The beginning of a new era of cryptocurrencies? CME Group Exchanges Issue Bitcoin Futures

On Wednesday, November 29, various media outlets citing Bloomberg sources said that on December 18, a group of Chicago-based exchanges CME Group and the Cantor Exchange will issue bitcoin futures. It was also announced that NASDAQ (the largest technology exchange in the world) operations director Adena Friedman said that her structure is considering launching the trading of futures and options for bitcoin. This issue is currently in an early stage of discussion. According to Friedman, the exchange management plans to launch sales in the second quarter of 2018.

What does this mean for the cryptocurrency market?

If you go back to historians and recall the manifesto of Satoshi Nakamoto, then bitcoin and cryptocurrencies were considered as an alternative and, as a result, a replacement for fiat currencies (real money). Almost ten years of cryptocurrency development have shown the gradual formation of bitcoin and altcoins, but not in the direction in which the anonymous Nakamoto suggested. Now, global financial institutions have recognized bitcoin at least as an object of investment and a tool for saving funds. However, do not confuse this with the recognition of Bitcoin as a means of payment: now no one pays with gold bars or coins. Therefore, bitcoin has an approximately the same status in the eyes of traders: an instrument of accumulation and multiplication. It is for this reason that futures (and possibly options) will be traded on the exchange, and not the currency pairs BTC / USD or BTC / EUR.

The steps taken by the CME Group and Cantor Exchange to issue BTC futures clearly show the interest of the traditional financial sector in cryptocurrencies. Bitcoin was chosen as the largest token (in terms of trading volume and capitalization), and not just because it sets value records over the past six months. It is also the most reliable in terms of capital investment: if BTC crashes, then the entire cryptocurrency market crashes, while a fall in the conditional ETH or Waves on Bitcoin will have little effect.

And what, are we on our way to $ 20,000 per coin?

It is now impossible to clearly predict the course of bitcoin. Its value and capitalization is constantly growing, but the cryptocurrency sphere is still an extremely volatile market, which is very strongly influenced by any negative news or too intensive growth. Even the participants in the crypto market are wary of this area, and any careless statements by politicians, regulators, or simply experts respected in financial circles lead to an instant negative reaction. At the same time, the cryptocurrency market always reacts violently to positive news.

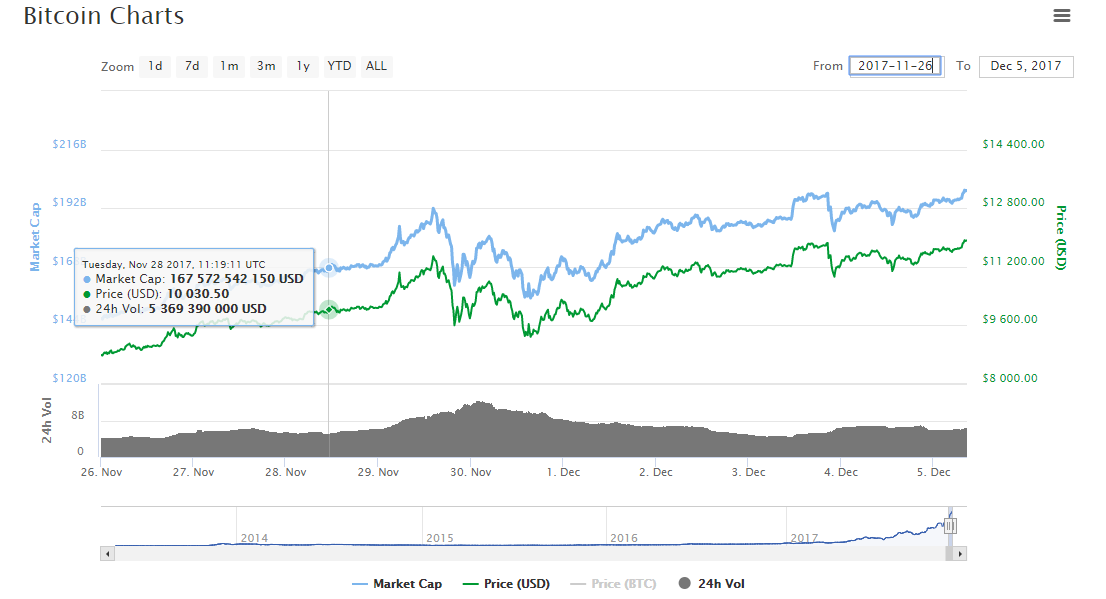

Recall that the information that NASDAQ is considering introducing Bitcoin futures appeared on Wednesday, the 29th. According to the CoinMarketCap charts, on the eve of the 28th, Bitcoin took another psychological milestone of $ 10,000 per coin.

BTC rate chart from November 26 to December 5

Usually, after taking such heights of value with any exchange asset (currency, security, cryptographic token), you can observe a correction, but the very next day BTC continued unreasonable, at first glance, growth and “broke through” the ceiling of $ 11,500 per coin. News of the NASDAQ position, obviously, played an important role in this. This did not save Bitcoin from correction and decline in the following days, but now the rate has relatively settled around $ 11,000. The closer the launch of trading in futures and options on the CME Group platforms is, the more support this event will have for the Bitcoin exchange rate. Further growth of the cryptocurrency depends on how much money will come from Bitcoin to CME Group and Cantor, which will show how much traditional exchange brokers trust the new instrument. But by December 18, we may well see a rate of about $ 13,000 per token.

How is Bitcoin Cash and other altcoins?

There is no need to talk about a significant increase in the rate of BCH or other altcoins amid the release of futures and options on BTC. Its rate is weakly responsive to the growth of bitcoin (as can be seen from the graphs) and only the corresponding actions on it by the CME Group, which were undertaken with bitcoin, can significantly shift it. Quite the contrary: the growth of bitcoin puts pressure on other cryptocurrencies, because so far this market (relatively fiat) has a very limited volume. When the cost of bitcoin grows, it acts as a kind of “vacuum cleaner” for the liquidity of the entire cryptocurrency market, reducing the attractiveness of altcoins.

You need to understand that if exchange brokers show interest in the new futures, then all their money will be “poured” into the capitalization of BTC alone and will not go beyond it. The situation with altcoins will continue: the only source of their liquidity and capitalization is the money of private cryptocurrency holders.

Will these events increase the volume of cryptocurrency trading?

Sure, yes. But the main question: how much? Because the CME Group did not choose the most active period for the introduction of Bitcoin futures. The whole situation around the auction is complicated by the upcoming Christmas and New Year holidays, before which many brokers take profits and take a waiting position. So, some meaningful conclusions about the impact of the CME Group on the bitcoin exchange rate can only be made in January-February 2018, when the markets return to active work. We will have a window from mid-January to mid-February - one month - after which the markets will smoothly move to the stage when the Chinese New Year is celebrated. Token holders from the Middle Kingdom now have a huge impact on cryptocurrencies (both as holders and miners), but as other areas show, during the New Year on the Chinese calendar, China's business activity freezes.

So for now, all the positives from the release of futures and options on Bitcoin are compensated by the banal calendar and the schedule of holidays and vacations.

What other exchanges can introduce trading in bitcoin futures?

If the brokers of the CME Group show sufficient interest in bitcoin futures, this could accelerate their introduction on the NASDAQ. It is impossible to talk about some kind of general interest in cryptocurrencies from other classical exchanges. Cryptocurrencies have long been considered a very risky (and somewhat toxic) investment tool, and to overcome this negative trend, one rate increase is not enough. If the situation with the hacking of any large cryptocurrency exchange or the theft of tokens repeats in the next six months, this may throw the whole sphere back. Now funds and brokers are not ready to invest too much in crypto markets. Instead of the full-fledged interest that we can observe in the securities market, the cryptosphere is regarded as an experimental site, for which only safe amounts are allocated.

Other exchanges will show interest only if the explosive popularity of bitcoin futures on the CME Group exchanges (which is unlikely for a number of objective reasons) or if serious advances take place in the field of regulation and legalization of the entire segment at the level of the main world regulators. NASDAQ should also play its role - if this exchange drags out the process of issuing bitcoin futures, then others will follow its example. So far, no significant breakthrough is foreseen for the sphere, so in the next six months or a year you should not expect trading futures for bitcoin or other altcoins other than the CME Group exchanges.

If you want to get more first-hand information about the Hamster Marketplace, welcome to our Russian-language channel in Telegram .