Bitcoin will not become new digital money: on the drug business, transaction costs and gold

In the last publicationit was about the function of money and why limited issuance prevents bitcoin from becoming new money. In the comments, it has been suggested many times that Bitcoin is digital gold, not money. In the crypto paradigm voiced, Bitcoin will remain a cryptocurrency with a huge transaction fee, high cost and it will be stored, and not try to pay it in the store. For calculations, a cryptocurrency devoid of the disadvantages of bitcoin will be used. I agree with the second paragraph, but I will analyze the statements from the first paragraph in this publication. Let's start with the story about the Silk Road site, on which there was a trade in everything that was illegal and prohibited. We will look at a real-life example of how Darknet helped popularize bitcoin,

In the last publicationit was about the function of money and why limited issuance prevents bitcoin from becoming new money. In the comments, it has been suggested many times that Bitcoin is digital gold, not money. In the crypto paradigm voiced, Bitcoin will remain a cryptocurrency with a huge transaction fee, high cost and it will be stored, and not try to pay it in the store. For calculations, a cryptocurrency devoid of the disadvantages of bitcoin will be used. I agree with the second paragraph, but I will analyze the statements from the first paragraph in this publication. Let's start with the story about the Silk Road site, on which there was a trade in everything that was illegal and prohibited. We will look at a real-life example of how Darknet helped popularize bitcoin,The idea of making payments in favor of another person or organization and bypassing banking structures is simply excellent. Even 3-4 years ago, ideological Bitcoin users cited this argument first and presented it as the main one. This feature allows you to circumvent the embargo, protect against blocking accounts by regulatory authorities, and create an imaginary security in the event of a banking system crisis. We add here anonymity and the inability to cancel the transfer, and we get the perfect tool for transactions on the black market. It was Bitcoin that became the basis for the rapid development of Darknet and the chance to open Silk Road. Darknet is the Internet inside the Internet, protected from blocking, ensuring anonymity to users. In the vastness of darknet you can meet both harmless forums and resources that sell weapons, drugs, people, child pornography, passport details, stolen credit cards, etc. I even met a proposal to produce a Romanian passport for $ 50,000, not a fake, as they wrote, but a real one and issued by the relevant authorities. Silk Road is the first resource within the darknet to organize drug trafficking, stolen data, credit cards and weapons. He accepted, of course, bitcoin.

The store managed to work 2.5 years, after which the creator was arrested. From the reports of the special services, we can conclude that they arrested a technically illiterate person and poorly versed in ensuring anonymity. The detainee used his photo, the name on the forums, where he asked questions about ensuring anonymity on the Internet, rented servers for Silk Road for photoshopped documents, and the attempt to order a killer for an ex, partner, or employee became a cherry on the cake. He looked for a killer on the forums and there he went to an FBI agent. It seemed strange to me.

And I also conduct a telegram channel About IT without ties and a blog . On the channel I talk about management problems and how to solve them, I write about the principles of thinking in solving business problems, about how to become an effective and highly paid specialist.

And now an interesting fact. When authorities closed Silk Road, the price of bitcoin fell from $ 124 to $ 82 . Over the 2.5 years of the exchange’s operation, its turnover amounted to 9.5 million bitcoins , and by that time only about 11.5 million bitcoins had been mined. Professor Nicolas Christin of Carnegie Mellon University conducted a study, and according to his data, only Silk Road generated 9% of all network transactions. I recommend reading this study to anyone interested in this topic .

Silk Road is just one of the banned markets, but a major one. If you calculate the total turnover of the TOP-20 illegal sites of that time, then it will be equal to 25-30% of the total number of transactions.

Now everyone is trying not to mention the dark past of Bitcoin and does not want to associate its popularity and growth with black business. However, 900,000 users of Silk Road alone were forced to exchange dollars and euros for bitcoin to complete transactions. A great way to bring a new product to the market! Exchanges of that time were intermediaries and took money from drug buyers, and then withdrew them in favor of sellers. Why the authorities did not touch the exchange is not clear to me.

Bitcoin was a good fit for making payments in black markets. On the Bitcoin network, transfers are made from user to user (P2P), without using an intermediary bank. Yes, the government cannot block the Bitcoin wallet, but does the business need this? I think not, because white business is in any case regulated by the state. It turns out that only black business can take advantage of this. Ok, then what does business need?

There are many ways to pay for a product / service or transfer funds: payment by credit or debit card, PayPal, wire transfer, check, etc. Banks, Visa, Matsercard and processors charge an average of 2-3% of the payment amountwhen paying by credit card to their system. Usually this percentage is laid in the cost of the goods. According to statistics, the average purchase price with a Visa or Mastercard credit card is $ 88- $ 89 . Statistics for 2014, so I can assume that the amount has grown to $ 95-100. Thus, the transaction fee for the average amount is $ 2-3. The business uses Wire transfers for which the price is fixed and is $ 10-40 depending on the volume, currency, bank of the sender and bank of the recipient.

In the Bitcoin network, the transaction cost does not depend on the volume, but depends on the desired speed of transfer of funds. The user selects the amount of the commission for conducting the transaction independently. Miners receive a commission.

By the end of 2013, the average transaction cost was 5 cents, and today it is $ 3. The store will pay a commission of $ 3 to a visa or master card only if the product costs more than $ 100 dollars. As mentioned above, the average check is approximately at this level. It is worth raising fees for a transaction on the network and then Visa / Mastercard will become cheaper for processing. At the peak of speculation, the transaction cost exceeded $ 20-30.

So, what about the time of the transfer? When paying by card, this time is less than 5 seconds. With bitcoins, it is profitable for a miner to process transactions with the largest appointed commission. If the sender assigns a low commission, then the funds may be transferred for several days. If the number of transactions on the network is large, then transfers with a low commission may not be processed at all and will hang in the queue indefinitely. They started to deal with this problem a year ago and in October 2017 the Lightning Network was launched. “Solution!” Some will say. “The Lightning Network is a move away from decentralization,” I will answer. The LN-based network is slightly different from Visa and Mastercard. All for what they fought, as they say ...

Nevertheless, while the Lightning Network is not launched everywhere, many exchanges are only considering this possibility, because the size of the commission will play an important role. Many stores that started accepting bitcoin in 2013-2014 have already abandoned it. The test of time has not passed. In fairness, many companies are trying to solve this problem, for example, TenX, which raised $ 80 million at the ICO. Investors were in the red, and the company was in the black. But this is a different story. About how TenX masterfully used ICO-hype I wrote on my channel @noTieInIT .

Is Bitcoin New Gold? I heard this statement many times over the past year, it was discussed in the comments on the last publication ... If a year ago Bitcoin was called “new money”, “new payment tool”, then after the skyrocketing transaction price and price increase, there was a reorientation. Now they are increasingly talking about the new function of Bitcoin - gold.

Gold mining worldwide is just over 3,000 tons annually. Unlike cryptocurrencies, where useless calculations are used for mining, gold has very specific applications: manufacturing jewelry; production of computers, mobile phones, gadgets; in medicine and in the production of medical goods; gold is used in the aerospace industry. The financial sector also consumes gold for the manufacture and sale of bullion, coins, for ETF confirmation, etc. Gold consumption is 4,200 tons per year. Yes, more than mined. This means that previously accumulated gold, including gold from central bank vaults, is thrown to the market.

The largest buyer is jewelry factories and manufactures; they buy more than 70% of gold mined per year (50% of the 4,200 tons mentioned above). About 12-14% is spent for the production of electronic devices. Gold can be recycled and the proportion of processed gold is also quite high. I attached the schedule to the publication, you can see the distribution by type of production yourself. Source .

Thus, gold for savings purposes is used in less quantity than for the manufacture of real goods. Is it correct to compare cryptocurrency and gold? I don’t think so. Gold will always be in demand. Jewelry will not be bought less, the production of gadgets will not decrease.

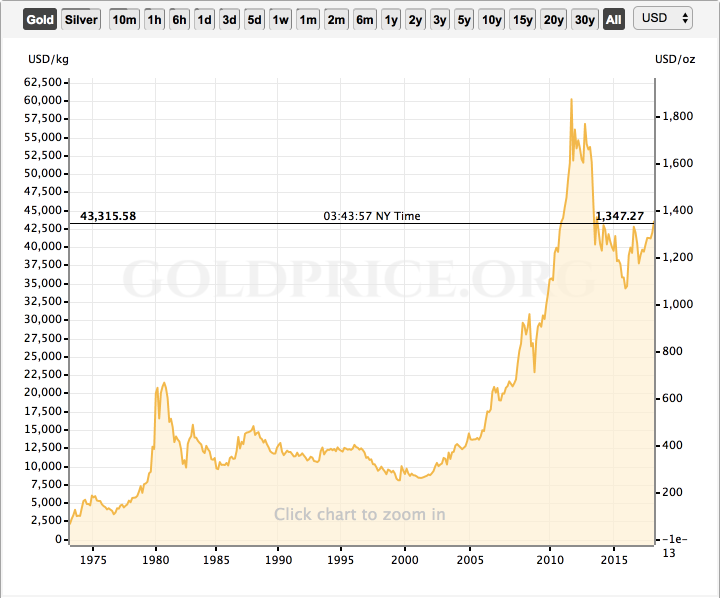

Does gold grow in value over time? Here is a chart from 1974.

There were speculative factors, the graphs are clearly visible. By the way, nothing reminds the schedule? One can make an assumption that in the long run gold is growing steadily, and is not suitable for short-term investments.

Not everything is so rosy, given inflation. Below is a graph for inflation.

Thus, I would not compare bitcoin and gold. They have a different history, purpose, applicability and properties. Gold will be in demand for a long time at least for the needs of production. Will Bitcoin be in demand in a few years?

PS Subscribe to my channel About IT without ties . I talk about the fundamental problems in the IT business and how to solve them, about the request for promotions and about building a career as a manager or your own business.