Study: Women's managed hedge funds perform better

Image: Unsplash

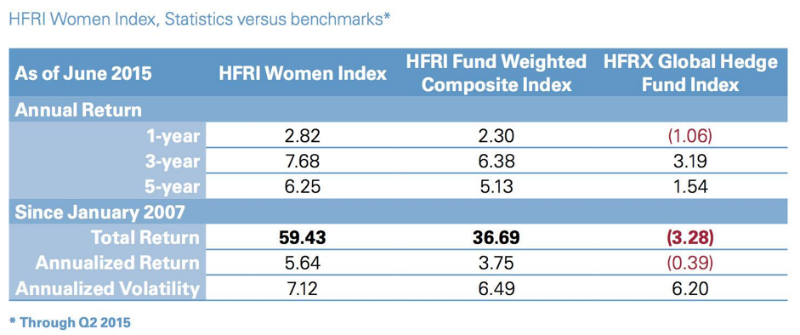

According to a study by Hedge Fund Research, Inc., the results of hedge funds managed by women, on average, are 20% higher than the industry figures for the last ten years.

Women's performance index outperformed the market

Issues of opportunity and the position of women in modern society are attracting more and more attention. Forbes , The Times , Financial Times over the past 3 years have released several materials that compared the HFRX and HFRI Women indices, evaluating the effectiveness of hedge funds managed by women, with similar industry-wide indicators.

Comparison of the indices showed that, contrary to stereotypes, “female” hedge funds were at their best. At the end of 2017, the HFRX Woman indicator almost doubled the average result: 11% versus 6% over the same period. According to the HFRI index, women also outpaced men by 0.9%. Statistics for three, five, ten years confirms the high performance of women financiers in the market.

Source: KPMG

Gender does not determine ability to invest

Looking at the above figures, one might think that women are simply better predisposed to such work: they are more careful or attentive to details. A study of the scientists Northeastern U. D'Amore-McKim School of Business, cited several times by the media in 2015, refutes this assumption.

Scientists compared funds managed only by women, only by men and managers of both sexes, based on the values of the Sharpe ratio (ratio of portfolio return to portfolio risk) in each group. There were no noticeable differences between the investment strategies of the groups.

Specialists also noticed that it is more difficult for women to raise capital and expand business, therefore, funds managed by women are usually smaller. They attribute this to the fact that most of the capital belongs to men and they are more inclined to trust it to people of their own sex.

Advantages of tough competition

According to researchers, the high rates of HFRX and HFRI Women are primarily due to the difficulties that women face in order to get into the profession. In the UK, less than one in twenty hedge funds hire female managers. In such circumstances, a career can only be built by the most talented and stubborn, while male managers often have the right to make mistakes.

In support of women participating in such competition, not only researchers act, but also market participants themselves. In 2001, the 100 Women in Finance charitable foundation was created to support, employ and educate women investors. The activity of the media and public organizations is aimed at increasing the visibility of women in the "male" world of finance.

This is not to say that women do not receive offers on the labor market at all. For example, at the end of 2017, one of the world's largest hedge funds, Bridgewater Assotiates, hired the most successful woman in tournament poker Vanessa Selbst to analyze trading strategies. Ultimately, the goal of hedge funds is not to hire specialists of a certain gender, but to maximize profits.

Other materials on finance and stock market from ITI Capital :

- Analytics and market reviews

- Back to the Future: Testing a Trading Robot with Historical Data

- Event-oriented Python backtesting step by step ( Part 1 , Part 2 , Part 3 , Part 4 , Part 5 )