What is Initial Exchange Offering (IEO) and how is it different from ICO?

At the beginning of 2017, there was an ICO boom in which a lot of people were deceived. Now ICO has been replaced by IEO, which should reduce the number of scam projects. Earlier, I already wrote about IEO from Huobi, I advise you to look.

What is IEO?

The initial exchange offer, as its name implies, is held on the exchange platform. Unlike Initial Coin Offerings (ICO) , IEO is managed by the exchange on behalf of a startup that is trying to raise funds using its recently released tokens.

Since the sale of tokens is carried out on the exchange platform, token issuers must pay a listing fee along with the percentage of tokens sold during IEO. In turn, crypto startup tokens are sold on exchange platforms, and their coins are transferred after the end of IEO.

IEO members do not send money to a smart contract such as an ICO. Instead, they should create an account on the exchange platform where IEO is conducted. Then, participants deposit funds into their exchange wallets with the help of coins, and use these funds to purchase tokens of the fundraising company.

IEO on stock exchanges

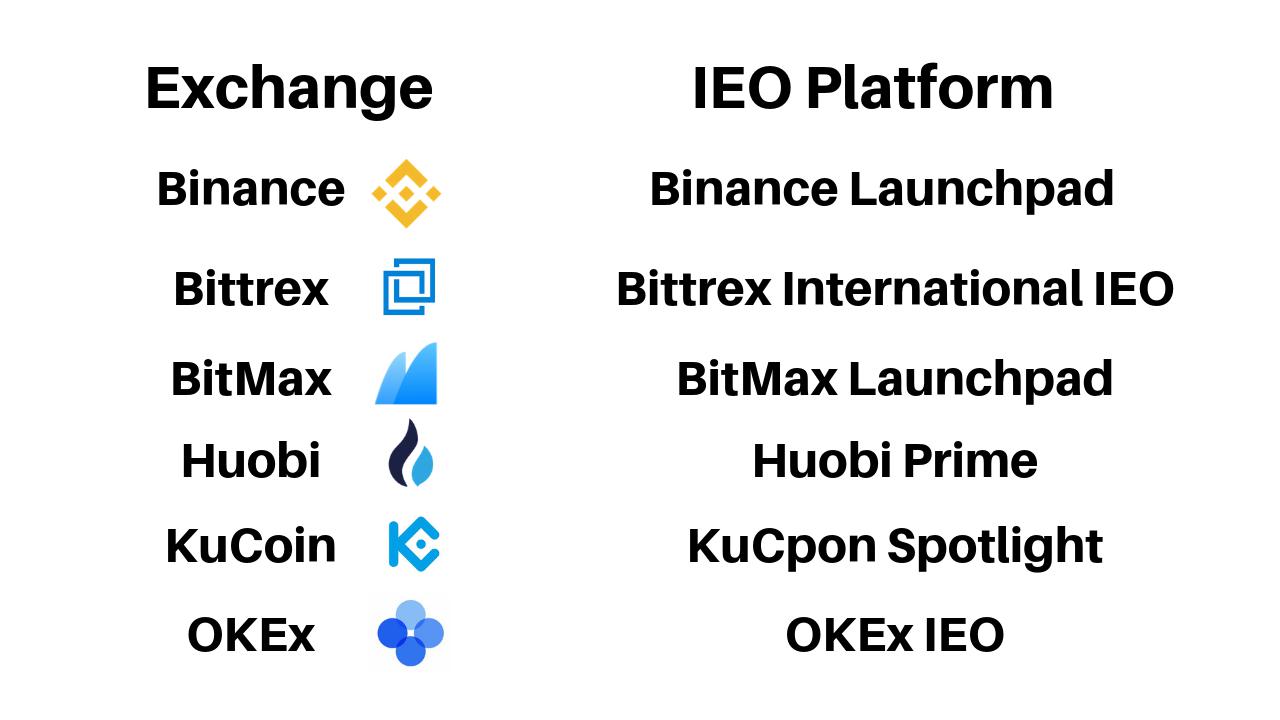

More and more exchanges began to create IEO. One of the first in the line was Binance, which released its IEO Binance Launchpad platform. In January, BitTorrent, bought by TRON, initiated a token sale on the Binance Launchpad and raised $ 7.2 million in less than 15 minutes. The next IEO on the platform broke this record and closed in just 22 seconds.

Watching the success of the Binance Launchpad, other well-known exchanges announced the launch of their own IEO platforms. IEO platforms include Bitmax Launchpad, Bittrex IEO, OK Jumpstart (OKEx), KuCoin Spotlight, and Huobi Prime.

IEO vs ICO - what are the differences?

We have created a table to show you the main differences between IEO and ICO. Here:

Advantages and disadvantages of IEO.

The trust

One of the main advantages of IEO is trust. Since the crowdsale is carried out on the exchange platform, the counterparty looks at each project that wants to launch IEO on its website. Exchanges do this to maintain a good reputation by carefully checking token issuers.

Thus, IEO can exclude fraudulent and dubious projects due to raising funds through exchange platforms.

IEO RAID is a great example. Bittrex recently announced that it had canceled IEO for the RAID project a few hours before the crowdsale began. The reason for the cancellation was a discontinued partnership between RAID and OP.GG.

According to Bittrex, the partnership between the two companies was a vital part of the project, and when the cryptocurrency exchange became aware of this event, she decided to cancel the sale of the token, as it considered that it was not in the interests of Bittrex customers.

Security

Token issuers do not need to worry about crowdsale security, as the exchange manages the smart contract IEO. The KYC / AML process is also handled by the exchange, as most service providers do KYC / AML for their customers after creating their accounts.

Easier for projects

Startups issuing tokens benefit from a more flawless process of launching IEO on exchange platforms - compared to launching their ICOs. While fundraising organizations must pay listing fees and a percentage of their tokens. Thus, startups launching their IEOs require a lower marketing budget than if they decided to go with an ICO. In addition, token issuers can use the stable client base of the exchange to get a greater contribution to their projects.

Listing

Since the listing of tokens is also “included in the transaction”, it is a natural process when the exchange in which IEO is conducted leafs through the startup token after the end of the crowdsale.

Although IEOs seem like a safer and more effective alternative to ICOs, the cost of selling tokens can be high for startups. Listing fees can go up to 20 BTC, while exchanges can even get a 10% discount on tokens from fundraising companies.

How to take part in IEO?

Since IEOs are currently relatively rare in the crypto community, it's not so hard to find what you like. After you find your IEO, you need to find out on which exchanges the crowdsale is placed.

The next step is to register an account on the cryptocurrency exchange and complete the verification process of KYC and AML.

After you are done with this, check out the cryptocurrencies you can use to participate in IEO and boil them. The final step is to wait for IEO to start.

Will IEO create the next fundraising boom?

ICOs created a fundraising boom in 2017 and 2018. However, a significant percentage of cryptographic projects were scammers. Because of this, and also because of ICO bans, we can say that this is not an effective fundraising model for cryptocurrency startups.

On the other hand, IEOs provide an increased level of trust in cryptocurrency projects, because the exchanges that host crowdsales are actively involved in the fundraising process, which increases the effectiveness of crowdsales. Consequently, IEOs can become the standard model for fundraising in the crypto space, and perhaps even create the next fundraising boom.

Transfer