Business case. Marvel's Miraculous Resurrection (part 3)

In the first and second parts of the case, a crisis situation was described, which led to the bankruptcy of Marvel. In the third final part, we will consider the rehabilitation measures, thanks to which the company emerged from the crisis, as well as their positive and negative points.

In the first and second parts of the case, a crisis situation was described, which led to the bankruptcy of Marvel. In the third final part, we will consider the rehabilitation measures, thanks to which the company emerged from the crisis, as well as their positive and negative points.Many who read the previous parts of the case have probably already familiarized themselves with some details of the event. So in English sources, many authors consider reorganization very superficially, and almost chorus describe it as a successful combination of circumstances and the success of the first part of the film about Spider-Man, due to which everything spun, but as you know, this is actually not so. But who cares to read about reformatting strategic goals, cutting costs, etc. In the spirit of Western blogs and news resources, catchy headlines and sensational stories in which the work of the management team are hushed up and the sanitation procedures are explained by the miraculous success of the super-hero on the screen.

In fact, the transformation of Marvel from bankrupt into a profitable company during 1997-2000 was the result of quality management under the leadership of Peter Cuneo (was Marvel’s CEO from 1999 to 2001) and Ike Perlmutter (Toy Biz’s CEO and Marvel’s CEO).

When Peter Cuneo came to Marvel in search of work in July 1999, he introduced himself as a specialist in financial rehabilitation of companies, although before that he did not have experience in a media company. In many sources, he is called no other than Turnaround CEO at Marvel .

Analysis of remediation measures allows us to divide them into three time steps:

- Bankruptcy 1997-1998,

- Repositioning 1999-2000,

- Stabilization and further development from 2001 until the moment of sale.

Within these time frames, we evaluate the positive and negative aspects of financial, operational and managerial decisions.

Bankrupt

During this period, the management did a great job and made significant efforts, trying to correct the mistakes made. They had to get rid of many unprofitable and non-core assets as quickly as possible, restructure their main business contracts and formulate clear, consistent goals for the company. Not all the tasks set were carried out with the required efficiency, as a result of which, the members of the management team twice in two years changed places on the board of directors of the company.

Good decisions

Firstly, Marvel management got rid of some assets, the most significant of which were:

- Heroes World Distribution is the exclusive distributor of Marvel comics, which has been unprofitable for many years. Instead, Marvel began distributing comic books to Diamond Comic Distributors.

- Fleer Confections is a manufacturer of sweets and chewing gum. The sale of Fleer led to a decrease in revenue by $ 7.1 million.

- Unprofitable children's magazines, disposal of which reduced revenue by another $ 15 million.

The next step was to reduce operating expenses:

- Dismissal of three hundred highly paid employees.

- Reduction of selling, general and administrative expenses (SG&A, selling, general and administrative expenses - selling and general business expenses, a group of expenses in the income statement, including payment for managers, salespeople, advertising, business trips, receptions and other overhead expenses; does not include payment interest or amortization) by $ 55.4 million (from $ 183 to $ 127 million).

- Reduced depreciation from $ 16 to $ 11 million as a result of write-offs of fixed assets associated with the sale of unprofitable units.

- Restructuring of labor costs for artists.

At the same time, the company retained comic book production, licensing, and the toy business, and also signed a contract for the films People in Black and Blade. However, Marvel was not able to fully utilize the possibilities of the movie contract due to its current situation.

Bad decisions

Despite all efforts, it can now be concluded that management could have done more. One could get rid of:

- Fleer and Skybox are collection card companies acquired by Marvel in 1995. This business was unprofitable due to market contraction and adverse licensing agreements with sports and entertainment organizations at a time when the market was booming.

- Panini is a sticker maker unprofitable for the past two years.

- Marvel Restaurant Venture Corp is a joint venture with Planet Hollywood, which created the Marvel Mania restaurant in Los Angeles, which lost $ 5.5 million in 1997. Marvel not only decided to keep this business, but also to develop it, on which another $ 25.7 million was lost.

- Toy Biz is a toy manufacturer that loses money by spraying onto a large segment of the toy market (the company produced both toys for the Marvel universe and toys based on NASCAR, Resident Evil and others). True, in 1998, it was decided to focus only on toys related to Marvel.

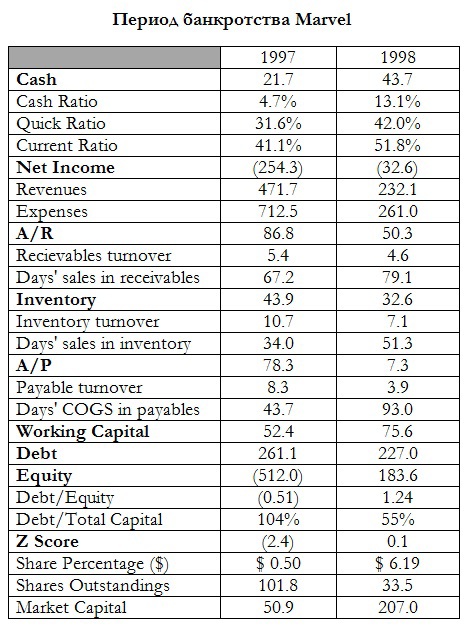

Marvel financials for this period

However, it is clear that Marvel was taking steps in the right direction, which led to the recovery of the company and gave it some freedom of maneuver in the short term. Moreover, it was very important to reduce the company's total costs by 63%. The company's accounts payable also plummeted. While the company was still in a very difficult situation, we see that the work on the errors was carried out in the right financial direction. Although we still observe a lack of a common strategic vision for the development of the company. Parts of Marvel were disjointed. Each of them worked as a separate division and connected them only using a common pool of characters.

From the data of the company’s reports of that time, it can be assumed that the board of directors was trying to choose the right anti-crisis management team. In 1997, CEO Joseph Ahern (Joseph Ahearn), together with the entire team was replaced by Eric Ellenbogenom (Eric Ellenbogen), which in turn was replaced in 1999 by Peter Cuneo ( by Peter Cuneo ).

In general, during this period, the company took unprecedented measures to improve the business, but was defeated on two fronts: the main problem assets and extremely small successes in eliminating the causes of the crisis - instability of income sources, reducing demand for products and coordination between units.

Repositioning

1999 was a year of liberation from the yoke of the bankruptcy code. Management continued to optimize the capital structure, the sale of non-core assets and the improvement of its core business. More importantly, the slow shift of the company's focus from resolving bankruptcy issues to the formation of a future company.

Good decisions

Firstly, the third team, working since 1999, behaved differently from its predecessors. Peter Cuneo has taken over the functions of CEO , COO and CFO . The “Old Guard” ultimately transferred to the leadership positions of the Toy Biz subsidiary.

In 2002, when Peter Cuneo left his post after the stabilization of the company, these posts were reinstated. He consolidated in his hands most of the authority to control the company, and as soon as he managed to make the company profitable, he resigned and allowed his successors to manage the company in accordance with their preferences.

Secondly, after several not very good years, Marvel finally sold Fleer and Skybox in February 1999 and Panini in October 1999, the company lost $ 400 million on these assets.

Thirdly, to compensate for the loss of income from these businesses, the company signed major film licensing agreements, the most important were agreements with Sony for the production of films based on Spider-Man (Marvel received a percentage of rental funds and sales of home videos) and with 20th Century Fox, for the production of X-Men, Fantastic Four "And" Silver erfera ". These steps proved the viability of the licensing business model. Revenues from monetizing their characters allowed the company to regain its position and cash flows.

Fourth, the reorganization has led the company to focus on five value categories: licensing, publishing, film (including television and DVD), the Internet (media) and toys.

Fifth, there were additional staff reductions from 1,650 full-time and 550 non-staff employees in 1998 to 800 and 530, respectively.

The most important thing in this period was a clear management position. Marvel turned out to be one of the leading entertainment companies, focusing on selling licenses and rights to its most valuable strategic assets (characters).

Bad decisions

Much of what Peter Cuneo did had a fruitful impact on the company, but some issues still remained unresolved:

- The toy business was still lagging, despite the elimination of some toy lines. Although the company focused on toys around the Marvel universe, efforts were sprayed on many characters, when the option of supporting only the most popular of them would have looked more logical. All others were worth giving up. In addition, a reduced price policy would be an excellent move to reduce operating costs and ensure production flexibility. However, the company has not gone so far.

- In 2000, the company is still at a loss. The small positive operating income from the agreement with Sony did not cover all of the company's expenses.

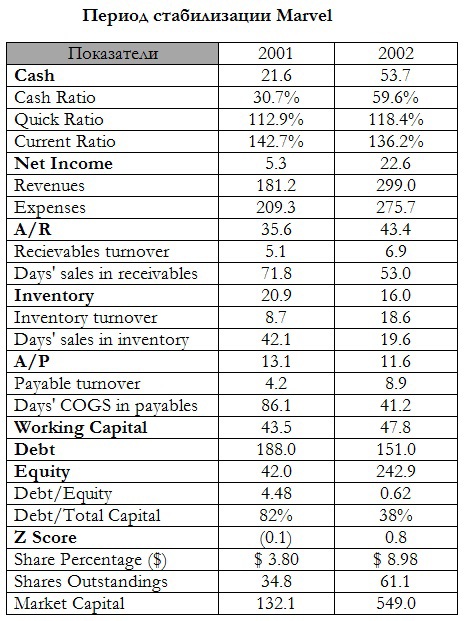

From the table below, it is clear that Marvel is still far from ideal and requires careful management aimed at improving the current financial situation of the company, rather than scaling the company.

In general, Peter Cuneo and his team did what no one had done before. They not only focused the company’s business, but also formulated strategic goals and began formatting the company’s structure according to these goals.

Stabilization and further development

Since 2001, the company began a period of stability. In the period from 2001 to 2003, the company successfully turned into a money producing machine. Low capital costs, low debt, low overhead costs and large licensing revenues for popular movie characters have allowed the company to forget about its past.

Good decisions

Firstly, management took a big step to reduce long-term debt and interest expenses, which impeded the growth of the company. The purchase of 12% of the priority securities for $ 99 million reduced annual interest payments by $ 10 million.

Secondly, the toy division was restructured. Instead of airplane production and sales, a royalty agreement was signed with the Hong Kong company Toy Biz Worldwide (do not confuse with a Marvel subsidiary).

Thirdly, management began to devote more time and attention to licensing:

- The number of transactions concluded for licensing characters for films - Daredevil, X-Men 2, Hulk.

- The quality of transactions with Hollywood companies has improved.

- Subsidiary agreements have been signed with companies such as Burger King, Activision and Universal.

Fourth, the company's core business has undergone significant improvements, reducing the cost of publishing comics and expanding its presence in large retail chains such as Borders and Barnes and Noble.

Finally, in 2001, Marvel further reduced its operating costs by reducing its headcount to 500 people (including units in Hong Kong and Mexico), and in 2002 it dropped to a total of 200 people. The company began to attract freelance writers and artists, the number of which fluctuated around 500, as necessary.

Between 2001 and 2002, there were significant improvements in financial reporting. Cash more than doubled, reaching levels that no one had seen for nearly ten years. Net profit in 2002 increased by 300%, inventories and accounts payable decreased significantly.

How successful was the recovery of Marvel?

From a purely financial point of view, it was an overwhelming success. Here are some evidence.

- Minimum capital expenditures - only $ 4 million of capital expenditures without any real fixed assets.

- Low debt - at the beginning of 2004 only $ 151 million.

- Lack of preferred shares - the company made a forced conversion of preferred shares to ordinary shares, eliminating interest obligations on preferred shares.

- A significant increase in stock prices from $ 5 (2000) to $ 35 (2006).

- High return on invested capital - 28%

- Assessment of the market value of equity in the diagram.

From an operational point of view, the recovery of Marvel is also seen as strong.

1. Licensing: the licensing model, on the basis of which the updated company worked, generated extremely high profits with almost no capital investments. Marvel was able not only to choose the right strategy using its strategic assets - popular comic book characters, but also to follow it. The company used the momentum from its films to diversify revenue from licensing DVDs, video games, television, theme parks, clothing, and other consumer goods.

2. Publishing business:Marvel has made its core business profitable again. The company reduced the cost of expensive exclusive agreements with some writers and artists, and replaced their manual labor with a less expensive computer. Marvel also managed to make peace with the most talented artists and authors, many of whom left the company after its bankruptcy or earlier, thanks to which sales grew again. As a distributor, the company signed a contract with Diamond Comics, which processes all orders from independent comic book stores, which allowed Marvel to print its products to order, eliminating excess inventory.

3. Toy business:Marvel also returned profitability to the business by dropping everything but the most lucrative toy lines, usually derived from the most popular Marvel characters such as Spider-Man, X-Men and Hulk. All products were manufactured in Hong Kong.

4. Management: The company finally got rid of the motley audience, plunging the company into the chaos of bankruptcy, and replaced them with people who put the interests of the company above personal ones. Marvel has simplified the management structure by reducing the number of directors on the board, consolidating the functions of CEO and COO, and eliminating management positions that are not related to the company's core business areas.

What's next?

Since 1998, Marvel participated in the joint production of films (Blade), and although the quality of licensing agreements increased every year, all the tastiest system profits went to Hollywood.

Back in 2004, Wall Street analysts still doubted the company's prospects, considering the new success temporary and short-term, but already in 2005 it became known that Marvel Studios was starting production of its own films. To this end, the company enters into a $ 525 million revolving loan agreement with Merrill Lynch for 7 years with amazing conditions: according to a loan agreement with Merrill Lynch, if Marvel is unable to pay interest, they will be paid by the insurance company in exchange for the rights to use the main character in the films .

The film industry and the public have already tried films about super-heroes and everyone was waiting for new adaptations. Since the rights to use the "blue chips" of the company already belonged to other studios, they focused on their less popular heroes - Iron Man, Thor, Hulk. In 2008, Marvel explodes the world by successfully reloading the Hulk (the first film is considered a failure) and an adaptation of Iron Man, which in the first 17 days raised over $ 430 million worldwide rental. Iron Man laid the foundation for the unique cinema universe developed by Marvel Studios. After that, the company began to shoot tapes flying like hot cakes. The Avengers in the United States started on May 4, 2012 and earned $ 207.4 million in the first three days of rental, setting a record for fees for their debut weekend, and in total, the picture collected more than one and a half billion dollars.

In 2009, The Walt Disney Company, on the strategic initiative of its CEO Bob Iger, acquired Marvel Entertainment for $ 4 billion, and, according to established practice, practically did not change anything in the company, only providing its resources and distributing Marvel products, which meanwhile set about creating film versions of his universe, although many publications describe this as pre-designed plans, the documentary Marvel Studios: Uniting the Universe suggests that such a goal was not even originally planned.

Thank you all for your attention and expectation. Here you can read the first part , and here the second part. Here is the pdf version of the whole case.