Save money from a young age or a couple of statements easily verified in Excel

Posts on personal finance systems regularly appear on the hub. These systems are simple, sophisticated, beautiful, etc. But! Most of them for some reason completely ignore such a simple thing as compound interest (sorry for the pun). But this is the basis of personal finance.

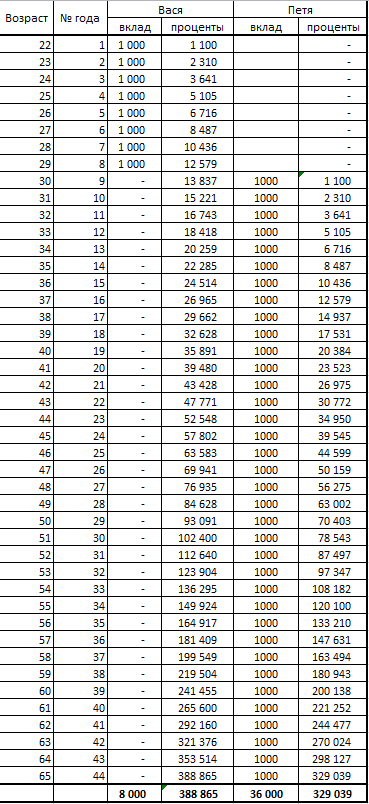

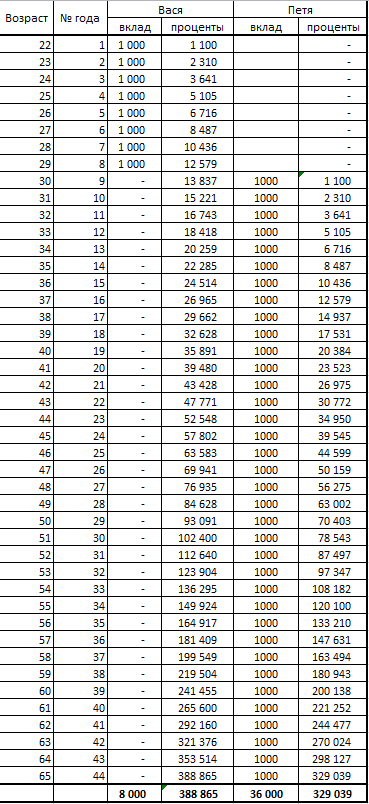

I’ll give you two simple examples illustrated with tablets in Excel. For the seed question: there are two peers: Vasya and Petya. Vasya is a freelancer and he is 22 years old. He began to put off pieces of dollars a year and put them off until 30 years (only 8 years). Then a child was born, it became a little tight with money and he could no longer put off. Petya, on the contrary, could not put off at the beginning of his career, but at the age of 30 he became a team leader and was finally able to carry the same thing to the bank annually. He did it right before retirement, i.e. up to 65 years (total 36 years). Question: who at 65 years old has more money in the account? The correct answer: of course, Vasya.

So, we believe that money is put into the bank at 10%. We neglect inflation (it is clear that $ 1000 now and $ 1000 in 20 years can be a little different money, but still). We make a simple calculation and get.

Total Vasya had $ 388,865 in his account (despite the fact that he had invested only $ 8,000), Petya had $ 329,039 (with $ 36,000 invested). As they say, draw conclusions. And yet, for reference, $ 1000 per year, a little more than 2.5 thousand rubles per month.

Now a second example (it is also called the Latte rule): the programmer Igor Petrovich felt a taste for a good life. He is 30 years old, he makes good money and every morning, going to work, he buys himself a glass of coffee at Starbucks. Coffee costs about 150 rubles. Since he does this every morning, he spends 365 x 150 = 54,750 rubles a year in coffee a year. Hera himself, said the attentive harachitatel. Hera yourself, said Igor Petrovich and stopped drinking coffee on weekends and holidays. Received 250 x 150 = 37,500 per year. This is the new iPhone! - said Igor Petrovich and switched to regular American at 100 rubles per cup. Received 25,000 a year. Then Igor Petrovich scratched his head and sent us in the ass with his math, because pleasure is higher than any money.

Again we make a simple calculation:

It turns out that if Igor Petrovich hadn’t drunk morning coffee and set aside 100 rubles daily, by the time he retired, he would have had 13.5 million rubles. Those. could buy an apartment, for example, a grandson. And so, he exchanged it for 10,250 cups of coffee. Each of which, incidentally, cost him a total of 1,309 rubles per cup.

Have a good friday, you% username :)

I’ll give you two simple examples illustrated with tablets in Excel. For the seed question: there are two peers: Vasya and Petya. Vasya is a freelancer and he is 22 years old. He began to put off pieces of dollars a year and put them off until 30 years (only 8 years). Then a child was born, it became a little tight with money and he could no longer put off. Petya, on the contrary, could not put off at the beginning of his career, but at the age of 30 he became a team leader and was finally able to carry the same thing to the bank annually. He did it right before retirement, i.e. up to 65 years (total 36 years). Question: who at 65 years old has more money in the account? The correct answer: of course, Vasya.

So, we believe that money is put into the bank at 10%. We neglect inflation (it is clear that $ 1000 now and $ 1000 in 20 years can be a little different money, but still). We make a simple calculation and get.

Total Vasya had $ 388,865 in his account (despite the fact that he had invested only $ 8,000), Petya had $ 329,039 (with $ 36,000 invested). As they say, draw conclusions. And yet, for reference, $ 1000 per year, a little more than 2.5 thousand rubles per month.

Now a second example (it is also called the Latte rule): the programmer Igor Petrovich felt a taste for a good life. He is 30 years old, he makes good money and every morning, going to work, he buys himself a glass of coffee at Starbucks. Coffee costs about 150 rubles. Since he does this every morning, he spends 365 x 150 = 54,750 rubles a year in coffee a year. Hera himself, said the attentive harachitatel. Hera yourself, said Igor Petrovich and stopped drinking coffee on weekends and holidays. Received 250 x 150 = 37,500 per year. This is the new iPhone! - said Igor Petrovich and switched to regular American at 100 rubles per cup. Received 25,000 a year. Then Igor Petrovich scratched his head and sent us in the ass with his math, because pleasure is higher than any money.

Again we make a simple calculation:

It turns out that if Igor Petrovich hadn’t drunk morning coffee and set aside 100 rubles daily, by the time he retired, he would have had 13.5 million rubles. Those. could buy an apartment, for example, a grandson. And so, he exchanged it for 10,250 cups of coffee. Each of which, incidentally, cost him a total of 1,309 rubles per cup.

Have a good friday, you% username :)