An inside look: graduate school at EPFL. Part 4.2: the financial side

- Tutorial

When visiting any country, it is important not to confuse tourism with emigration.

Folk wisdom

Today I would like to consider, perhaps, the most burning issue - the balance of finances when studying, living and working abroad. If in the previous four parts ( 1 , 2 , 3 , 4.1 ) I, as I could, tried to avoid this topic, then in this article we will draw a thick line under the long-term statistics of the balance of wages and expenses.

Disclaimer: The topic is delicate, and very few are willing to cover it openly, however I will try. All that is set out below is an attempt to reflect on the surrounding reality, on the one hand, and also setting out some guidelines for aspirants to Switzerland, on the other.

Country as a tax system

The tax system in Switzerland works the same as the Swiss watch: clearly and punctually. Not paying is quite difficult, although there are different schemes. There are many tax deductions and exemptions (for example, there is a deduction for using public transport, lunch at work, the purchase of representative things if they are required for work, etc.).

As I mentioned in the previous part , Switzerland has a step-by-step taxation system of three levels: federal (the same tariff for all), cantonal (the same for everyone inside the canton) and communal (the same for everyone inside the aka communevillages / cities). In principle, taxes are lower than in neighboring countries, however, additional, actually mandatory, payments eat up this difference, but more on that at the very end of the article.

But all this is good, until you decide to start a family - here taxes are abruptly unsharp, but they increase. This is explained by the fact that now you are a “cell of society”, your income is summed up (hello, progressive scale), that the family will consume more, and the child still needs to give birth, and then kindergartens, schools, universities, many of which are on the state balance, but for which you still have to pay somewhere more, somewhere less. Locals often live in a civil marriage, because the economy must be economical, or they live in cantons with low taxes (for example, Zug), but they work in "fat" cantons (for example, Zurich - about 30 minutes by train from Zug). A couple of years ago there were attempts to rectify the situation and at least not raise taxes for families compared to single people - it didn’t work.

The ups and downs of referenda

Often, under the pretext of useful referenda, they try to smuggle some muddy decisions and proposals. In principle, a common idea is to reduce taxes for married people, and especially with children; The support for this idea at first was very high. However, the Christian party, which launched the referendum, decided at the same time to push the definition of marriage as “union of men and women” - alas, they lost the support of the majority. Tolerance.

However, when you have a child, or even two, then the taxes are slightly reduced, because now you have a new member of the society dependent. And if only one of the spouses works, then you can count on various subsidies and exemptions, in particular, in terms of medical insurance.

If you wanted to manipulate and - God forbid - evade taxes, then in life there is one and only one chance to be caught in tax fraud and to be forgiven. That is, you can retroactively rectify the situation and tarnished reputation, of course, by paying all unpaid taxes. Next - the court, poverty, a lantern, a lumpen tent opposite the Ryumin Palace in Lausanne.

Lumpen tent: selected places of local “intelligentsia” - opposite the museum and library ...

For those who plan to move and pay taxes on their own (for example, through the opening of their own company), here is more chewed.

From the pleasant thing - you can not fill out a tax return until your income does not exceed ~ 120k per year, and the company supports the practice of “taxe a la source”, and the permit is B (temporary). As soon as I received C, or my salary exceeded ~ 120k, please pay taxes yourself (at least in the canton of Vaud you must fill out a declaration). As Graphite notes , in German-speaking cantons like Zurich, Schwitz, Zug or St. Galen, this has to be done. Or if you need to submit documents for deduction (see above + the third pension pillar), then you also need to fill out a declaration (it is possible according to a simplified scheme).

It’s clear that it’s difficult to do it for the first time, therefore, for 50-100 francs, a good uncle fudusier ( aka trehander, German Treuhänder, on the other hand is rushtigraben ) will fill it with you with honed movements (the main thing is to trust, but check!). And next year you can do it yourself in the image and likeness.

However, Switzerland - con federation, and therefore, taxes vary from canton to canton, from city to city and from village to village. In the last part, I mentioned that you can win on taxes by moving to the village. The network has a calculator that clearly shows how much people save or lose from moving from Lausanne to, say, Ekublan (a suburb where EPFL is located).

Panorama of Lake Leman near Vevey to brighten up tax sadness

Air taxes

There are in-kind taxes on air in Switzerland.

Billag or Serafe from 01.01.2019. This is the most “favorite” tax for many - a tax on the potential opportunity to watch television and listen to the radio. That is, in our world - into the air. Of course, the Internet is also included here, and since almost everyone has a telephone (read - a smartphone), it is very, very difficult to get rid of it.

Previously, there was a division into radio (~ 190 CHF per year) and TV (~ 260 CHF per year) for each household(yes, a country chalet is another household), then after a recent referendum, the amount was unified (~ 365 CHF per year, in francs every day), regardless of whether it was a radio or TV, and at the same time they were obliged to pay all households, regardless of the availability of a receiver. In fairness, it is worth noting that students, retirees and - suddenly - an RTS employee do not pay this tax. By the way, for non-payment a fine is up to 5,000 francs, which is sobering in a special way. Although I know a couple of examples when a person has not paid this tax in principle for several years and has not been fined.

Well, and the

If you want a pet, pay a tax (up to 100-150 francs in the city and almost to zero in the village). Do not pay, do not chip the animal - fine-fine! It comes to the ridiculous: the police, while patrolling the streets, stop the Portuguese with the dogs and try to solder them a fine.

And again, I dialectically note that this amount includes bags in which the owners of the animal are required to clean the excrement of their wards, specialized areas for walking large dogs with the appropriate infrastructure, as well as street cleaning and the almost complete absence of stray pets in cities (yes and villages too). Clean and safe!

In general, it is difficult to think of a type of activity that would not be taxed, but taxes are used for the purposes for which they are collected: social programs - social, dogs - dogs, and garbage - trash ... Speaking of garbage!

Garbage sorting

To begin with, every household in Switzerland pays a garbage collection fee (this is such a base fee as tax). However, this does not mean at all that now you can throw any garbage wherever you want. To do this, you have to buy special packages at an average cost of 1 franc for 17 liters. Until recently, they were not only in the cantons of Geneva and Valais, but since 2018 they have also joined. That is why all Swiss so “love” to sort garbage: paper, plastic (including PET), glass, compost, oil, batteries, aluminum, iron, etc. The most basic are the first four. Sorting can significantly save on packages for general waste.

There is a garbage police that can selectively check that you throw it away with paper, compost, or ordinary rubbish. If there are violations (for example, they threw a plastic packaging with paper or a Li-battery into ordinary rubbish), then a person can be found and sentenced to a fine in the garbage itself. In some cases, you can also get a receipt to pay for the hourly work of the garbage detectives themselves, that is, to get to the full. The scale is progressive, and after 3-4 fines a person can be blacklisted, which is already fraught.

Similarly, if there is a desire to throw out the garbage in an ordinary bag in a public place or put it in someone else's trash can.

Insurance is like taxes, but only insurance

In Switzerland there are a lot of all kinds of insurance: unemployment, pregnancy, medical insurance (similar to our compulsory medical insurance and voluntary medical insurance), travel abroad (usually done with OMC), dentist insurance, disability insurance, accident insurance, pension insurance, fire insurance and natural disasters ( ECA ), for renting a rented apartment (RCA), for protection against damage to other people's property (yes, this is different than RCA), life insurance, REGA (evacuation from the mountains, valid in summer on hikes and skiing in winter), legal (for easy and easy communication in the courts) and this is far from complete list. For those who have cars, there’s a whole series: local CTP, CASCO, call for technical assistance ( TCS ) and more.

An ordinary citizen thinks that insurance is such an almshouse where everything is free. I hasten to disappoint: insurance is a business, and business must be profitable, both in Africa and in Switzerland. Conditionally: the amount of fees - the amount of payments - the amount of salary and overhead costs, which, of course, is greater than 0 (at least the same advertising and payment of premiums to insurance agents for new customers) should be noticeably positive. Notice, not equal, not less, but strictly more.

A little more Swiss nature: a look at Montreux from the opposite bank

Here is an example of an honest kidalov out of the blue.

How CSS students threw in 2014

So, the year 2014 was on, I didn’t touch anyone. The Swiss authorities, as part of a routine inspection, revealed that one of the largest insurance companies - CSS - illegally received compensations of 200-300k francs from the budget every year to cover the costs of compulsory medical insurance for students. Damage over 10 years amounted to 3 million francs. And cho, great business!

Just at that time, PhD students were removed from student insurance and forced to pay in full as a working adult (they introduced a qualification for income for the year).

What did CSS do ?! Repented, compensated for something, helped somehow? No, just a notification was sent that from such a date, a respected student is no longer covered by their insurance, and even though the grass does not grow. Everything else is your problem, gentlemen!

Details here .

Just at that time, PhD students were removed from student insurance and forced to pay in full as a working adult (they introduced a qualification for income for the year).

What did CSS do ?! Repented, compensated for something, helped somehow? No, just a notification was sent that from such a date, a respected student is no longer covered by their insurance, and even though the grass does not grow. Everything else is your problem, gentlemen!

Details here .

Medical insurance: when it is too early to die, but it is too late to treat

And, since the conversation turned to medical insurance, then it is worthwhile to stop separately, since the topic is extremely complex and very ambiguous.

Switzerland has a system of co-financing medical services, that is, each month the insured pays a certain amount, then the client pays up to the amount of the deductible on his own. The system is so tuned that increasing the deductible decreases in proportion to the monthly contribution, so if you do not plan to get sick and you have no family / children, then safely take the maximum deductible. If the treatment costs more than the deductible, then the insurance begins to pay for it (in some cases, the client will be required to pay another 10%, but not more than 600-700 per year).

Total, the maximum that the insured pays from his pocket - 2500 + 700 + ~ 250-300x12 = 6200-6800 per year per adult working person. I repeat: this is actually a minimum without subsidies.

Firstly , if you intend to ride ambulances or wallow in hospitals for a long time, I advise you to take care of a separate insurance that will cover these costs.

For example, a friend of mine fainted at work, compassionate colleagues called an ambulance. From the place of work to the hospital - 15 minutes on foot ( sic! ), But you need to ambulance along the roads to a detour, which also takes about 10-15 minutes. Total, 15 minutes in ambulance cost ~ 750-800 francs(something around 50k wooden) per call. So, even if you give birth - take a taxi better, it will cost about 20 times cheaper. The ambulance here is only for really difficult cases.

For reference: a day in a hospital costs from 1,000 francs (depending on procedures and department), which is comparable to a stay in Montreux or Lausanne Palace (hotels of the level of 5 stars +).

SecondlyDoctors are one of the highest paid professions, even if they do nothing. 1 minute of their time costs x credits (each doctor has his own “rating” depending on specialization and qualifications), each loan costs 4-5-6 francs. The standard reception is 15 minutes, which is why everyone is so friendly and ask about the weather, well-being and so on. And since medical treatment is a business (well, through insurance, of course), and business should be profitable - well, you understand, yes ?! - the price of insurance grows on average by 5-10% per year (there is almost no inflation in Switzerland, you can take a mortgage at 1-2%). For example, from 2018 to 2019, the difference was 306-285 = 21 francs or Assura 7.3% for the simplest insurance.

And as another cherry on the cake, to win a dispute with local doctors who harmed the patient’s health is an extremely costly and problematic social contest. Actually, for these purposes, there is its own insurance - legal, which is inexpensive, but it fully covers the costs of lawyers and courts. You don’t have to go far for an example : how can you mix up 98% acetic acid and diluted vinegar (just try to open both bottles at your leisure) - I don’t even know.

About the death of the ex-head of Fiat (to put it mildly, not a poor man) in Zurich after a minor operation, I generally am silent.

Apples in the snow: that same hike when we started to calculate how much our evacuation would cost, and some medical aid. Still 32 km instead of 16 - it was a setup

Thirdly , the rather mediocre quality of basic medicine (this is not when to collect arms and legs in one body after an accident, but to make a diagnosis and prescribe a cold treatment). It seems to me that a cold is not considered a disease here - they say, it will pass by itself, but for now, drink paracetamol.

I have to search through acquaintances of sensible doctors (for an explanatory record for 2-3 months in advance), and bring drugs from the Russian Federation. For example, the analgesic / anti-inflammatory Nimesil or Nemuleks costs 5 times more expensive, and in a pack often 2 times less tablets, about any Mezim, to digest fondue or raclette, I generally am silent.

Fourth, stories about long lines in anticipation of medical care are more likely a prose of life than something unbelievable. In any hospital / hospital (analogue of ambulance) there is a priority system, that is, if you have a deep cut of your finger, but don’t whip blood per liter per hour, then you can wait for an hour, two, three, or even four to five hours! Alive, breathe, life is not in danger - sit and wait. Similarly, an x-ray of a broken finger can be waited up to 3-4 hours , despite the fact that this procedure takes 1-2 minutes (put on a lead vest, the nurse set up the shooting, the click and the x-ray is already digitally displayed on the screen).

Fortunately, this does not apply to children. All “breakdowns” of children are usually eliminated out of turn, and insurance itself is several times cheaper than that of adults.

Private example

A small child broke his nose and was hospitalized. In total, the treatment (including medicines) cost 14,000 francs, which was almost completely covered by the insurance, while parents gave 400 francs out of their pocket. Is it expensive or not? Write in the comments!

A spoon of honey. Despite the fact that this insurance should be profitable to its owners, there is good news - in Switzerland it is relatively good at its function. For example, on the very eve of the new year, misfortune happened - he put a finger on a broken glass. We were just setting off to celebrate the New Year in France, so we were already sewing in Annecy. They waited ~ 4 hours , 2 hours to the ward and 2 hours on the "operating table". The check was sent to the insurance with a brief description of the situation (the EPFL has a special form). Formally, the 29th - ½ working day, which the professor gives us as a day off, i.e. accident insurance fully covers.

Collage from friends. Caution, tin - I warned

Pension system

I will not be afraid of this word and I will call the Swiss pension insurance system one of the most thoughtful and fair in the world. This is such a nationwide insurance. It is based on three pillars , or pillars.

The first pillar is a kind of analogue of the social. pensions in the Russian Federation, which include disability pension, survivor's pension, and so on. Deductions for this type of pension are paid by all who have an income of more than 500 francs per month. It is also worth noting that the unemployed spouse in the presence of minor children takes into account the years of the first pillar, similar to the working spouse.

The second pillar is the labor funded part of the pension. Mothier-mothier (50/50) is paid by the employee and the employer with a salary of 20,000 to 85,000 francs per year. With a salary above 85,000 francs (in 2019, this is 85,320 francs 00 centimes) the insurance premium is not paid automatically and the responsibility is transferred to the employee (for example, he can deposit money into the third pillar).

The third pillar is a purely voluntary activity to accumulate pension capital. Approximately 500 francs per month can be deducted from taxation, postponing to a special account.

It looks something like this:

Three pillars of the Swiss pension system. Source

Good news for foreigners: when leaving the country for permanent residence in another country that has not signed an agreement with the Confederation on the pension system, you can pick up the 2nd and 3rd pillar almost completely, and the first partially. This is a huge advantage for foreign workers compared to other countries.

However, this does not apply to departure to EU countries or countries that have signed an agreement with the confederation on the pension system. Therefore, leaving Switzerland, it makes sense for several months to move to their homeland.

Also, the second and third pills can be used when starting a business, acquiring real estate and as a contribution on a mortgage. Very convenient mechanism.

As elsewhere in the world, the retirement age in Switzerland is set at 62/65 years, despite the fact that retirement is possible from 60 to 65 years with a corresponding reduction in payments. However, now there is talk of letting the employee decide when to retire from 60 to 70 years. For example, Gratzel still works at the EPFL, although he is 75 years old.

To summarize: what does the employee pay in the form of taxes?

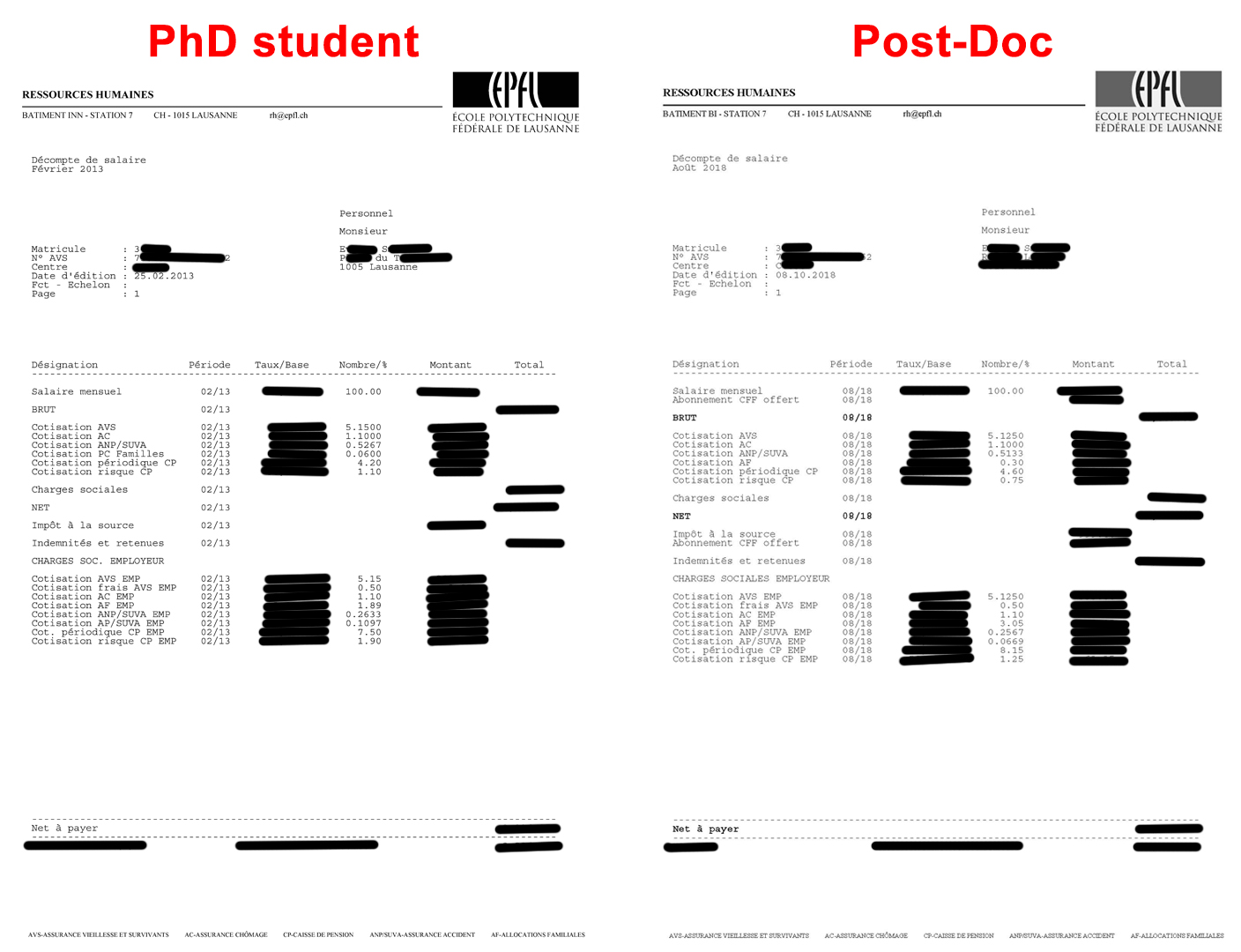

Below I give salary statements that show what exactly and to what extent is kept from a working employee, for example, in state institutions (EPFL):

Legend: AVS - Assurance-vieillesse et survivants (old-age insurance aka first pillar), AC - unemployment insurance, CP - caisse de pension ( aka second pillar pension fund ), ANP / SUVA - assurance accident (accident insurance), AF - allocations familiales (tax from which family benefits will be then paid).

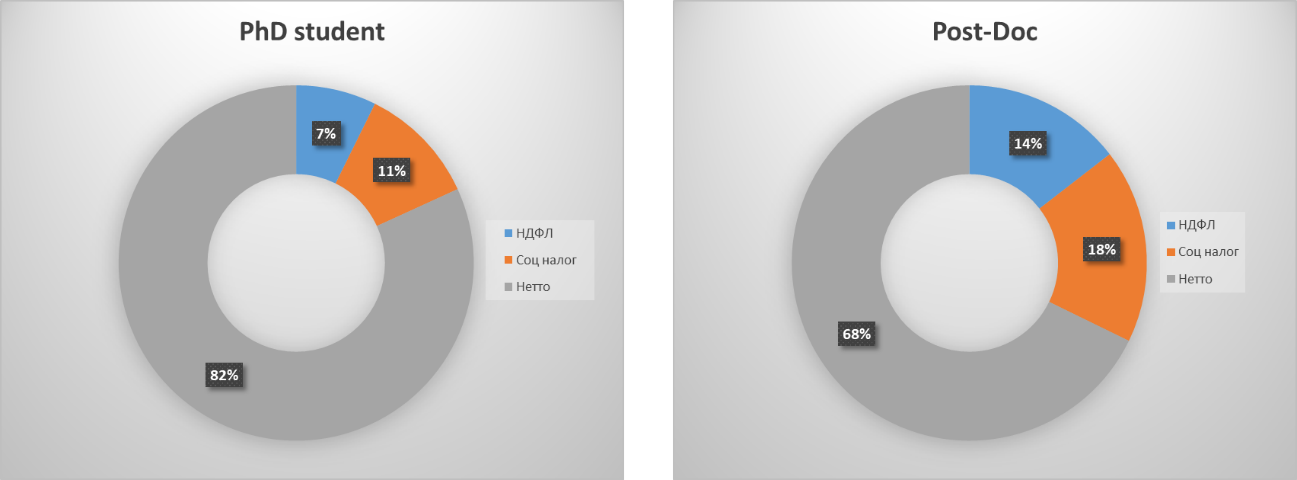

Total, the total tax burden is about 20-25%. She swims slightly from month to month (at least in the EPFL). One Argentinean acquaintance tried to find out (an Argentinean with Jewish roots;)) and to figure out how this happens, but it is unknown to anyone except those who are spinning in the EPFL accounting system. However, at least the annual income tax rate and evaluate the progressive scale can be in the second part of the document .

Plus, do not forget to add insurance of your choice, but mandatory payments will be added at least another 500-600 francs. That is, the "total" tax, including all compulsory insurance and payments, has already exceeded 30%, and sometimes reaches 40%, as, for example, among graduate students. Of course, living on a post-dock salary is freer, although in percentage terms the post-dock pays more.

Student PhD and Post-Doc Revenue Structure in EPFL

Housing: rent and mortgage

Specially made in a separate topic, since the hottest expense item in Switzerland is housing. Unfortunately, the shortage in the housing market is enormous, housing in itself is not cheap, so the amount that you have to pay for rent is sometimes just cosmic. However, the price per square meter is growing disproportionately to the increase in housing.

For example, studio 30-35 m 2 in the center of Lausanne can cost 1100 and 1300 francs, but an average value of about 1,000 francs. I even saw a studio in the garage, but furnished, in Morge-St.Jean (not the most popular place, frankly) for 1,100 francs. With Zurich or Geneva it’s even worse, so there are few who can afford an apartment or a studio in the center.

This was my first

This is how the new studio in Lausanne looks like A

one-room apartment (1.0 or 1.5 rooms is when the kitchen is formally separated from the living room, and the so-called living room or hall is considered to be 0.5 for a similar area of approximately 1100- 1200, two-room (2.0 or 2.5 rooms in 40-50 m 2 ) - 1400-1600, three-room and above - an average of 2000-2500.

Naturally, it all depends on the area, amenities, proximity of transport, whether there is a washing machine (usually this is one machine for the whole staircase, and in some old houses there isn’t even that!) And a dishwasher and so on. Somewhere on the outskirts of an apartment I can cost 200-300 francs, but not at times, cheaper.

It looks like a two-bedroom apartment in Montreux

That is why Switzerland often has a “communal” housing

Well, the search for your own home is also a lottery. In addition to salary statements, permits (permits to stay in the country) and pursuit (the absence of any debts), it is also necessary to be the chosen landlord (usually this is a company), which has a whole queue of suffering, including Swiss. I know people who, like when looking for a job, write motivational letters for landlords. In general, the option of a communal apartment through friends and acquaintances is not so bad.

Briefly about buying a home. Naturally, you can’t even dream of buying your own home in Switzerland to the position of full professor, because real estate can cost space money. And, accordingly, permanent permite C. Although Graphite corrects: “L - only the purchase of the main housing, in which you will actually live (you can’t register and then move out - check). In - one unit of the main and one unit of "cottages" (chalets in the mountains, etc.). C or citizenship - purchase without restrictions. You can give a mortgage on V Permit without any problems if you have a good permanent job. ”

For example, a house on the beach in the rich village of St-Sulpice will cost 1.5-2-3 million francs. Prestige and show off are more expensive than money! However, an apartment in a village near Montreux overlooking the lake and 100 meters from it 300,000 - 400,000 (the studio can be found up to 300,000). And again, we return to the previous article, where I mentioned that villages in Switzerland are in certain demand, when for the same 300-400-500k francs you can get a whole house with a house plot.

At the same time, as mentioned above, you can use pension money to buy real estate, and a “nice” bonus to this is a mortgage loan fee, which can be 500, 1000, and 1500 francs per month, i.e. comparable to rent. It is beneficial for banks to have, in every sense of the word, a mortgage, since property in Switzerland is only growing in value.

Repair in the apartment according to Russian patterns (to hire a team either from the Internet or from a neighboring construction site) is unlikely to be possible, since only specially trained people have access to electrics, ventilation, and heating. Most likely, these will all be different people, and the payment for each hour is 100-150 francs per hour. Plus, it is necessary to obtain permissions and approvals from the governing and controlling bodies, for example, to remodel the bathroom or replace the batteries. In general, you can give another half of the cost of housing only for its repair.

To make it a little more colorful and understandable in which habitat they live, I prepared a short video with a story about where I lived.

Part one about Lausanne:

Part Two about Montreux:

Well, in fairness, it is worth noting that students are often provided with dormitories on the campus of the university. The rental price is moderate, for the studio you can give 700-800 francs per month.

Oh yes, and the last thing, do not forget to add 50-100 francs per month of utility bills to the amount of the rent itself, which include electricity (about 50-70 per quarter) and heating with hot water (everything else). Although heating and hot water are by and large all the same electricity or sometimes gas, which are used in boilers installed in each house.

Family and kindergartens

Once again, family is not a cheap business in Switzerland, especially when there are children. If both work, the tax is taken from the total family income, i.e. higher, life in a kopeck piece comes out cheaper, you can save a little on food and entertainment, but in general it turns out bash on bash.

Everything changes abruptly when children appear in the family, as kindergarten in Switzerland is a very expensive pleasure. At the same time, in order to get into it (we are talking about more or less accessible state gardens), you must sign up almost in the first weeks of pregnancy. And given that the decree lasts for

In fairness, it is worth noting that almost all firms provide benefits, one-time payments, part-time jobs (80% of 42 hours a week, for example) and other buns to support new parents. Even SNSF grants provide for the so-called family allowance and children allowance, that is, a small surcharge for the maintenance of families and children, as well as a 120% program, when 42 hours for a working parent are considered 120% of the working time. It is very convenient to spend one extra day a week with your child.

Nevertheless, the cheapest kindergarten, as far as I know, will cost parents 1,500-1800 francs per month per child. In this case, most likely, children will eat, sleep and play in the same room, changing, so to speak, surroundings. And yes, kindergarten in Switzerland usually works up to 4 days, i.e. one of the parents still has to work part-time.

In general, the breakeven threshold is ~ 2-2.5 children, i.e. if there are 3 or more children in a family, then it is easier for one parent to stay at home than to work and pay for a kindergarten and / or nanny. A nice bonus for parents: kindergarten expenses are deductible from taxes, which makes a significant contribution to the budget. Plus, the state pays 200-300 francs per month for each child (depending on the canton), starting from 3 to 18 years. This also applies to expats who came with children.

And although in Switzerland there are many goodies for families with children, such as benefits, tax breaks, almost free educational institutions, subsidies (for health insurance or even garbage bags from the commune), the latest rating speaks for itself.

Scrupulous debriefing

It seems that they sorted out the balance of income and expenses, now it is time for some statistics on the basis of almost 6 years of stay in Switzerland.

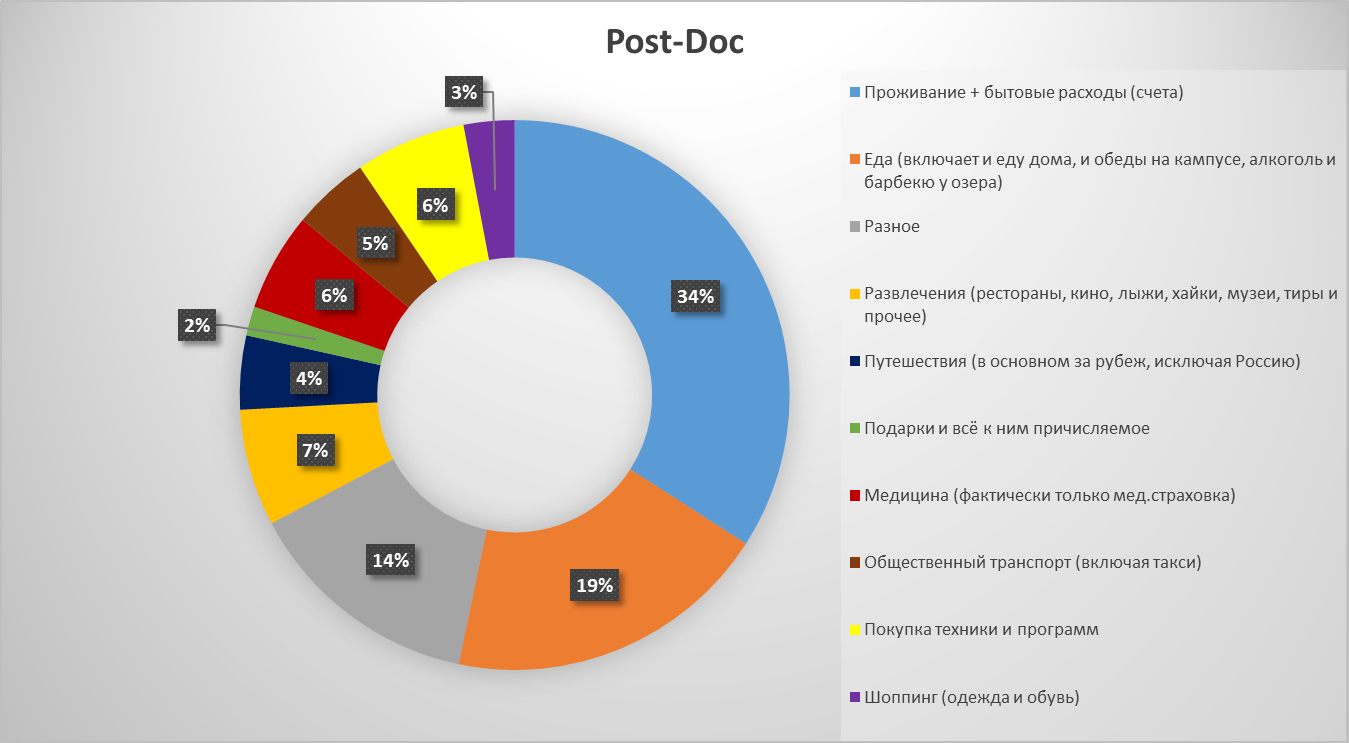

During graduate school, I did not have the goal of living as economically as possible in order to postpone the financial fat somewhere in the depths of Swiss banks. However, the food, I think, could be reduced by a third or a quarter. Post-doc post-

graduate student cost structure in EPFL

Post-doc cost structure in EPFL

At the beginning of 2017, after defending my dissertation, I was forced to move to another application for calculating expenses, in connection with which the categories changed slightly, but on the graphs they are painted in identical colors. For example, the categories of accommodation, household expenses and communications merged into one “Bills” (or accounts).

About mobile internet and traffic

The Bills category also included bills for mobile Internet, which at some point in time began to fly away only on the road (tariff with prepaid traffic). I usually use this internet to work while traveling on the most traveled trains in Switzerland. At some point in time: statistics on traffic packets on the tablet: 01-1x, 02-2.5x, 03-3x, 04-2x, 05-2x, where x = 14.95 CHF for 1 Gb of traffic. I noticed this somewhere in March-April and slightly moderate my appetites.

Returning to medicine and insurance, we can clearly see that if a graduate student spends about 4-5% of his income on health insurance, then the post-dock spends 6%, while his salary is higher.

In addition, with an increase in income (graduate student -> post-doc), the percentage ratio of the first two categories of expenses practically remained the same - ~ 36% and 20%, respectively. Indeed, no matter how much you earn, you still spend it all!

Public transport is more likely an indicator of expenses for taxis and airplanes, since EPFL paid for a subscription throughout Switzerland for 4 years, which he wrote about in the previous part .

Some fun facts:

- I bought my main computer, as well as a laptop, back in 2013, however, the cost of buying equipment for 2 years of the postdock increased in percentage terms, and therefore in real terms. Most likely, this purchase of a 4K monitor and video card had such an effect, plus if earlier it was possible to collect a normal computer for ~ 1000 francs and it was already considered a little expensive, today top-end hardware can cost 2000, 3000, and even 5 thousand. And, of course, Aliexpress is doing its job: a lot of small purchases - and voila, the wallet is empty!

- spending on shopping increased significantly ( aka clothes). In my opinion, this is due to a drop in the quality of goods, as in the sale of products they rely on reducing everything and everything (portions, volumes, etc.). If earlier it was possible to buy shoes and wear them for 2-3, and sometimes even 4 years, then now everything has become simply disposable (the last example is shoes from one German well-known company that “fell apart” in two ( sic! ) Months) .

- Gifts cringed twice, i.e. in fact, expenses in real terms remained almost at the same level - the number of friends / events attended was almost constant.

That's all folks! I hope that my articles will answer the lion's share of questions about moving and living in Switzerland. I will show and tell some aspects and moments on YT:

KDPV is taken from here

PS: since this is the last article of this series, I would like to leave here two facts about Switzerland that did not appear in previous articles:

- In Switzerland, you can easily find coins until 1968, when the monetary reform took place, and old, still silver francs were replaced with ordinary nickel coins.

- Lovers of apocalyptic investments who buy physical gold prefer special Swiss gold coins - they are associated with reliability.

PPS: For the proofreading of the material, valuable comments and discussions, my big, great gratitude and appreciation to my friends and colleagues Anna, Albert ( qbertych ), Anton ( Graphite ), Stas, Roma, Julia, Grisha.

Minute of advertising. In connection with the latest trends of “fashion”, I would like to mention that this year Moscow State University opens a permanent campus (and has been teaching for 2 years!) Of a joint university with the Beijing Polytechnic in Shenzhen. There is an opportunity to learn Chinese, as well as get 2 diplomas at once (IT specialties from VMK MSU available). More information about the university, directions and opportunities for students can be found here .

Do not forget to subscribe to the blog : it’s not difficult for you - I am pleased!

And yes, please write about the shortcomings noted in the text in the PM.