IIDF Online Accelerator

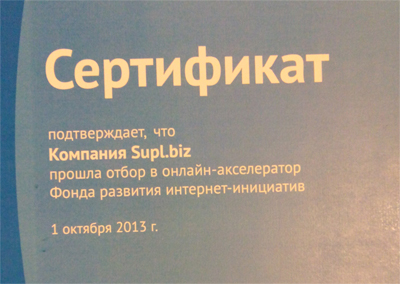

In this article, we will talk about how we went through online acceleration in the Internet Initiatives Development Fund (IIDF), what benefits we got and what conclusions we came to.

The first set of IIDF had two forms of accelerator:

1. Off-line acceleration includes investments in the amount of $ 25,000 for 7% of the company, and the prerequisites are the transfer of 2-3 team members to the IIDF coworking for 3 months and attend lectures.

2. Online - a remote form of acceleration, in which the team works with its tracker on skype, sets goals and reports on their implementation. Lectures can be watched in videos or attended in person if you are in Moscow.

Acceleration lasts 3 months. IIDF said that upon exiting the accelerator, all projects will have equal conditions to speak to investors on Demo Day and attract up to $ 450,000 investment from IIDF.

We found ourselves in the online accelerator, but for my other business, I moved to Moscow, so I had the opportunity to attend lectures and other events.

How did we get into the online accelerator? Firstly, we submitted an application (the full text of our application is here ), then there was a 15-minute skype interview, and after a couple of weeks we found out that we were in the TOP 100. Then there was the Selection Day of projects offline, where I gave a 5-minute report to experts.

In fact, we had a desire to go offline, but we hesitated: moving three team members to Moscow for 3 months meant that we would have lost all of our $ 25,000 investment “for food” (housing, food, flights). As a result, we did not go offline. Of course, they were a little upset that they didn’t go through some kind of competition, but they understood that we were not strong and wanted to give 7% of the company “for food”.

Online acceleration looked something like this: first we determined the metrics of our project (measurable numerical parameters that characterize success), then once a week we called up with the tracker, discussed plans and current metrics.

At the same time, I periodically attended lectures in the IIDF. For example, I really liked the lecture by Anna Chukseeva, Head of SuperJob PR Department. Anna agreed to consult our project on PR on an ongoing basis - this is perhaps the most important thing that we received from IIDF.

It was very interesting to listen to the lectures of their fellow countrymen from Tomsk. Stas Eleseyev and Eugene Poley (UserStory) talked about UI and UX. We also started cooperation with these guys. Crossss Daniel Khanin was supposed to talk about market appreciation, but it was rather an inspirational lecture on ambition.

The sad thing is that the IIDF almost forgot about the projects from the online accelerator: there were almost no video lectures, and at the end of the accelerator IIDF set up, not allowing almost all online before Demo Day. When people first promise one thing, and then deliberately do the exact opposite - it is somehow unpleasant.

Despite the ugly behavior of the FRII leadership, we really enjoyed talking with lecturers and our tracker Nikolai Kotkin. By the way, Nikolai has his own startup - dropup.ru, which we really liked, and which we plan to use in one of our projects. Fedor Skuratov (I don’t even know what his position in the IIDF) was solving or trying to solve all our problems and requests: whoever we asked any question, everyone sent us to someone and in the end the chain closed Fedore. We even got the impression that Fedor alone works in the Fund, and all the rest will only redirect.

It was very interesting to get acquainted with the venture investment market in Russia. He's kind of weird. For me, a classic venture investor is Andy Bechtolsheim.who wrote a check for $ 100,000 in the name of the still non-existent company Google Inc., because he liked their product, and he hoped to get his money back with a coefficient of 100 or 1,000 (it turned out even 17,000).

Russian venture investors prefer to invest in projects that have ARPU indicators, etc., while none of the investors want to look at the product itself, only financial indicators are important. It seems that they are more interested in investing in a business with the ambitions of a vegetable stall in the yard: he certainly has ARPU and almost no risks, and a conversion of 5% of people passing by. I exaggerate, of course, but the impressions are just that. Venture capital fund managers should listen to Daniel Hanin's lecture on ambition.

By the way, upon leaving the Internet, IIDF invited us to an offline accelerator. But we still do not want to give 7% of the company for “food”. In addition, it is not very convenient to separate 2-3 team members from other colleagues and loved ones in Tomsk. Therefore, we declined this offer. Of course, we were flattered that IIDF was ready to invest $ 25,000 in money for us (+ $ 20,000 with our services) for a 7% stake, which gives an overall assessment of the project of 20 million rubles. It is nice to know that over the year we have created a company that is valued at such an amount.

As a result, participation in the IIDF project left a very wide range of emotions. In any case, we are very glad that these 3 months participated in their online accelerator. During this time, almost all the indicators on our project grew 4 times: the number of orders, the number of responses, the attendance of the resource. And we are happy that every day we hear and read positive reviews from our users about Supl.biz .