Amazing near or how to mock stock analysts (using Excel)

From channels like CNBC, people in suits and expensive accessories broadcast with a clever air about the alleged movement of a course. As a visual aid, they use course graphs with lines of various indicators and figures of technical analysis drawn on top of them.

An indicator (in the context of this article) is just some kind of function over the price. For example, a moving average. There are hundreds of different indicators.

A technical analysis figure is some well-known pattern, for example, a triangle, a double bottom, a head and shoulders. These figures are also hundreds.

The “science” of technical analysis associates certain combinations of indicators and figures with the likely future behavior of the course. For example, if a course crossed the moving average of 10 days, touched the average of 100 days, and looks like a Flag figure, then the course will probably go there.

There are a lot of analysts, and they give different forecasts, and given that the course can go only up or down, there is always a large set of analysts who claim that they have carried out the “correct analysis”.

Perhaps you also think that these exchange analysts are some very smart people. I will try to dispel this view.

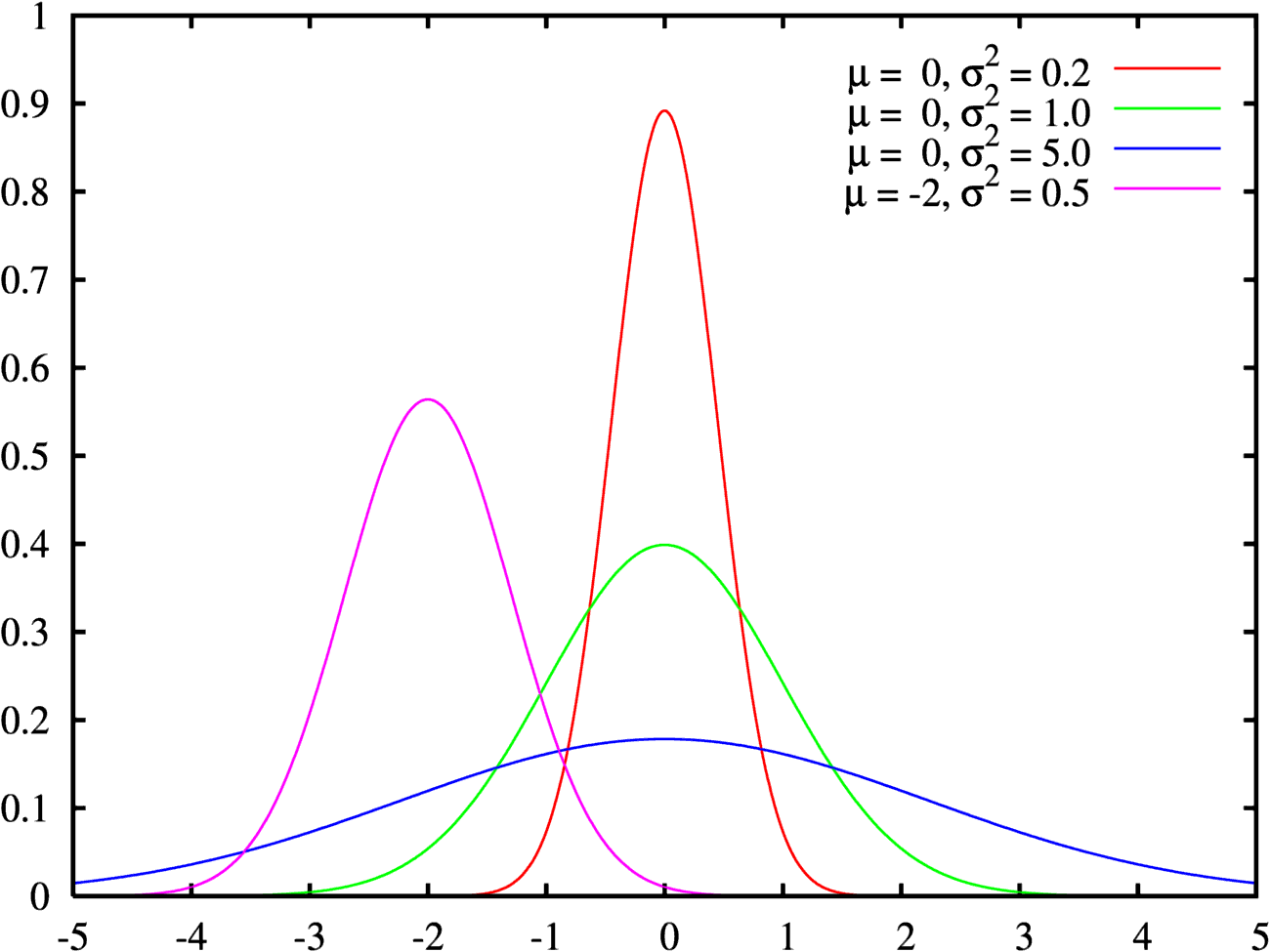

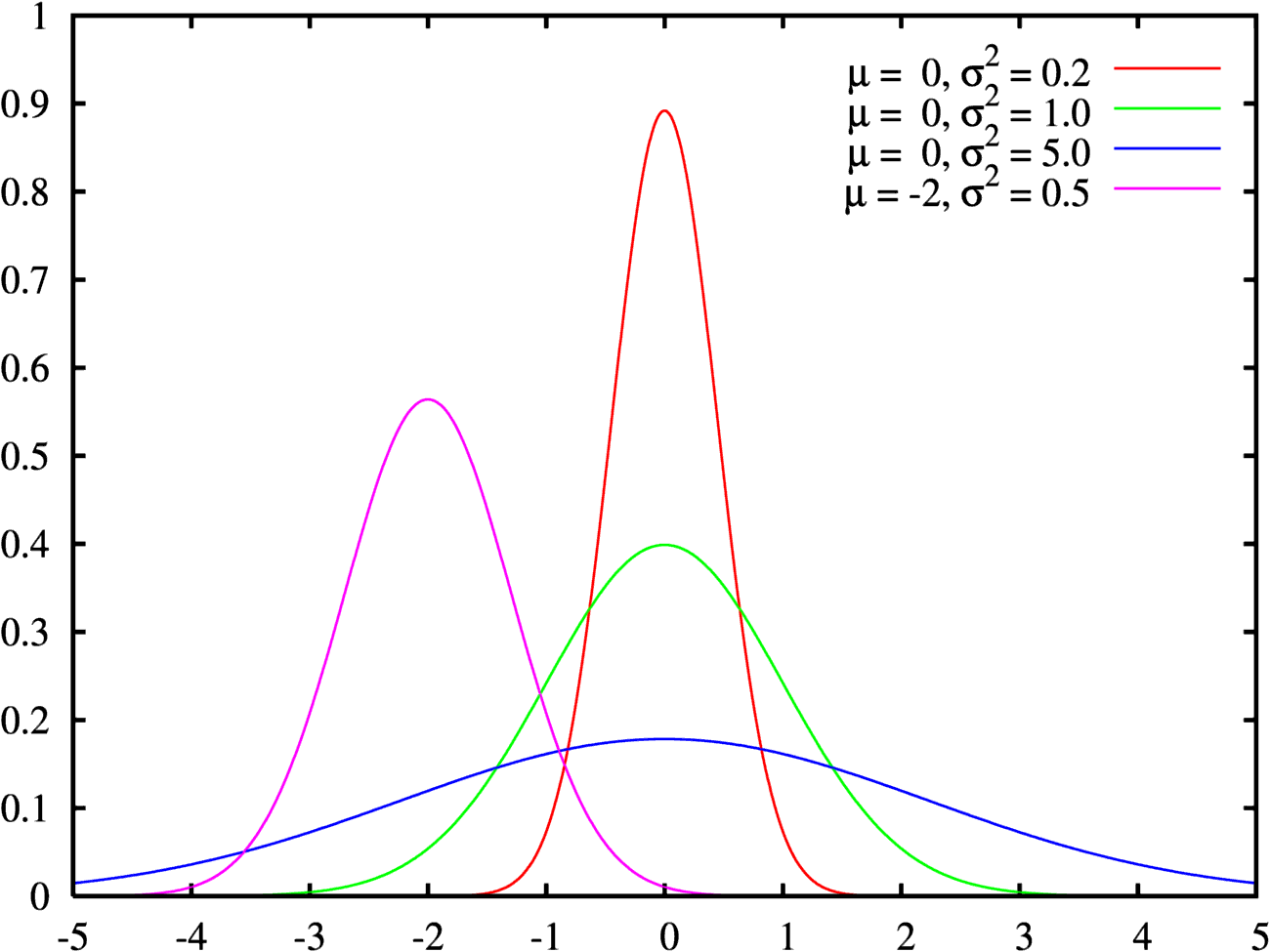

To begin with, the question is: let's say we have 1000 values of a random variable distributed according to the normal law, with a mathematical expectation of 0, and a variance of 1. (The green curve in the picture):

These values will be positive and negative, more or less symmetrical with respect to 0, and usually no more than 3x, no less than -3x.

If you plot these values, you will get something like a strip from 3 to -3.

And if we now make a series of amounts:

Amount 1 to 2

Amount 1 to 3

Amount 1 to 4

...

Amount 1 to 1000

What do you think the graph of these amounts will look like?

Arguing logically, we can say “well, there are symmetrically distributed positive and negative numbers. The graph of sums will resemble the graph of the original random variable - something so fluctuating around 0 ”

Do you also think so?

If yes, then let's take Excel and check.

To get started, takerandom data (it is possible to generate in Excel)

Now wait a minute .

And now the schedule. How do you like the result? They did not expect?

Generate new data, how do you like the new chart?

Well, now you can go to a familiar analyst. Do not say that these are random variables, say that these are some stocks and you need help with technical analysis.

Enjoy “smart” discourse on “obvious” trends, trend breaks, bounces and breakouts.

If someone is interested in the theory, then you need to google “wandering of a point on a line” and “the arcsine theorem”.

For the lazy - sample charts:

An indicator (in the context of this article) is just some kind of function over the price. For example, a moving average. There are hundreds of different indicators.

A technical analysis figure is some well-known pattern, for example, a triangle, a double bottom, a head and shoulders. These figures are also hundreds.

The “science” of technical analysis associates certain combinations of indicators and figures with the likely future behavior of the course. For example, if a course crossed the moving average of 10 days, touched the average of 100 days, and looks like a Flag figure, then the course will probably go there.

There are a lot of analysts, and they give different forecasts, and given that the course can go only up or down, there is always a large set of analysts who claim that they have carried out the “correct analysis”.

Perhaps you also think that these exchange analysts are some very smart people. I will try to dispel this view.

To begin with, the question is: let's say we have 1000 values of a random variable distributed according to the normal law, with a mathematical expectation of 0, and a variance of 1. (The green curve in the picture):

These values will be positive and negative, more or less symmetrical with respect to 0, and usually no more than 3x, no less than -3x.

If you plot these values, you will get something like a strip from 3 to -3.

And if we now make a series of amounts:

Amount 1 to 2

Amount 1 to 3

Amount 1 to 4

...

Amount 1 to 1000

What do you think the graph of these amounts will look like?

Arguing logically, we can say “well, there are symmetrically distributed positive and negative numbers. The graph of sums will resemble the graph of the original random variable - something so fluctuating around 0 ”

Do you also think so?

If yes, then let's take Excel and check.

To get started, takerandom data (it is possible to generate in Excel)

Now wait a minute .

And now the schedule. How do you like the result? They did not expect?

Generate new data, how do you like the new chart?

Well, now you can go to a familiar analyst. Do not say that these are random variables, say that these are some stocks and you need help with technical analysis.

Enjoy “smart” discourse on “obvious” trends, trend breaks, bounces and breakouts.

If someone is interested in the theory, then you need to google “wandering of a point on a line” and “the arcsine theorem”.

For the lazy - sample charts: