Tesla Inc. became the most expensive car manufacturer in the USA

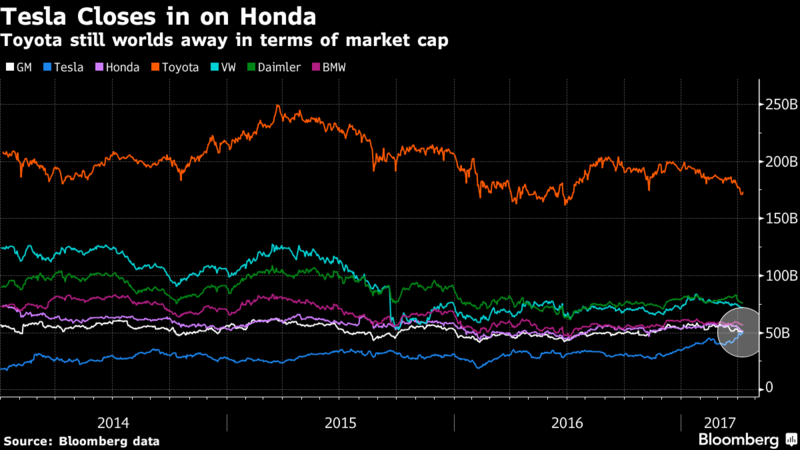

Company Ilona Mask Tesla Inc. (formerly Tesla Motors) was able to bypass the capitalization of General Motors Co., becoming the most expensive car manufacturer in the United States. At the beginning of the week, Tesla shares rose 3.3%, raising the company's capitalization to $ 51.17 billion. At the end of the day, on Monday, Tesla surpassed General Motors by $ 64 million. Now, the electric car manufacturer is only $ 1 billion separated from Honda Motor Co., a company ranked fifth in the list of the five largest car manufacturers in the world.

The increase in stock prices indicates investor confidence in Tesla, now they agree with Mask's opinion on the gradual replacement of conventional cars. “Tesla is associated with many with optimism, feeling, freedom, challenge and other emotions, which, as it seems to us, cannot be repeated by other companies,” said Piper Jaffray Cos analyst Alexander Potter.

A week earlier, the company surpassed the capitalization of Ford Motors, the company ranked third in the ranking of the most expensive US automakers. Ford currently has a capitalization of approximately $ 45 billion.

Investor enthusiasm is not even affected by the fact that Tesla Inc. this year may bring not profit, but losses of almost $ 1 billion. At the same time, GM’s expected profit this year will be about $ 9 billion, Ford’s expected profit of $ 6.3 billion. Mask continues to be unprofitable.

“The value of a company should be determined by financial success, and our financial performance is pretty good,” said Joseph Hinrichcis, Ford Vice President, responsible for his company in the Americas.

After rising stock prices, Tesla ranked sixth in the world in capitalization. The first five places belong to Toyota Motor Corp., Daimler AG, Volkswagen AG, BMW AG and Honda. Toyota's capitalization is now about $ 172 billion, so in order to take first place, Tesla has to work very hard.

“The market is more concerned with Tesla's success in other markets than real profit and revenue,” said David Winston, an analyst at Morningstar Inc. “Right now there is nothing that could slow Tesla. They can get around Honda. ”

Tesla has long been regarded by investors as a company that is able to dominate the market for electric cars and batteries. At the same time, sales of GM and Ford cars are gradually slowing down, which reduces profitability. In 2009, GM declared itself bankrupt, so the state had to save the company. True, a little later this company managed to return to the market again.

By the way, Tesla delivered just 80,000 electric cars last year, which is nothing compared to 10 million cars sold by GM. Until now, Tesla is considered a luxury electric vehicle supplier, but the Model 3 sedan can make a difference. This electric car is more affordable, its cost is about $ 35,000. The battery lasts about 350 kilometers. Despite the fact that GM wins the market due to the price of the competitor Tesla Model 3, the Chevrolet Bolt, the general situation is in favor of the company Mask.

“Even if the launch of Model 3 on sale goes sluggishly, we believe that buyers and shareholders will not be too strict,” said Piper Jaffray.

It is likely that the success of another offspring of Elon Musk, SpaceX, also has an impact on the value of Tesla shares.