The hunt for the best sugar

- Transfer

When the history of sugar is written, 2016 may be remembered as the year when its image changed. Of course, we always knew that these sweet white crystals ruin teeth and make people gain extra pounds. Obesity and diabetes have already become a national disaster, with the latter costing 10% of all US healthcare costs.

But now an increasing number of researchers, and The Case Against Sugar, have also begun to associate our favorite natural sweetener with such terrible conditions as heart disease, Alzheimer's, and cancer. (These conclusions are still far from generally accepted.) Thicken paint we can assume that the sugar industry paid Harvard scientists in the 1960s to downplay their role in ischemic problems, and instead saturated fat was assigned as the main culprit, which formed the direction of nutrition research and to this day.

“Sugar is the new tobacco” in the public mind, says David Turner, global food and beverage analyst at research firm Mintel.

And the war began for public health. Several cities responded with taxes on sugary drinks, and next year the FDA will start requiring companies to disclose the amount of added sugars on the product packaging.

Consumers seem to hear calls. Research firm NPD Group found that sugar is the number 1 substance they are trying to reduce or remove from their diets. Of course, “trying” is not the best word. Whatever their aspirations, people do not stop eating him. Americans now consume a total of 76 pounds of sugar each year, 8% higher than in 1970.

This is a problem for food companies: they are built on that. According to a recent study by The Lancet, about 74% of packaged foods and drinks in the United States contain some form of sweetener, making it more than a 100 billionth market. Companies “use hedonic substances, and sugar is the most ubiquitous hedonic substance,” said Robert Lustig, a professor at the University of California at the San Francisco School of Medicine and a senior critic on the subject. This is an academic way of saying that food companies know that customers crave sugar fever.

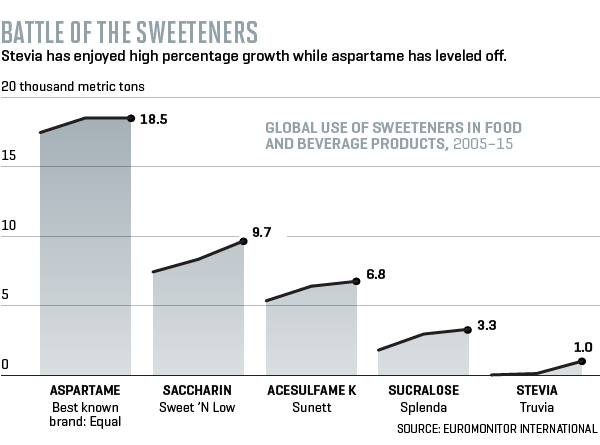

All this poured new energy into the desire to find low-calorie sweeteners. And this is because existing alternatives face even greater skepticism. According to Mintel, 39% of consumers believe that it is better to avoid products containing artificial ingredients such as aspartame and saccharin due to health risks. Sales of such substitutes fell 13% between 2011 and 2016.

This brings us to the last factor that strongly affects food companies: an increasingly aggressive appetite for "natural", unprocessed foods. “Health and well-being used to be synonymous with reduced calorie intake,” says Bernstein analyst Ali Dibaj. By this standard, as he put it, referring to the iconic first diet cola, “Tab used to be damn healthy”. No more.

Think of the plight of food companies in this way: the best scientists in the industry have spent decades trying to find or invent a non-nutritive sweetener that tastes as good as sugar extracted from pure cane. And now, after they have largely failed to cope with this difficult, difficult task, the level of complexity rises even higher: this incredible mixture cannot be designed by scientists.

Let's stop here to look at the sugar embrace of food companies and the American consumer. You can rightfully blame consumers for their insistence on an impossible product. But who has indulged their fantasies for many decades, promising a sweet, good taste and no calories? Companies, of course. Now customers are raising rates - and it’s not at all clear that companies can pass the test.

It is no coincidence that sugar was a food supplement 10,000 years ago. Historians watch the first use of sugarcane in New Guinea. By 500 BC some farmers in India turned cane into raw sugar. Sucrose, as scientists know, is an almost perfect compound. She cans. It is fermented and caramelized. It provides viscosity and taste, texture and mass. It improves the taste of other ingredients. Like even a newborn will tell you that she is the gold standard of sweetness.

This did not stop several applicants from overthrowing it. A series of sweeteners - saccharin, aspartame and sucralose - they all appeared on the scene for decades, each of them claimed maximum sweetness and minimum calories. Each product followed a similar trajectory: initially presented as a scientific miracle, with assurances that it tastes exactly the same as the original, it is popular before it ultimately disappoints consumers with a strange aftertaste or, in some cases, raises concerns about its effects on health

The most recent low-calorie miracle is stevia - the most famous brand is Truvia, and it is extolled as natural because it is extracted from the leaves of plants. The history of stevia illustrates the possibility - and the riddle - of a sugar substitution mission, so I went to Illinois to visit PureCircle, the largest producer in the world.

Winter weather does not agree with stevia, which thrives in warm climates. “You have to forgive our plants,” apologizes Faith Song, head of global marketing and innovation, she looks at the seedlings on the table in the conference room. "This is January in Chicago." Her company built its entire business on the small green leaves that Dream had set before us.

Stivia’s sweetness is unexpected. To begin with, it is not extracted from the fruit, but from the leaves of the plant. More surprising, however, is how sweetness is felt. Even a few minutes after I bit, chewed and spat out, it remains in my mouth. “It's almost a miracle of nature,” says Dream.

Compounds that give a plant its magical properties are called stevioglycosides. They are 100-350 times sweeter than sugar, and make up only a small part of the weight of the leaf. This is what the industry calls a high-intensity sweetener that delivers a taste of sugar, but not any other attributes, like its mouthfeel or texture.

Stevia was supposed to be the answer to a great dilemma. But, like its predecessors, it is saddled with a tragic flaw: a constant bitter aftertaste due to steviol glycosides, along with a metallic and licorice flavor. “It tastes like sucking a penny!” - This is not the type of product that manufacturers can sell well.

Scientists believed that the antidote to bitterness hides inside more than 40 different glycosides that were found in the leaves. At Cargill, one of PureCircle's rivals, scientists initially believed that there was one bad actor, the only glycoside that he could remove and solve taste problems.

Everything turned out to be more complicated. Each chemical compound has a unique sweetness and bitterness. Cargill scientists began to classify each taste profile individually and in combination to create a sophisticated model of what works best. “It was not intuitive,” says Andy Ohms, who runs the high-intensity sweetener business. In 2014, Cargill launched ViaTech, a sweetener system based on this work that combines a selection of nine approved glycosides for use. Some, including the best tastings, such as Reb M, are present in less than 1% of the leaf. Cargill and PureCircle try to create them through crossbreeding.

Stevia has other disadvantages. Some product developers say they are harder to use than artificial sweeteners, which are more like sugar and can therefore be more easily used as a substitute. PepsiCo CEO Indra Nooy, for example, said that stevia does not work well in stake.

Like other sweeteners, stevia enjoyed an early moment of fame. Companies that do not recognize that well-known glycosides can replace only 70% - 80% of the sweets in a typical soda, have released really terrible products. At a certain point, adding more stevia leads to a decrease in taste and makes its flaws more noticeable. Stevia was used to reduce the calories of the product, and not completely eliminate them. Even then, glycosides act differently depending on the product. Reb A works well in tea, for example, but may not be compatible with citrus flavors. There is no single solution even for one product category. “It's an unpredictable ingredient,” says John Martin, head of engineering and innovation at PureCircle.

Many companies are currently experimenting with improving or modifying sweeteners. For example, MycoTechnology in Colorado uses the mushroom root system to block the taste of stevia. It can also reduce the need for sugar by masking bitterness in foods such as wheat bread. Sensient at Milwaukee is looking for the right qualities in natural ingredients, such as tree roots or bark, that can increase the sweetness of sugar, so compilers can use them less. Chromocell, working with Coca-Cola, does the same job as Senomyx, which works with PepsiCo.

Most people in the business believe that a “systems approach” —mixing ingredients rather than a single molecule — is the future of the natural sweetener industry. “I don’t think you will see only one thing,” says Mike Harrison, senior vice president of product development for the British giant Tate & Lyle.

For some people, all this will never be enough to make stevia tasty. When I was at the Tate & Lyle US office in Chicago, I tasted a stevia cucumber lemon drink made by their team. I find it light and refreshing, although a little sweet, with a few hints of bitterness. But I looked at my master, Harrison, and saw his grimace. “I can't drink it,” he says. "It is disgusting." An hour later, the feeling was still bothering him. Harrison opened a can of beer to try to drown out the sensation in his mouth.

This is not the fault of his team. Harrison's high sensitivity is unusual, but, in truth, almost half the population is disgusted with the bitterness of Stevia. This is unacceptable for a company hoping to enter the mass market. “If you make a food product, and about 40% refuse it,” says Harrison, “this is a very big problem.” Another 20% of the population does not show any bitterness at all. It only depends on your genes. “This threshold is different for everyone,” says John Smythe, head of the Tate & Lyle sensor system.

Tate & Lyle is working on new incarnations of stevia, mixing glycosides in different ways. Its second generation, which will appear on the market next year, is not as bright in taste as sugar; it's a little lighter, explains Smythe (who worked for the wine company). The next generation of Tate & Lyle, under development, is getting closer. But do not expect to see it in the market soon. Now it is just too expensive.

However, even this expensive version has a sweetness that slowly dissipates, suggesting that the Stevia problem simply cannot be fixed. This is partly due to the fact that the taste of sugar consists not only of intensity, but also of more subtle aspects. The sweetness of sugar rises rapidly and then disappears almost as fast. Its replication requires replication of this curve. “Making the same profile looks more like a miracle,” Smythe admits.

PureCircle solves this problem by talking about the taste of stevia in advance. “People will tell us when we come up with new ones: 'Well, that doesn't look like sugar.' No, it tastes like stevia, ”says Dream. “We recognize that they are different from each other.”

However, every time I eat something sweet, and it’s not sugar, it seems artificial to me. This is how my brain and taste buds are connected. “We think it tastes like sugar, good,” says Smythe. “Tasting, like something else, is not good.”

For decades after World War II, “scientific” food production was seen as the pinnacle of progress. Today, of course, consumers want their food to be “natural” and simple.

This greatly complicated the search for a low-calorie sweetener. Buyers see products with fewer ingredients, healthier than those with long assortments. “The goal is not to add something,” said consultant Alex Wu, who worked at Kraft and PepsiCo. If ingredients need to be added, he says, our position is "to state that there are no artificial flavors or sweeteners."

This is the essence of the current dilemma. How do you develop a natural solution? For example, Cargill is trying to create some of the rarest and best tasting steviol glycosides in the fermentation process. The product, called EverSweet, was delayed due to manufacturing costs, but there is also the issue of whether consumers will perceive the product as natural if it is not derived from leaves.

The same can be said of erythritol, an alcohol with calorie-free sugar found in fruits, whose ingredients can also be produced by fermenting yeast. Erythritol is often combined with stevia, especially in sweeteners such as Truvia Cargill's, to mimic the mass and volume of sugar. “Our biggest problem is that the consumer does not understand how wonderful erythritol is,” says A. Aumok, Cargill's global marketing leader for Truvia. Some of them are afraid of its chemical name and its classification as sugar alcohol, some of which are associated with what is known in polite circles as "gastrointestinal upset."

Even stevia did not escape the question of naturalness. Of course, it is obtained from a plant, but then turned into an extract. “There is a lot of discussion about whether these products are natural,” says Dibaj, an analyst from Bernstein. “Some argue that sugar is more natural than stevia.” (“Natural” sugar is also made by applying chemicals to pure canes or beets.) The FDA does not define the term “natural”, so in the end it remains to the opinions of buyers and sellers.

Some consumers clearly prefer what they perceive as pure substances - one of the reasons that cane sugar comes back all the time. They would rather accept the dangers of too much sugar than the possible risks of an artificial alternative.

“Everything, sweet to the taste, we will take and send for analysis,” says the executive director for finding a new sweetener.

It is irrational to assume that natural sugar substitutes are better than artificial ones, ”says Paul Breslin, a professor who specializes in taste perception at the Department of Food Sciences at Rutgers University. For example, natural calorie-free sweeteners have not been spared the risks that some researchers attribute to artificial ones - problems with intestinal bacteria, causing metabolic dysfunction such as glucose intolerance and causing people to overeat.

“We just don't know which is better,” says Dana Mal, deputy director of Yale’s laboratory, John B. Pierce, who studies physiology and health. "We know enough to know that we don't know enough." For example, what does it mean that sweetness has always indicated the presence of calories, and now it is often absent? And what do sweet receptors do not only in the mouth, but also in the intestinal tract? Even today, scientists do not understand what exactly we want to replace.

When Grant Dubois joined Coca-Cola in 1992, an epidemic of type 2 diabetes came up. “I quickly focused on finding alternative sweetener systems,” said Dubois, an organic chemist who became director of the company for ingredients and product science. It was his job to find a way to make diet Coke as real. By the end of the decade, an additional warning was that this should have been natural. “They have already concluded that they should have eliminated artificial flavors and sweeteners from their products,” he says.

Dubois and his team began combing plant materials with potential. They examined over 50 possibilities. All had their drawbacks - some of them are quite large. For example, Monatin comes from a South African plant and is 3,000 times sweeter than sugar, but when exposed to light it produces an unpleasant smell of feces. “It was awful,” says Dubois. Finding this ideal alternative is a “crazy errand,” he says. “From my point of view, the probability is less than the search for gold. The probability is essentially zero. ”

Even if Dubois and his team would find something tasty, it should also be cost-effective. It's hard to beat the price of artificial sweeteners. “They are very cheap,” he explains, “cheaper than sugar.” When Dubois left Coca-Cola in 2011, he said it cost about 60 cents to sweeten a box with 24 bottles of sugar, 50 cents with high fructose corn syrup and just 5 aspartame. Companies “love to sell it because of profit,” he says. On the contrary, natural sweeteners are "very expensive and always will be." This would significantly reduce profits or lead to higher soda prices for consumers.

Despite obstacles - and a low probability - companies continue to search. “Chemists have been fascinated by natural sugars since chemists came into existence,” said Dubois, who is currently a consultant.

Natur Research Ingredients has developed a product called Cweet, made from brazzein protein, which is 2,000 times sweeter than sugar and comes from Africa. Miraculex in Davis, California, works with a sweetener protein found in a berry called a miracle fruit that binds taste buds and makes an acidic substance sweet.

Tate & Lyle already has a rare sugar allulose in the market. The body does not use it, and it cannot cause weight gain, it has a clean and bright taste of 70% sugar. But he suffers from a huge marketing hurdle: since allulose is chemically sugar, it needs to be identified as such on the label, even if it has almost no calories. Tate & Lyle is currently asking the FDA to provide an exception.

One plant-based alternative that has attracted attention is monk fruit extract or luo han guo, which is a member of the melon family and grown in China. Its fruity taste is often combined with stevia to soften its bitterness, but it is rarely used as the only sweetener in part because it costs about five times more than sugar. Elaine Yu, president of the United States monk fruit subsidiary and stevia producer Guilin Layn Natural Ingredients, says the company is trying to lower its cost. Guilin Layn is trying to double the release of its active ingredient, Mogroside V, crossbreeding, and also get two crops a year from its crop, not just one.

However, Yu says she is always on the lookout. On a recent trip to Central America, she tried a sheet, and now sends someone back for a sample. “Everything tastes sweet,” she says, “we will take and send for analysis.”

Some scientists believe that improving sugar is a better idea than replacing it. For example, a startup called DouxMatok, based in Israel, takes lessons from pharmaceutical industry research on targeted drug delivery. If a chemotherapeutic drug is encapsulated, it is released only when it enters the tumor, and this will lead to less damage. DouxMatok is trying to use a similar approach. It covers the minerals with sugar, which holds most of it until it reaches the receptor. Since the losses are very small, the company says it can achieve the same level of sweetness by using 50% less sugar.

However, even the DouxMatok product, which consists of more than 99.5% sugar, does not always behave like sugar. Although they are indistinguishable in taste, the company had to come up with different options that, say, would respond appropriately to fatty foods or cooking at high temperatures.

Meanwhile, Nestlé is trying to change the structure of sugar. Stefan Katsikas, head of the innovation company, describes the sugar crystal as a box. We only feel the appearance in our mouths, but we absorb the contents of everything, even if the sugar inside is not essential for our receptors. “We can change it so that everything we put on the tongue is for the most part what we swallow,” says Katsikas. This can reduce sugar levels by 40%. A compromise - and you should know that there is always a compromise - is that it breaks down in the water that is present in most foods. Fortunately for Nestlé, chocolate is one of the few products without water.

There seems to be an obvious solution to all this, which would be much easier for everyone: why not just eat less sugar? “When we move away from sugar, we are faced with this dilemma that nothing is like sugar,” says consultant Wu. In the end, we know that our expectations are not set by nature. Products in the USA are generally sweeter than in Europe. For example, a liter bottle of American Dr. Pepper contains 108 grams of sugar versus about 73 grams for the US equivalent. Why not just lower the threshold in the US market?

Several major food and beverage manufacturers have followed suit, promising to reduce sugar in their products. Coca-Cola says she has already reduced it to over 200 of her carbonated drinks. For its part, PepsiCo said that by 2025, at least two-thirds of its volume will have 100 calories or less for every 12 ounces. (For example, a Pepsi jar has 150 calories.) General Mills began cutting sugar in his cereals and yogurt. Nestlé and Dr Pepper Snapple made their own promises.

The problem is largely due to what the rest of the market is doing. “They are afraid that consumers will experience 20% less sweetness and go to the competitor,” says Dubois. Paul Bakus, president of corporate affairs at Nestlé, told me that a company should follow a narrow line between being better than the rest of the market and not sacrificing taste. “We want to reduce sugar, if possible, if we are not at a disadvantage for competitors,” he says. “How can you compete if your competitors do not follow the process, rules or recommendations?”

Some experts believe that the industry should follow the pattern of the UK sodium reduction program. In 2005, the country's food industry pledged to reduce sodium consumption in key categories by as much as 50% in eight years. By 2011, sodium intake was down 15%, and mortality from stroke and heart disease was down about 40%. UK is currently considering a similar attack on sugar.

It is hard to imagine how the US government would take such an initiative. Most likely, US regulators will leave consumers and food companies in their sweet arms. The former will demand, and the latter promise the perfect sweet solution, and the next miracle will always be beyond the horizon.