Cryptocurrency payments: the view of entrepreneurs and service providers

For several years of existence, crypto payments have not yet come close to ubiquity. Pay bitcoins for goods and services can only be in selected stores, and the daily use of cryptomattes and not worth talking about.

What prevents crypto payments to gain global popularity and why are entrepreneurs in no hurry to use a crypt? What problems do crypto payment providers face? We understand the material of two studies.

Blockchain Speaker & Bitcoin Conference Prague , co-founder of the Graft Blockchain payment ecosystem, Dan Itkis shared with us the results of a survey conducted by his company. The study revealed the main deterrent and motivating factors that influence the decision of entrepreneurs to work with cryptocurrency.

The survey involved 65 respondents. Of these, 21 own a physical business, 30 own an online business, another 14 - owners of both types of businesses. All of them do not accept payments in cryptocurrency. The survey was conducted using questionnaires. Entrepreneurs were asked about their occupation, factors affecting the implementation of cryptocurrencies, and what they want to see in existing crypto payment systems.

All entrepreneurs in the aggregate

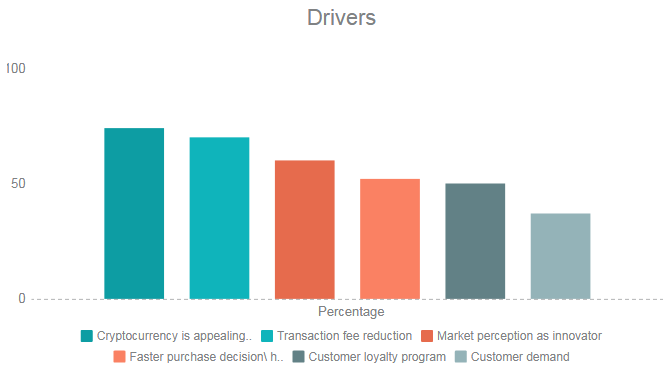

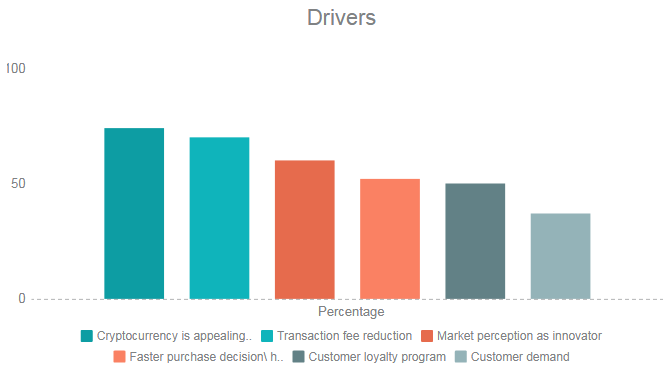

The graph shows the numbers for the total number of respondents. The entrepreneurs admitted that they would be interested in implementing crypto payments, because:

Summing up, you can see that the main driver for implementing crypto payments for business is an increase in profits (which is quite logical). Nevertheless, the status of their company is also important for entrepreneurs. Therefore, some are ready to introduce cryptocurrency payments only in order for customers to consider the company as innovative and advanced.

All entrepreneurs in the aggregate

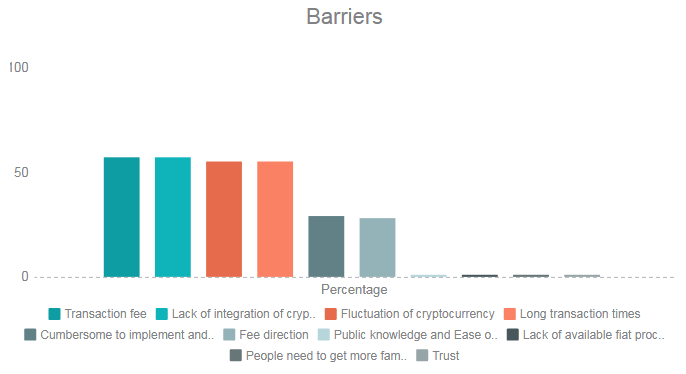

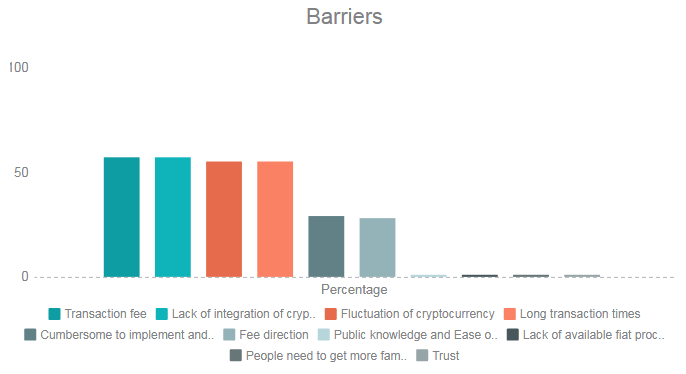

The entrepreneurs indicated the following reasons why they have not yet implemented cryptocurrency payments in their business:

As you can see, the main problems in the way of making cryptocurrency payments are related to the ease of handling for users. Today we have to wait for transactions for too long. Along with this, crypto payments are poorly integrated into modern payment terminals - few people want to deal with the bugs and glitches of cash registers and production accounting systems.

All entrepreneurs in the aggregate

For all respondents it is important that when working with crypto payments there are available:

Obviously, business is waiting for crypto payments to be made as easy as paying with a bank card today. For this you need to solve a number of problems, which will take a lot of time.

A look at the situation from the other side will help research representatives of the Cambridge Center for Alternative Finance at Cambridge University (Cambridge Center for Alternative Finance). It shows that cryptographic payment providers today face a number of problems.

It turned out that the main problem for such companies is related to maintaining relations with banking institutions and money transfer operators. In second place is the observance of all legal requirements - it flies companies in the "penny". And behind them comes the problem of low liquidity in local currency markets.

The problems that concern crypto-payments providers the least are the competition with traditional payment systems like Western Union, as well as fintech organizations.

144 respondents took part in the survey: owners of crypto companies and miners. The study was conducted in 2017 and concerns the global cryptoindustry.

The geography of the providers of crypto payments

in full

Companies from North America, Latin America, Europe, Asia-Pacific, and several African countries that did not significantly affect the overall statistics were selected for the study.

If we summarize all the companies participating in the research and providing crypto-payment services, then the largest percentage of providers were shown by two regions: European and Asian-Pacific - in both 33%. North America comes next - 19%, then Latin America - 11%, and in the end - Africa with 4%.

If you take specific countries, the number of crypto payment providers participating in the study is in the lead of the United States and the United Kingdom (15% each). Third place for South Korea (10%). But for some reason, a huge reservoir of 44% is simply called “other countries”, without explanation.

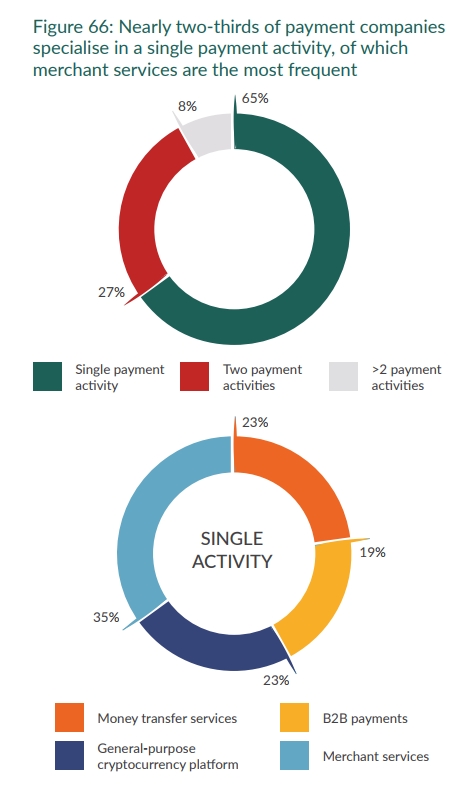

Nearly two thirds (65%) of these companies are involved in only one of four activities:

1. Money transfer services.

2. Universal cryptocurrency platform.

3. B2B payments.

4. Trading services.

27% of companies provide two types of services, and only 8% provide users with three or more services.

Crypto payment providers in Latin America and Asia-Pacific serve mainly local customers - those located in the countries of the region. But in North America and Europe there is a much more diverse portfolio of clients. For example, in Europe, 30% of all consumers of crypto payments are from the Asia-Pacific region. And North American providers are 39% engaged in providing services to European customers.

This difference in customer composition is easily explained: in North America and Europe, providers accept more types of currencies. Companies in Latin America and the Asia-Pacific region work primarily with national currencies.

Despite all the problems, providers and users of crypto payments are becoming more and more. Both those and others seek to improve the conditions in which they have to work, but the widespread introduction of crypto payments will not happen soon.

When exactly will we be able to pay with a cryptocurrency as easily as with a bank card today? What must change in the world of finance for this? These and other questions will be answered by co-founder of the global payment ecosystem Graft Blockchain Dan Itkis - he will speak May 17 in Prague as the speaker of Blockchain & Bitcoin Conference Prague. See the full program of the event on the website .

What prevents crypto payments to gain global popularity and why are entrepreneurs in no hurry to use a crypt? What problems do crypto payment providers face? We understand the material of two studies.

A word to businessmen

Blockchain Speaker & Bitcoin Conference Prague , co-founder of the Graft Blockchain payment ecosystem, Dan Itkis shared with us the results of a survey conducted by his company. The study revealed the main deterrent and motivating factors that influence the decision of entrepreneurs to work with cryptocurrency.

The survey involved 65 respondents. Of these, 21 own a physical business, 30 own an online business, another 14 - owners of both types of businesses. All of them do not accept payments in cryptocurrency. The survey was conducted using questionnaires. Entrepreneurs were asked about their occupation, factors affecting the implementation of cryptocurrencies, and what they want to see in existing crypto payment systems.

What spurs business interest in cryptocurrency?

All entrepreneurs in the aggregate

The graph shows the numbers for the total number of respondents. The entrepreneurs admitted that they would be interested in implementing crypto payments, because:

- cryptocurrencies attract new customers (48 out of 65 - 74% of respondents);

- transaction fees will be reduced (46 out of 65 - 74%);

- business will be perceived as a supporter of innovation (38 out of 65 - 60%);

- customers will quickly make a purchasing decision and will buy more (34 out of 65 - 52%);

- new loyalty programs for customers will appear (33 out of 65 - 50%);

- consumer demand will increase (24 out of 65 - 37%).

Summing up, you can see that the main driver for implementing crypto payments for business is an increase in profits (which is quite logical). Nevertheless, the status of their company is also important for entrepreneurs. Therefore, some are ready to introduce cryptocurrency payments only in order for customers to consider the company as innovative and advanced.

Owners of physical points of sale and online stores had slightly different answers.

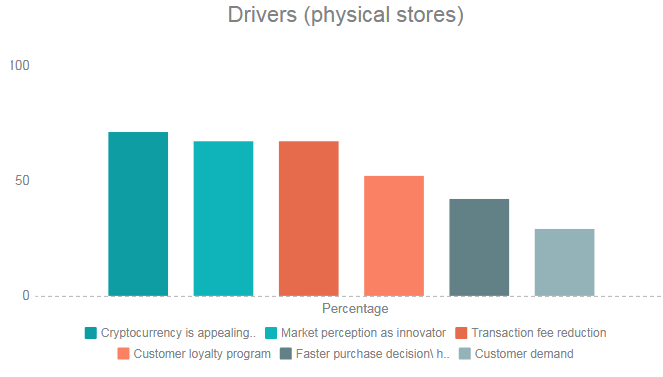

Owners of physical points of sale

Владельцы онлайн-магазинов

Owners of physical points of sale

- cryptocurrencies attract new customers (15 out of 21 - 71% of respondents);

- business will be perceived as a proponent of innovation (14 out of 21 - 67%);

- transaction fees will be reduced (14 out of 21 - 67%);

- new loyalty programs for customers will appear (11 out of 21 - 52%);

- customers will quickly make a purchasing decision and will buy more (9 out of 21 - 42%);

- возрастет потребительский спрос (6 из 21 – 29%).

Владельцы онлайн-магазинов

- криптовалюты привлекают новых клиентов (23 из 30 – 77% опрошенных);

- сократятся комиссии за транзакции (19 из 30 – 63%);

- клиенты быстрее примут решение о покупке и станут больше покупать (18 из 30 – 60%);

- бизнес будет восприниматься как сторонник инноваций (17 из 30 – 57%);

- появятся новые программы лояльности для клиентов (12 из 30 – 40%);

- возрастет потребительский спрос (11 из 30 – 37%).

What prevents the introduction of payments in cryptocurrency?

All entrepreneurs in the aggregate

The entrepreneurs indicated the following reasons why they have not yet implemented cryptocurrency payments in their business:

- high transaction fees (37 out of 65 - 57%);

- lack of integration with payment terminals (37 out of 65 - 57%);

- excessive fluctuation of the cryptocurrency rate (36 out of 65-55%);

- transactions take too long (36 of 65 - 55%);

- it is difficult to implement cryptocurrencies and train employees to work with them (19 out of 65–29%);

- it is not clear who should pay the transaction fee (18 out of 65 - 28%);

- There is no public knowledge about cryptocurrencies and convenience in their use (1 out of 65 - 1%);

- there are no devices available for operations with fiat funds (1 out of 65 - 1%);

- customer distrust (1 out of 65 - 1%).

As you can see, the main problems in the way of making cryptocurrency payments are related to the ease of handling for users. Today we have to wait for transactions for too long. Along with this, crypto payments are poorly integrated into modern payment terminals - few people want to deal with the bugs and glitches of cash registers and production accounting systems.

Answers from owners of physical points of sale and online stores

Владельцы физических точек продаж

Владельцы онлайн-магазинов

- недостаточная интеграция с платежными терминалами (11 из 14 – 79% опрошенных);

- высокая комиссия за транзакции (9 из 14 – 64%);

- транзакции проводятся слишком долго (9 из 14 – 64%);

- чрезмерное колебание курса криптовалют (9 из 14 – 64%);

- сложно внедрить криптовалюты и обучить сотрудников с ними работать (5 из 14 – 36%);

- непонятно, кто должен оплачивать комиссию за транзакции (4 из 14 – 29%).

Владельцы онлайн-магазинов

- высокая комиссия за транзакции (17 из 30 – 57% опрошенных);

- чрезмерное колебание курса криптовалют (15 из 30 – 50%);

- транзакции проводятся слишком долго (14 из 30 – 47%);

- недостаточная интеграция с платежными терминалами (11 из 30 – 37%);

- непонятно, кто должен оплачивать комиссию за транзакции (8 из 30 – 27%);

- сложно внедрить криптовалюты и обучить сотрудников с ними работать (8 из 30 – 27%);

- нет общедоступных знаний о криптовалютах и удобства в их использовании (1 из 65 – 1%);

- нет доступных устройств для операций с фиатными средствами (1 из 65 – 1%);

- недоверие со стороны покупателей (1 из 65 – 1%).

What do entrepreneurs expect from cryptographic payment systems?

All entrepreneurs in the aggregate

For all respondents it is important that when working with crypto payments there are available:

- integration with existing terminals (47 out of 65 - 72% of respondents);

- instant cash payments (40 out of 65 - 62%);

- integration with e-commerce software (40 out of 65 - 62%);

- integration with POS systems (40 out of 65 - 62%);

- tracking integrated loyalty programs (22 out of 65 - 34%);

- the ability to accept cash and convert to cryptocurrency (1 out of 65 - 1%);

- availability of operations through the website (1 out of 65 - 1%).

Obviously, business is waiting for crypto payments to be made as easy as paying with a bank card today. For this you need to solve a number of problems, which will take a lot of time.

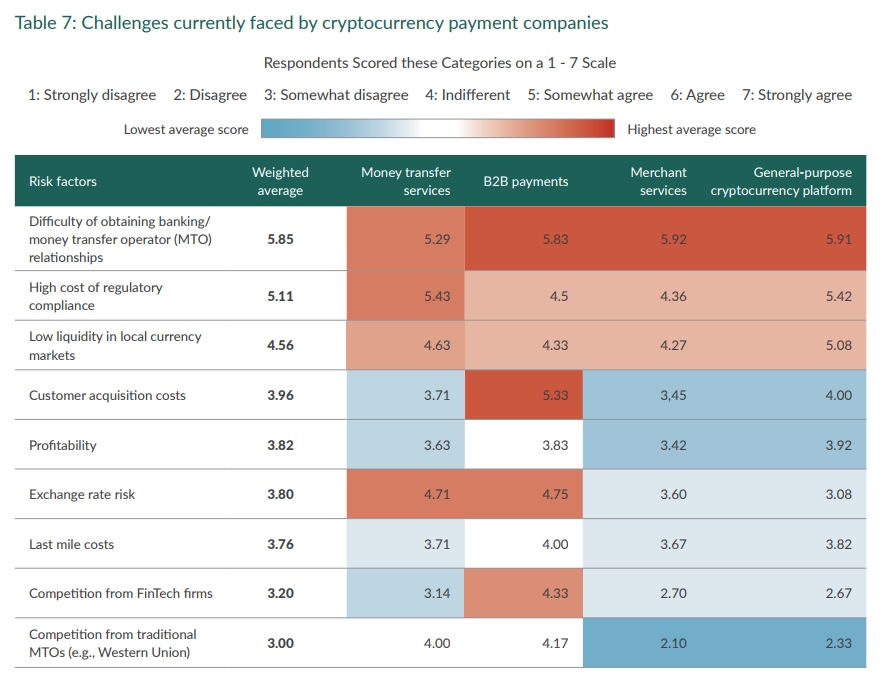

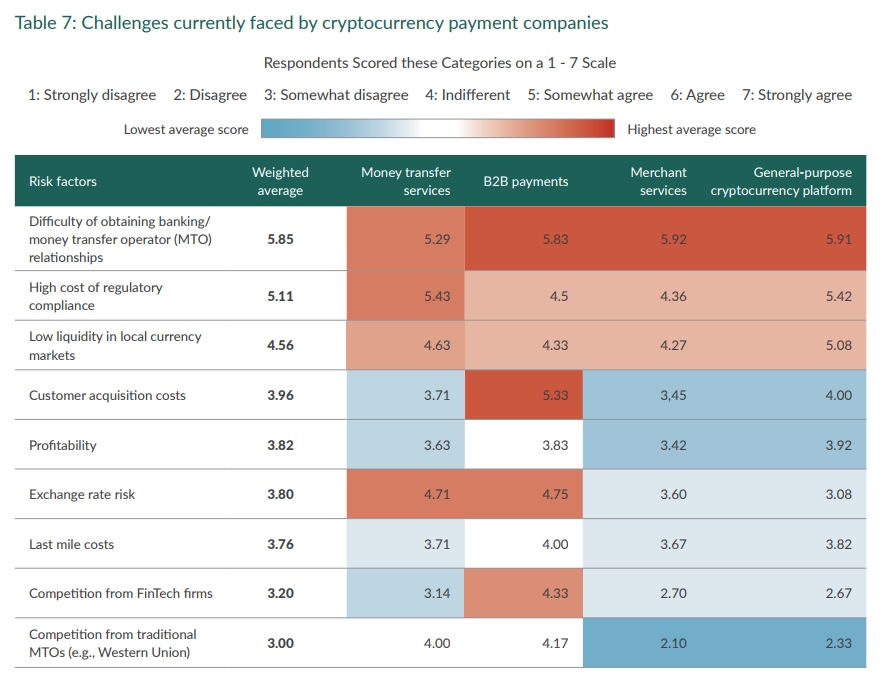

Problems of crypto payment providers

A look at the situation from the other side will help research representatives of the Cambridge Center for Alternative Finance at Cambridge University (Cambridge Center for Alternative Finance). It shows that cryptographic payment providers today face a number of problems.

It turned out that the main problem for such companies is related to maintaining relations with banking institutions and money transfer operators. In second place is the observance of all legal requirements - it flies companies in the "penny". And behind them comes the problem of low liquidity in local currency markets.

The problems that concern crypto-payments providers the least are the competition with traditional payment systems like Western Union, as well as fintech organizations.

144 respondents took part in the survey: owners of crypto companies and miners. The study was conducted in 2017 and concerns the global cryptoindustry.

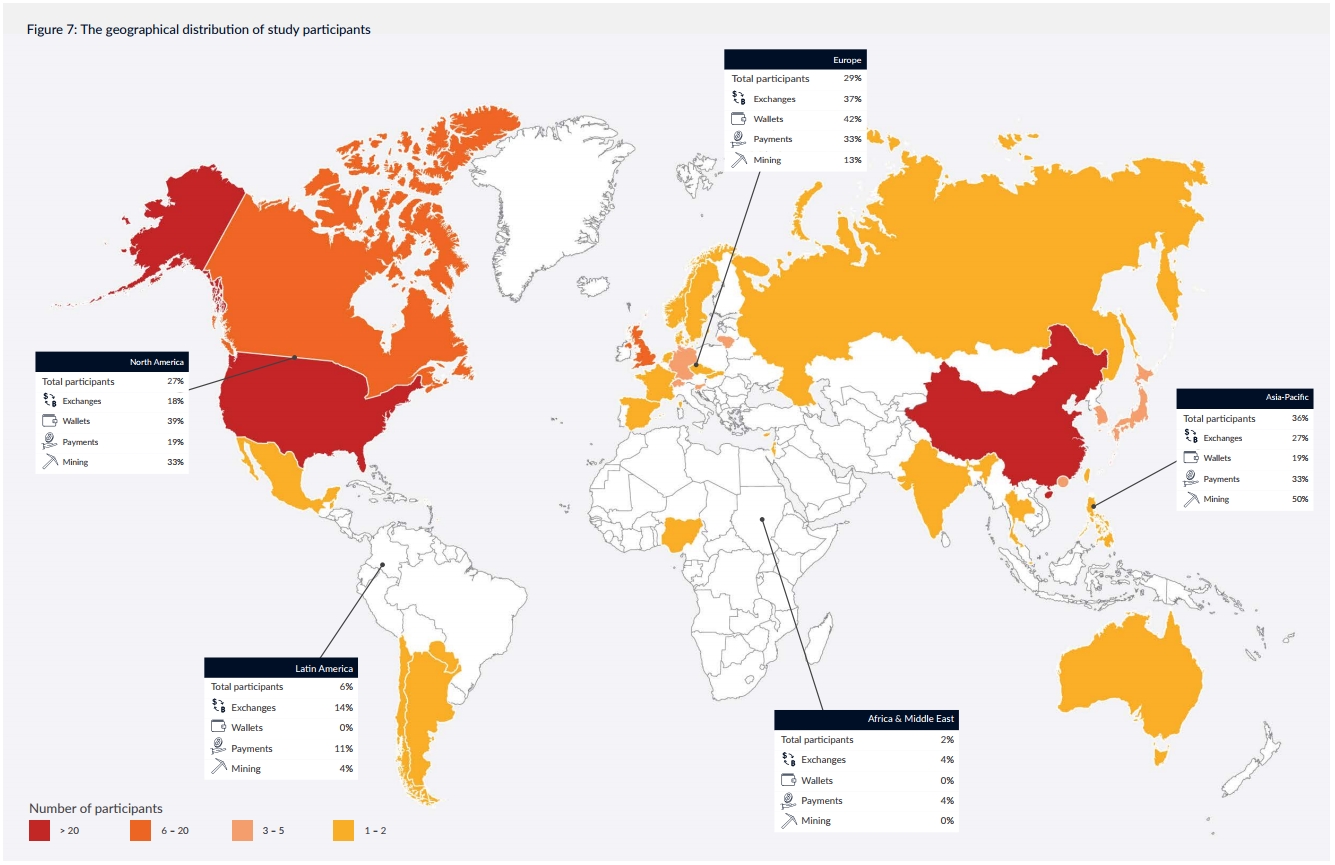

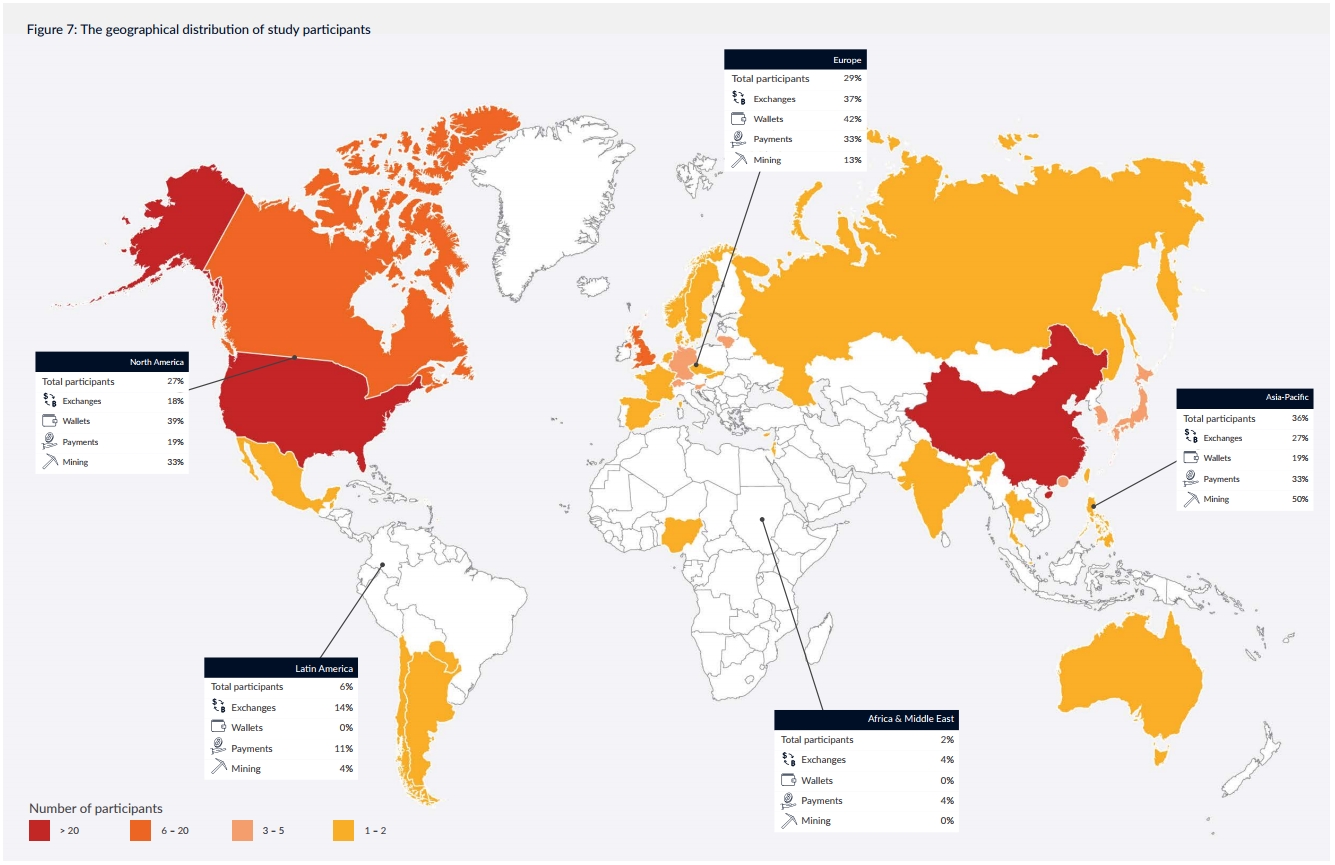

The geography of the providers of crypto payments

in full

Companies from North America, Latin America, Europe, Asia-Pacific, and several African countries that did not significantly affect the overall statistics were selected for the study.

If we summarize all the companies participating in the research and providing crypto-payment services, then the largest percentage of providers were shown by two regions: European and Asian-Pacific - in both 33%. North America comes next - 19%, then Latin America - 11%, and in the end - Africa with 4%.

If you take specific countries, the number of crypto payment providers participating in the study is in the lead of the United States and the United Kingdom (15% each). Third place for South Korea (10%). But for some reason, a huge reservoir of 44% is simply called “other countries”, without explanation.

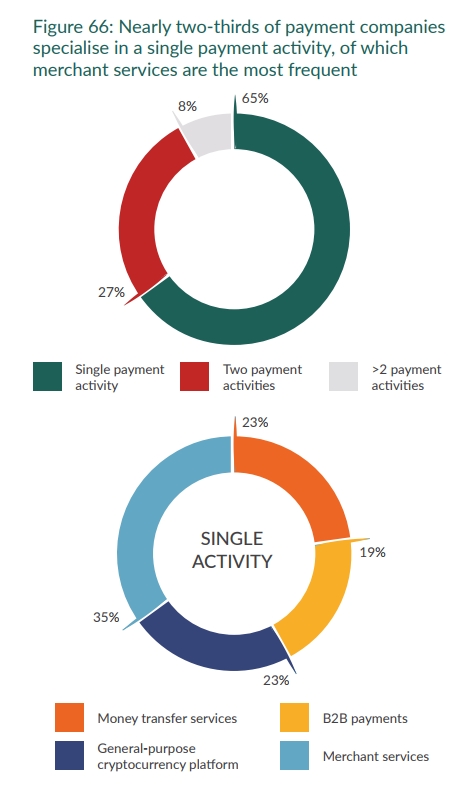

Nearly two thirds (65%) of these companies are involved in only one of four activities:

1. Money transfer services.

2. Universal cryptocurrency platform.

3. B2B payments.

4. Trading services.

27% of companies provide two types of services, and only 8% provide users with three or more services.

Crypto payment providers in Latin America and Asia-Pacific serve mainly local customers - those located in the countries of the region. But in North America and Europe there is a much more diverse portfolio of clients. For example, in Europe, 30% of all consumers of crypto payments are from the Asia-Pacific region. And North American providers are 39% engaged in providing services to European customers.

This difference in customer composition is easily explained: in North America and Europe, providers accept more types of currencies. Companies in Latin America and the Asia-Pacific region work primarily with national currencies.

Despite all the problems, providers and users of crypto payments are becoming more and more. Both those and others seek to improve the conditions in which they have to work, but the widespread introduction of crypto payments will not happen soon.

When exactly will we be able to pay with a cryptocurrency as easily as with a bank card today? What must change in the world of finance for this? These and other questions will be answered by co-founder of the global payment ecosystem Graft Blockchain Dan Itkis - he will speak May 17 in Prague as the speaker of Blockchain & Bitcoin Conference Prague. See the full program of the event on the website .