Overview of decentralized crypto platforms. Part 1: Waves

With this post, I would like to open a series of reviews of blockchain platforms, the main purpose of which is to talk about the possibilities of practical application of blockchain technology to build not only individual services, but also entire digital ecosystems. In our reviews, we will talk about systems that are undeservedly deprived of attention on Habré, but are widely known and discussed in the cryptocurrency hangout.

With this post, I would like to open a series of reviews of blockchain platforms, the main purpose of which is to talk about the possibilities of practical application of blockchain technology to build not only individual services, but also entire digital ecosystems. In our reviews, we will talk about systems that are undeservedly deprived of attention on Habré, but are widely known and discussed in the cryptocurrency hangout. The first part of the series will focus on the Waves open source blockchain platform , which by June this year managed to attract funding in the amount of 29,445 BTC as part of the crowdfunding campaign , which amounted to more than $ 15 million at the current rate at that time.

I decided to learn more about the functionality of this decentralized platform, specializing in the blockchain token model, the main areas of its activities, as well as the strategic steps of the project management.

Unlike the Canadian-based core of the Ethereum team and the German Lisk team, the backbone of the Waves team works in Moscow.

The founder of the platform, Sasha Ivanov, graduated from the Faculty of Theoretical Physics of Moscow State University. Before diving into the cryptocurrency environment, he specialized for several years in developing bots for trading on the exchange, based on the model of artificial neural networks.

Prior to the Waves project, Ivanov managed to launch the Coinomat instant cryptocurrency exchange service, develop the first CoinUSD crypto fiat token, and, together with several notable blockchain enthusiasts, founded the Crypto Asset Fund, a venture fund specializing in blockchain technology.

During the development of cryptocurrencies, the founder of Waves attracted the potential of blockchain technology for the issuance of securities and crowdinvesting. One of the projects that influenced the formation of Waves was the NXT blockchain platform - one of the first platforms providing users with the opportunity to create their own crypto-analogues of shares - blockchain tokens - and trade them on the exchange, thus attracting investments. In Whitepaper Wavesreferences to the NXT experience, which was taken into account when developing its own platform, are also noticeable.

Blockchain crowdfunding has a number of advantages compared to the classic models of venture investment and crowdfunding.

So, instead of working under the patronage and observing the conditions of one large venture investor, the founders of projects may find it much more interesting to use a model in which funds for a project are raised due to a large number of micro-investments. In addition, in addition to obtaining funding, startups automatically have the opportunity to form a primary user base that can test a particular project within the framework of the crowdfunding community that has developed as a result of the campaign. It is likely that Direct Investment will gradually bite off its piece of the market from venture funds.

As for the classic crowdfunding model, in contrast to, for example, the popular international crowdfunding platform Kickstarter, Waves will allow you to exit the project investors by selling your token on the exchange to another user, without waiting for the final results of the project.

Waves is a platform whose functionality allows users to issue custom tokens that will be the equivalent of some assets, carry out various operations with them, and also implement such areas as trading, fiat and cryptocurrency exchanges, blockchain voting and decentralized crowdfunding.

As part of the crowdfunding campaign on Waves, startups can issue crypto tokens, the acquirers of which, in turn, get the opportunity to operate them at their discretion: buy, sell, transfer or exchange without intermediaries. And all this is based on the principles and technologies of the blockchain.

For all of the above operations with tokens, a special p2p exchange is created within the framework of the Waves platform. We can say that tokens play the role of a universal tool, tied depending on the purpose to a particular asset.

This mechanism is implemented as follows: with the help of network gateways that support the token, it is confirmed that it is linked to a particular currency, for example, the US dollar. Unlike the tokens of the BitShares decentralized exchange platform(based on a dynamic mechanism that operates through scripts, where, in order to make sure that the token value remains tied to the asset, the bots automatically carry out a purchase and sale transaction on the exchange), the Waves platform functionality involves the use of blockchain payment systems in as a transactional layer.

In order for participants in a crowdfunding project to decide how to distribute profits or how to spend the raised funds, it is planned to implement a voting system based on blockchain technology within Waves.

To enable the transition from NXT to Waves, the development team plans to launch a protocol that will transform the assets of a project hosted on the NXT platform into Waves assets.

In addition to the benefits of the Waves blockchain model, it also implies a number of some risks that can be divided into three categories:

- Technical risks, for example, bugs that cause a loss in the value of the token, as is the case with Ethereum. This type of risk lies with the Waves platform itself.

- Risks of fraud, which can be mitigated by the KYC-assessment system of projects placed on the site. In fairness, it should be said that during the ICO and crowdsales of cryptocurrency projects, there were practically no cases of successful fraud, since investors trust their money only to famous people from the industry who have a positive reputation.

- Legal risks, in order to avoid which a competent assessment of the model's compliance with existing state legislation is necessary. For example, in the USA there is a very strict policy regarding crowdinvesting, but at the same time in Asia and Europe it is possible to choose a more favorable jurisdiction for this type of project.

From a legal point of view, Waves crypto tokens are implemented as a digital product and cannot be equated with securities or shares in a business. In fact, the token is tied to the value of certain products within the system. Thus, tokens can simultaneously maintain control over the company and satisfy the interests of investors.

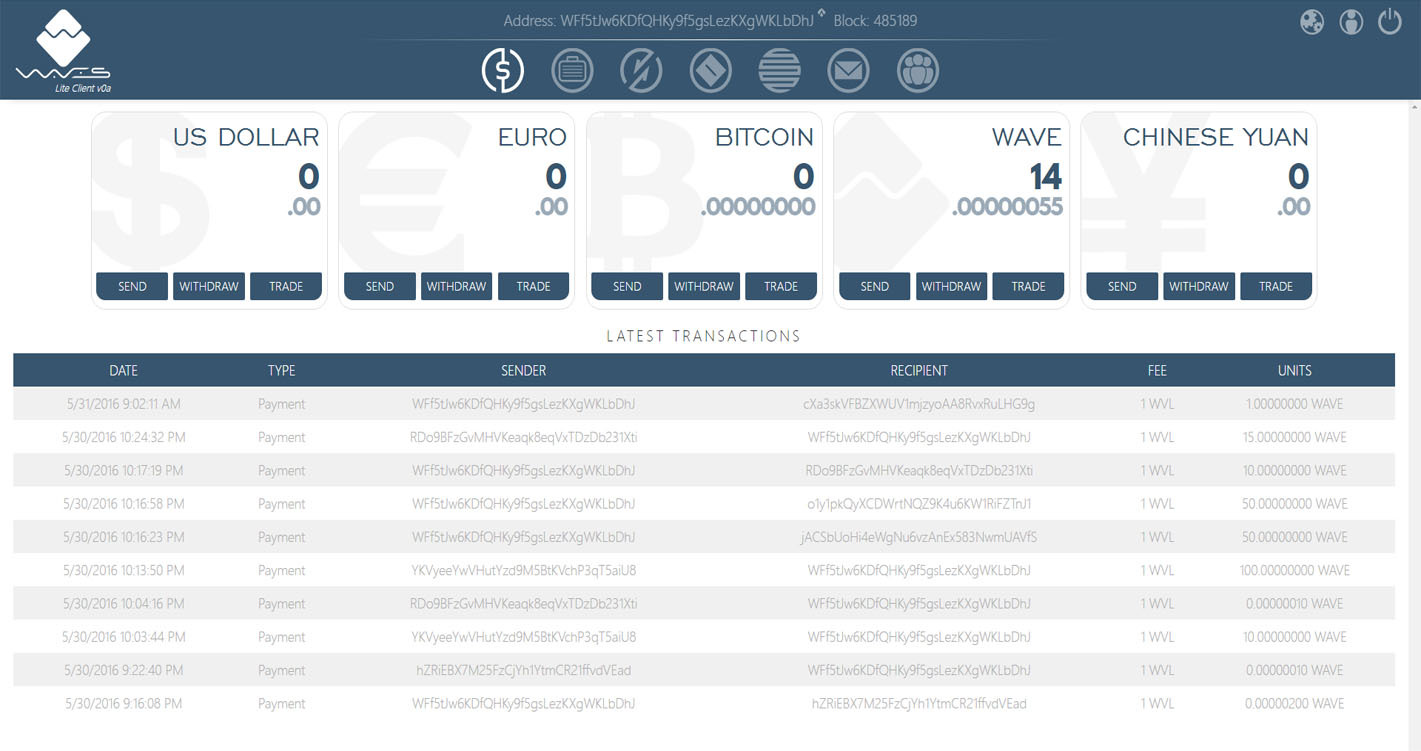

In order to start working with Waves, users are invited to install Lite Client . Lite Client does not imply the installation of the full Waves blockchain and only stores information about the user's own assets within the platform.

In addition, server software for nodes with a full blockchain is offered.

Waves Platform Begins with Scorex Framework Code, an open source blockchain project that, as its creators assure, is capable of accelerating the research and development processes in the field of cryptocurrencies and blockchain. This is largely explained by the compactness of the Scala code at the core of Scorex. For comparison: Bitcoin Core code contains more than 100,000 lines of code, NXT contains more than 45,000 Java codes, and the code structures are very confused in both projects, which slightly reduces the amount of space for experimenters to develop. At the same time, Scala's Scorex code consists of less than 4,000 lines of code.

Waves platform mining is based on the Leased Proof of Stake (LPoS) consensus. This type of consensus allows you to create blocks in 10 seconds due to the limited number of nodes (about 100). LPoS allows users to lease their balance sheets to other nodes in exchange for a portion of the profits, unlike the consensus of the Bitshares DPoS (Delegated Proof of Stake) platform , where miners are determined by simple voting.

According to the founder of Waves, the consensus LPOS implies the existence of a system within which users who generate blocks are selected according to the balance of the Waves token. At the same time, users can withdraw their funds at any time and send them at their discretion. But ordinary users cannot use the money for mining, they can only lend it to the generating nodes in exchange for a fee. This approach is called “account leasing”.

Not so long ago, a reward program was announced, in which enthusiastic testers created a test network of 100 full nodes. The goal of this step is to test the operation of the LPoS consensus protocol and to monitor the transactions carried out through the Waves network. In case of positive test results, the participants of the next stage of the program will try to find the platform vulnerabilities and break the system. Motivation for participants - a bonus for the result determined by the Waves development team depending on the stage of this testing.

After some time, they plan to add smart contracts to the platform, which will be launched only on full nodes to achieve greater scalability. Given the unsuccessful experience of The DAO, within the framework of Waves, it is planned to implement a less flexible solution compared to Ethereum, but a safer one - transactions will not be carried out through smart contracts, but will occur inside the sandbox. This program works in a protected environment and, in fact, does not have access to anything - neither to resources within the system, nor to external resources. Unlike Ethereum code, which functions independently of developers, the sandbox receives data through certain communication channels, processes it and gives it away. This is the usual approach of virtual machines.

The results of the code in the sandbox will be available to all developers. Unlike Ethereum, in Waves the code will not be integrated with the blockchain. The Waves code will be in Sandbox where calculations will be made. The code will work on several nodes, the indicators of which can be compared. Third-party developers will be offered an API for implementing contracts in any programming language.

The platform will allow the development of an additional password system ( 2FA) on the blockchain. Unlike other systems where the risk of stealing the password database remains, the security of each password in the Waves authentication system provides distributed technologies and cryptography. Users of sites that are integrated with the Waves 2FA solution will be able to authenticate with a password stored in a decentralized system that eliminates the risk of password spoofing by an attacker.

Unlike the Ethereum platform, whose founder Vitalik Buterin initially recognized the experimental tasks of his development, the Waves platform aims to solve specific business problems with a large load and the ability to scale.

Sources on GitHub - github.com/WAVESPLATFORM

Discussion on Bitcointalk - bitcointalk.org/index.php?topic=1387944.0

In this review, we examined the Waves blockchain platform as an example of the successful application of the concept of using crypto tokens. In the next article of the review series, we will consider the Lisk crypto platform, which offered its users the opportunity to develop JavaScript-based applications without having to learn the language of the platform itself, as is implemented on Ethereum.