Why Sweden rejects the idea of a complete transition to cashless payments

Image: Pexels

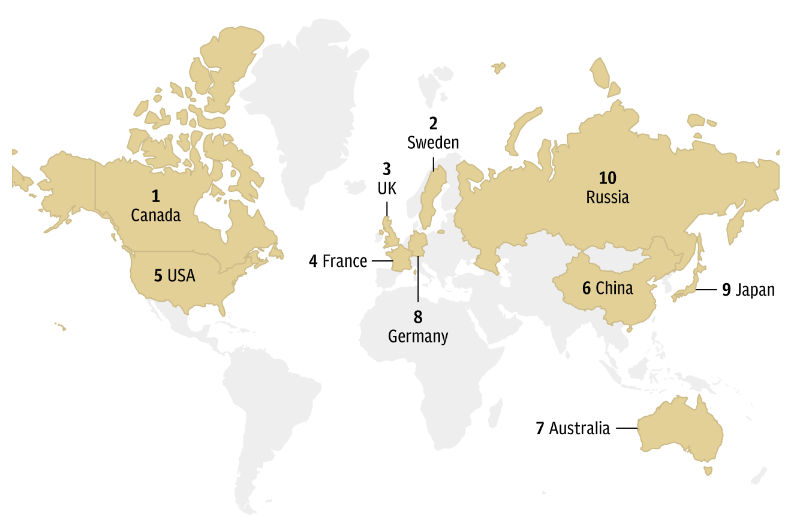

HSBC Bank in its recent report called the transition to cashless payment methods one of the main trends of the current year along with the development of blockchain technology. In many countries, this trend is already visible - there are even ratings of countries in which cashless payments are most developed.

However, not everything is so smooth, and in Sweden, which has consistently occupied one of the first places in such ratings, there has been a public discussion about whether society should strive to completely abandon cash. The story about this was published by the Guardian, the main points of the material read in our article.

Sweden and denial of cash

This Scandinavian country is one of the world leaders in the development of contactless payments, ahead of all European countries. Many Swedish citizens don’t use “cache” at all in their lives, and the number of shops and cafes that refuse to accept cash is constantly growing .

Source: Forex Bonuses

However, not everyone in the country is happy with this state of things. And if until recently the voices of critics were practically inaudible in the general chorus of fans of the idea of refusing cash, then recently this discussion has flared up with renewed vigor. The main thesis of opponents of transferring the sphere of finance to online is the growing dependence on transnational corporations and the increasing risks of various attacks.

The main points of opponents of the "digitalization" of finance

The chairman of the Swedish Central Bank, Stefan Ingves, also belongs to the camp of opponents of a complete refusal of cash. He stated the need to develop new legislation that would help ensure public control over international payment systems. In his opinion, the possibility of sending and receiving payments is a “public good”, comparable to the judicial system, public statistics or the field of defense. “Most citizens would not want to transfer such social functions to private companies,” the functionary said.

He is supported by a former member of the European Parliament from the Pirate Party of Sweden, Christian Engstrom, who is convinced that "if you control the Visa and MasterCard servers, Sweden is in your hands."

Politicians are concerned about the country's dependence on payment instruments that are not fully controlled by the state. In this case, in the event of a serious international crisis and a hypothetical restriction of access to these tools, residents may have difficulty in paying for their basic needs and receiving money.

On the other hand, some IT professionals point out the increasing risks of information security. According to IB consultant Matthias Skarec, a complete rejection of cash is “impossible” and seriously counting on it is naive. As an example of possible problems, he cites situations with failures in the processing of card payments, which over the past year occurred with two large Swedish banks. There are also known cases when hackers managed to find gaps in the protection of digital payment systems and steal money from people, including pension savings .

Prospects

According to opinion polls, currently a quarter of Swedish citizens (25%) support a complete rejection of cash, while almost seven out of ten respondents would prefer to retain the opportunity to use various means of payment. Meanwhile, the country's parliament is conducting an internal analysis of legislative initiatives proposed by the central bank - MPs will consider all the possible difficulties associated with both the use of cash and the rejection of them.

Other financial and stock market related materials from ITI Capital :

- Educational Resources ITI Capital

- Analytics and market reviews

- Distrust of authorities and saving: the main trends in investment activity of millennials

- Where is it more profitable to buy currency: banks vs exchange

- How the introduction of artificial intelligence trading systems will affect investment management

- Bloomberg: how Elon Musk's flamethrower promotion will change startup financing