IT retirement pension

On June 7, news appeared in the media that the Government would determine the parameters of the pension reform next week. The basis is the option of increasing the retirement age to 65 for men and to 63 for women.

Let me remind you that now the retirement age for women is 55 years, for men - 60. Thus, the main option is retirement for men 5 years later and women for 8. IT specialists, like all employees under the laws of the Russian Federation, shape their future pensions. Employers are required to deduct insurance premiums from payments to employees, including pension insurance. In accordance with Articles 425-426 of the Tax Code of the Russian Federation, until 2020, the general rate for insurance premiums is 30%, of which 22% for pension insurance.

According to the data

service salaries "My Circle" median wages IT-specialist - 90 000 rubles. Let's try to figure out how possible changes in the pension system will affect our pension.

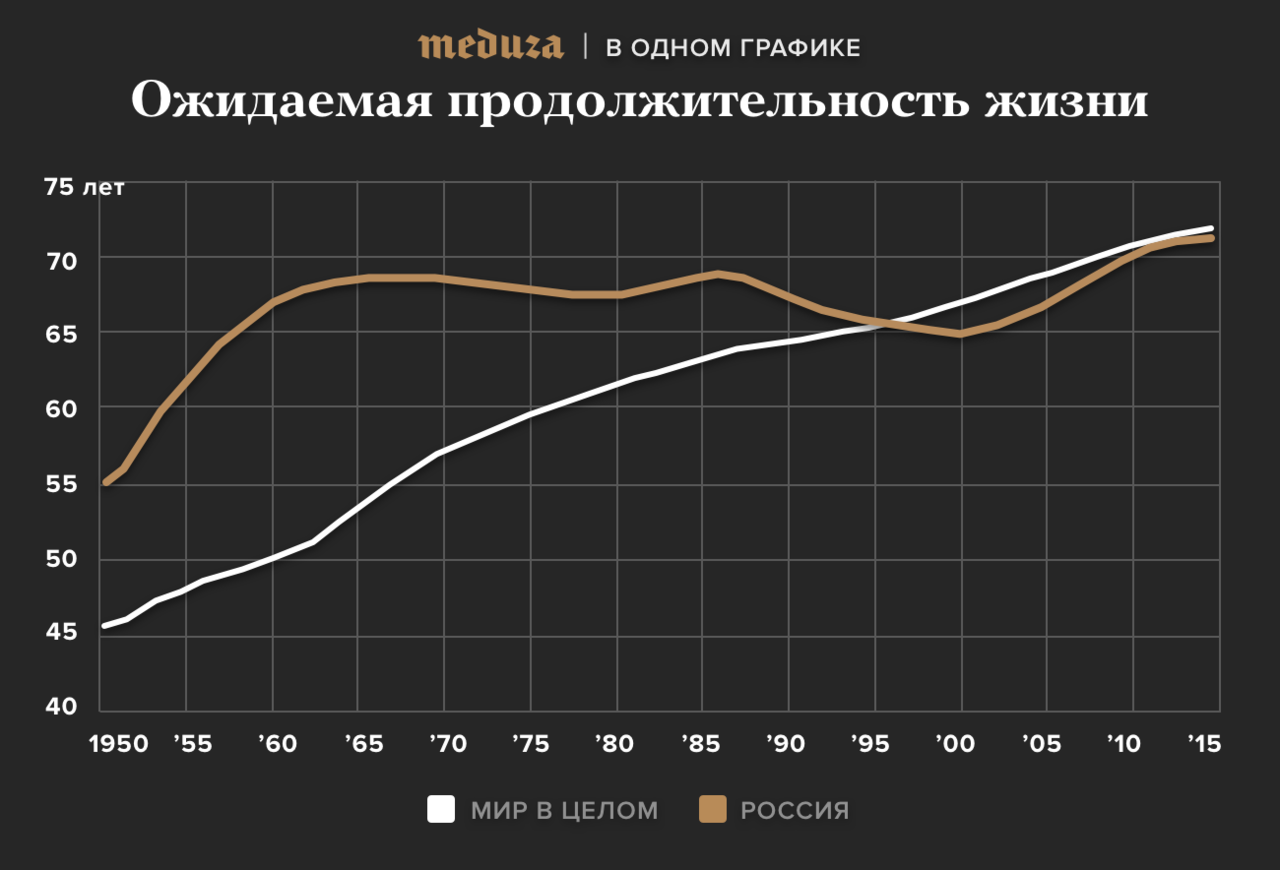

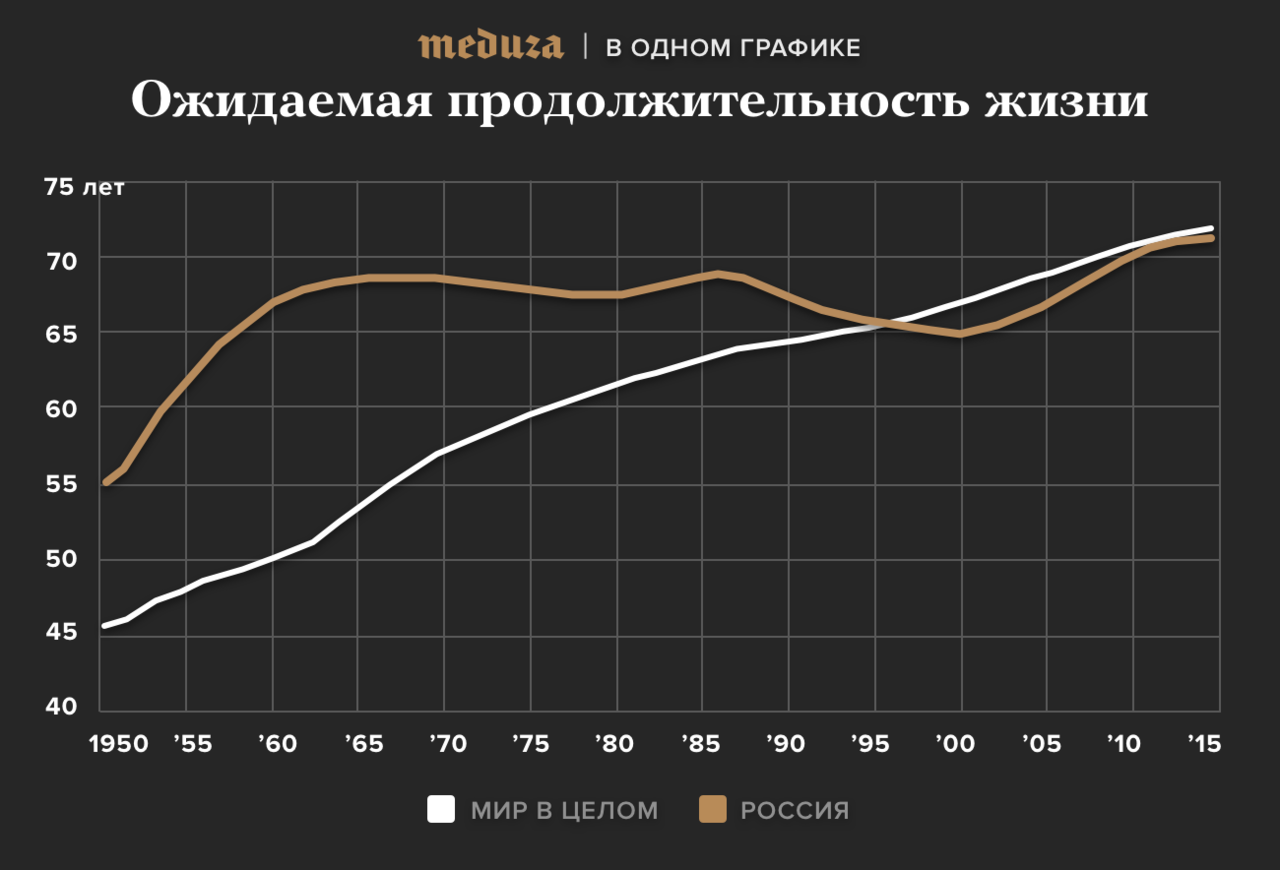

On September 11, the Russian Ministry of Health announced that the life expectancy of Russians broke a historical record and reached the level of 72.5 years. By modern standards, expected at birth 72.5 years - this is more likely to correspond to the global average. After clarification, the indicator was 72.1 years (66.80 for men and 77.16 for women).

As a rule, by “life expectancy” (life expectancy) is understood the life expectancy at birth, that is, at the age of 0 years. This is the number of years that one person will live on average from this generation born, provided that throughout the life of this generation, mortality in each age group will remain unchanged at the level of the estimated period. In short, mortality rates for one year (based on the civil registry office for one year, for example, 2017) are taken for all ages of the conditional generation, and this data extends to the distant future.

What the Ministry of Health has reported is life expectancy for people born in 2017. The average (expected) life expectancy is not the average age of the deceased during the calendar year. Statistics from the registry offices really underlies the indicator of life expectancy, but is used to calculate the probability of death during the year at each age. The life expectancy indicator itself is obtained by constructing complete mortality tables. This indicator can coincide with the average age of the deceased only by chance.

We at Cloud4Y wondered how many years a man would receive benefits upon retirement at 60 and 65, and how a later exit would affect the usefulness of this system for a particular person.

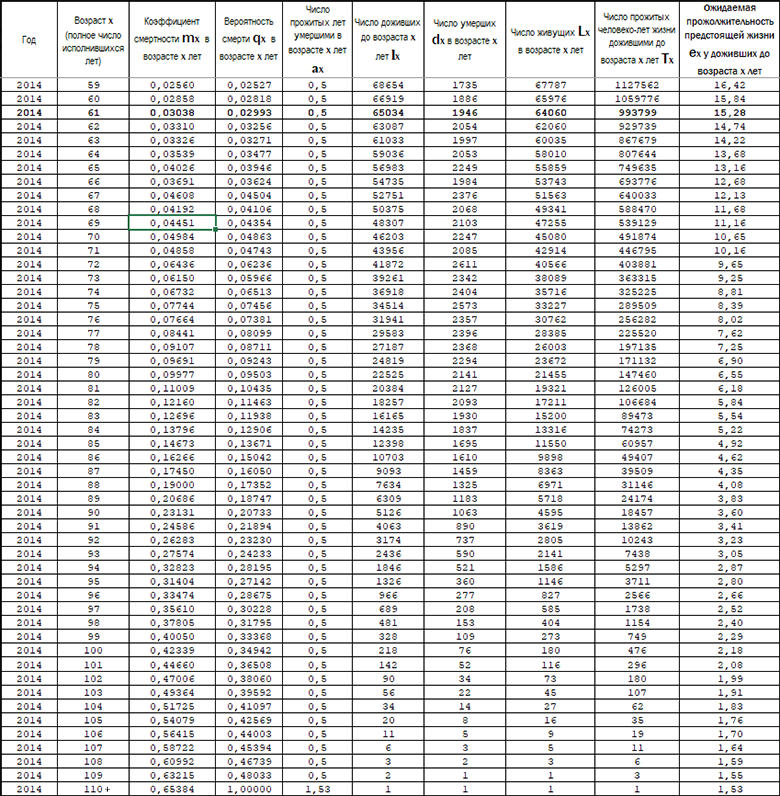

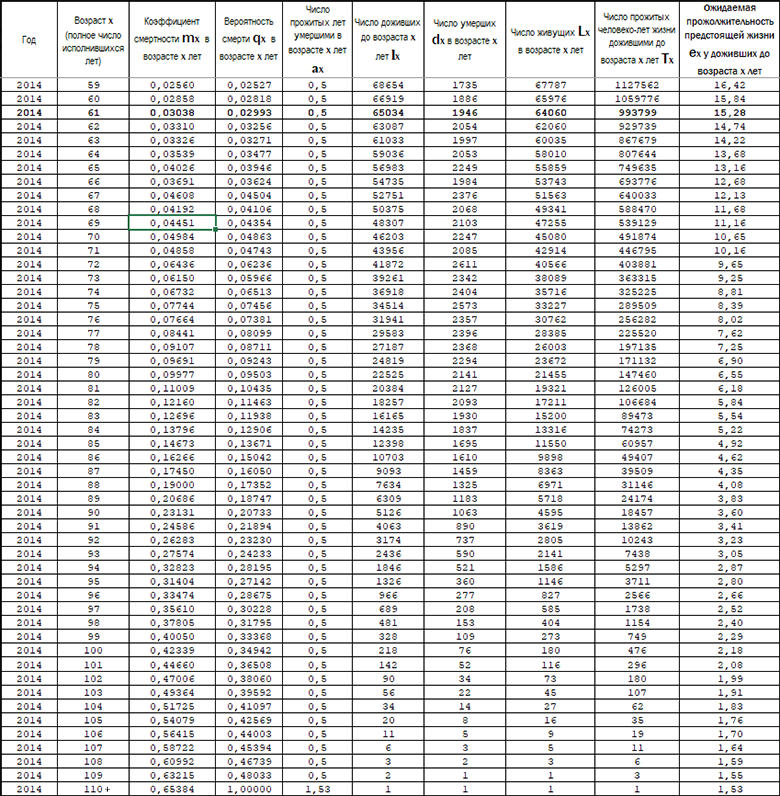

Life expectancy at birth cannot help with this calculation. We needed to find out how many years an average man has lived who has reached the age of 60. The " Mortality table for the population of Russia for the calendar year 2014 " helped us in this . Source: www.mortality.org - they refer to Rosstat data that were unpublished but available for researchers to request.

To begin with, in 2014, only about 67% of men reached the age of 60 and older, and 57% reached the age of 65. This is a partial answer to the question about the possibility of surviving to retirement. Yes, it is quite possible. In addition, we note that with such an increase in age, 10% fewer men survive before the insured event of pension insurance. Further, all calculations are made for survivors.

Paying attention to the column “Life expectancy for those who have lived to the age of x years”, we see that at 60, the “average man” will have to live 15.84 years in 2014 and receive 190 pensions, and when leaving 65 years old 13.16 years and 158 pensions.

Yes, one would think that 5 years of raising the retirement age would reduce the length of the “retired” period by 5 years, but this is not so. The probability of death does not increase linearly, which means that in 5 years from 60 to 65 a significantly smaller number of men die, than in the period from 65 to 70 years and so on. An increase in the retirement age by 5 years is a reduction in the period of receiving a pension by an average of 2.68 years or almost 17%.

For women, when they retire at 55, the average life expectancy in 2014 was +25.53 years, and with a retirement age of 63 years — 19 years. Thus, an increase in the retirement age of 8 years for women is a reduction in the period of receiving a pension by an average of 6.48 years or more than 25%!

So, back to the average IT specialist who receives 90 thousand rubles and whose employer transfers 22% to the FIU. In 2018, the limits for the calculation of contributions to the FIU changed - 1,021,000 rubles. (in case of excess, contributions are paid at a reduced rate - 10%). There are also reduced rates for certain types of organizations.

The annual contributions to the FIU for such an employee will amount to 230.5 thousand rubles. Since the total annual income is close to the accrual limit at the rate of 22%, and we don’t know the dates on which the state will raise the limit, we will assume that the growth in wages will exactly correspond to the inflation rate. For calculation, this means that for the rest of his working life, the employee will receive 90 thousand rubles at zero inflation.

We also assume that at the moment the employee is 30 years old and before retiring he will have another 35 years of work experience.

Consider the option when an employee begins to save money for old age on his own in an amount equal to pension contributions.An employee places funds on a bank deposit with a monthly capitalization of interest. Due to zero inflation in the economy, the deposit rate at the bank is only 1% per year.

The example with a salary of 90 thousand rubles per month at 2017 prices is indicative of the reason that the total annual income is close to the accrual limit at a rate of 22%. If your salary is lower than 90,000 N times, the expected alternative self-accumulated pension will also differ by N times.

Making deductions for a “private” pension, as in our example, an employee can achieve a wage replacement rate of 67.8% for the average man and 46.7% for the woman. In 2016, this ratio was 33.7% with an average salary in Russia, according to the Federal State Statistics Service, at 36,746 rubles and an average pension of 12,391 rubles.

Thus, we are talking about a twofold difference in the replacement rate for men between the “private” and state pensions.

With the “old”, now existing system of retirement at 60 years old, a male worker will receive an average pension of 15.84 years, which means 190 times. It should also be noted that the employer will make contributions to the FIU for 5 years less, which means that the amount of accumulated funds and interest will be reduced. In our example, it will amount to 8.47 million rubles instead of 9.6 million and 44,600 rubles instead of 61,600 rubles. The replacement rate would be 49.6%.

The calculation for women is 25.53 years in retirement or 306 payments of 27,700 rubles with a replacement rate of 31%.

This means that while before a possible increase in the retirement age, women with a salary below the average in Russia benefited from a state pension that provided 33.7% wage replacement, then after raising the retirement age by 8 years, such an opportunity would “get more private pension” greatly reduced.

The existing model of the pension system is based on the mechanism of intergenerational transfer. In such a system, the pension contributions of people working now go to the payment of pensions to previous generations. Deductions also go to the funded personified part of the pension, but in recent years it has been frozen and may be canceled by replacing it with a voluntary funded pension.

The size of the intergenerational transfer does not allow canceling the existing mechanism, which does not allow accumulating a personal pension and%. To cover pension liabilities to current retirees, a huge amount of financial resources would be required.

The younger generation, or rather its “behavioral irrationality”, can negatively affect the existing model of the pension system. This conclusion was reached by the experts of the Central Bank in the preparation of the report “The Main Directions of the Financial Market for the Period 2019 - 2021” .

Readers who want to confidently meet old age are advised to look into the Geek Health hub in order to reach the age of receiving a state pension, as well as save money for a “private” pension, which, as calculations have shown, is more effective.

service salaries "My Circle" median wages IT-specialist - 90 000 rubles. Let's try to figure out how possible changes in the pension system will affect our pension.

On September 11, the Russian Ministry of Health announced that the life expectancy of Russians broke a historical record and reached the level of 72.5 years. By modern standards, expected at birth 72.5 years - this is more likely to correspond to the global average. After clarification, the indicator was 72.1 years (66.80 for men and 77.16 for women).

As a rule, by “life expectancy” (life expectancy) is understood the life expectancy at birth, that is, at the age of 0 years. This is the number of years that one person will live on average from this generation born, provided that throughout the life of this generation, mortality in each age group will remain unchanged at the level of the estimated period. In short, mortality rates for one year (based on the civil registry office for one year, for example, 2017) are taken for all ages of the conditional generation, and this data extends to the distant future.

What the Ministry of Health has reported is life expectancy for people born in 2017. The average (expected) life expectancy is not the average age of the deceased during the calendar year. Statistics from the registry offices really underlies the indicator of life expectancy, but is used to calculate the probability of death during the year at each age. The life expectancy indicator itself is obtained by constructing complete mortality tables. This indicator can coincide with the average age of the deceased only by chance.

We at Cloud4Y wondered how many years a man would receive benefits upon retirement at 60 and 65, and how a later exit would affect the usefulness of this system for a particular person.

Life expectancy at birth cannot help with this calculation. We needed to find out how many years an average man has lived who has reached the age of 60. The " Mortality table for the population of Russia for the calendar year 2014 " helped us in this . Source: www.mortality.org - they refer to Rosstat data that were unpublished but available for researchers to request.

To begin with, in 2014, only about 67% of men reached the age of 60 and older, and 57% reached the age of 65. This is a partial answer to the question about the possibility of surviving to retirement. Yes, it is quite possible. In addition, we note that with such an increase in age, 10% fewer men survive before the insured event of pension insurance. Further, all calculations are made for survivors.

How many years on average do people who live up to 60 and 65 receive a pension?

Paying attention to the column “Life expectancy for those who have lived to the age of x years”, we see that at 60, the “average man” will have to live 15.84 years in 2014 and receive 190 pensions, and when leaving 65 years old 13.16 years and 158 pensions.

Yes, one would think that 5 years of raising the retirement age would reduce the length of the “retired” period by 5 years, but this is not so. The probability of death does not increase linearly, which means that in 5 years from 60 to 65 a significantly smaller number of men die, than in the period from 65 to 70 years and so on. An increase in the retirement age by 5 years is a reduction in the period of receiving a pension by an average of 2.68 years or almost 17%.

For women, when they retire at 55, the average life expectancy in 2014 was +25.53 years, and with a retirement age of 63 years — 19 years. Thus, an increase in the retirement age of 8 years for women is a reduction in the period of receiving a pension by an average of 6.48 years or more than 25%!

So, back to the average IT specialist who receives 90 thousand rubles and whose employer transfers 22% to the FIU. In 2018, the limits for the calculation of contributions to the FIU changed - 1,021,000 rubles. (in case of excess, contributions are paid at a reduced rate - 10%). There are also reduced rates for certain types of organizations.

The annual contributions to the FIU for such an employee will amount to 230.5 thousand rubles. Since the total annual income is close to the accrual limit at the rate of 22%, and we don’t know the dates on which the state will raise the limit, we will assume that the growth in wages will exactly correspond to the inflation rate. For calculation, this means that for the rest of his working life, the employee will receive 90 thousand rubles at zero inflation.

We also assume that at the moment the employee is 30 years old and before retiring he will have another 35 years of work experience.

Consider the option when an employee begins to save money for old age on his own in an amount equal to pension contributions.An employee places funds on a bank deposit with a monthly capitalization of interest. Due to zero inflation in the economy, the deposit rate at the bank is only 1% per year.

- On such a deposit, over the course of 35 years, the employee will accumulate 9.6 million rubles. On average, he would have to receive 158 pensions, each of which would be equal to 61,000 rubles in today's prices.

- For an average woman who retired at 63 years with an expected life of another 19 years, an independent pension would be 42,000 rubles a month.

The example with a salary of 90 thousand rubles per month at 2017 prices is indicative of the reason that the total annual income is close to the accrual limit at a rate of 22%. If your salary is lower than 90,000 N times, the expected alternative self-accumulated pension will also differ by N times.

Making deductions for a “private” pension, as in our example, an employee can achieve a wage replacement rate of 67.8% for the average man and 46.7% for the woman. In 2016, this ratio was 33.7% with an average salary in Russia, according to the Federal State Statistics Service, at 36,746 rubles and an average pension of 12,391 rubles.

Thus, we are talking about a twofold difference in the replacement rate for men between the “private” and state pensions.

With the “old”, now existing system of retirement at 60 years old, a male worker will receive an average pension of 15.84 years, which means 190 times. It should also be noted that the employer will make contributions to the FIU for 5 years less, which means that the amount of accumulated funds and interest will be reduced. In our example, it will amount to 8.47 million rubles instead of 9.6 million and 44,600 rubles instead of 61,600 rubles. The replacement rate would be 49.6%.

The calculation for women is 25.53 years in retirement or 306 payments of 27,700 rubles with a replacement rate of 31%.

This means that while before a possible increase in the retirement age, women with a salary below the average in Russia benefited from a state pension that provided 33.7% wage replacement, then after raising the retirement age by 8 years, such an opportunity would “get more private pension” greatly reduced.

Why can’t you switch to a private accumulation model?

The existing model of the pension system is based on the mechanism of intergenerational transfer. In such a system, the pension contributions of people working now go to the payment of pensions to previous generations. Deductions also go to the funded personified part of the pension, but in recent years it has been frozen and may be canceled by replacing it with a voluntary funded pension.

The size of the intergenerational transfer does not allow canceling the existing mechanism, which does not allow accumulating a personal pension and%. To cover pension liabilities to current retirees, a huge amount of financial resources would be required.

The younger generation, or rather its “behavioral irrationality”, can negatively affect the existing model of the pension system. This conclusion was reached by the experts of the Central Bank in the preparation of the report “The Main Directions of the Financial Market for the Period 2019 - 2021” .

“Despite the comparative activity of Russian youth in the formation of savings, the majority of them are inclined to invest free cash in obtaining quality impressions, which are not always oriented toward the future in their motivation.

In addition, the desire to control one’s destiny reduces the tolerance for participation in “joint” schemes. In the medium term, this may undermine the stability of the existing model of the pension system based on the mechanism of intergenerational transfer, ”the report says.

People of the next generation Z (born no earlier than the mid-1990s) have a short planning horizon, and most do not set ambitious goals in order not to be disappointed.

The philosophy of the consumer society - “live your life here and now” - leads to an increase in the level of debt, improving the short-term prospects for the production of goods and services, but creates potential risks for longer-term prospects.

This really poses a threat to the existing pension system in Russia, based on the continuity of generations, not only personal, within the same family, but in general, through a system of redistribution of resources through the national Pension Fund.

Conclusion

Readers who want to confidently meet old age are advised to look into the Geek Health hub in order to reach the age of receiving a state pension, as well as save money for a “private” pension, which, as calculations have shown, is more effective.