Analysts: Microsoft capitalization could reach $ 1 trillion

Image: Pixabay

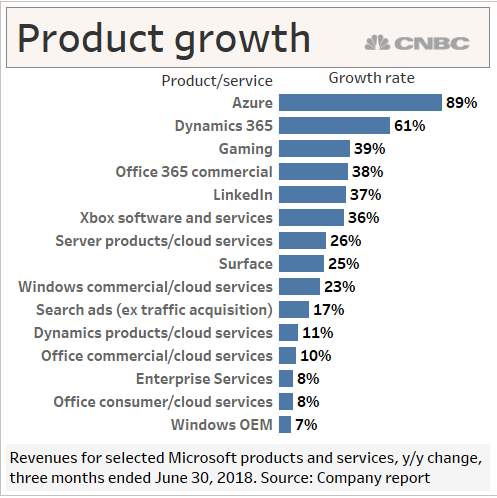

More and more experts are inclined to believe that Microsoft will soon exceed $ 1 trillion, CNBC writes . The company's main growth point was the successful sale of the Azure cloud product. ?

Microsoft has increased its capitalization, reporting on a successful year

Financial analysts believe that by the end of 2018, Microsoft's capitalization will exceed $ 1 trillion. Investors are attracted by the latest reports published by the company: for the past financial year, the company first earned more than $ 100 billion, exceeding its previous result by 14%.

The data show that the company's results continue to improve: the company's revenue for the last completed quarter has increased by 17% compared to the same period last year. This was made possible thanks to the course taken several years ago for the development of cloud services - today this area is becoming increasingly profitable.

Other trillion bidders

In addition to Microsoft, according to forecasts for 2018, Apple, Amazon and Alphabet (a holding owned by Google) can achieve a capitalization of $ 1 trillion. Today, Microsoft is not the main, but the fastest growing challenger. Apple is valued at $ 940.23 billion, which is more than $ 100 billion more than Microsoft, Amazon and Alphabet are also ahead of the company.

At the beginning of the year, when the target price of Microsoft shares was $ 106, ISI Evercore analysts predicted that Microsoft's capitalization would exceed $ 1 trillion by 2020. In July, after the release of the last quarterly report, many analysts raised their target prices for Microsoft shares by $ 5 - $ 10. Today they reach $ 130, and when the value changes to $ 0.16, Microsoft will overcome the trillion mark.

Microsoft's growth: how and for how long

Cloud direction is key to Microsoft's growth today. Having taken this step five years ago, the company not only correctly predicted the market trend, but also established a new monetization model for itself - user subscriptions. Unlike classic licensed software sales for a company, subscriptions provide more stable and regular income.

Following the results of the last fiscal year, the Commercial Cloud direction, which includes the Microsoft Azure cloud solution, commercial subscriptions for Office 365 applications and Dynamics 365 cloud software, grew by 3% and provided 25% percent of Microsoft's total revenue.

Chart: CNBC

After publishing the results of the year, Microsoft announced its intention to continue double-digit growth. Not all experts are convinced of the feasibility of the company's plans: in the long run, scalability will decrease, and Commercial Cloud products will become more competitive with Amazon's cloud services.

Other financial and stock market related materials from ITI Capital :

- Analytics and market reviews

- Back to the future: checking the performance of a trading robot using historical data

- Event-driven Python backtesting step by step ( Part 1 , Part 2 , Part 3 , Part 4 , Part 5 )