Apple shares have experienced the strongest fall since 2014. Large investors have lost billions

The end of last week was unsuccessful for Apple - Friday, November 2, was the worst day for the company's shares since 2014. After the publication of the forecast for the supply of new iPhones, in which the figures were lower than expected, Apple shares fell by 6.6%.

Despite the fact that the company still costs more than $ 1 trillion, some large investors have suffered serious losses. So one of the most famous financiers of the world, Warren Buffett, lost more than $ 3.5 billion.

What happened

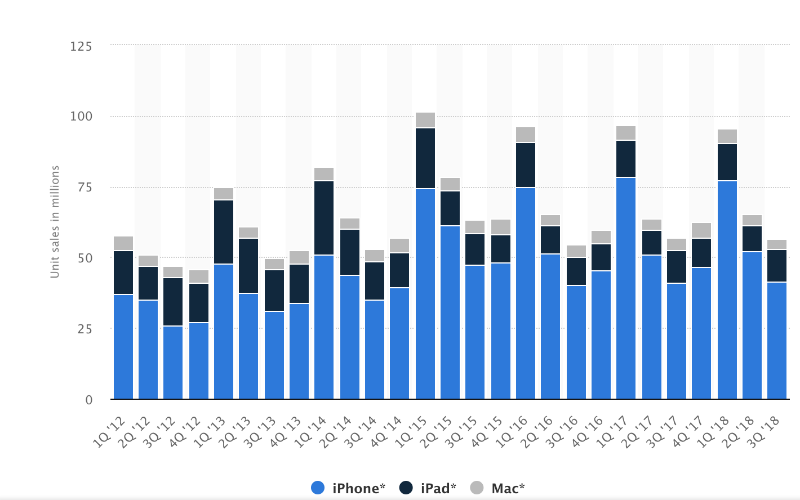

Apple reported losses for five consecutive weeks - this was the first time since 2012. Also, the share price was affected by a negative outlook on shipments of new iPhones, as well as the fact that the company announced that it would no longer publish data on sales of certain types of devices (unit-sales figures), focusing on providing a “big picture”.

Sales data for various gadgets Apple 2012-2018. Source: Statista

Prior to the publication of this information, on Thursday, November 1, Apple shares closed the trading day at $ 222.22. On Friday, trading ended at $ 207.48.

For Apple's large investors, this all resulted in serious losses. In particular, one of Apple's main supporters on Wall Street, Warren Buffett, lost more than $ 3.5 billion.. The investor, nicknamed "The Oracle of Omaha," owns more than 250 million shares of a company from Cupertino. Moreover, at the end of the summer, he also increased his package.

Berkshire Hathaway Buffett Investment Fund is the second largest shareholder of Apple - its share was estimated at $ 52 billion.

Perspectives

Growing tensions between China and the United States can have a negative impact on Apple shares. The trade war between the two countries leads to an increase in duties on various categories of goods, including Apple products, including Apple Watch, AirPods, Beats.

Recently, Apple has sent a letter to the US Trade Representative. In the message, the company expressed concern that the increase in trade duties for goods produced in China would lead to higher prices for Apple products for American consumers.

Amid negative news, some investors are getting rid of Apple stock. For example, the hedge fund Greenlight Capital of billionaire David Einhorn completely sold Apple stock. "We are somewhat concerned about the measures taken by China in response to American trade policy," commented on the sale of

shares for $ 40 million Ayhorn.

At the same time, suffered a serious loss of Warren Buffett does not show signs of anxiety. On the contrary, in his interviews he often said that he appreciates Apple not for short-term financial results, but for the power of the brand and the overall business ecosystem.

“I do not focus on sales in the next quarter or next year. It’s much more important to me ... hundreds, hundreds, hundreds of millions of people who practically live [on the iPhone]. ”

In addition, he claimed that the iPhones themselves are “terribly cheap” and should cost much more than, on average, the $ 1,000 Apple asks for its latest models.

The most up-to-date information about Apple and other US companies promotions is now available through the ITI Global service .

Other materials and links on finance and stock market from ITI Capital :

- Analytics and market reviews

- Purchase of shares of American companies from Russia

- Huawei overtook Apple in terms of sales. The capitalization of the American company still reached $ 1 trillion

- Analysts: Microsoft's capitalization could reach $ 1 trillion

- Mass media: large-scale cyber attacks accelerated the growth of capitalization of companies from the information security industry

- Bloomberg: Hedge Funds Recognize Brexit Results Before Others And Earn Billions