The child prodigy "spread" investors for $ 30 million in venture capital investments

In June 2013, Stanford's 21-year-old graduate, Lucas Duplan, raised $ 25 million in venture capital funding to develop a mobile payment system. This was the largest seed funding round in Silicon Valley history. At the same time, Daplan had neither work experience, nor a ready-made application.

Lucas Daplan founded the startup Clinkle back in 2010, at the age of 19. Apparently, even before he prematurely graduated from Stanford with a degree in computer science. Since then, the startup worked in a "secretive" mode and did not appear in the press until 2013.

By and large, it all started in April 2013 with an article in the Wall Street Journal, which told about the “young child prodigy” from Stanford, who managed to attract more than 10 best university students to his startup (they left the university for the promised six-figure salary and generous options . As it turned out later, Lucas promised to distribute up to 20% of the attracted investments in options.

In a WSJ article, it was written that several university professors have also invested in startups.People

are still discussing how Lucas managed to get the best university students and professors to his side. achalas hype Clinkle, so that the production of investment was, in fact, a matter of technique. But he collected a team? The site Quora someone explainshow could this be possible. They say that through his academic adviser, Lucas went to the best Stanford computer science professors and asked them to recommend talented students and programmers.

are still discussing how Lucas managed to get the best university students and professors to his side. achalas hype Clinkle, so that the production of investment was, in fact, a matter of technique. But he collected a team? The site Quora someone explainshow could this be possible. They say that through his academic adviser, Lucas went to the best Stanford computer science professors and asked them to recommend talented students and programmers. Through the same supervisor (by luck, it turned out to be the authoritative co-founder of VMWare Diana Green, pictured), the entrepreneur came to venture investors from the A16Z fund (Andreessen Horowitz), and then to others. As a result, many companies joined in the financing, each of which contributed its relatively small share. These are the aforementioned Andreessen Horowitz, as well as Peter Thiel, Accel Partners, Intel, Intuit, former COO Facebook Owen van Natta, Salesforce CEO Mark Benioff, founders of Qualcomm, VMware and many others. In total, more than 18 investors participated.

Clinkie’s venture capital investment totaled $ 30 million .

What happened next? In the fall of 2013, a list of current and past employees of the company was published on Pastebin , followed by the dismissal of 16 people . Presumably, this was due to the signing of a collective letter demanding that Lucas explain the position on options.

In March 2014, after 5 months of work, Barry McCartney, the former CFO of Netflix, the most authoritative person in the leadership of the startup, quit the company. Following him, Josh Brewer, a former Twitter designer, left after 1 week of work (probably the brightest head in the company’s staff, he realized the futility of this business faster than anyone).

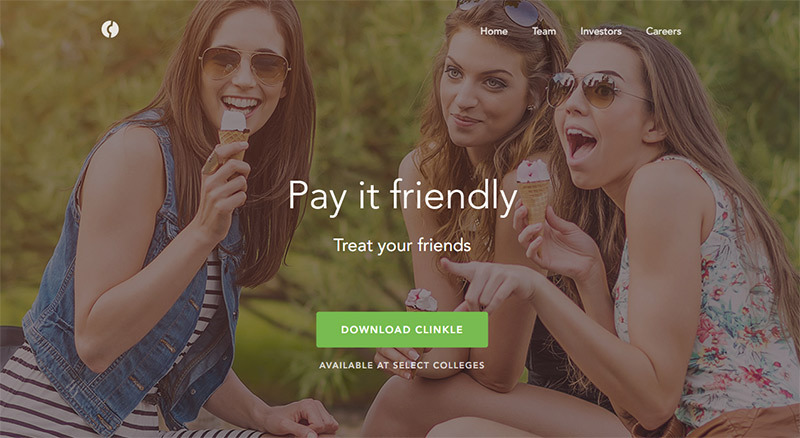

After all, the app from September 24, 2014 is available atGoogle Play and App Store . Now it is completely incomprehensible what is so revolutionary about him. The application is intended for students. They link the payment card to the Clinkle online account and can transfer money to each other, as well as pay for purchases from their mobile phones. After every seventh purchase, the user is awarded a “treat” - free coffee or ice cream. This "treat" can be duplicated to a friend. To receive a gift, a friend must also make a payment through a Clinkle card.

Offer a friend an ice cream: Clinkie payment system viral distribution scheme

Of course, the “viral” invite distribution scheme is very beautiful, but it seems to be the only innovation. Nothing else distinguishes Clinkle from Venmo, Square and others.

The image in the profile of Lucas Daplan in the Clinkle program, January 2014.

For the first time after the appearance of the program, it is not yet visible that it was very popular. The average score on Google Play is 3 points, on the App Store - 4+.

In the world of venture capital investments, real scams sometimes occur. The best of them are those when you don’t even dig into the swindler. He mastered investments, earned a lot of money, and the product “for some reason” turned out to be not very good. Well, what to do, they say, tried as best they could.