Reflections on Tokens

- Transfer

It’s early for tokens today, but behind them is the future of technology

In 2014, we wrote : “Bitcoin is more than money, and more than protocol. It is a model and platform for true crowdfunding - completely open, distributed and easily implemented. ”

And this new model has already been implemented - on the idea of an “appcoin”, or “token,” which is a scarce digital asset based on Bitcoin-inspired technology. At the time of writing, the market capitalization of the token sector was estimated at tens of billions of dollars (of course, this sector is overvalued, and nonetheless). Such thick protocols can ultimately create and attract more capital than the latest generation of Internet companies.

Here we will discuss many concepts related to tokens: start with the basics for beginners in this area, and then move on to more complex concepts.

Translated to Alconost

The main thing to understand: tokens are not stocks - they are more like paid API keys. However, they can provide a 1000-fold decrease in liquidity entry time and a 100-fold increase in the customer base - compared to traditional US technology financing tools (such as Kickstarter on the most successful projects). This, in turn, will make it possible to finance projects of a new type that previously remained outside the scope of venture capital opportunities, including open-source protocols and projects with the potential of quick double-return.

But let's start with the basics. Why did the tokens come right now?

1. Tokens - the result of a four-year development of the infrastructure of digital currencies

The last time the general public heard about digital currency was in late 2013 - early 2014 , when the price of bitcoins last touched the then high of $ 1242 . Something has happened since then:

- The value of bitcoin for several years fell down to $ 173 and went up. It is now slightly below its all-time high of over $ 2,900.

- Dozens of exchangers appeared in many countries , which facilitated the transfer of “paper” money, such as dollars and yen, into digital currencies: Bitcoin, Ethereum, etc.

- Large financial institutions have begun to study the underlying blockchain technology for creating so-called “private blockchains,” or distributed registries, for use independently or as part of a consortium.

- The Ethereum programmable blockchain was launched , which survived major crises , received significant support from corporations and in early 2017 increased in price .

In 2013, the digital currency still did not have a certain legal position: many predicted her death , and someone went so far as to even call Bitcoin evil . But in the end, such predictable headlines were a thing of the past, and at the Davos Economic Forum you could see a billboard greeting Satoshi , and Economist put on the cover an artistic interpretation of the technology behind Bitcoin .

By 2017, all major countries already have digital currency exchanges, and each major financial institution has a team working on blockchains. The development of infrastructure and the adoption by the company of digital currencies laid the foundation for the next stage - Internet crowdfunding of new bitcoin-like tokens for a new sphere of application.

2. Tokens differ in their blockchains and code bases

First of all, it should be said that a token is a digital asset that can be transferred (not just copied) between two participating parties via the Internet without the consent of any third party. “Bitcoin” is the very first token: with the ability to transfer bitcoins and the release of new bitcoins recorded in the corresponding blockchain. Other tokens also have a transfer mechanism, and changes in the monetary base are recorded in their own blockchains.

One of the key points is that the token code base is different from its blockchain database. Here is an analogy from the real world. Imagine that the banking infrastructure of the United States began to manage Australian dollars: both currencies are “dollars” and have a common cultural origin, but they have completely differentmonetary base . In the same way, two tokens can use the same codebases (money policies), but have different blockchain databases (moneybases).

Due to the success of Bitcoin, several different types of tokens have appeared:

- Tokens based on the new “chains” and branches of the Bitcoin code. These were the first tokens. Some of them, such as Dogecoin, simply changed the parameters in the Bitcoin code base. Others, such as ZCash and Dash, have introduced new privacy solutions. And there were some (for example, Litecoin) that started as small modifications in the Bitcoin code, but eventually became a testing ground for new functions. All these tokens launched their own blockchains that are not related to the Bitcoin blockchain.

- Tokens based on new chains and new code. The next step was the creation of tokens based on completely new code bases, and Ethereum is the most striking example . Ethereum is a project based on the principles of Bitcoin, using its own blockchain and developed from scratch in order to expand programming capabilities. At the same time, the number of possible types of attacks increases , but functionality is expanded .

- Tokens based on branch "chains" and code branches. The most important example is Ethereum Classic, which is based on the Ethereum blockchain branch that is not compatible with the original , which occurred after the security flaw was discovered , which allowed using a large smart contract in an unintended way. At first glance, this is a technical issue, but at its core it was a crisis that forced the Ethereum community to split into two groups with different monetary policies - in the ratio of 90 to 10. An example from the real world: imagine that all US citizens are not those who agreed with the Law on Emergency Stabilization of the Economy of 2008, would exchange their dollars for “classic dollars” and create another Fed.

- Tokens issued on top of the Ethereum blockchain. These include Golem and Gnosis - they are based on ERC20 - tokens released on top of Ethereum .

In general, launching completely new tokens on new code bases is a technically difficult task, and it is much easier to launch new tokens through a branch of Bitcoin or ERC20 tokens based on Ethereum.

The latter deserves special mention since Ethereum simplifies the issue of tokens so much that this procedure is the first example in the Ethereum manual ! However, the ease of creating tokens on Ethereum does not mean that they are basically useless. Often, these tokens are a kind of public debt , designed to redeem in the new chain that will be created, or to redeem other digital goods.

3. Token buyers receive private keys

When creating a new token, it is often pre-mined and sold when the token is launched, by crowdsale or both. Here, “ pre-mining ” means the allocation of part of the tokens to the creators of the token and related parties. " Kraudseyl " - similar to Kickstarter kraudfaunding in which all internet users are able to buy tokens.

Tokens are a digital commodity. And in fact, their customers acquire a private key . In the case of Bitcoin, it looks something like this:

5Kb8kLf9zgWQnogidDA76MzPL6TsZZY36hWXMssSzNydYXYB9KFIn the case of "Ethereum" - like this :

3a1076bf45ab87712ad64ccb3b10217737f7faacbf2872e88fdd9a537d8fe266You can consider the private key a bit of a password. Just as a password gives access to e-mail stored in a centralized cloud database (Gmail, for example), so a private key gives access to a digital token stored in a decentralized blockchain database - for example, Ethereum or Bitcoin.

However, there is a significant difference: unlike the password, no one, including you, will be able to recover the lost private key. There is a private key - there are tokens. No key - no tokens .

4. Tokens look like paid API keys

Perhaps the best analogy for tokens is the concept of a paid API key. For example, if you buy the Amazon Web Services API key for dollars, you can exchange it for machine time in the Amazon cloud. Also, the purchase of a token - for example, "ether" (ETH) - allows you to exchange it for computing time in the decentralized computing network "Ethereum".

Such an exchange gives tokens their own usefulness.

Tokens have another common property with API keys. If someone gains access to your Amazon services API keys, they will be able to bill your Amazon account. In the same way, if someone sees the private keys of your tokens, he will be able to get your digital money. However, unlike traditional API keys, tokens can be transferred to other parties without the consent of the issuer of the API key.

Thus, tokens have their own utility. And tokens can be traded. So, tokens have a price.

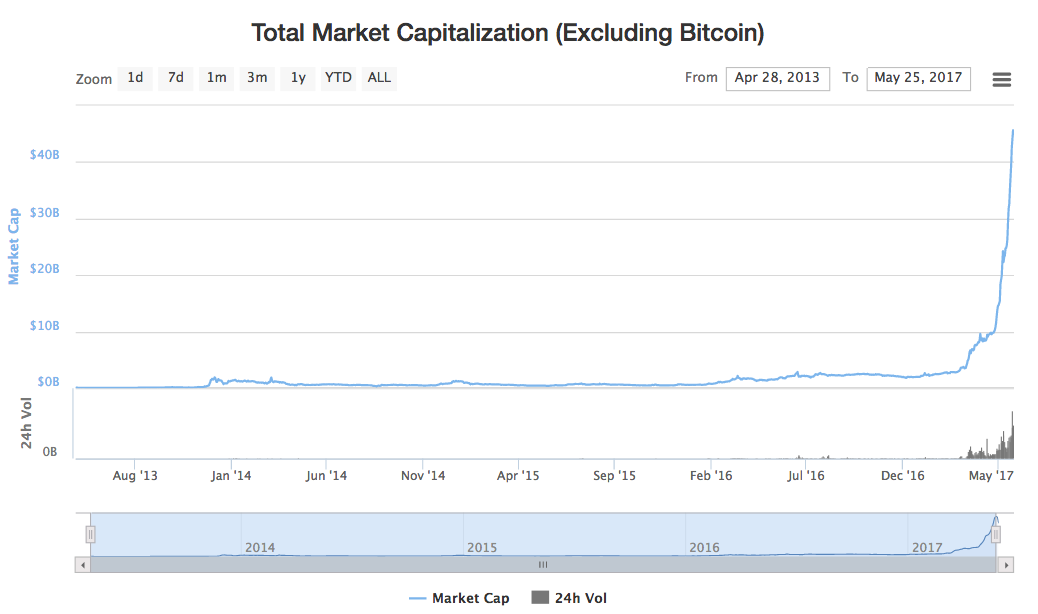

Exponential growth of tokens (not related to Bitcoin) before the market correction. Data - coinmarketcap.com/charts

5. Tokens are a new technological model, not just startups

Tokens have a price, so they can be mass- produced and sold at the stage of the birth of a new protocol - to finance its development, just like startups used Kickstarter to finance product development.

Usually, money in this case - in the form of a digital currency - goes to an organization that issues tokens, which can be either a traditional company or an open source project that is fully funded through the blockchain.

Just as increasing sales is an alternative to fundraising, the launch of tokens can be an alternative to traditional equity-based financing. Moreover, tokens allow you to finance distributed infrastructure, which was previously impossible to finance. - for example, open source infrastructure. However, you should be careful: before starting the launch of tokens, read these three articles and consult a good lawyer!

6. Tokens are a “non-destructive” alternative to traditional financing

Tokens are not stocks because they have internal utility and they are not dilutive in relation to the company's capitalization table. Selling tokens is more about selling paid API keys through Kickstarter than crowdfunding stocks.

Nevertheless, if we consider tokens as an alternative to classical financing through the issuance of shares, token sales provide a more than 100-fold increase in the available customer base and a more than 1000-fold decrease in liquidity entry time compared to traditional startup financing methods. There are three reasons for this: a 30-fold increase in the number of customers in the United States, a 20–25-fold increase due to other countries, and a 1000-fold decrease in the time to reach liquidity.

7. Any American can buy tokens (increase in the number of buyers by more than 30 times)

The issue of tokens differs from the sale of shares: the latter is regulated by the US Securities Exchange Act of 1934 , and the former is more like selling API keys.

Shares may be sold in the United States only to so-called “ accredited investors ” (3% of the adult population with a net worth> $ 1 million), while the sale of API keys in the United States cannot be limited in the same way without harming the IT industry USA. Therefore, if tokens (as API keys) can be sold to 100% of the American population, this gives a 33-fold increase in the available purchasing base in the United States compared to traditional financing through the issue of shares.

However, it should be noted that sometimes tokens can be issued and explicitly advertised as a way to get part of the profit from the work of the company. For example, the issuer may want to give the owners of tokens the right to corporate dividends, the right to vote, and the company's total share capital may be expressed in these tokens. In these cases, we are actually talking about tokenized shares (namely, the issue of securities), which differs significantly from the examples with the “appkoyas” that we discussed. If you do not want to limit yourself to accredited investors under the US Securities Act, do not issue tokenized shares. The fundamental difference is that a regular token is just a useful digital product - such as a paid API key. Again: check out these firstthree articles , consult a good lawyer, and only then launch your own tokens!

8. Tokens can be sold worldwide via the Internet (20–25-fold increase in the number of buyers)

The launch of the token is usually international , and the digital currency comes from all over the world. If a recently opened bank account in a few minutes receives thousands of transfers from around the world in the millions of dollars, it is likely to be frozen. And the sale of tokens in digital currency is always open for companies. Given that US residents make up only about 4–5% of the world’s population, the international sale of tokens multiplies the available customer base by another 20–25 times.

9. Tokens have an advantage in liquidity (more than 1000-fold reduction in the time to liquidity)

The token receives the price immediately after the sale, and this price is freely set in the international market - without days off and lunch breaks, which can not be said about promotions. It may take up to 10 years before the liquidity reaches the stock , and the token can theoretically be sold within 10 minutes (although the creators of the token can and should cryptographically block the tokens to prevent short-term speculation).

Regardless of whether tokens are sold or used, the difference between 10 years and 10 minutes before entering liquidity is an advantage in time of 500,000 times , although, of course, any estimate of the cost is likely to be higher and more stable within a 10-year period.

This is a huge liquidity advantage.in itself, it will be the reason that how tokens will dominate each time they are legally and technically feasible, since the inverse of the time to liquidity is included in the indicator of the degree of aggregate rate of average annual growth . The rapid achievement of liquidity allows you to reinvest in new tokens, which accelerates growth.

10. Tokens will be able to decentralize technology financing

Tokens can be launched in any country, therefore, to attract funding, the importance of a presence in the United States as a whole, and in Silicon Valley or Wall Street in particular, will be reduced. Silicon Valley, most likely, will continue to be the world leader in capital invested in technology, but now it will not be necessary to personally travel to the United States, as was the case with the previous generation of technical specialists.

11. Tokens create a new business model: “better than free”

Large technology companies such as Google and Facebook offer extremely useful free products. Despite this, they are sometimes harshly criticized for making billions of dollars in profit, while their first customers receive only free services.

Once the problems that appear at an early stage are eliminated, the token launch model will give high-tech companies (and open source projects in general) a technologically feasible way to distribute revenue among the users who are behind the company's success. This is the “ better than free ” model : users earn money for becoming first customers. Kik is the first example of this approach, but other similar projects can be expected.

12. Token buyers will become for investors what bloggers have become for journalists

Tokens will remove the barrier between professional investors and token buyers, just as the Internet has removed the barrier between professional journalists and bloggers (including microbloggers).

And this is what it will lead to:

- The Internet has allowed everyone to become an amateur journalist . Now millions of people will become amateur investors.

- As in the case of amateur journalism, some will do very well, and thanks to their success in purchasing tokens, they will be able to get into the professional league.

- In the end, it became mandatory for professional journalists to use Twitter - investors of any scale of activity (from seed investments to hedging) will also come to buy tokens.

- New tools will be developed, similar to the Blogger and Twitter platforms, which will make it easy to use, buy, sell and discuss tokens.

There is no term for this phenomenon yet, but it can be called “trading media” - by analogy with “social media” (English “commercial media” and “social media”).

13. Tokens give technicians an even greater advantage over traditional managers

Since the advent of Bill Gates in the late 70s, there has been a tendency to increase the technological savvy of managers . With the spread of the token sale, it will only increase, since valuable protocols will be created by people who are even more inclined to work in the field of pure theory of computer technology. Many successful token creators will have skills that are more common with open source developers than with traditional leaders.

14. Tokens are instant security without intermediaries

Tokens buyers need to store only private keys to ensure their safety, and this changes our concept of property rights. In the case of tokens, the decision about who owns what property is taken not by the state judicial system, but by the international blockchain. It is clear that there will be many controversial border cases, but over time, blockchains will form “legal regulation as a service” - as a worldwide programmable add-on to the US Chancellery of Delaware .

15. Tokens can be summarized for each technology company as paid logins

Is it possible to expand the token model beyond pure protocols - Bitcoin, Ethereum, ZCash, etc.? It is easy to imagine the sale of tokens as tickets - for access to logins, car trips, future products. They can also be distributed as rewards to authors who make a significant contribution to the work of social networks, or to drivers who help develop auto-sharing networks. In the end, tokens can be expanded to hardware: when someone buys a place in the queue for Model 3 from Tesla or resells a ticket, he exchanges primitive tokens. But first, the model must prove working on protocols, and only then can it be generalized.

Conclusion

Tokens are a very recent phenomenon, and most likely there will be a significant market correction (at the time of publication of the transfer, the capitalization of the tokens discussed has reached a global maximum and fluctuates at a level close to the level at the time of publication of the original article). To deal with the expected abundance of tokens and work with them, we will need information sites like Coinlist , portfolio management tools (e.g. Prism) , exchanges (e.g. GDAX) , as well as many other components of the technical and legal infrastructure supporting the tokens.

But the world has already changed. Tokens are 1000 times better than the tools that are now, and this can be observed infrequently.

About the translator

Translation of the article was done in Alconost.

Alconost localizes applications, games and sites in 68 languages. Native translators, linguistic testing, cloud platform with API, continuous localization, project managers 24/7, any format of string resources, translation of technical texts .

We also make advertising and training videos - for sites that sell, image, advertising, training, teasers, expliner, trailers for Google Play and the App Store.

Read more: https://alconost.com