Bitcoin distribution also obeys a power law

The Pareto distribution in probability theory is a two-parameter family of absolutely continuous distributions that are power-law. When the probability of obtaining a particular value is inversely proportional to some degree of this value, then this quantity is characterized by a power law. Simply put, this is one of the main mathematical laws of our lives. It looks like this:

Power laws are often found in physics, biology, earth sciences, space, economics, finance, computer science, demography, and other social sciences [see Guerriero, V. (2012). "Power Law Distribution: Method of Multi-scale Inferential Statistics." Journal of Modern Mathematics Frontier (JMMF), 1: 21-28. as well as "MEJ Newman Power laws, Pareto distributions and Zipf's law" ].

The power law describes the size of craters on the Moon, the population of cities on Earth, the strength of earthquakes, the size of computer files, the scale of military conflicts, the frequency of words in any human language, the frequency of surnames in most cultures, the sale of goods of almost any category with many trademarks, and the number of species biological kind, the number of articles that scientists write, the number of clicks on web pages.

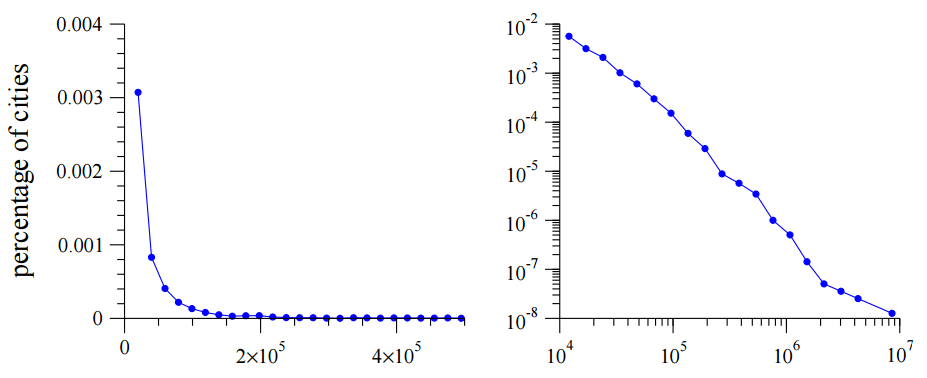

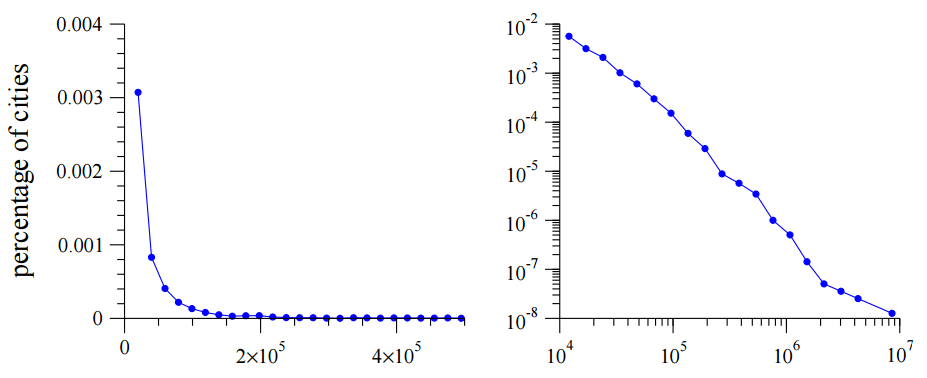

Histograms of US settlements by number of inhabitants (the number of inhabitants is plotted along the abscissa axis)

And of course, the distribution of human well-being is subject to power law.

The Italian engineer and economist Wilfredo Pareto developed his theory initially to describe the distribution of welfare, as well as the distribution of people's incomes in society. According to Pareto, society has a pyramidal structure, on top of which is the elite - the leading social stratum that guides the life of the whole society. In his work, Pareto was skeptical of democratic regimes. The scientist believed that in political life there is a universal law under which the elite always deceives the masses.

In one of his works, Wilfredo Pareto noted that 20% of Italian households receive 80% of their income. Although the scientist died in 1923, in 1941 they decided to name the so-called “Pareto law” in his honor, stating that 20% of the labor implements 80% of the result, but the remaining 20% of the result requires 80% of the total cost. As you can see, the Pareto distribution and power laws again showed themselves.

If we assume that the distribution of welfare in society is subject to a power law, then we indirectly confirm the elite theory that Pareto himself spoke about.

One way or another, but capitalist Western society fully demonstrates the validity of this theory. The well-being of people is indeed subject to a power law. We can get the most obvious confirmation of this if we studydistribution of bitcoins in wallets .

Blockchain allows you to study in a detailed way the path of each coin: record when it appeared, through which wallets it went through and in which wallet it is now. Due to the anonymous nature of the system, we cannot conclude on the number of users of the system or the welfare of each of them, but the distribution of coins by wallets is shown in the most accurate way.

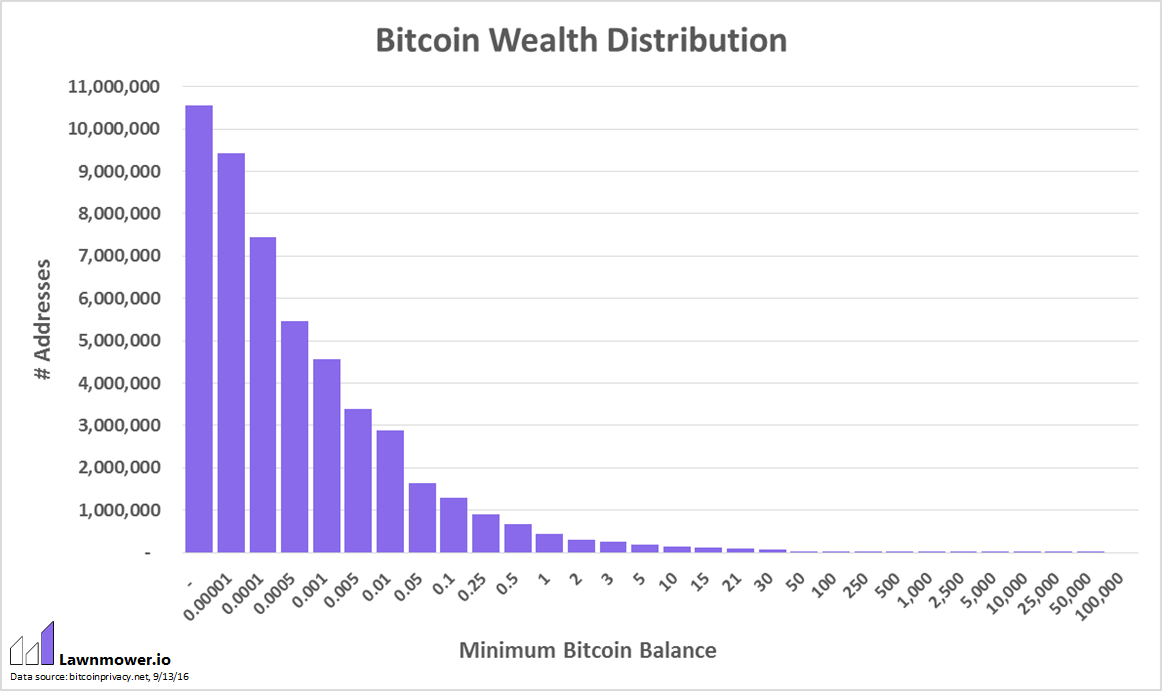

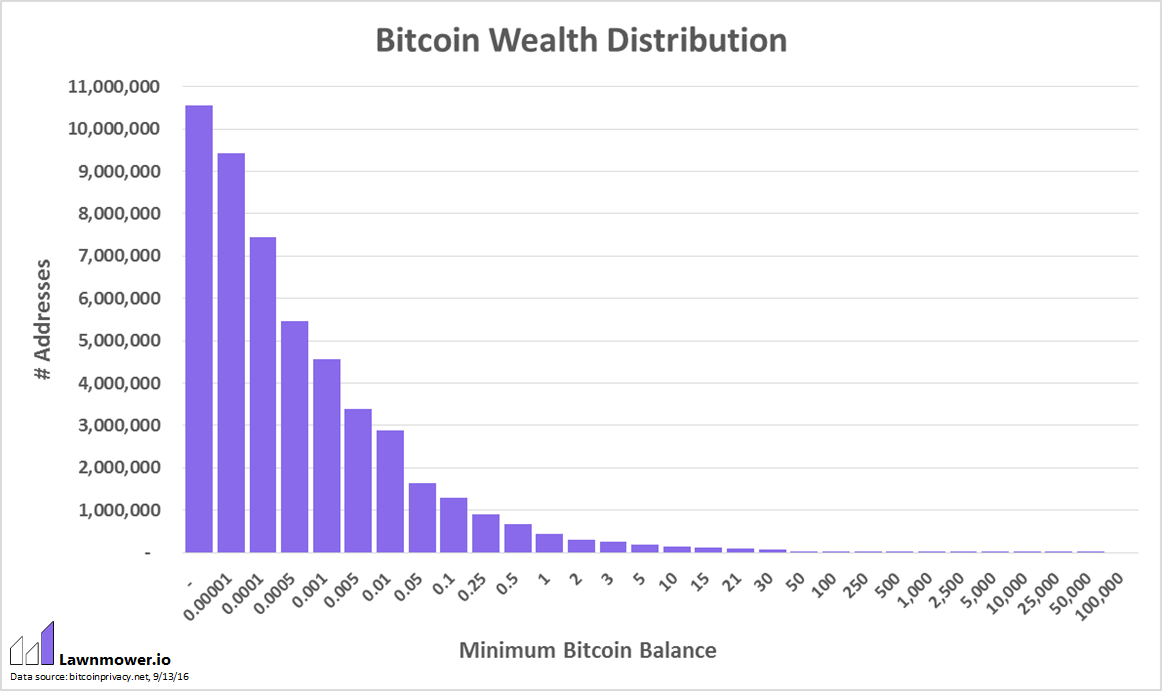

In absolute numbers, the following picture is obtained:

7.4 million addresses with a balance> 0.0001 BTC ($ 0.06)

7.4 million addresses with a balance> 0.0001 BTC ($ 0.06)

4.5 million addresses with a balance> 0.001 BTC ($ 0.61)

2.8 million addresses with a balance> 0.01 BTC ($ 6.08)

1.2 million addresses with a balance> 0.1 BTC ($ 60.80)

446 301 addresses with a balance> 1 BTC ($ 608)

131 709 addresses with a balance> 10 BTC ($ 6080)

13 698 addresses with a balance> 100 BTC ($ 60,800)

1,658 addresses with a balance> 1,000 BTC ($ 608,000)

121 addresses with a balance> 10,000 BTC ($ 6,080,000)

1 address with a balance> 100,000 BTC ($ 60,800,000)

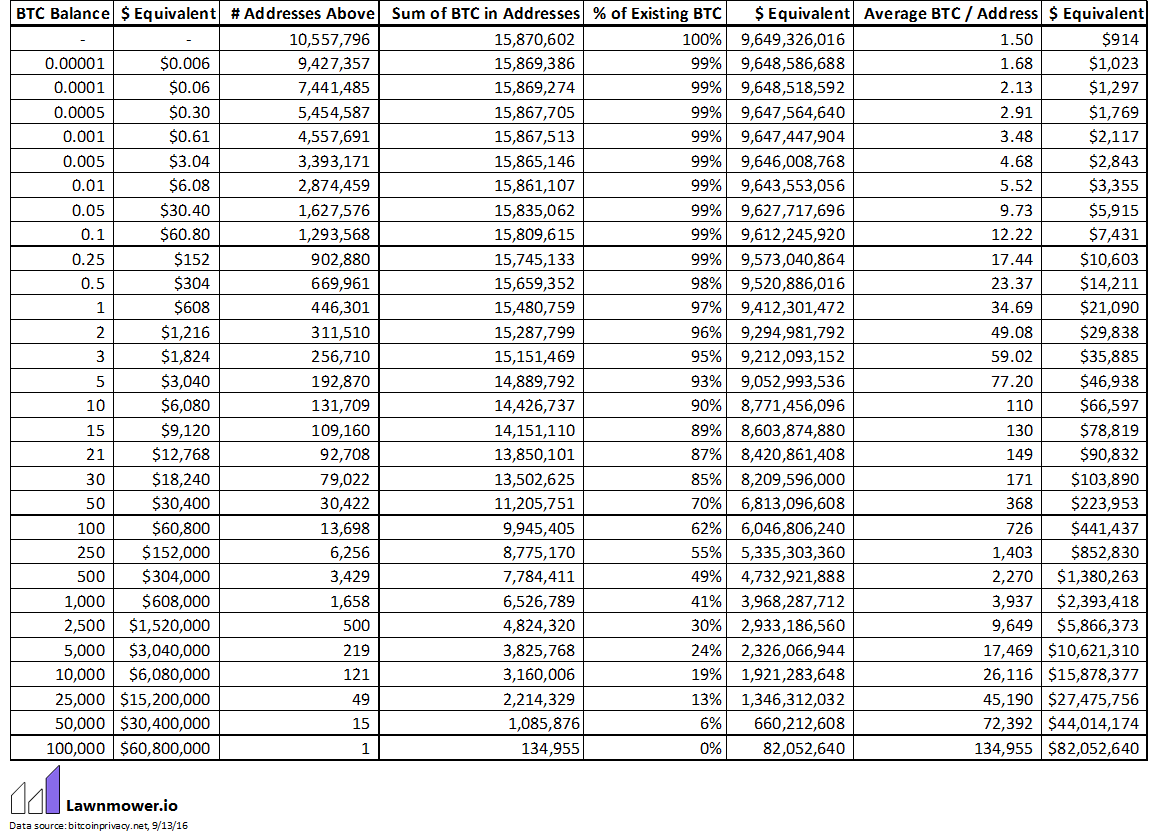

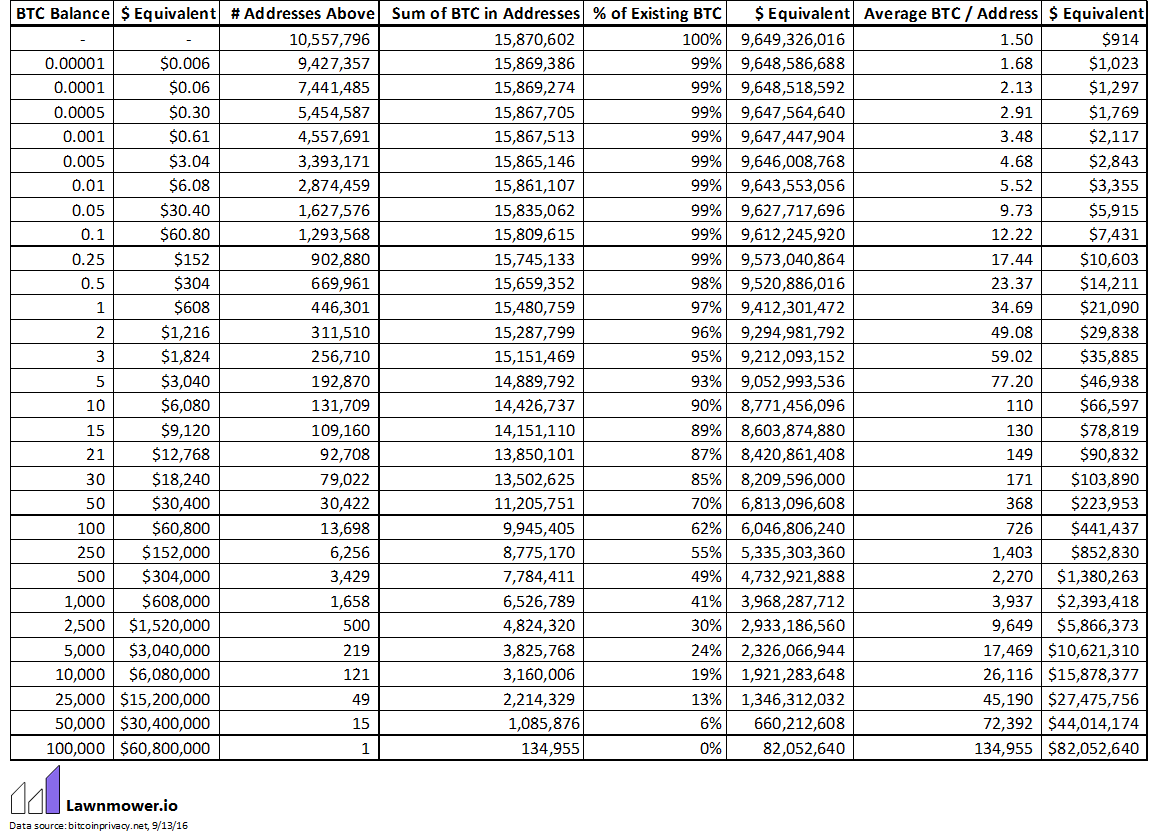

Detailed statistics are given in the table.

There is an almost perfect power distribution.

As already mentioned, the number of wallets cannot be used to judge the number of Bitcoin users. One person can own many wallets. Conversely, a group of persons (or a legal entity) can jointly own one wallet with a large amount.

Nevertheless, based on other indirect evidence, we can conclude that approximately 7 million people used bitcoins all over the world. True, the total number of users can be spread out over time. Some researchers suggest that up to 30% of existing Bitcoin users are “zombies,” who have lost their private keys and access to cash. The fate of Satoshi Nakamoto, who mined a million coins on his personal computer at the dawn of the formation of the system , is also unknown .

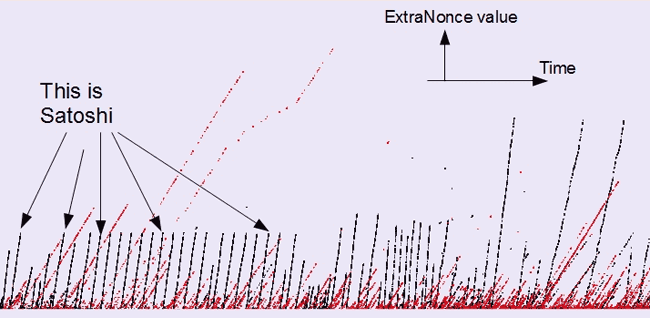

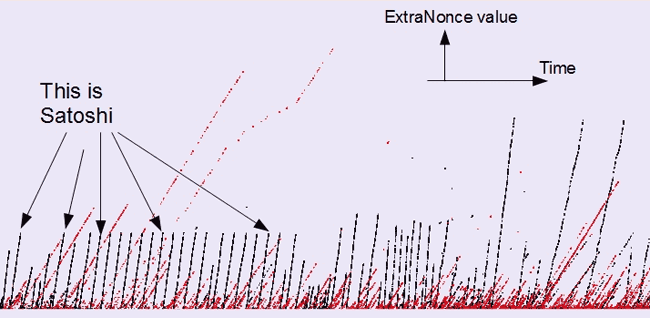

As the investigation showed, from January 3, 2009 to January 25, 2010, only one person was engaged in mining bitcoins, and the vast majority of the coins mined at that time are still kept with him.

Black and red colors show the generation and waste of coins in the interval between blocks 1 and 36288

Of course, it is impossible to 100% say that the coins generated in the first time belong to Satoshi, but the fact is that someone started mining from the first block and continued it for a whole year at a stable speed of about 7 megahashes per second , with small pauses about every 100 hours, presumably for backing up your wallet.

According to estimates, Satoshi mined about 1 million coins in the first months, which is about $ 602 million at the current exchange rate.

p (x) = Cx -m

Power laws are often found in physics, biology, earth sciences, space, economics, finance, computer science, demography, and other social sciences [see Guerriero, V. (2012). "Power Law Distribution: Method of Multi-scale Inferential Statistics." Journal of Modern Mathematics Frontier (JMMF), 1: 21-28. as well as "MEJ Newman Power laws, Pareto distributions and Zipf's law" ].

The power law describes the size of craters on the Moon, the population of cities on Earth, the strength of earthquakes, the size of computer files, the scale of military conflicts, the frequency of words in any human language, the frequency of surnames in most cultures, the sale of goods of almost any category with many trademarks, and the number of species biological kind, the number of articles that scientists write, the number of clicks on web pages.

Histograms of US settlements by number of inhabitants (the number of inhabitants is plotted along the abscissa axis)

And of course, the distribution of human well-being is subject to power law.

The Italian engineer and economist Wilfredo Pareto developed his theory initially to describe the distribution of welfare, as well as the distribution of people's incomes in society. According to Pareto, society has a pyramidal structure, on top of which is the elite - the leading social stratum that guides the life of the whole society. In his work, Pareto was skeptical of democratic regimes. The scientist believed that in political life there is a universal law under which the elite always deceives the masses.

In one of his works, Wilfredo Pareto noted that 20% of Italian households receive 80% of their income. Although the scientist died in 1923, in 1941 they decided to name the so-called “Pareto law” in his honor, stating that 20% of the labor implements 80% of the result, but the remaining 20% of the result requires 80% of the total cost. As you can see, the Pareto distribution and power laws again showed themselves.

If we assume that the distribution of welfare in society is subject to a power law, then we indirectly confirm the elite theory that Pareto himself spoke about.

One way or another, but capitalist Western society fully demonstrates the validity of this theory. The well-being of people is indeed subject to a power law. We can get the most obvious confirmation of this if we studydistribution of bitcoins in wallets .

Blockchain allows you to study in a detailed way the path of each coin: record when it appeared, through which wallets it went through and in which wallet it is now. Due to the anonymous nature of the system, we cannot conclude on the number of users of the system or the welfare of each of them, but the distribution of coins by wallets is shown in the most accurate way.

In absolute numbers, the following picture is obtained:

7.4 million addresses with a balance> 0.0001 BTC ($ 0.06)

7.4 million addresses with a balance> 0.0001 BTC ($ 0.06) 4.5 million addresses with a balance> 0.001 BTC ($ 0.61)

2.8 million addresses with a balance> 0.01 BTC ($ 6.08)

1.2 million addresses with a balance> 0.1 BTC ($ 60.80)

446 301 addresses with a balance> 1 BTC ($ 608)

131 709 addresses with a balance> 10 BTC ($ 6080)

13 698 addresses with a balance> 100 BTC ($ 60,800)

1,658 addresses with a balance> 1,000 BTC ($ 608,000)

121 addresses with a balance> 10,000 BTC ($ 6,080,000)

1 address with a balance> 100,000 BTC ($ 60,800,000)

Detailed statistics are given in the table.

There is an almost perfect power distribution.

As already mentioned, the number of wallets cannot be used to judge the number of Bitcoin users. One person can own many wallets. Conversely, a group of persons (or a legal entity) can jointly own one wallet with a large amount.

Nevertheless, based on other indirect evidence, we can conclude that approximately 7 million people used bitcoins all over the world. True, the total number of users can be spread out over time. Some researchers suggest that up to 30% of existing Bitcoin users are “zombies,” who have lost their private keys and access to cash. The fate of Satoshi Nakamoto, who mined a million coins on his personal computer at the dawn of the formation of the system , is also unknown .

As the investigation showed, from January 3, 2009 to January 25, 2010, only one person was engaged in mining bitcoins, and the vast majority of the coins mined at that time are still kept with him.

Black and red colors show the generation and waste of coins in the interval between blocks 1 and 36288

Of course, it is impossible to 100% say that the coins generated in the first time belong to Satoshi, but the fact is that someone started mining from the first block and continued it for a whole year at a stable speed of about 7 megahashes per second , with small pauses about every 100 hours, presumably for backing up your wallet.

According to estimates, Satoshi mined about 1 million coins in the first months, which is about $ 602 million at the current exchange rate.