Money as a measure of trust

Today I found an article on hard that I wrote in January, but for unknown reasons I forgot about it. All of the following are reflections on the structure of the modern system of monetary relations between people, companies, institutions. If you have

Recently, I often think about the structure of the modern monetary system. And I began to think of interesting thoughts and concepts that I will try to share with you.

Let's start with what kind of monetary system is presented to everyone. Money is a medium of exchange. Each product and each service has a certain market price. It can vary greatly depending on the place, time and circumstances, but nevertheless, almost any product and almost any service can be bought for a finite amount of money. Everyone in society can receive money for work or services that they perform, for the sale of some of their resources, and so on. Everyone has certain savings - a certain amount of money in their wallet. He can buy goods and services in the amount that fits into the amount of money that he has at the moment. Something like this looks like a society with commodity-money relations in the basic version, and roughly the way this structure of our society seems to most people. That’s how society would work

In recent centuries, a huge number of derivatives have been introduced into society. In particular: banknotes as a written obligation of the bank to pay the nth amount in gold upon request; bank accounts; checks as a written order of the account holder to transfer money to another person; various types of loans. Securities and exchanges appeared. Loans themselves have become the object of trade - you can buy and sell them, expect from them one or another profitability. Concepts such as futures and options have appeared on exchanges, such as obligations to complete or agree to complete a transaction at a given price. And they, too, have been traded. Etc.

Organizations and individuals who work together often no longer require each other money immediately to complete a transaction. Enough of their written (and some - and oral) obligation to pay money. Moreover, the payment of money looks like a transfer of numbers from one bank account to another bank account. Moreover, the amount of cash in your hands may not change at all in the process. But it is believed that the money has been transferred.

The trust

This whole system works, in fact, on trust. I will explain my thought on an example that I recently had to face.

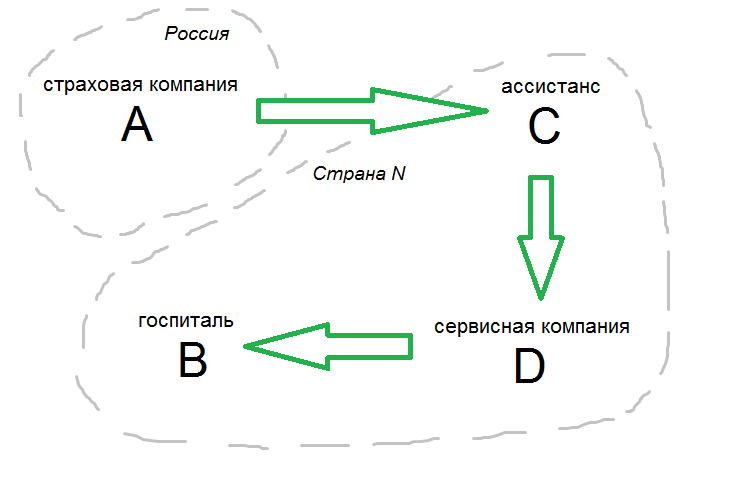

In Russia, there is an insurance company A, which covers the costs of treating tourists with whom something happened in country N. There is a hospital B in country N, which treats people for money. Country N also has the so-called Assistance C, a company that works directly with hospitals and coordinates clients of insurance A. Moreover, there may be, or may be, no cooperation between Hospital B and Assistance C. In the second case, the fourth company D appears between them, it is called the service company. Service company D works with assistant C and hospital B, so that, as a result, insurance company A can cover the treatment of its client in hospital B through this entire chain (or it may not, haha).

There are many details that are not directly relevant, but I want you to feel the role of trust in this system. So, we have 4 companies. When an insured event occurs and insurance client A wakes up in the intensive care unit of hospital B, the latter wants guarantees that the treatment will be covered by insurance. He receives these guarantees from the service company D. Service company D regularly works with Assistant C and expects only an official letter from C that C will transfer the indicated amount D. Assistance C constantly works with insurance A, therefore, only official consent to cover costs in the indicated size is enough to convey the promises further down the chain.

As a result, it turns out that A promises money C, C promises money D, and D promises money B, and this chain of promises is enough for B to provide service to client A (cured a person, which can cost a lot of money). Feel it? The client receives a paid service in exchange for a long chain of payment promises. This happens very quickly, although the money itself will come a long way.

Or it may turn out as happened in our situation in practice. Assistance C owed money to D, so just a written promise was not enough for D to send a payment guarantee to the hospital. Now the whole chain is stuck because Assistant C has a low credit of trust. It’s as if they don’t have this very fluid and fast form of “money”. Therefore, everyone will have to wait until all approvals and bank transfers along the entire chain are completed before Hospital B receives confidence in payment.

Another example. You do a certain service and publish information about it. You have already established yourself as a successful entrepreneur with three shot start-ups, so investors are already standing in line to give you money. Or, on the contrary, you are known as a loser startup and burned the budgets of ten projects already, never having reached the payback period. In this case, getting money will be much more difficult for you.

Going even lower: you trust your friend Misha, so it’s not a problem to give him 10 thousand in debt, he always repays on time. But you don’t give a hundredth to the neighbor-drunk Kolya, because you know that he will not return.

You trust your bank, so you think that 50 thousand in your account is the money available to you, which you can receive at any time. You trust our state and central bank, so you use rubles, expecting that they will not become candy wrappers.

What will happen next?

What kind of picture emerges in the end? I will try to describe how I see the device that the whole system is aiming for.

Everything is built on levels of trust, commitment and expectation. Modern money degenerates and becomes the "last century", as gold used to go out of circulation. Each person and each organization has a certain trust on the part of other people and organizations. The wealth of man A is determined not by the papers under his pillow and not by the numbers on the account, but by those who trust him as much as he does. When paying for a product or service, he only in some form transmits a “promise of payment”, his own or someone else's, which he received from someone else. By benefiting, he receives such promises of payment from other people and can subsequently pay them. We call them conditionally “credits”, by analogy with all sorts of fiction and games.

Most likely, there will be several hundred fairly stable issuers of loans in the world that will be trusted everywhere. For example: Fed loans, Google loans, Apple loans, eBay loans. Less global organizations may have a local influence, for example, some Mavro loans may appear, which will be accepted for payment in some regions of Russia, but not in the rest of the world. However, they will also be able to play the role of quick money on their territory for their audience. Or, for example, Federation loans, which you can pay on many planets in the Galaxy, but not on Tatooine.

But this is a fairly simple scheme, to which we are already close. In fact, from such a financial structure of society, we are constrained only by state regulation of currencies at the level of laws. To create "surrogates of money", as we recall, is still prohibited. If you go further and deeper, you can come to something even more interesting. For example: each person in a certain unified social network has his own loans. And each of them has one or another value and liquidity, depending on the financial relationship of this person with others. People can “minus” and “plus” each other’s financial karma, affecting the value and liquidity of each other’s loans. Shops and all kinds of services integrate with this social-monetary network and accept credit payments from people from this network.

Imagine in this case a situation when a certain Vasya accidentally was left without money, being stuck in a foreign country, he has 100 rubles in his wallet (or 0.0000055 BTC, or even 0.5 Google credit on his account - in general, there is nothing). It does not take extra calls and body movements to go eat in a cafe or spend the night in a hotel. You just pay off your social loans, and a request is automatically sent to the system such as: "Does your friend Vasya ask for loans in the amount of $ 100 to pay for a Hilton hotel in New York, borrow?" The request may be accompanied by conditions, comments, geo-tags, something else. As soon as Vasya receives consent from someone from the network, the payment is confirmed and he can go to spend the night with a calm soul in the hotel, and he will return the loans later. And the hotel automatically exchanges loans from the network for a more stable currency on the exchange. Moreover, confirmation of such a loan can not be expected if Vasya has high karma in this network - the hotel can simply trust him for this or that amount. Well, in case of non-payment, the hotel, of course, is insured. By the way, as I found out later, our hospital B is also insured against defaults from its clients.

Ordinary people in this network can configure automatic services for issuing loans on demand, with white and black lists. All services that accept payments in loans are insured against the illiquidity of accepted loans and against defaults. Funds of ordinary people can be transferred to deposits of distributed insurance companies and credit organizations.

I admit honestly, beyond my imagination is not enough to richly and in detail imagine all the possible development prospects. Therefore, I propose to reason together. What do you think of this?