Why are large corporations saving trillions of dollars?

- Transfer

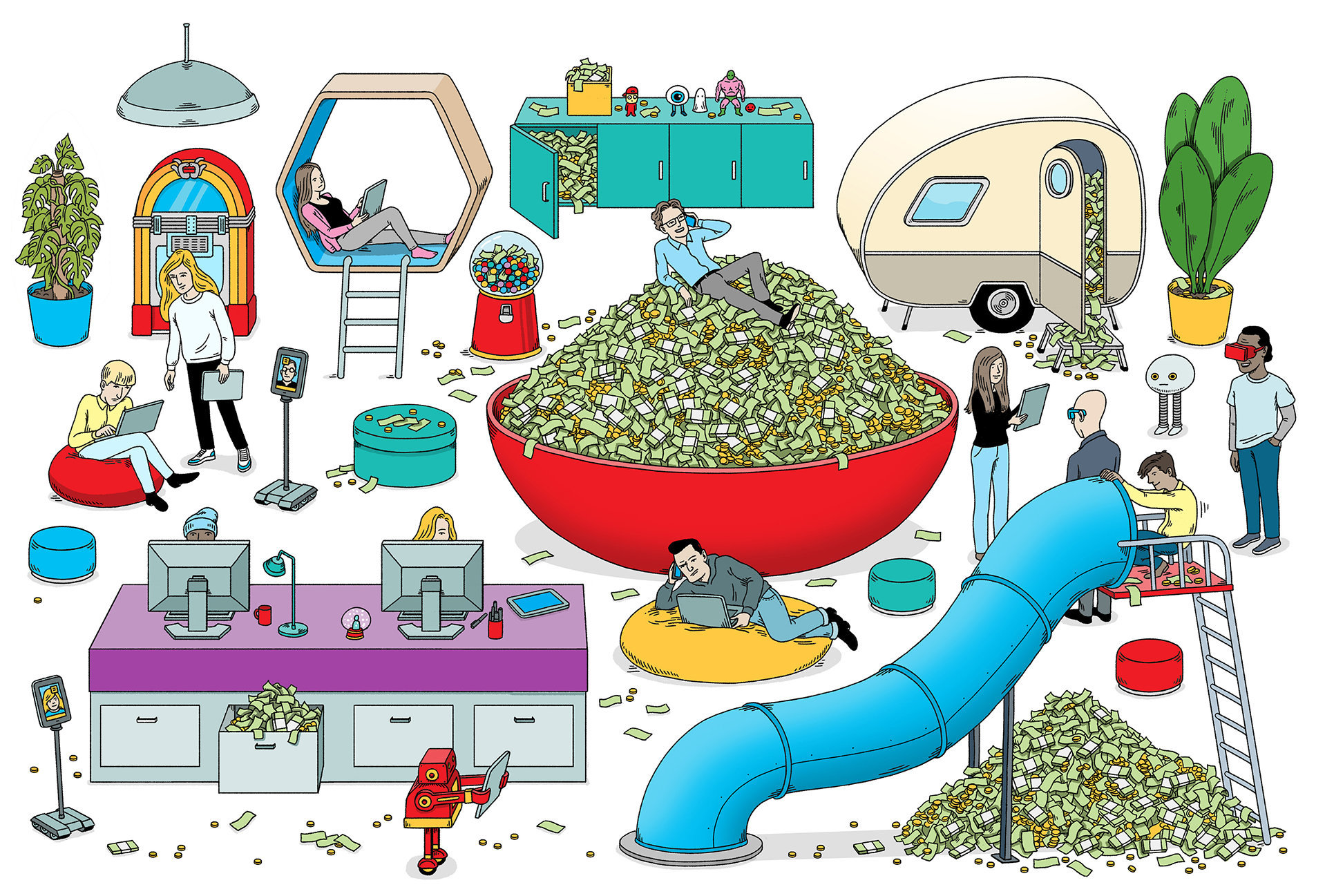

Illustration by Andrew Rae

There is an economic mystery that many have been trying to solve for quite some time. Financial experts often call it a puzzle or paradox. The meaning of this paradox is as follows: American companies collectively own $ 1.9 trillion in bank accounts and Treasury bonds, without using this money. This state of affairs has no historical analogues. American corporations have always been borrowers, not holders of funds, therefore, it is impossible to analyze the initial information and compare the current situation with similar periods in the past, such data simply does not exist. But there are several assumptions that explain the reason for the cash fashion. The answers to the question “Why do corporations need trillions of dollars?” You will find further in the translation article of The New York Times Magazine,The PayOnline .

The very idea that corporations will keep such a large part of their profits seems absurd for economic reasons, especially now that the treasury bonds in which they hold the money give only 2% of the profits. It would be much more profitable to invest them in something else - products, services or the acquisition of other companies. This would allow to exceed the minimum corporate profitability of 2 cents per dollar. However, they prefer to keep this money.

Take, for example, Google. His new parent company, Alphabet, costs about $ 500 billion. She owns the amount of $ 80 billion she holds in Google bank accounts or other short-term investments. Therefore, buying 1 share of Alphabet, which recently traded at around $ 700, you actually get $ 100 in cash at your disposal. With these $ 80 billion, Google could buy Uber and its Indian rival Ola, and spend the remaining money on Palantir, a startup working in the field of data analysis and presentation. Or, with that money, Google could easily buy out Goldman Sachs or American Express, or an almost 100% stake in MasterCard. Another option is to buy Costco or eBay, or a 25% stake in Amazon. In general, Google has all the features to

Apparently, the beginning of this strange fashion of corporations for hoarding took place at the beginning of the 2000s. The most striking example is General Motors, which holds cash in the amount of almost half its value. Apple holds more than a third of its value. Of course, not everyone can put up with this state of things: if instead of accumulating funds in this way, companies would put them into action, we would immediately see sharp economic growth, and with it, an increase in the number of highly paid jobs. In the 90s, when companies retained a much smaller portion of their profits, they built new plants and acquired new buildings. Partly because of this habit of putting money into business, these years have been a period of the lowest unemployment and tangible economic growth.

What is the reason for this behavior? The number of articles on this topic in economic journals can not be counted. Each offers its own theory of why corporations have moved from borrowing funds to saving them. Some give quite prosaic reasons: just like people, companies want to have money for an emergency or to stay afloat in bad economic periods, and the past decade has not been calm due to increased risks. In addition, corporations began to pay much more attention to the so-called tax optimization, which everyone else calls "tax avoidance." There are many reasons why withholding money and carefully distributing it among subsidiaries, especially foreign ones, is an excellent way to reduce the amount of taxes paid.

Another reason for the retention of money is associated with constantly increasing competition for getting the best personnel and buying promising companies. This is especially true for high-tech companies and the pharmaceutical industry. When Google or Apple enter into negotiations to buy smaller companies, they can scare away other competitors, because the latter understand that they are entering into an unequal battle with the owners of almost endless resources. It turns out to be a rather strange situation when holding money helps companies save even more of their money due to the ability to pay less for a takeover in the absence of competition. Google, by the way, buys one company a week, while Apple, despite the less regular nature of its acquisitions, generally does not lag behind its competitor.

But even if you are satisfied with these explanations, the riddle still remains unsolved. Companies like Google or GM are holding too much cash. So much that even a reserve fund, tax optimization, and scaring off competitors combined cannot be an excuse. Georgetown University professor Lee Pinkowitz says economists who recognize the ambiguity of this issue have split into two different camps.

Representatives of the first camp believe that a large supply of cash signals the presence of serious problems in the company. It is also possible that things are going badly for the whole industry, so much so that its representatives simply have nothing to invest in. Maybe the fact is that top managers are engaged in their dark affairs and accumulate such "nest egg" to achieve personal goals. For example, they want to hide the consequences of wrong decisions to preserve their posts. In this case, they can use the cash reserve, temporarily making the company more profitable.

Illustration by Andrew Rae

Representatives of another camp doubt that the free market is capable of creating opportunities that would allow managers to keep such large amounts of cash for their own purposes.

Together with his colleague Roan Williamson, Pinkovits created an assessment model that allowed us to analyze the reaction of investors to different levels of cash savings from companies. The data were analyzed by 12888 open joint-stock companies from 43 industries for the period from 1965 to 2014. The model shows how much investors value $ 1 invested in a particular company.

His data show that both theories are justified. For some industries, cash accumulation obviously correlates with negative results. For the publishing business and the entertainment industry, attempts to accumulate additional cash reserves cause this money to lose its value in the eyes of investors, falling in value to 40 cents per dollar. In the defense and coal industries, things are much worse: the value of one dollar invested falls below zero. Perhaps this means that company executives in these industries are trying to create an airbag for themselves or their companies, as the market obviously reacts negatively to their desire to accumulate money.

However, in the case of other industries, the value of each dollar invested increases as a result. For pharmaceutical companies, the value of one dollar of such savings rises to $ 1.50. For software companies, this figure is even higher - $ 2. This investor attitude means that they trust company leaders in these industries, such as Larry Page, who heads Alphabet. In fact, investors believe that the management of such companies can use the capital even better than themselves. A superficial study of the industries of the second group, which, among others, includes automobile companies and manufacturers of medical equipment, shows that the number of companies that accumulate the most funds clearly correlates with their affiliation to these industries. It is possible that a decent portion of the amount mentioned above is 1.

As a result, there is only one question: Why do companies do this? The answer, perhaps, lies in the fact that both managers and investors believe that big changes are coming in their sectors, but no one knows for sure what changes they will take. Throughout the twentieth century, as mankind passed from the agrarian sector driven by horses and the sun to the electrified and motorized industrial economies, and further to the “silicon” information economies, it became clear that investing in innovation helped the majority of companies grow and develop. they did it. This is a major investment in the acquisition of buildings, equipment and computer technology. Today, however, the value of companies is growing more likely due to new ideas and ways of interaction. Ideas come and go much faster than before. At the same time, it becomes more difficult to assess their value. A vivid example of this trend is the “dotcom crisis”, which occurred, among other things, due to the inability of companies to provide a correct estimate of the value of the Internet market.

Of course, the main economic issues of our time are very simple: “Are the favorable times gone? Are we really waiting for the widening gap between the rich minority and the less affluent majority? ”The money puzzle gives us little reason to be optimistic. If corporate executives and their investors truly believed that the future would be bleak, and innovation and economic growth would inevitably slow down, they would have little reason to keep that much money. In fact, this accumulation may be a sign that the next innovative transformation is just around the corner. And if that is indeed so, then soon all of us will receive good news.