Ideal presentation for a startup: 3 minutes 44 seconds to convince investors

- Transfer

Creating a company is an extremely difficult process. Raising capital is an important step for many IT startups, which, however, is difficult for those who do this for the first time. Given this, we would like to shed light on what constitutes the process of successfully attracting seed financing.

DocSend , a startup that provides users with secure and private file sharing services, such as job offers or legal agreements, has analyzed over 200 presentations to find out the right way for a startup to transition from self-development to getting seed investments, or from working with business - Angels to serious funding from venture capital firms.

In collaboration with Tom Eisenmann , a professor at Harvard Business School, they studied the business of companies that managed to raise $ 360 million in total.

What did they manage to find out? All research results can be found here .

They learned that companies, on average, need about 40 meetings with investors and a little over 12 weeks to successfully complete the seed investment process. Investors do not view the startup’s presentation for long - on average for 3 minutes and 44 seconds.

It is easy to conclude that the more investors you come in contact with, the more chances you will have to attract financing. Unfortunately, this is not the case. Of course, to some extent, the number of investors you meet affects the number of business meetings held with them. Note: in the above example (graph on the left), an entrepreneur can have several meetings with the same investor, so the number of meetings can be more than the number of people who were contacted.

By contacting a large number of investors, you will receive more meetings with them, but this will not necessarily help to get more money. Focus on the quality of business dialogue with investors. On the graph on the right, we compared the number of investors with whom we managed to get in touch, and the amount of funds invested in the company. The dependence here is insignificant, and for that matter, there is even a reverse trend. As such, the relationship between the number of investors with whom it was possible to get in touch and the amount of funds invested in the company is actually not. If you contact a large number of investors, you will hold meetings with them. However, there is no correlation between the number of investors with whom negotiations were possible and the volume of proposed investments.

It would be better to find companies that are already interested in your activity, and first of all concentrate on working with them.

In general, seed investments from business angels are more common than similar investments from fund firms. According to David S. Rose, who works as a business angel, seed finance companies invest 1,500 startups every year, while business angels invest about 50,000 startups.

In part, this discrepancy is explained by the fact that seed funds invest in one of the 400 startups that they consider, while business angels choose one of 40. These numbers are far from accurate, but they show that if you want to attract the attention of any company, you need an excellent presentation, and you must know all the strengths of your business from and to.

According to information from the DocSend website, although funding from business angels is more common, investing on behalf of funds has more preferable characteristics. If you have the opportunity to receive money from the seed fund, you will receive twice as much in a shorter period - 30% faster. You will also need to contact only 40% of investors (compared to receiving investments from business angels).

In addition, seed investment funds can act faster and provide more cash than business angels. The average amount of time required to receive money from firms turned out to be four weeks shorter compared to the same time when working with business angels. In addition, the amount of investments provided by seed funds turned out to be 36.8% higher than expected, while in the case of business angels this value was 18.9%.

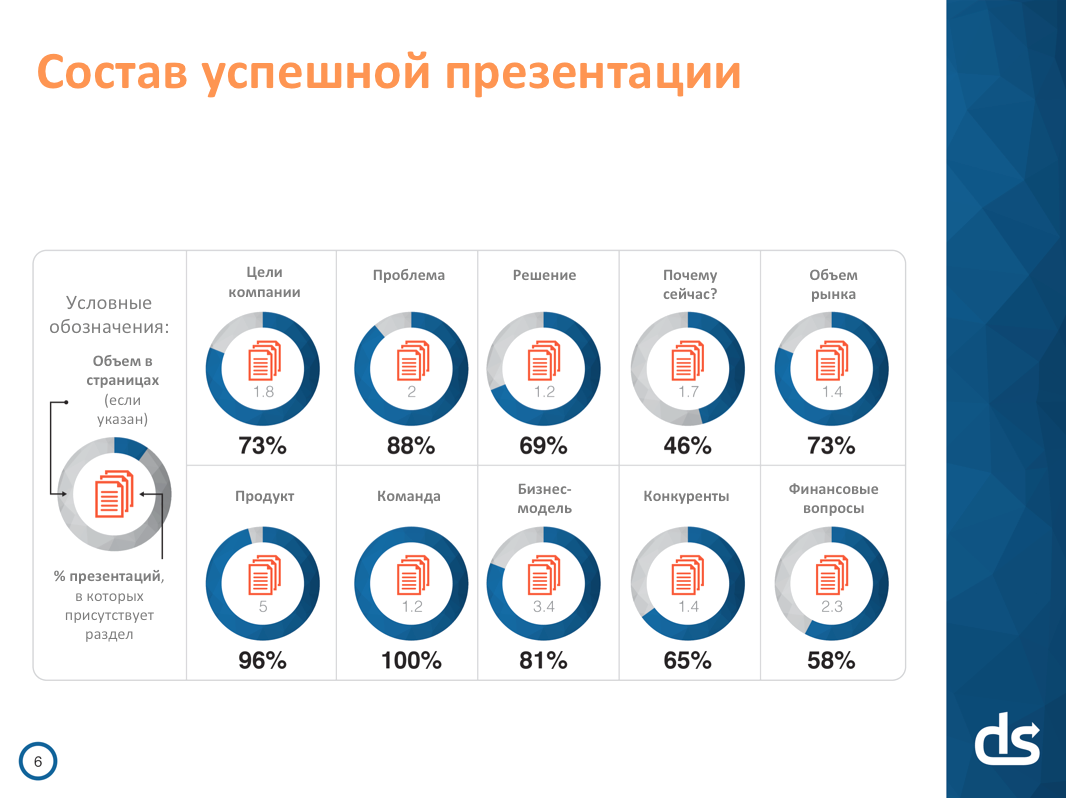

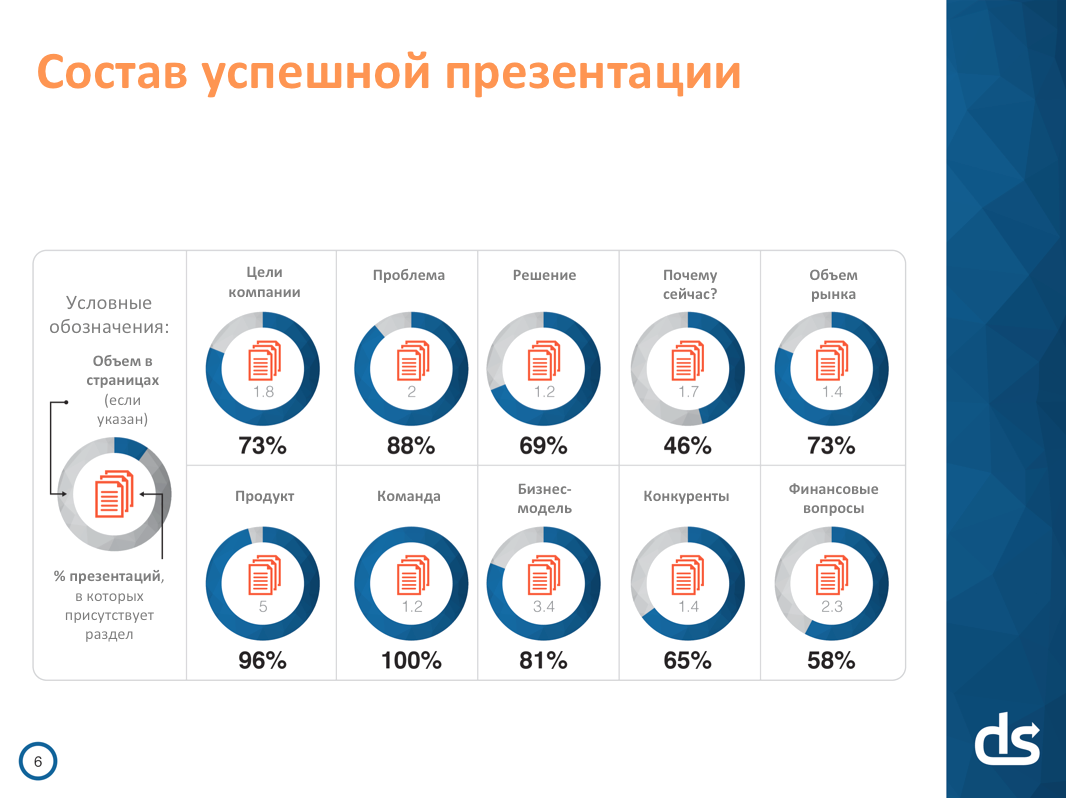

The average volume of presentations that we analyzed was about 19 slides, and most of them were made in a similar format. The table below shows the types of pages that were commonly used, sorted by the frequency of their appearance in presentations. The table also determines the average volume of each section relative to the volume of the entire presentation, provided that this value was indicated [by its authors]. We classified the pages according to the list of categorization recommendations from SequoiaCapital.

If you are creating a presentation in order to get a seed investment, you will most likely need to include 10 slides shown below. Of course, a slide called “Team” is included in the presentation by default. But you also need to add slides that tell about the goal of the company, the size of its market and its competitors.

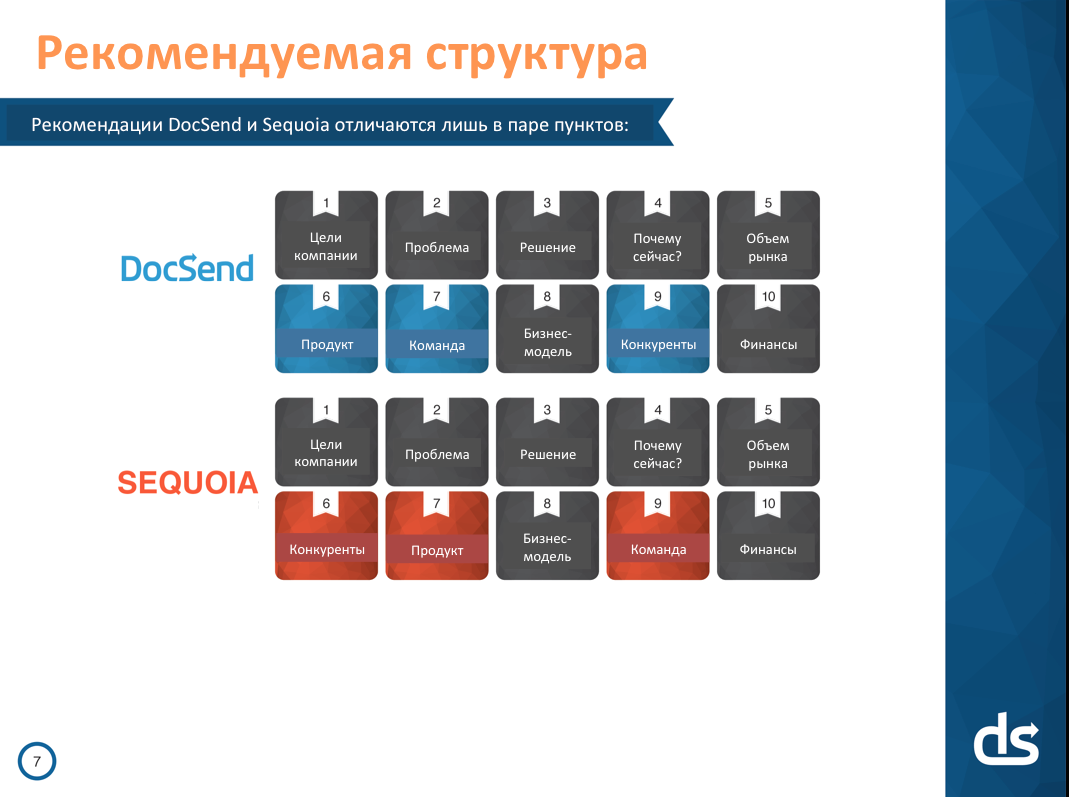

The order of sections [in the presentations that analyzed DocSend] was standard except for the slide with information about the team. This page appeared either at the beginning or at the end of the presentation, but never fit in its middle. Of the 200 startups that the company studied, most placed this page at the end of the presentation, and not at the beginning. This approach is consistent with the advice of Reid Hoffman, who recommends companies to post their thesis on proposed solutions at the beginning of the presentation, rather than a page with information about the team.

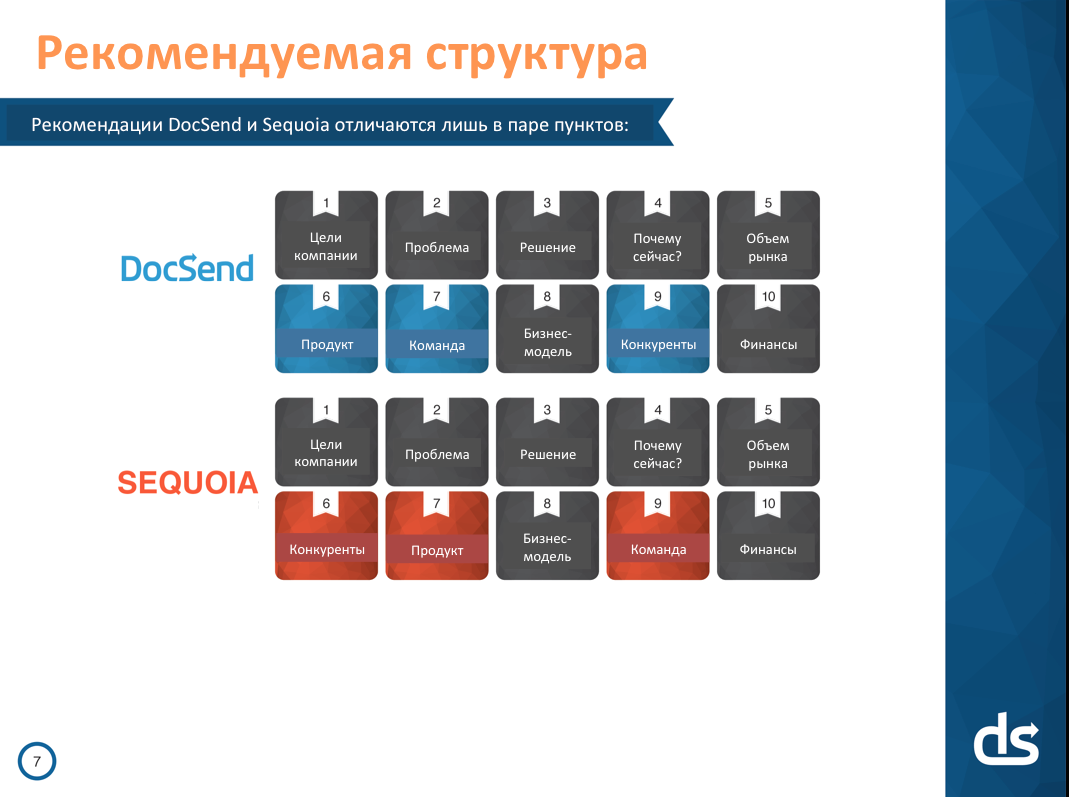

The slide order, which DocSend defines as the most effective, is very similar to the SequoiaCapital recommendations. The only elements that have changed location are slides describing the product and team.

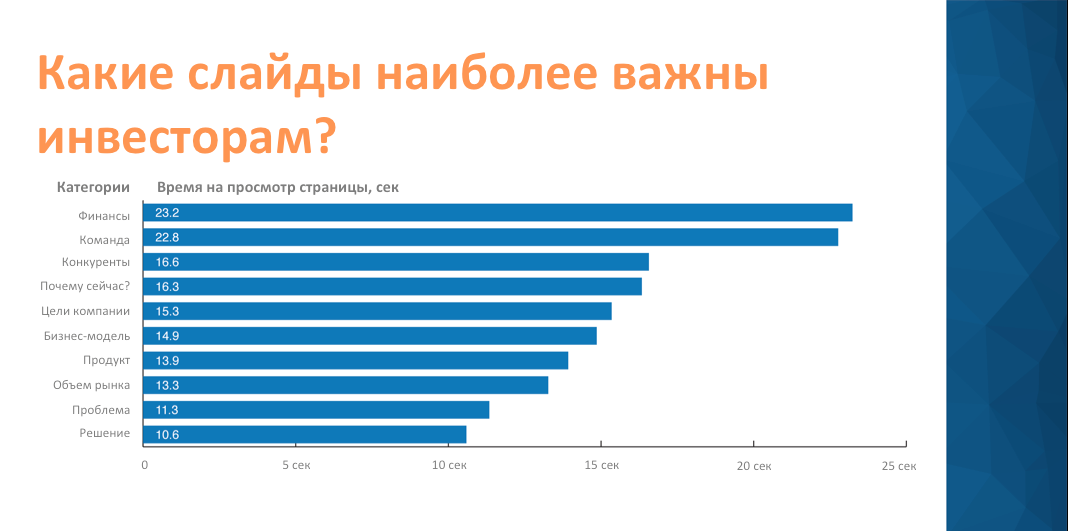

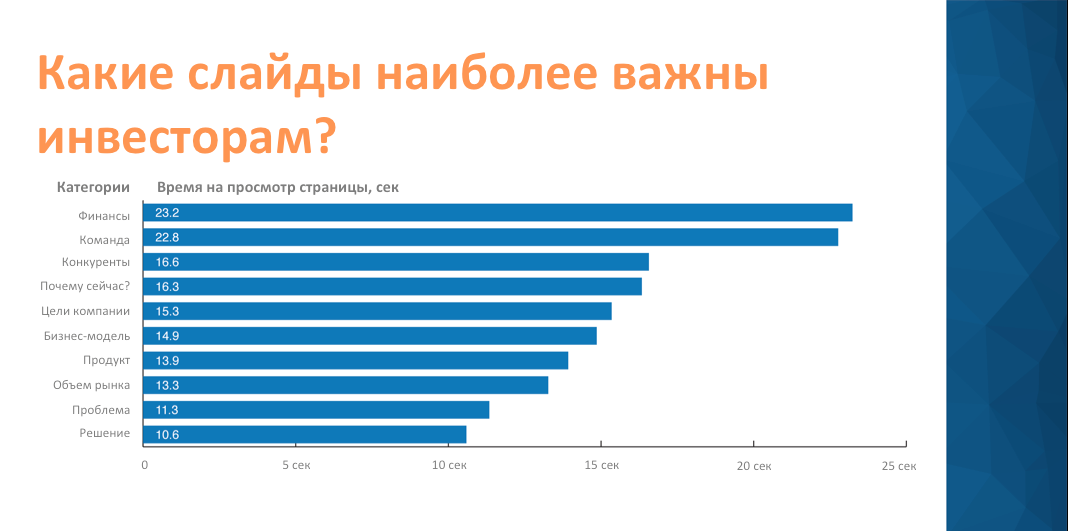

The question arises: What is the focus of the presentation on? If you spend time correcting your presentation, which slides should you focus on? To which part of the presentation do you expect questions from the audience? The table below shows the average amount of time spent exploring each category of slides. Although the “Finance” section attracts the most attention, only 57% of successful presentations contain it. Basically, such a low percentage of use of this section is explained by the fact that many companies at an early stage of financing do not yet have financial results. Almost all startup presentations at the planting stage and many of the round A presentations do not contain significant financial data.

If you include this section in a presentation, be very careful and carefully think through its contents, as investors will look at this section especially carefully. Make sure that the slide about your team (in whatever part of the presentation it is) also looks as convincing as possible.

It is interesting that practically in none of the presentations studied the amount that the project needed and the conditions under which the team was ready to work with investors were mentioned. It is always better to voice this information verbally in person - it can change depending on who you are talking to.

The most important are the pages with information about finances, team and competitors, judging by how long investors have been studying these sections.

How long does the standard seed funding process take? According to information on the DocSend website, on average, it takes 12.5 weeks. However, we found that real data can deviate greatly from the average. In 20% of the companies, the study took 20 weeks or more, while the other 20% took 6 weeks or less. The longest term for successful financing is 40 weeks.

To close the round of financing, perseverance is needed. In 15% of cases, completion of this procedure takes from zero to five weeks. In almost half the cases, it takes from 11 to 15 weeks, and with a probability of 17% you will need 16 weeks or more to close the round.

Companies that did not succeed in obtaining financing gave up, on average, after 6.7 weeks. Perhaps these companies failed simply because of a lack of patience: firms that succeeded reported that the process took longer than planned. On a scale of one to five, where 3 is “as expected,” and five is “much longer”, the average score for seed financing was 3.6.

Although for startups, patience is usually a virtue, it is important to understand when to stop, take a step back and look at the situation with a fresh look. Three quarters of all companies that could not get seed funding were going to try again - on average, it took 8.9 weeks to plan a second attempt - enough time to achieve business development and establish the necessary connections.

Round A funding is much less common than investments at the seed stage. According to DocSend, there are nine seed financing procedures per round A financing procedure. It turns out that the round A crisis is still ongoing. Despite the smaller amount of data, we were able to compile some statistics on the differences between seed funding and round A financing.

If you have the opportunity to raise funding in round A, the investment process will be easier than with seed funding. This procedure takes less time, brings more cash and requires fewer investors than in the case of seed investment.

It is very interesting that in spite of everything that we read about the “round A financing crisis”, this method of investing in the later stages of the company’s development lasts shorter compared to seed investment. The companies reviewed in the study spent 9.6 weeks successfully completing the financing process in Round A. However, they needed to negotiate with an average of 26 investors. Of course, the example examines a very small number of companies, so perhaps it is not representative enough, as Russ Hiddleston, one of the founders of DocSend, explained to me.

User needs and other economic conditions affect which business models are most successful in attracting finance. Although trends in this area are constantly changing, over the past 12 months, four types of companies have been most successful in attracting seed funding: b2c companies (32% of the total number of funded startups), b2b companies (also 32%), marketplaces (22% ) and hardware startups (14%).

Marketplaces attracted the largest amount of funds at the seed financing stage (an average of $ 1.73 million). They are followed by hardware companies (about $ 1.3 million), b2b startups (about $ 1.2 million) and consumer businesses (about $ 945 thousand).

Successful marketplaces are a rare occurrence, however, when they manage to get ahead, they acquire the potential for significant growth like Airbnb. Such a company takes a lot of time to attract financing. And although businesses in this category make a lot of money, it will take more time to convince investors that your startup will succeed.

The runaway performance of companies of various types is not surprising. Consumer startups occupy the largest share of the seed investment market, since it is cheaper and easier for such companies to launch a minimally viable product - the same thing happens in the b2b sphere.

PS You can prepare for attracting investments using the presentation template developed by IIDF experts [ Slideshare, Keynote , PPT ]:

DocSend , a startup that provides users with secure and private file sharing services, such as job offers or legal agreements, has analyzed over 200 presentations to find out the right way for a startup to transition from self-development to getting seed investments, or from working with business - Angels to serious funding from venture capital firms.

In collaboration with Tom Eisenmann , a professor at Harvard Business School, they studied the business of companies that managed to raise $ 360 million in total.

What did they manage to find out? All research results can be found here .

They learned that companies, on average, need about 40 meetings with investors and a little over 12 weeks to successfully complete the seed investment process. Investors do not view the startup’s presentation for long - on average for 3 minutes and 44 seconds.

It is easy to conclude that the more investors you come in contact with, the more chances you will have to attract financing. Unfortunately, this is not the case. Of course, to some extent, the number of investors you meet affects the number of business meetings held with them. Note: in the above example (graph on the left), an entrepreneur can have several meetings with the same investor, so the number of meetings can be more than the number of people who were contacted.

By contacting a large number of investors, you will receive more meetings with them, but this will not necessarily help to get more money. Focus on the quality of business dialogue with investors. On the graph on the right, we compared the number of investors with whom we managed to get in touch, and the amount of funds invested in the company. The dependence here is insignificant, and for that matter, there is even a reverse trend. As such, the relationship between the number of investors with whom it was possible to get in touch and the amount of funds invested in the company is actually not. If you contact a large number of investors, you will hold meetings with them. However, there is no correlation between the number of investors with whom negotiations were possible and the volume of proposed investments.

It would be better to find companies that are already interested in your activity, and first of all concentrate on working with them.

In general, seed investments from business angels are more common than similar investments from fund firms. According to David S. Rose, who works as a business angel, seed finance companies invest 1,500 startups every year, while business angels invest about 50,000 startups.

In part, this discrepancy is explained by the fact that seed funds invest in one of the 400 startups that they consider, while business angels choose one of 40. These numbers are far from accurate, but they show that if you want to attract the attention of any company, you need an excellent presentation, and you must know all the strengths of your business from and to.

According to information from the DocSend website, although funding from business angels is more common, investing on behalf of funds has more preferable characteristics. If you have the opportunity to receive money from the seed fund, you will receive twice as much in a shorter period - 30% faster. You will also need to contact only 40% of investors (compared to receiving investments from business angels).

In addition, seed investment funds can act faster and provide more cash than business angels. The average amount of time required to receive money from firms turned out to be four weeks shorter compared to the same time when working with business angels. In addition, the amount of investments provided by seed funds turned out to be 36.8% higher than expected, while in the case of business angels this value was 18.9%.

The average volume of presentations that we analyzed was about 19 slides, and most of them were made in a similar format. The table below shows the types of pages that were commonly used, sorted by the frequency of their appearance in presentations. The table also determines the average volume of each section relative to the volume of the entire presentation, provided that this value was indicated [by its authors]. We classified the pages according to the list of categorization recommendations from SequoiaCapital.

If you are creating a presentation in order to get a seed investment, you will most likely need to include 10 slides shown below. Of course, a slide called “Team” is included in the presentation by default. But you also need to add slides that tell about the goal of the company, the size of its market and its competitors.

The order of sections [in the presentations that analyzed DocSend] was standard except for the slide with information about the team. This page appeared either at the beginning or at the end of the presentation, but never fit in its middle. Of the 200 startups that the company studied, most placed this page at the end of the presentation, and not at the beginning. This approach is consistent with the advice of Reid Hoffman, who recommends companies to post their thesis on proposed solutions at the beginning of the presentation, rather than a page with information about the team.

The slide order, which DocSend defines as the most effective, is very similar to the SequoiaCapital recommendations. The only elements that have changed location are slides describing the product and team.

The question arises: What is the focus of the presentation on? If you spend time correcting your presentation, which slides should you focus on? To which part of the presentation do you expect questions from the audience? The table below shows the average amount of time spent exploring each category of slides. Although the “Finance” section attracts the most attention, only 57% of successful presentations contain it. Basically, such a low percentage of use of this section is explained by the fact that many companies at an early stage of financing do not yet have financial results. Almost all startup presentations at the planting stage and many of the round A presentations do not contain significant financial data.

If you include this section in a presentation, be very careful and carefully think through its contents, as investors will look at this section especially carefully. Make sure that the slide about your team (in whatever part of the presentation it is) also looks as convincing as possible.

It is interesting that practically in none of the presentations studied the amount that the project needed and the conditions under which the team was ready to work with investors were mentioned. It is always better to voice this information verbally in person - it can change depending on who you are talking to.

The most important are the pages with information about finances, team and competitors, judging by how long investors have been studying these sections.

How long does the standard seed funding process take? According to information on the DocSend website, on average, it takes 12.5 weeks. However, we found that real data can deviate greatly from the average. In 20% of the companies, the study took 20 weeks or more, while the other 20% took 6 weeks or less. The longest term for successful financing is 40 weeks.

To close the round of financing, perseverance is needed. In 15% of cases, completion of this procedure takes from zero to five weeks. In almost half the cases, it takes from 11 to 15 weeks, and with a probability of 17% you will need 16 weeks or more to close the round.

Companies that did not succeed in obtaining financing gave up, on average, after 6.7 weeks. Perhaps these companies failed simply because of a lack of patience: firms that succeeded reported that the process took longer than planned. On a scale of one to five, where 3 is “as expected,” and five is “much longer”, the average score for seed financing was 3.6.

Although for startups, patience is usually a virtue, it is important to understand when to stop, take a step back and look at the situation with a fresh look. Three quarters of all companies that could not get seed funding were going to try again - on average, it took 8.9 weeks to plan a second attempt - enough time to achieve business development and establish the necessary connections.

Round A funding is much less common than investments at the seed stage. According to DocSend, there are nine seed financing procedures per round A financing procedure. It turns out that the round A crisis is still ongoing. Despite the smaller amount of data, we were able to compile some statistics on the differences between seed funding and round A financing.

If you have the opportunity to raise funding in round A, the investment process will be easier than with seed funding. This procedure takes less time, brings more cash and requires fewer investors than in the case of seed investment.

It is very interesting that in spite of everything that we read about the “round A financing crisis”, this method of investing in the later stages of the company’s development lasts shorter compared to seed investment. The companies reviewed in the study spent 9.6 weeks successfully completing the financing process in Round A. However, they needed to negotiate with an average of 26 investors. Of course, the example examines a very small number of companies, so perhaps it is not representative enough, as Russ Hiddleston, one of the founders of DocSend, explained to me.

User needs and other economic conditions affect which business models are most successful in attracting finance. Although trends in this area are constantly changing, over the past 12 months, four types of companies have been most successful in attracting seed funding: b2c companies (32% of the total number of funded startups), b2b companies (also 32%), marketplaces (22% ) and hardware startups (14%).

Marketplaces attracted the largest amount of funds at the seed financing stage (an average of $ 1.73 million). They are followed by hardware companies (about $ 1.3 million), b2b startups (about $ 1.2 million) and consumer businesses (about $ 945 thousand).

Successful marketplaces are a rare occurrence, however, when they manage to get ahead, they acquire the potential for significant growth like Airbnb. Such a company takes a lot of time to attract financing. And although businesses in this category make a lot of money, it will take more time to convince investors that your startup will succeed.

The runaway performance of companies of various types is not surprising. Consumer startups occupy the largest share of the seed investment market, since it is cheaper and easier for such companies to launch a minimally viable product - the same thing happens in the b2b sphere.

PS You can prepare for attracting investments using the presentation template developed by IIDF experts [ Slideshare, Keynote , PPT ]: