Report of the Club of Rome 2018, Chapter 2.6: “Philosophical Errors of Market Doctrine”

- Transfer

Philosophical mistakes of market doctrine

To continue the criticism of the failures of the present doctrine would only mean repeating what has already been shown by many other authors. Instead, it would be more useful to refer to the history and values of some basic tenets of the economy. The three main dogmas, according to their relevance, deserve further consideration and clarification:

- The concept of Adam Smith’s “The Invisible Hand” and the corresponding conviction, mainly of the Chicago School of Economics, that markets are by definition are higher than states or legislators in their search for the optimal path of development.

- David Ricardo's discovery of comparative advantages, which in theory make trading a profitable operation for both sides of the exchange.

- The theory of Charles Darwin, which was falsely interpreted as a postulate from the fact that competition, the tougher, the better, leads to the continuation of progress and evolution.

All three dogmas are still relevant today, but everyone needs a better understanding from a historical perspective.

2.6.1. Adam Smith. Prophet, moralist, enlightener

Adam Smith is often seen as the prophet of the free market. A rather amusing testimony of this view is the 2001 Adam Smith Institute card:

Ill.2.4. This 2001 illustration, a card from the seasonal charity fair from the Adam Smith Institute, presents its mastermind as a messiah jumping out of the box and preaching a free market to the whole world, and the world is smiling at the Royal Institute. Adam Smith.

This is an obvious caricature. In reality, Adam Smith was a social ethologist. Together with David Hume and John Locke, he represented the Enlightenment in Britain. One of the most influential principles developed by Smith was the principle of the “invisible hand” (an explicit reference to divine conduct for his time) that could turn the pursuit of self-interest into the benefit of the majority, because a self-serving economic interest in better quality work could increase utility all products.

However, one of the conditions for the existence of Smith's logic was that the geographic wealth of law and morality was identical to the geographic wealth of the market, hence the invisible hand. This fact, not subject to doubt in the XVIII century, established a healthy balance between the market and the law. Even if the market had the meritorious ability to “open” the right prices and convenient opportunities to improve production, in the Smiths' world it had to, nevertheless, be limited to strict laws and rules of morality. Moreover, during Smith's time, the market was small, and trade was conducted between much less powerful partners.

On the contrary, today trade is subordinated to huge world corporations. The geographical wealth of today's market is the whole world. While moral conventions and legal restrictions apply only to a nation or a specific culture. This leads to the phenomenon of economic globalization, where the market, mainly the capitalist market, can encourage lawmakers to adjust laws to investors and shareholders.

“It is clear that the political manageability of democratic capitalism has decreased significantly in recent years,”

says Wolfgang Strick

Adam Smith's modest statement about the balance between the market and the law was thus ignored at its very foundation.

Modified economic theory should include mechanisms for reinstalling this healthy balance and also to provide a special place for moral laws.

Political power should try to encompass, rather than limit, the wealth of the law, for example, through legally related international agreements, where the law could provoke an increase in transportation prices by transferring subsidies, which would thus provide economic advantages for the local production of goods. Such actions put the riches of the law closer to the wealth of the market, that is, closer to what Adam Smith had in mind.

2.6.2 David Ricardo. Capital mobility and comparative vs absolute advantage.

It is often said that in a globalized economy, countries and companies have no choice but to take part in the global development race. It is not true. Globalization in the form in which it evolved in the 90s and later was a political choice of our elites, and not an imputed necessity. On this basis, a broad agreement was reached between the center-left and the center-right, meaning that the question of basic postulates was not raised here either.

The Bretton Woods system was a major achievement aimed at avoiding the monetary chaos and inflation that caused the Great Depression of the 1930s. Current stability has fostered international trade based on common advantages among countries. Free capital mobility and global integration were not originally part of the plan, even if the United States insisted on the International Trade Association from the very beginning, and its trade representation established major agreements on tariffs and trade with 27 countries as early as 1947. GATT passed the test of time, and In 1995, when the organization was restructured in the WTO, it already consisted of 108 countries, and tariffs were reduced by 75%.

Cross-border financial flows began to increase in the 1970s and literally exploded in the 1980s along with the removal of restrictions by home banks in many countries and the beginning of electronic commerce. After 1995, the WTO began to insist on unlimited and mandatory capital mobility, coupled with the deliberate lifting of restrictions by the US banking system in 1999. (see sections 1.9 and 2.5).

Globalization is the controlled integration of many previously relatively independent national economies into one closely connected global economy, built around an absolute rather than a comparative advantage. A comparative advantage arises when one country can produce a product or service at a lower price, meaning that that country can produce a product that is relatively cheaper than another. The theory of comparative advantage says that if countries specialize in the production of goods, where they have such a low price, there will be an increase in overall economic well-being. An absolute advantage, however, means the ability to produce goods or services using as little investment as possible. For example, the tomato industry in Mexico, where there is plenty of sun all year round,

Since the country began to sell according to free trade and free capital mobility, it is effectively integrated into the global economy and it is no longer free to decide for itself what to trade and what to not. Moreover, all economic theorems on the achievement of profit through trade imply that trade is carried out voluntarily. But how can trade be voluntary, if you are so specialized that it is no longer free to trade? Countries can no longer take into account social and environmental costs and include them in the price if all other countries do not do the same and to the same extent.

To integrate into the global omelet, you have to disintegrate the national eggs. Despite the fact that nations have many sins that must be redeemed, they remain the main locus for society and policy-making power. They should not be allowed to disintegrate in the name of abstract “globalism”, even if a global federation of national communities can be useful. But when nations are disintegrated, there is nothing left that can be combined to meet the legitimate global goals. “Globalization” (national disintegration) was a consistently pursued policy, not a fact of development, but greatly facilitated by the development of technology. On the other hand, it can be canceled in the way that the US government sees since 2017.

The IMF has been preaching free trade based on comparative advantage for a long time. Recently, the WTO-WB-IMF began to preach the gospel of globalization, which, in addition to free trade, means the free mobility of capital throughout the world, and especially free migration. However, the classic comparative advantage of David Ricardo is explicitly fulfilled at the level of the international immobility of capital (and labor). Capitalists are interested in increasing absolute gains, and therefore are mostly looking for how to reduce absolute costs. If capital can move between nations, it moves toward a nation with the lowest absolute costs.

Only if capital is immobile, do capitalists have no reason to compare the domestic indicators of the domestic costs of countries and choose specialization among household products that have the lowest price compared with other nations, and engage in trade in this commodity (in which they have a comparative advantage) for other goods. In other words, a comparative advantage is the second best policy that capitalists will follow only when the first best policy of pursuing absolute advantage is blocked by the international immobility of capital. This is derived directly from Ricardo, but is also an aspect of his thought that is too often ignored. Therefore, it is very strange to see the IMF and some trading theorists who adhere to the dogma of comparative advantage,

There is, of course, a global benefit from specialization and commerce, based on absolute advantage as well as on comparative advantage.

In theory, the global benefit from absolute advantage should be greater, because specialization is not constrained by the international immobility of capital. However, with an absolute advantage, some countries gain and some lose, while at a comparative advantage, while some gain more than others, there are no losers. The guarantee of a common advantage was the main force of a free trade policy based on comparative advantage. Theoretically, a global benefit with an absolute advantage could be distributed by the winners as compensation to the losers, but in this case it would not be “free trade”.

On the contrary, neoliberal economists, prevalent in the WTO, MVB and other organizations, faced with this contradiction, only waving their arms. They would rather assume that you must be a protectionist, isolationist, and xenophobe, and then change the subject. WTO-IB-IMF contradict themselves in favor of international corporations and their policies for offshore products in pursuing cheap labor, mistakenly calling it "free trade."

The international mobility of capital, combined with free trade, allows corporations to avoid national regulation in the interests of the people, inciting one nation against another. Since there is no global government, they turn out to be, de facto, uncontrollable. The phenomenon closest to global government (WTO-IB-IMF) showed little interest in the direction of transnational capital for the common good. Instead, they have increased the power and growth of the financial sector and transnational corporations, pushing them out of the control of nation states and provoking the corporate feudalism of open global communities.

2.6.3 Charles Darwin meant local competition, not global exchange

Not only Adam Smith and David Ricardo are European giants of thought, whose theories have been sadly simplified and misquoted. Charles Darwin, recognized as one of the most influential scientists who ever lived on earth, outlined the causes for the emergence and development of life, which gave the foundation to all modern life sciences. His name and theory were borrowed and economic and social theory, appearing under the title "Social Darwinism." One of the most disgusting distortions of this was the Nazi ideology, which postulated the inexorable struggle for survival between human races.

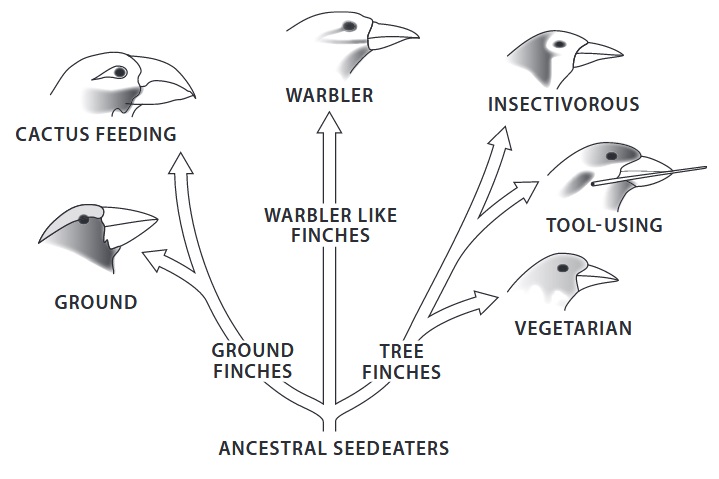

Darwinian theory was, of course, built on the observation of competitions taking place between species. Competition, however, was for the most part a local phenomenon. From the taxonomy of Linnaeus and other scientists, Darwin knew that the diversity of species is related to the diversity of habitats. He visited the Galapagos Islands, where he found a striking variety of finches, apparently evolving from a single pair of finches multiplying several million years ago (ill. 2.5). This was for him the latest evidence to confidently complete the "Origin of Species" 35. He clearly saw that it was the absence of other rivals on the island that allowed the reels to explore and conquer new niches and thus evolve into new species.

Ill. 2.5 - Darwin finches on the Galapagos Islands, descendants of a single pair that evolved into many different specializations (and species). From: www.yourarticlelibrary.com/evolution/notes-on-darwins-theory-of-natural-selection-of-evolution/ 12277 )

Modern izvoda Darwinism, developed Dzh.B.S. Haldane, Ronald Fisher, Theodosius Dobzhansky and others, established another, no less surprising feature of evolution: limited competition. The main for this phenomenon, well known since the discoveries of Gregor Mendel in the XIX century, served as gene pairs (alleles), of which one strives to "dominate" the other, the recessive allele. The recessive traits of the “genotype,” the genetic outfit of the personality, tend to remain invisible in the “phenotypic” expression of the physical body. Brown color of the iris dominates over blue. You cannot say, looking into someone's brown eyes, whether she or he carries the blue eye gene from the mother or father. However, blue-eyed people are exactly homozygous (double) carriers of the blue iris gene from both parents.

Differing eye colors are a prominent feature, called a mutation immediately after scientific fixation. Noticeable mutations were the basis for Gregor Mendel’s experiments on peas and other plant species. But in the real world, these are exceptions, obeying the law of small genetic mutations that are usually recessive and therefore “hidden” behind their dominant wild allele. This mechanism, according to the discovery of Haldane and others, allows you to accumulate more than a million genes in huge “genetic pools” containing countless mutations. Most of those not only recessive, but also those who, if they had found expression in the phenotype (that is, in the legacy of two parents), would in the future be the least suitable "wild" alleles. However, being recessive, they remain protected from selection for a large amount of time,

Population biologists in the 1930s explained this mechanism as a realistic base for a long and adaptive evolution. They argued that a small, but existing statistical probability should connect two identical recessive parental genes, while another probability should have made the preferred phenotypes the correct response to a changing environment. Evolution could no longer depend on meeting “hopeful monsters,” the obvious mutations that have been the subject of speculation, even when biologists were trying to connect Darwin's theory and Mendel's discoveries together. The concept of the genetic basin has restored its plausibility to Darwinism. He explained the positive evolutionary value of protecting and accumulating less suitable traits, even things like hereditary diseases, genetic predisposition of a small part of the human population to sickle cell anemia; genes also provide immunity to local infections, such as malaria.

Some evolutionary biologists, especially agricultural breeders, struggle and therefore dislike the abundance of invisible recessive genes, seeing in them an obstacle to strategic selection. They want homogeneity, not gene diversity. But then such homogeneous, tamed, varieties will be less resistant, less able to adapt to unforeseen weather challenges, food changes, to microbiological infections. Subsequently, scientists, Stephen Jay Gould and Niles Eldredge, suggested another important quality of the genetic pool: rare recessive genes become visible only when the breeding population is small. This usually occurs when a sudden appearance of new parasites, droughts, reduction of feed. With a little but the existing probability of some of the recessive mutations may be an appropriate response to a new challenge, such as resistance to parasites, less need for water, or the ability to adapt to new types of feed. In this case, the advantage of recessive genes will soon prove to be an advantage for the entire population, another proof of the usefulness of preserving those options that in former conditions could be weaker.

Perhaps the most relevant revision of evolution, according to Darwin’s theory, was by Andreas Wagner. His mantra is the grandiose multi-thousand-year construction of huge “libraries” with the genetic capabilities of each species. Until recently, these libraries were mistakenly called "useless DNA." In reality, species can use their libraries in order to test a multitude of “existing” genes that produce beneficial proteins. Building new genes in draft could be useful in the long term. So, Wagner says with conviction that innovation in evolution depends on these libraries, on finding treasures that must be protected from destruction during natural selection, even if most of the “books” can be inferior compared to the same “books” of instant action.

At this point, it seems appropriate to mention an impressive new discussion in genetics, usually called “gene editing” or CRISPR / cas9 (short palindromic repeats, regularly arranged in groups).

Developed and published in 2012, this method allows cutting and modifying DNA from some sides, thus, in perspective, cutting out disease-causing genes. The scientific community, especially the medical community, is agitated by the potentials that this discovery carries. The latest NAS report is optimistic about the use of the method in health, ecosystem conservation, and other basic research. Critics, for example, from the NCO ETC group's innovation search group, say that the reports in no way refer to the three most important areas of gene editing: militarization, commercialization, and preservation of food.

However, even in the scientific community, doubts about the long lifetime of the method as the editing of human genes prevail. If this methodology becomes mainstream, one can expect / fear the systematic discarding of genetic diversity, that is, a reduction in the size of the Wagnerian “library”. Further studies should be implemented at least with caution in order to prevent a systematic rupture in the inherited genetic diversity of any of the species subjected to gene editing.

In any case, we have already understood that Darwinism, correctly understood, basically recognizes limited competition and the protection of weaker genes as the unavoidable basis of a revolution.

On the contrary, the doctrinal economic theory, which recognizes innovation and evolution as the advantage of high-intensity competition anywhere and the destruction of weakness, is a simplification that is completely opposite to the truth.

2.6.4. Soften contrasts

Three times during the analysis, the word "opposite" was said. Many problems in modern economic theory lie in the use of incorrect or distorted quotes or references to the three giants of economic and social thought. Darwin, of course, did not see himself as the father of the economy, but his discovery of the power of competition and selection is fundamental to the market concept. Tidying up incorrect quotations and references should be as follows:

- The blessing of the invisible hand requires the existence and effectiveness of a strong legislative framework, and should be outside the influence of powerful market players.

- The theory of comparative advantage should not be automatically applied to trade in capital. The power of capital is frighteningly asymmetric: big capital always has a “comparative advantage” over small; while many local improvements require little capital.

- Competition in its origin is a local phenomenon. Protecting - to this extent - local cultures, local specialization, and local politics from the overwhelming forces of world players can be useful for preserving diversity, innovation, and evolution. The term "non-discriminatory" was originally a good anti-Nazi term, but is now used in trade agreements in order to exclude weak local producers from under protective measures.

It was a brief overview of some of the failures in economic doctrine, which, of course, can be corrected. At the moment, however, many economists, historians and academicians, such as those mentioned above, agree that the general line of thought is correct. A growing list of those who find the doctrine of the market anxious and unfair can be a powerful and persuasive reason for its rigorous revision.

Fortunately, a strong pluralist movement has emerged in the economic theory. It is called ISIPE. Originally established in Paris, it now includes more than 165 associations in more than 30 countries. They require, among other things, that "the real world is reintroduced into the class, as well as the debate about pluralistic theories and methods."

Some prominent economists who supported the movement of systematic changes in the economy are closely associated with the Club of Rome. Among them are Robert Constanza and Herman Daley, Tim Jackson, Peter Victor and Enrico Giovannini (to whom we owe statistics to determine well-being in the post-GDP era).

To be continued ...

For the translation, thanks to Ilya Deikun. If you are interested, I invite you to join the “flashmob” to translate a 220-page report. Write in a personal or email magisterludi2016@yandex.ru

More translations of the report of the Club of Rome 2018

Preface

Chapter 1.1.1 “Various types of crises and feelings of helplessness”

Chapter 1.1.2: “Financing”

Chapter 1.1.3: “An Empty World Against Full Peace”

Chapter 3.1: “Regenerative Economics”

Chapter 3.2: “Development Alternatives”

Chapter 3.3: “ Blue economy ”

Chapter 3.4:“ Decentralized energy ”

Chapter 3.5:“ Some success stories in agriculture ”

Chapter 3.6:“ Regenerative urban planning: Ecopolis ”

Chapter 3.7:“ Climate: good news, but big problems ”

Chapter 3.8:“ Economy of a closed cycle requires a different logic "

Chapter 3.9:" The fivefold performance of resources "

Chapter 3.10: “Tax on Bits”

Chapter 3.11: “Financial Sector Reforms”

Chapter 3.12: “Reforms of the Economic System”

Chapter 3.13: “Philanthropy, Investment, Crowdsors and the Blockchain”

Chapter 3.14: “Not a single GDP ...”

Chapter 3.15: “Collective Leadership”

Chapter 3.16: “Global Government”

Chapter 3.17: “Actions at the national level: China and Bhutan "

Chapter 3.18:" Literacy for the Future "

"Analytics"

- "Come on!" - the anniversary report of the Club of Rome

- The anniversary report of the Club of Rome - embalming capitalism

- Club of Rome, jubilee report. Verdict: “The Old World is doomed. New World is inevitable! ”

- Hour: Report of the Club of Rome. Orgies of self-criticism

About #philtech

#philtech (технологии + филантропия) — это открытые публично описанные технологии, выравнивающие уровень жизни максимально возможного количества людей за счёт создания прозрачных платформ для взаимодействия и доступа к данным и знаниям. И удовлетворяющие принципам филтеха:

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку