What you need to be able not to be afraid of losing your job

- Transfer

The method used by Jeff Bezos, Warren Buffett and Elon Musk

Jeff Bezos is often asked a question that we all need to ask ourselves: “What will change in the next 10 years?”

This is not a simple question: the world is changing very quickly, and decisions made today determine our destiny.

If you make a mistake in choosing, you can end up on a sinking ship, observing how the industry in which you decided to work has completely gone bankrupt, and the skills you have acquired over the years are hopelessly outdated. Millions of people, from journalists to financial analysts, found themselves in this situation at one time.

But if you find the right solution, you will ensure a calm future for life. For example, the best artificial intelligence programmers earn no less than the superstars of the US National Football League. Suddenly it turned out that the skills, the acquisition of which the first had devoted many years, became incredibly valuable.

At the same time, both the programmers mentioned and those whose skills depreciated could spend the same time learning and become professionals in their field. But they chose different areas of work and went in completely different ways.

Over the past few years, I have met people who have dedicated their careers to skillfully predicting the future: they invested based on their forecasts, and year after year they received a solid jackpot. I noticed that they have something in common - an approach that at first glance contradicts common sense to investing money and time, which turns upside down the usual ideas. In this article, I will explain how you can secure your future using the methods that billionaire entrepreneurs and investors, such as Jeff Bezos, Ray Dalio, Howard Marx, and Warren Buffett, have used with their wits.

Translated to Alconost

“What will change in the future?” Is the wrong question.

As I said, Jeff Bezos is often asked: “What will change in the next 10 years?” But this is fundamentally the wrong question. See how Jeff rethinks it (my emphasis):

This is a very interesting question, it is often asked - but they almost never ask: “WHAT WILL NOT CHANGE in the next 10 years?”

And I suggest that the second question really more important - because on the fact that over time it remains unchanged, you can build a business strategy.

He goes on to explain how Amazon succeeded by focusing on the second question (emphasis mine):

In the retail business, it is obvious that customers want low prices, and I know that it will be so in 10 years. Buyers want fast delivery, want a wide selection. It’s impossible to imagine that after 10 years a client will come to me and say: “Listen, Jeff, of course, I love Amazon, but I would have a little higher prices”, or: “Everything is cool with you, but I would like delivery not so fast ". Sounds wild, right?

Therefore, we are putting our efforts precisely here and are developing in these areas: we know that what we invest today will delight our customers in 10 years. If you find something that does not change in the long run, you can allow yourself to seriously invest in it.

I remember when I first read this, a lot of thoughts filled my head. To me, this approach seemed both obvious and completely illogical. On the one hand, I thought: “There is definitely something to it! Why not just focus on what is definitely not going to depreciate, and not speculate? ”On the other hand, Bezos’s answer contradicts the usual understanding of events and shakes him cool. Usually we plan the future as if we are playing roulette:

- We are trying to determine what will become important in the future (for example, artificial intelligence, virtual reality, blockchain, synthetic biology, nanotechnology).

- We choose one of these, invest our resources and improve ourselves.

- We hope that the topic will “shoot”, that we have chosen the right time, and therefore will benefit.

Yes, sometimes it works, but such an approach cannot boast of reliability. I will not advise my children to do this. In 2012, the Kaufman Foundation conducted a study that showed that "the venture capital industry has not returned the investments made since 1997." And if you remove a couple of companies such as Uber, Amazon, Google and Facebook, the profitability will be terrible. In other words, the chances that the company you invest in, or that you founded, or in which you work among the first employees, will become a “unicorn” are not far from the chances of winning the lottery. Today, only 200 startups are valued at $ 1 billion - but the chance to get a lightning strike is ten times greater !

Why not focus on more specific and reliable trends?

Why the prediction of the future does not work

"You can’t predict, you can prepare."

- Howard Marx

Howard Marx, a billionaire, entrepreneur, and investor, runs Oaktree Capital, an investment firm that manages $ 100 billion, one of the largest hedge funds in the world. Each year, Marx writes a letter to shareholders, which then widely disperses around the world. In one of these messages, he showed why investing in future trends is not always reasonable:

- The seemingly most profitable industries will be the most competitive, making them less profitable. Marx writes: “The best investments are where you don’t want to invest. For most people, a sense of confidence is evoked by investments, the main premise of which is widely accepted, current indicators are positive, and prospects are assessed rosy, but you can’t buy such assets cheaply. The opportunity to take something cheaply can rather be found in controversial, controversial areas, which do not have high hopes and which now have not the best indicators.

- Luck and chance are essential factors that cannot be avoided. “It’s not necessary that even the“ right ”decisions will be successful, because every time you have to predict the future, and even the most reasonable assumptions may not be justified due to some kind of randomness,” says Marx. Some accidents affect the course of events so much that they completely change everything for everyone. Nassim Taleb calls such events "black swans." (A great example is the financial crisis of 2008.)

- Forecasting correctly is much more difficult than it might seem. “Consistently making decisions that correctly take into account all the facts and considerations related to them (that is, correctly predict) is difficult,” says Marx with the modesty inherent in many of the best investors in the world. Independently making his billionth fortune, Ray Dalio in the first paragraph of his new book shows how difficult it is to invest: "Before I share my thoughts with you, I want to clarify that I'm dumb as a traffic jam and know little about what I need to know."

- Even if you make the correct prediction, you are likely to make a mistake with time. Marx says: “Even well-founded decisions that ultimately turn out to be correct rarely prove their correctness quickly enough. This is due to the fact that uncertainty is characteristic not only of future events, but also of the time of their appearance. ” And the problem is that the wrong time is actually identical to making the wrong decision.

The field of artificial intelligence is a good example of Marx's argument. Investing in artificial intelligence today seems like a good choice, but this has not always been the case. In 1974-1980 and 1987-1993 this industry has experienced what is now called the “cold winters of AI”. This was a time when the charm of AI faded away, and as a result, trust and funding disappeared. Talented young programmers massively left this sphere. Many of those who are successful in this field today are just those who survived these winters and continued to move forward, even when it did not seem reasonable. Today, those who want to break into the world of AI have to compete with many smartest people from around the world.

I want to say that to understand what area of knowledge will be popular in 20 years is not as simple as it seems. And predicting the consequences of the third, fourth and fifth orders is generally practically impossible. Could anyone in the early 1900s. to predict that the invention of the car will ultimately lead to random growth of the suburbs, the development of the hotel industry (in the United States, due to the federal highway network) and the insurance industry.

Please note that Warren Buffett - the best investor in history - does not invest in the hottest technology startups. Instead, in his career, he relied on companies built on principles that do not change or change very slowly. This allows Buffett to invest in companies for the long term. For decades, he has had a stake in companies such as Geico, Coca-Cola, and American Express.

So, if predicting the future is not what we are looking for, what do we need?

Meet the “trunk method”

“The main thing is not the ability to predict rain, but the ability to build an ark.”

- Warren Buffett

The methods used by Buffett, Dalio, Marx, Taleb and Bezos are based on a common principle: you need to focus on what is almost guaranteed to retain its value in the future, no matter what happens.

Jeff Bezos talks about how to focus on the constant wishes of customers and build on this a solid foundation for the company. I would take the next step: an effective way to secure a future for myself is to focus on the knowledge that will always be needed . I call this approach “trunk method”.

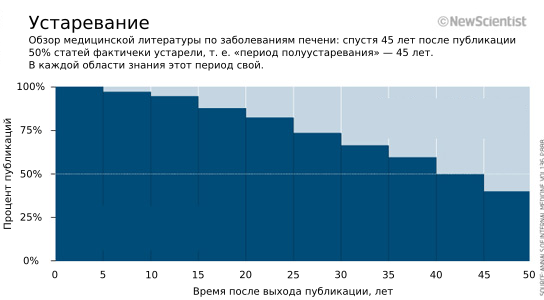

Some forms of knowledge quickly arise and become obsolete just as quickly. Others remain relevant for a very long time. In the article Why to be great is much more complicated than it seems.I share my thoughts on how information obsolescence is increasing.

One study , for example, found that the “half-life” of knowledge about cirrhosis and hepatitis is 45 years. That is, if you take a 70-year-old liver specialist who did not maintain the relevance of his skills, then the chance to get the wrong information from such a specialist is 50%. The semi-aging period of engineering knowledge decreased from 35 years in 1930 to 10 years in 1960.

Source: New Scientist

So what is the difference between knowledge that is relatively outdated from long-lived knowledge?

Generally speaking, “transient,” or rapidly losing relevance of knowledge, is precisely what helps us navigate in a specific environment (for example, in such a specialized field of knowledge as liver disease). And the “pillars”, that is, knowledge that has not lost its relevance for a long time, are based on fundamental principles and mental models that can be applied in various contexts, including those that are impossible to predict today.

I will explain. As already mentioned in the article How Elon Mask manages to learn faster and better than the others , when most people think about knowledge, they imagine a horizontal landscape of knowledge on various topics . The problem here is that if you look at one dimension, you can skip important connections.

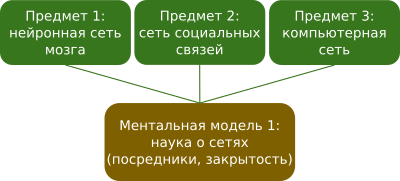

It is often overlooked that knowledge has a vertical dimension. Prominent thinkers and figures, as far as I can tell, see the world around them in this context. The subjects that we study are interconnected by deeper principles and mental models .

In the example in the figure, studying the universal mental models of the science of networks applicable to any network, one can easily understand the specific laws of how the brain works or how social networks work.

And here you can not do with one level of depth - these are multi-level structures. Answering questions from Reddit users, Elon Musk explained this as follows:

It is important to consider knowledge as a kind of semantic tree: first you need to understand the fundamental principles, that is, the trunk and large branches, and only then move on to the leaves - otherwise the last will have nothing to hold on to.

The figure shows an example of visualization of such a semantic tree.

Using the trunk method, you focus on mastering the fundamental mental models, basic principles , and only then move on to the “leaves”. Thus, you are building a more sustainable “knowledge tree” with a greater potential for adaptability - which means you are securing a stable career. Every winter, trees drop leaves, but at the same time grow dozens (and sometimes hundreds) of years - because they have strong trunks and roots.

Take the topic of experiments as an example. For success at the individual, corporate and social levels, it is important to understand the rule of 10,000 experiments. If you are trying to learn how to set up experiments using the approach opposite to the one discussed - let's call it the “leaf method” - you first need to focus on quickly understanding how to conduct A / B testing on a website. The “trunk method”, on the other hand, requires first to understand what a scientific approach is (and these are controlled experiments, peer-reviewed journals, blinding and randomization, falsifiability, placebo control, double blinding, computer modeling and meta-analysis). Having understood several basic principles that make up the scientific approach, you can create thousands of experiments in any area of life. With the advent of new techniques and software, you can quickly understand their significance and begin to use them. And when the tools become obsolete, you’ll still have a “trunk of knowledge”, on which new "branches" and "leaves" will grow. Most of the successes that I had as a writer I attribute to the scientific approach to creating ideas.

Here's another example: I am obsessed with a healthy lifestyle, so I picked up advice on taking trace elements, interval training, short-term fasting, taking a cold shower and baths. And this is wonderful, but more fundamental for my health - knowledge of the fundamental principle of post-traumatic growth: all of the above methods can be deduced from the understanding that the body systems grow after exposure to them and provided there is sufficient time for recovery.

In short, the “trunk method” helps in the following:

- Build a tree of knowledge that will never lose relevance. Winston Churchill once said: "The farther you look back, the more you can see ahead." Recently, this phenomenon has been called the Lindy effect : “The projected life span of“ non-perishable ”objects (these include, for example, technologies and ideas) is generally proportional to their current age, therefore, with each new second of their existence, their life expectancy increases.” From this follows the following principle regarding the obsolescence of information: "the more you focus on fundamental knowledge, the more your" knowledge tree "will live."

- Quickly adapt to any changes and prosper. The fundamental mental models, by their nature, are such that they are found everywhere. Therefore, when you move into a new field for yourself, you will have an advantage, because you will immediately recognize the principles that are already familiar to you.

- It’s better to understand what is happening and what it means. Just as a professional chess player can look a few moves ahead , so mental models will help put what is happening in context, react accordingly and think through their actions in advance.

- Reduce the risk of investing in an area that does not "shoot." In this article, I do not propose completely ignoring the future. I am trying to say that an understanding of trends should be balanced by something that will never change: fundamental principles and mental models. In his book Anti-Fragility, Nassim Taleb, a very successful investor who is rumored to cost hundreds of millions of dollars, offers an approach to investing resources that allows you to get maximum profitability and eliminate losses . He calls this the “bar strategy”: you need to create a portfolio of extremes (the safest assets + high risk assets), and not collect a bit of everything.

Source: Nassim Taleb The

“trunk method” works in the same way as the “bar strategy” of Taleb. By creating a stable base of risk-free knowledge, we reduce the likelihood of a pessimistic outcome and at the same time provide greater flexibility and confidence, allowing you to make risky bets for the future that can shoot well. Therefore, I affirm that the use of the “trunk method” is one of the basic skills that should be mastered to everyone who wants to determine their own future.

About the translator

Translation of the article was done in Alconost.

Alconost localizes games , applications and sitesinto 68 languages. Native-language translators, linguistic testing, cloud platform with API, continuous localization, project managers 24/7, any format of string resources.

We also make advertising and training videos - for sites that sell, image, advertising, training, teasers, expliner, trailers for Google Play and the App Store.

Read more: https://alconost.com