Fixed and variable costs in software development

Software development and operation of already implemented software (for example, applications) is in a special situation in the context of cost analysis. The peculiarity is that a typical production cycle of a product and its sale does not exist in the IT industry. Instead, we have virtually free copies of the product, but the high costs of creating and maintaining this product are high. For this reason, the economy of an IT company is very different from that of a “candle factory” or a store.

Let's take a closer look at the cost situation in an IT company. Unfortunately, it will not be possible to generalize all IT companies into one scheme. I will try to highlight a few common schemes of work and consider them. Perhaps one of the readers will add some other schemes interesting for consideration.

I want to highlight the following types of IT companies, although this list, of course, is not complete:

- Outsourcing development - the team writes software for the order and for the requirements of the customer. In the future, software is often accompanied by the customer himself. Relationships focus only on the development and essentially the sale of hours of employees (both in the form of direct sale of watches and fix price, when the risks of changing the terms of the project fall on the developer)

- B2B software vendor - the team writes software for B2B distribution, implements, supports and develops new functionality.

- B2C products - here I will take all the companies involved in the creation of B2C applications and products that work with a mass client.

- Infrastructure providers - hosters, data centers, server capacities, transaction processing services, etc.

What are the costs of the first type of company? Let's divide the expenses into different groups according to the main types that are independent of the enterprise:

- Operating expenses

- The costs associated directly with the production of 1 unit of output.

- General and administrative expenses

- Development costs

- Rental of premises

- Marketing

- Sales expenses

- Expenses administrative staff

- Infrastructure costs

- Depreciation

- Financial expenses

- Interest on debt

- Exchange differences

- Revaluation of property

- Taxes

Let me draw your attention to the fact that in finance there is a big difference between “expenses” in the financial sense and “expenses” in the household. On this occasion, I wrote a separate article

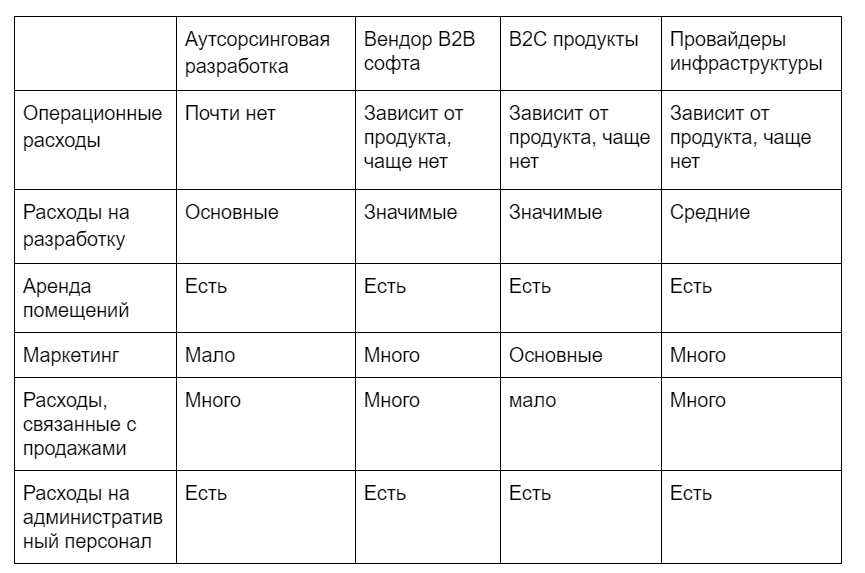

Returning to our 4 types of companies, we have the following picture regarding their cost structure (excluding financial expenses):

How to analyze the cost structure of such different enterprises?

Just the picture and cost structure does not give us too much. We can find out the largest articles and this may give us directions for optimization, but it often happens that the largest expense items are the largest for a reason.

You can try from these data to calculate the cost per 1 unit of the sold service / product. But this information really does not give you anything. Firstly, we have a mixture of fixed and variable factors, each of which varies differently in response to sales growth / decline, and secondly, the figure for “such” cost does not give you any additional information, which means that you are not based on these You can’t imagine data. Moreover, for the reasons described above, our investment projects do not fall into this data. The conclusion suggests itself that we need a different view of the enterprise economy.

One approach is to divide the enterprise into products and projects, and then to divide the costs into general and project / product. How then can the cost structure look like:

Product

- Direct product operating costs

- General allocated expenses

- Perfomance marketing

- Infrastructure (in terms of assets used)

- Escort costs

- Development costs

- Rental of premises (occupied projects)

- Depreciation (in terms of assets used)

- Whole enterprise

- General non-allocated expenses

- Sales expenses

- Administrative staff costs

- Brand marketing

- Financial expenses

- Depreciation of common property

- General infrastructure

Allocated expenses are expenses allocated to a project based on an analytical / expert assessment of resource consumption. When you do not have an unambiguous “account” for the power consumption services of your server infrastructure, you can give an estimate by dividing the cost of maintenance in proportion to the use of resources. Do not get carried away with finding the exact metric, allocation already implies assumptions, so you probably need to determine a less or less correct proportion between products than to come up with a formula for “fair” calculations.

Non-allocated expenses are expenses whose consumption will not change if you change the scale of your projects. This includes expenses that can no longer be tied to specific projects and which the company needs in general: brand marketing, financial expenses, accounting expenses, lawyers, etc.

What gives us this approach:

- Expenses that are directly generated by an individual project are correlated with the income generated by it. You understand whether the project is profitable or not. If it is not profitable, it will already become better for you to understand what you will lose when it is closed and how much resources you will free up.

- You also understand that you are not burying yourself under the yoke of bloated general expenses and can try to work on reducing costs in this part. Many of these costs are not productive and their control and minimization is an important task for any manager.

- You can now begin to compare projects and evaluate their dynamics, because now you will not have hidden costs and situations where the project’s profit is fictitious, because The absorption of the total associated costs was not taken into account.

Combining this data with data on revenue and its decomposition into components ( Introductory article, inside, at the bottom of the link to the rest of the series of articles ) you get your basic reporting on products and the enterprise.