Fintech digest: a trillion rubles to the wind, a bank branch under the control of robots and PayPal as a bank

Hello, Habr! We suggest discussing what happened in the fintech industry over the past few days. And a lot of interesting things happened.

First of all, the fact that some experts consider attempts to build a digital economy in Russia to be completely in vain. And well, if the losses were purely temporary. But no, about a trillion rubles were spent on the development of this sphere.

That is how much has been spent in the country on innovative projects in the sphere of fintech. As it turned out, innovation and public finance are poorly compatible areas. With all this, the digital economy is considered extremely important for strengthening Russia's national security.

Of course, there are some shifts in this direction, but there is no need to talk about cardinal changes. It's a pity.

Robots in a Chinese bank

In China, China Construction's second largest bank has opened a branch in which customers are served by robots. They work with clients in an office located in Huangpu District. There are several smart robotic systems that act as cashiers. With their help, a bank client can open an account, send a transfer, exchange currency, invest in gold and receive asset management services.

The Chinese have designed the system in such a way that an informant robot meets customers at the entrance, who answers questions using a voice recognition system. Initially, the robot carefully analyzes the visitor. And only then, after a few years, he begins to recognize his owner by voice.

China Construction Bank can now handle about 90% of cash and cashless transactions. If necessary, you can always contact the human operator, if there is such a need. As a result of the installation of machines, the bank increased the influx of customers and reduced staff costs.

New bills

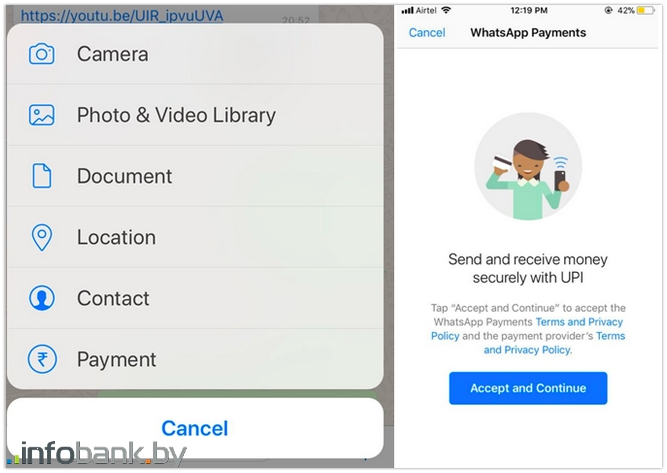

And in Belarus , a bill is being prepared that will allow you to pay for goods or services with the help of instant messengers. In addition, messengers themselves gradually create and improve this function. For example, Whatsapp plans to allow the possibility of translation to its friends. Given the messenger's user base, this is a great idea.

Apparently, the function should be added to the messenger soon. Users can use SMS to confirm their own phone number, after which the application will open access to the Unified Payments Interface payment system.

Well, about the blockchain

About a week ago, more than 20 EU countries signed a declaration on the establishment of a European partnership in the field of blockchain technologies.

“In order to use the capabilities of blockchain technologies and to avoid a fragmented approach, the participants in this declaration agree to collaborate in the creation of a European partnership to develop a blockchain infrastructure that will help improve trustworthy and user-oriented digital services within a single market,” the declaration said signed by 22 states. As far as one can judge, the first cross-border actions will begin by the end of 2019.

Well, PayPal is going to pay attention even to those users who do not have a bank account. In particular, some users will be given ready-made debit cards if they don’t have anything. PayPal still calls the implementation of its idea "alternative financial services."