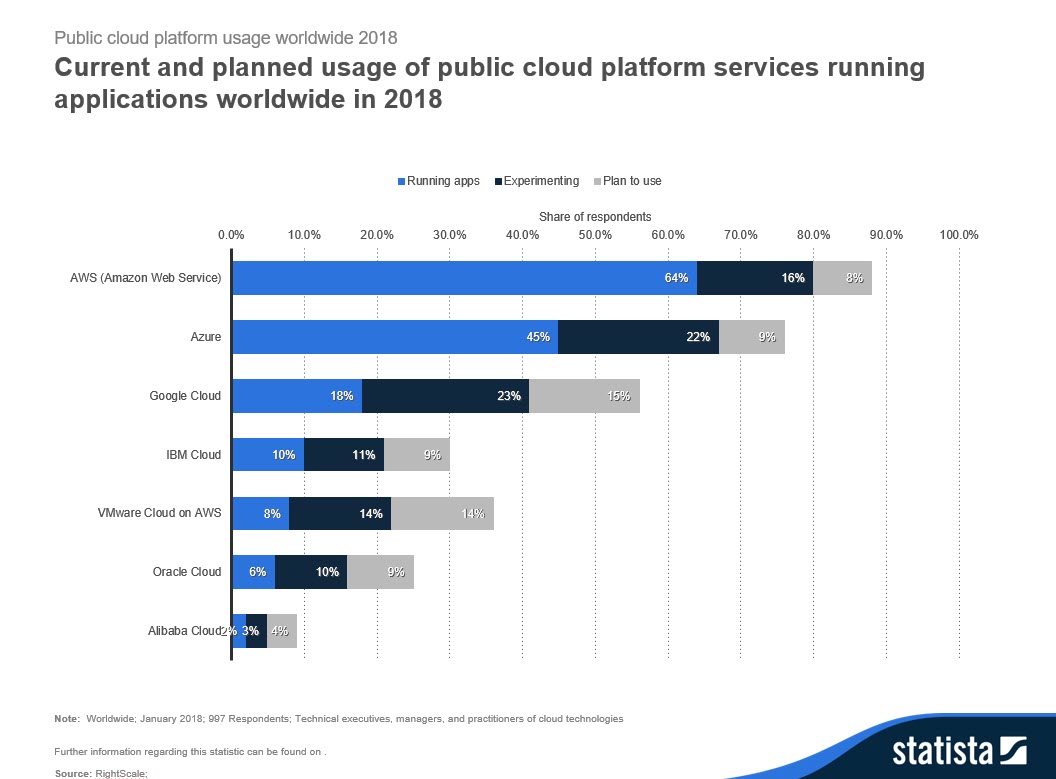

80% of enterprises run applications or experiment on Amazon Web Services (AWS) as the most preferred cloud platform

In total, 67% of enterprises deploy applications (45%) and experiment (22%) on the Microsoft Azure platform. 18% of businesses use the Google cloud platform for workloads, and 23% rate the platform for future use. The RightScale study in 2018 was included in the Statista source dataset used to create this comparison. Source: Statista, Current and planned use of public cloud platforms that run applications across the world in 2018.

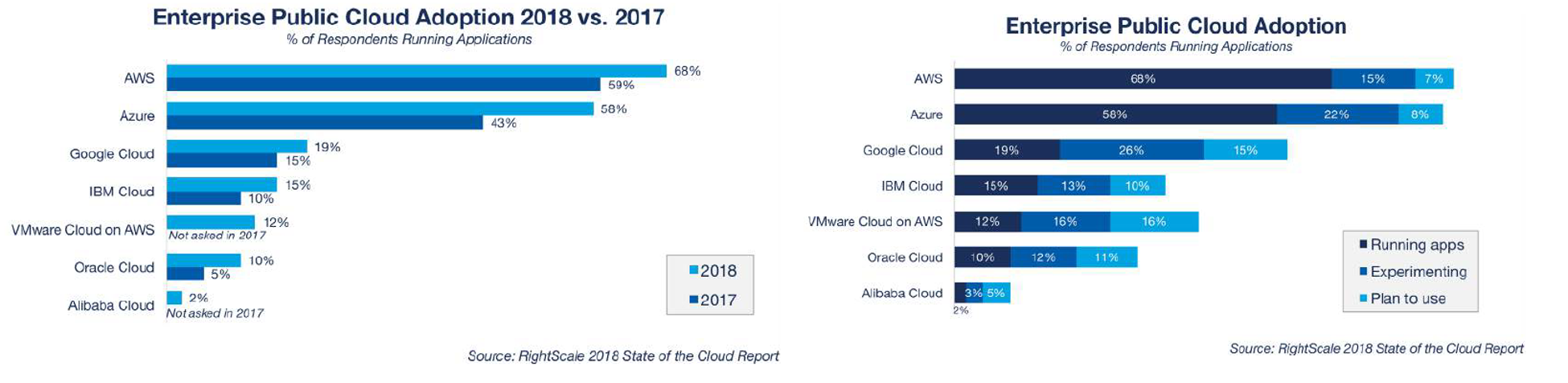

The introduction of Microsoft Azure in the corporate environment has increased significantly - from 43% to 58%, CAGR - 35% (cumulative average annual growth rate), while the prevalence of AWS in this market increased from 59% to 68%

Respondents with plans for future projects (for experiments and workloads) show the greatest interest in Google (41%). Source: RightScale 2018 State of the Cloud Report. To simplify viewing, click on the chart to expand it.

In the SaaS market, customers generate quarterly revenues for software providers of $ 20 billion, and their number is growing at 32% per year.

Microsoft leads with a global market share of more than 17% and is currently the leading provider of SaaS, mainly due to its leadership in the fast-growing collaborative segment. Source: Quarterly SaaS Spending Reaches $ 20 Billion as Market Leadership, Synergy Research August 21, 2018 .

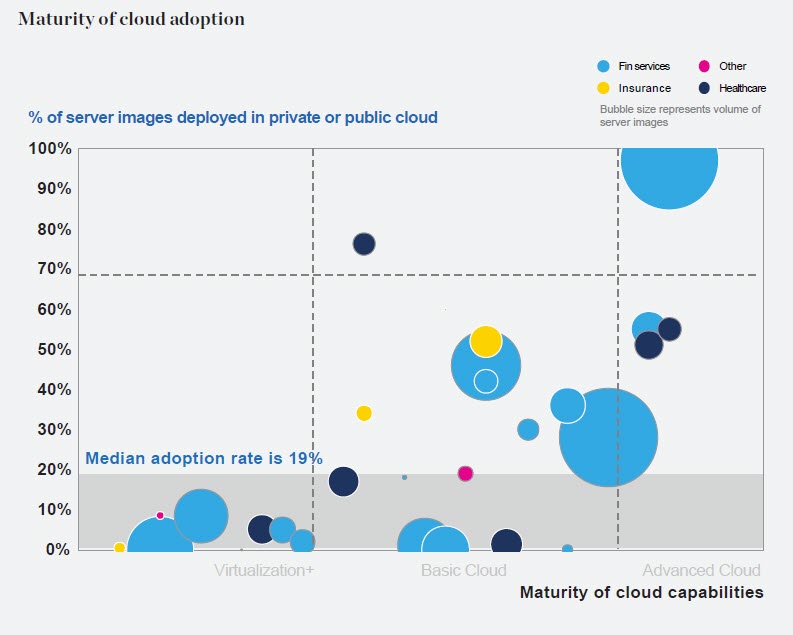

The financial services industry has the highest percentage of virtual servers deployed in private or public clouds, approaching almost 100% compared to the median implementation rate of 19%

A recent study by McKinsey & Company has shown that the financial services industry has advanced in cloud development beyond virtualization and the base cloud, outpacing insurance and healthcare. Source: McKinsey & Company, Cloud Acceptance, Andrea Del Miglio, and Steve Jansen .

Quality management, computer-aided design and production management systems (MES) are the three most widely used systems in the cloud.

The study also shows that 60% of manufacturers with discrete and continuous production state that their end users prefer the cloud instead of on-premise infrastructure. Source: Amazon Web Services & IDC: Industrialists are ready for the cloud . To simplify viewing, click on the chart to expand it.

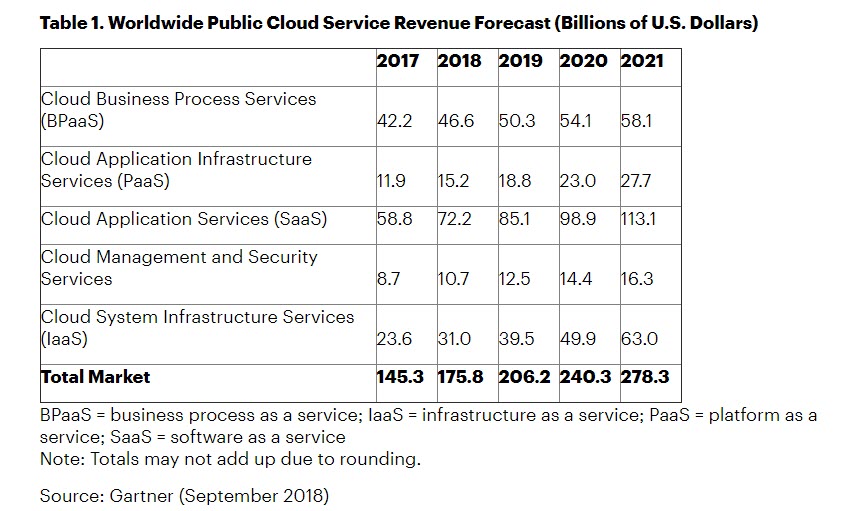

According to forecasts, the global market for public cloud services will grow by 17.3% or to $ 206.2 billion in 2019 from $ 175.8 billion in 2018

In 2018, the market will grow by 21% compared to $ 145.3 billion in 2017, according to research and consulting company Gartner. Infrastructure as a service (IaaS) will be the fastest growing market segment. Projected growth in 2019 will be 27.6%, and the market will reach $ 39.5 billion, compared with $ 31 billion in 2018. By 2022, Gartner expects that 90% of enterprises consuming IaaS public cloud services will use IaaS and Platform-as-a-Service (PaaS) and their capabilities together with one provider. Source: Gartner Forecasts Worldwide Growth 17.3 Percent in 2019.

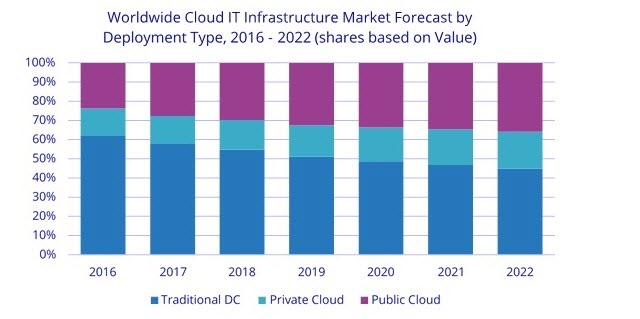

It is projected that the growth in total expenditures on infrastructure IT products (servers, corporate storages and Ethernet switches) for deployment in cloud environments will reach 10.9% on an annualized basis, reaching $ 52.3 billion in 2018.

In the future, IDC expects that the cost of off-premises infrastructure will grow at an average annual growth rate of 10.8% according to 5 years, reaching $ 55.7 billion. Source: Spending on IT Infrastructure for the Cloud for Growth 10.9% in 2018 , IDC.

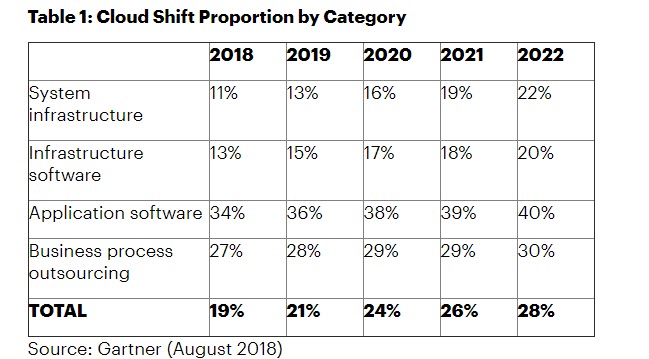

More than 1.3 trillion dollars in IT costs will be directly or indirectly associated with the transition to cloud technology by 2022

By 2022, 28% of the costs of enterprises in key IT markets will be spent on the cloud, compared with 19% in 2018. The largest shift until 2018 occurred in the application software, in particular, due to customer relationship management software (CRM), where Salesforce dominates as a market leader. The CRM market has already reached a point when there is a higher proportion of costs in the cloud compared to traditional software. Source: Gartner Says 28 Speech in Spending in IT Key Segments

IDC predicts that spending on public cloud services worldwide will reach $ 180 billion in 2018, an increase of 23.7% compared with 2017

According to IDC, it is expected that the market will reach a five-year average annual growth rate (CAGR) of 21.9%, and in 2021, expenditures for public cloud services will total $ 277 billion. The industries that are projected to spend most on cloud services in 2018 are discrete manufacturing ($ 19.7 billion), professional services ($ 18.1 billion), and banking (16.7 billion). billion dollars). It is also expected that in 2018, continuous production enterprises and retailers will spend another $ 10 billion each on the public cloud services market. These five industries will remain at the top of the list in 2021 due to continued investment in previously chosen solutions.

The sectors that will experience the fastest growth in spending over the five-year forecast period are professional services (24.4% CAGR), telecommunications (23.3% CAGR), and banking services (23.0% CAGR). Source: Worldwide Public Cloud Services $ 160 Billion This Year , IDC.

One of the reasons for migrating to the cloud is the cost-effectiveness of such solutions. This issue is discussed in more detail in the Cloud4Y “White Paper. Calculation TCO: Cloud vs Purchase Servers .

Other related articles: