Startup is one of the possible scenarios for the development of the project.

In an attempt to create in your imagination a series of images that will lead the thought to one of the options for developing a startup - or to merge a project (takeover by a competitor) or to launch it on an IPO , I will start from far away, or rather from the quote from “Songs about the Relocation of Souls”. As Vladimir Semenovich Vysotsky said in one of his musical interviews : “The Indians came up with a good religion: that, having given our ends, we don’t die for good ...”

According to Steve Blancathat: “A startup is a temporary organization to find a repeatable, profitable, and scalable business model.” The photo on the right depicts the idea of cyclicity that takes place in one of the Indian religions included in the work of Vysotsky. In my opinion, such a comparison can be applied to the life cycle of a startup. In the process of its development and formation, a startup inevitably approaches the stage of existence in the competitive market when it comes time to decide on the offers of competitors to absorb the project, either as the leader of this market segment, or as another large company. And if, even during the planning of future activities, lay the possibility of such a startup development option in which the preliminary value of the project can be determined even before it goes to IPO. So, having in your arsenal a system of preliminary sale of securities, to do this is simple.

What is this system of pre-sale of securities? This is a set of measures of which one part is an option contract or option . You probably ask: "And how does the proposed system differ from existing stock market instruments?"

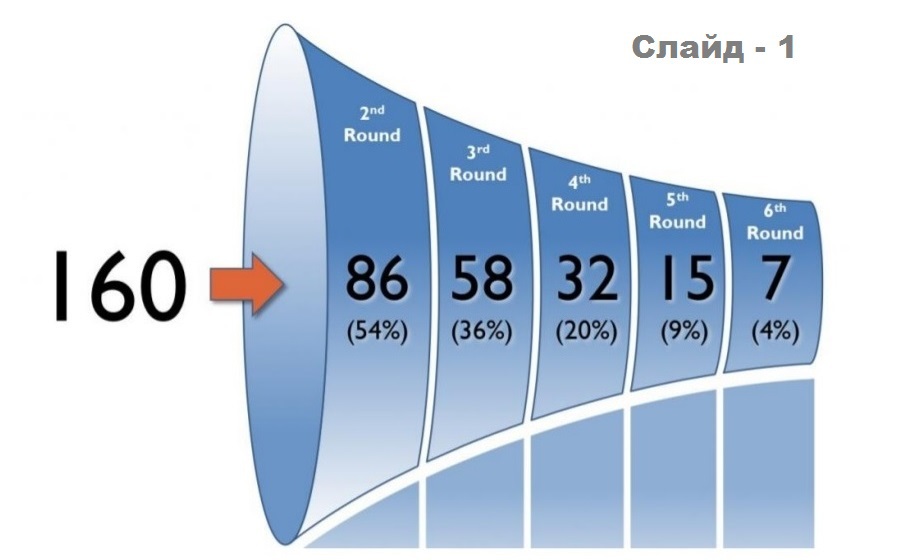

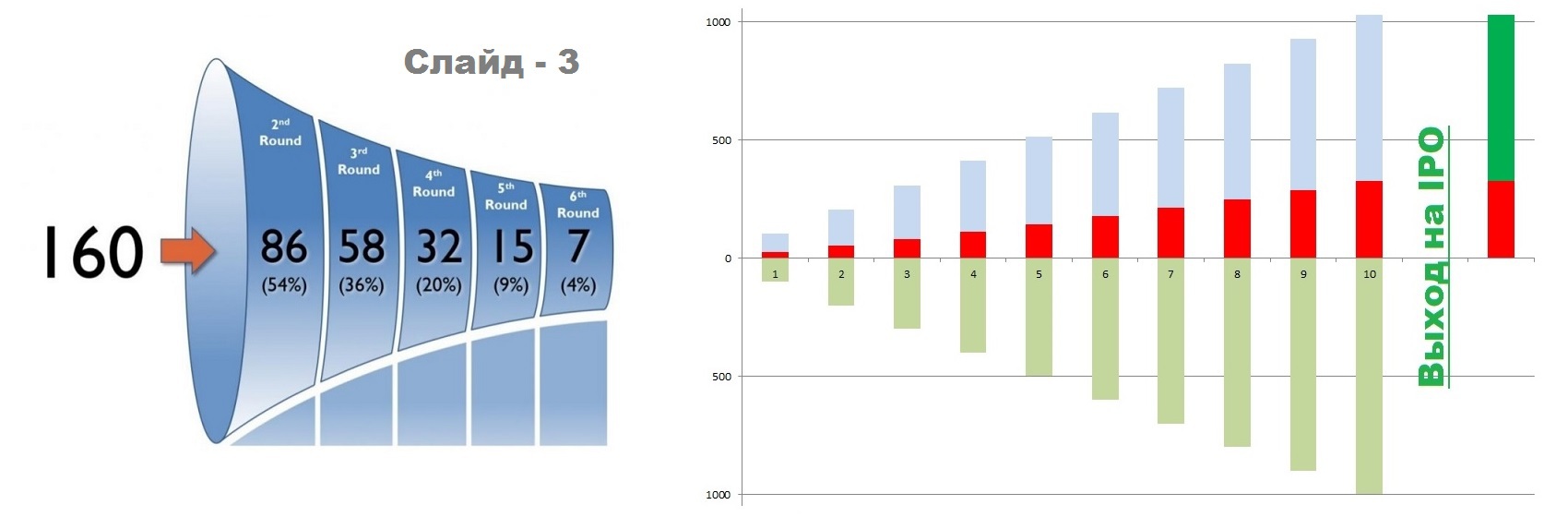

To do this, let's look at the statisticsattracting investment capital. At first, startups attract investments in a large volume, then it is becoming more and more difficult to attract funds into the project, and now, in the final stages, a few companies come out to cross the start-up finish line (IPO). The fate of those who left the race and did not enter the IPO is rarely presented in rainbow colors. The funds that were raised at first were already over, and the next round of financing became impossible. And in these difficult financial conditions, sometimes you have to make a choice from the proposed merger options. And if, instead of using such fundraising mechanisms as venture funds, immediately start preparing for an IPO. And here’s how you can do it: determine for yourself the desired dates and expected accomplishments, give them tangible values. Then, based on these data, start issuing options preceding the issue of shares in your company. For clarity, take a look atgraph 1 (right)

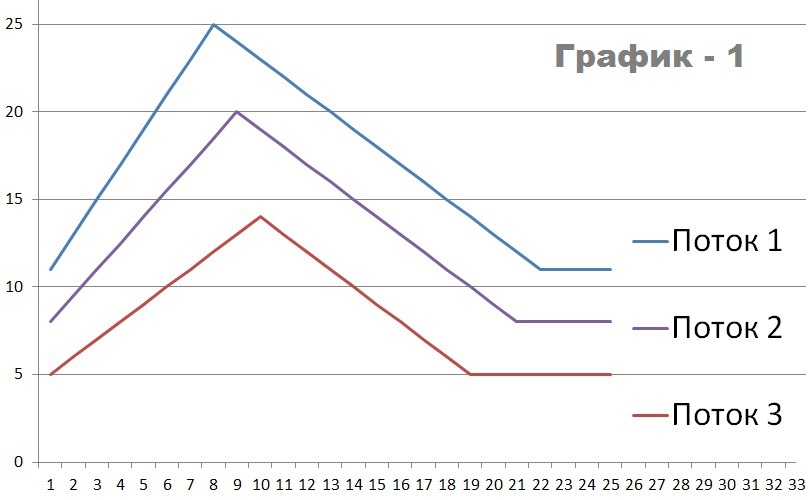

To do this, let's look at the statisticsattracting investment capital. At first, startups attract investments in a large volume, then it is becoming more and more difficult to attract funds into the project, and now, in the final stages, a few companies come out to cross the start-up finish line (IPO). The fate of those who left the race and did not enter the IPO is rarely presented in rainbow colors. The funds that were raised at first were already over, and the next round of financing became impossible. And in these difficult financial conditions, sometimes you have to make a choice from the proposed merger options. And if, instead of using such fundraising mechanisms as venture funds, immediately start preparing for an IPO. And here’s how you can do it: determine for yourself the desired dates and expected accomplishments, give them tangible values. Then, based on these data, start issuing options preceding the issue of shares in your company. For clarity, take a look atgraph 1 (right)(here the ordinate axis is the price, the abscissa axis is the time in hours). It represents a programmed price change for one option of a company that is preparing to issue shares.

Changes are made by the program in which the desired parameters are previously made. In this case, it is a public resource on the Internet, the address of which is: http://krox.96.lt/ Now, in more detail ...

Changes are made by the program in which the desired parameters are previously made. In this case, it is a public resource on the Internet, the address of which is: http://krox.96.lt/ Now, in more detail ...LET US FOR EXAMPLE that you estimate your startup and investments necessary to attract in the foreseeable future at ≈ 1`000`000 conventional monetary units (cu), the estimated period of development and establishment of the company, before going public IPO ≈ 3 years (for convenience, take 1`000 days). Take 10% of the amount necessary to raise funds, this is 100`000 cu and issue options on them, but not at a fixed price. Let the market determine the price. To do this, we divide the first part of the options, which will be sold in the first round lasting 100 days, into different price flows:

- Stream 1 - 10% of options issued for the first round

- Stream 2 - 25% of the same amount

- Stream 3 - 65% (largest part)

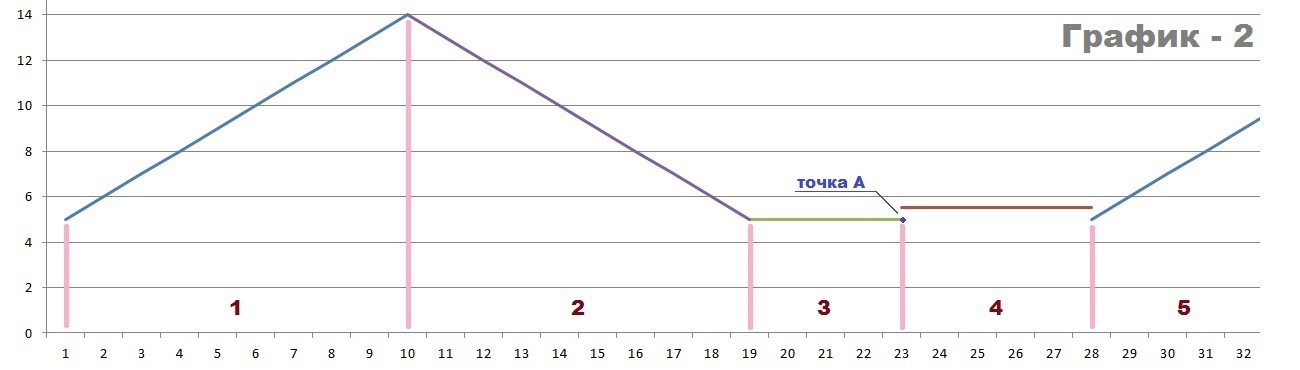

Now the fun begins - bidding. Let us fix our eyes on chart 2 (below) . It depicts a cycle in accordance with which the price of options in “Stream 3” (from our example) will change . The first part of the graph shows how the price will automatically rise, let's call this part of the graph - the phase of automatic price increase. In the second part of the chart, the price automatically decreases, let it be a phase of automatic price reduction. In the third part of the graph, the price is at the minimum level, called the phase with the minimum price. “Point A” - becomes the culmination of the trading process. That's because right after the sale of an option from “Stream 3”, the price goes into the phase of active sale (the fourth part of the chart). It differs from the previous one by a predetermined value (in this example, 10% more than the price of the option just sold). If during the active sales phase, which lasts a certain time, the transaction does not occur, then the price goes to phase five - that is, it returns to the phase of automatic price increase. And the cycle of price changes is repeated, starting with the minimum for this stream.

Now consider the following situation (graph 3)in which there are several option purchases in a row. For each subsequent transaction, the price, in this example, increases by 10% (part of the schedule is seven and nine). If during the active sales phase there were no option purchases (during, in our case, 5 periods of time), then for the price the phase changes from active sales to the phase of automatic price increase (the eighth of the graph). As you already understood from the charts, the price of options will NEVER (!) Decrease below the programmed value, and this introduces PREDICTION in the process of changing the price of options.

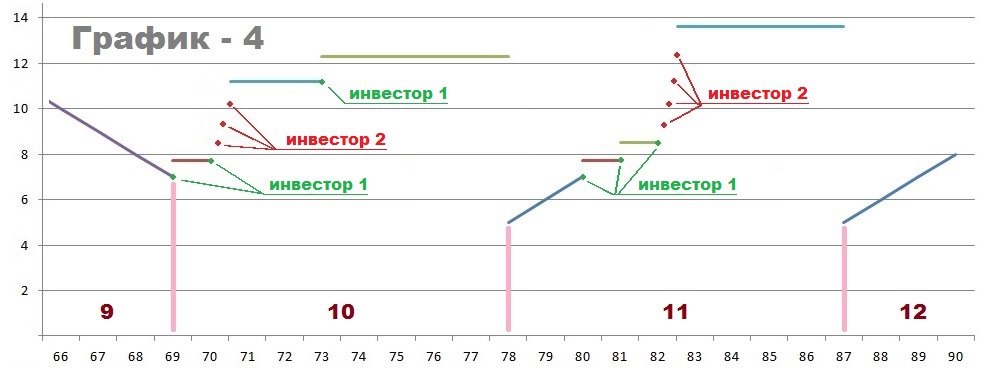

It was the turn to consider a situation involving several investors at the same time. In the tenth and eleventh parts of the graph 4, the red and green dots indicate the price at the time of purchase. There is clear competition herebetween buyers of securities who are willing to buy them, even above the minimum price. And they compete with each other, thereby raising the price for the next transaction.

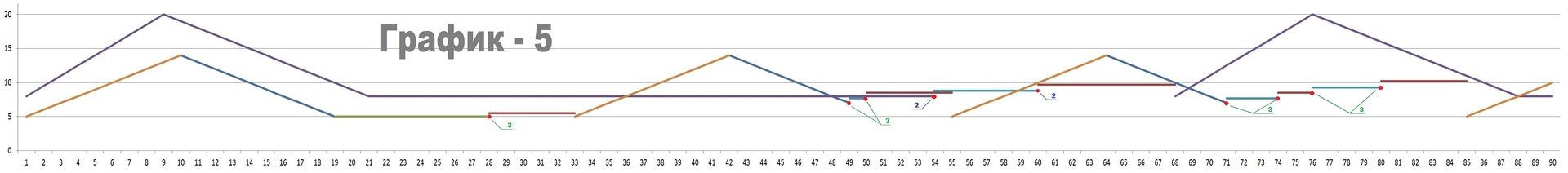

Now we have come to the point where several price flows appear that differ in all respects. On schedule 5 (press and will appear in this chart enlarged view) - depicts the result of the interaction of the program to change the price of an option representing your interests, and buyers of your securities. A program of different actual prices in flows - selects the minimum and offers it to a potential investor. For simplicity of demonstration, only two price flows are involved here. Red dots indicate the sale of options (from “Stream 2” and “Stream 3”) The average value of funds raised from the sale of securities is greater than from the sale at a fixed minimum price (in this example, 69 cu divided by 9 options = 7.66 cu against 5 cu sold at a fixed minimum price).

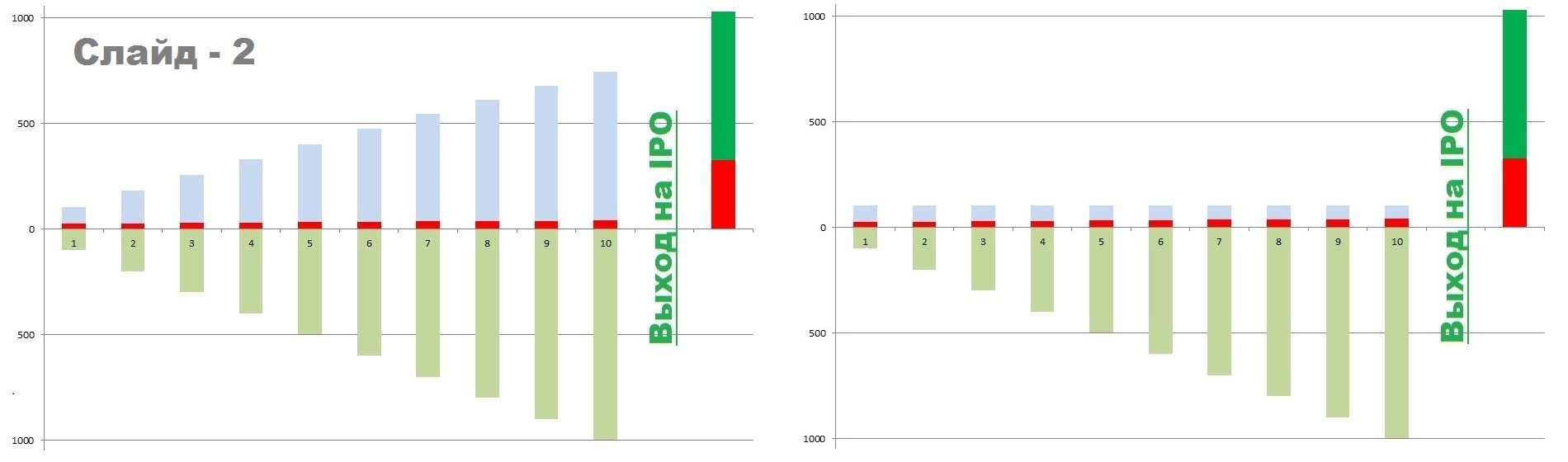

So I brought you to the point where 100 days have passed since the start of the fundraising campaign (the first investment tour has ended). We summarize and immediately launch the second investment tour (in our example , again to collect investments in the amount of 100`000 cu). A logical question arises as a result of the first round there may be uninvested options, what should I do with them? The first option is to add them to the securities of the second round, the second option is not to sell them, but to go for an IPO with more shares. Both options are shown in"Slide 2" . The left histogram shows 10 investment tours, each of which includes 10% of the total investment and options not sold in the previous round. The right diagram shows that in each investment round only 10% of the total volume of attracted investments was put up for sale. The red color on both histograms indicates the amount of money raised as a result of the tour. Light green indicates the volume of options already issued. Green indicates the number of shares issued in an amount equivalent to the number of remaining options.

As you have already seen, the system I am proposing is different from the system for selling options at a fixed price (for example, according to a system with a fixed price for an option, they are now attracting investment in the company - boomstarter.ru“Saved version of the page” ). Therefore, the number of attracted investments from the sale of options and the volume of issued shares exceeded the mark of 1`000`000 cu (taken by us for this example ). I would also like to note that something similar to the system for attracting investments in startups operates at iangels.co , which can be found in the video presentation . For comparison, evaluate the possibilities of entering an IPO by searching and attracting venture capital and by selling options without a fixed price. In the system that I propose, it’s hard not to enter an IPO, since raising the bar high at the very beginning will serve as an additional incentive, and the intermediate results of attracting investments will be, so to speak, “litmus paper” for youconfirming the correctness of your choice.

Now about what scope I see for this system. The first use case is described by me above.

The second option is to prepare for a merger or acquisition by another company. The tool I am proposing will allow you to have more powerful arguments in your arsenal during mergers or acquisitions, in the form of options already sold.

The third area of application of the system with a changing price seems to me to sell exclusive products for which the price is not yet known, since there are no analogues of the product yet.

And another option for using this system is presented in the advertising field, for example, for selling impressionsadvertisements to users of some popular service. Impressions to sell portionwise at 500-1000 in one order, the higher the demand for the advertising service, the more the price of impressions will increase.

If reading this article has not yet completely bored you, I can offer you to see how this model works on a real site. To do this, click on the alien guest, carefully studying the text of the epigraph and he will transfer you to a minimally working version of such a service.