Effective personal finance. Level 1

I decided to write this article for the employees of our company, because I realized that they are very educated and intelligent people, but

nobody stops worrying about pension reform,

nobody has taught them how to handle finances effectively. As a manager, caring not only about my own welfare, but also about the well-being of my colleagues, I tried to take on the role of a financial mentor. And my instructions on how to become financially efficient, you can read under the cut.

Having become almost 6 years ago an entrepreneur, the first thing that became clear: our money is everything. And I'm not talking about the measurement of happiness or power in money. I’m talking about extremely pragmatic facts: to live in our society, you need money. Money is the blood of the modern economy. Realizing this, I also realized that in order to be a happy person in our capitalist world, you need to learn how to effectively manage money. Therefore, I began to actively study financial literacy: both personal and entrepreneurial.

In this article I will try in a concentrated form to give a theoretical basis, my personal experience and practical advice that will allow everyone to improve personal financial performance).

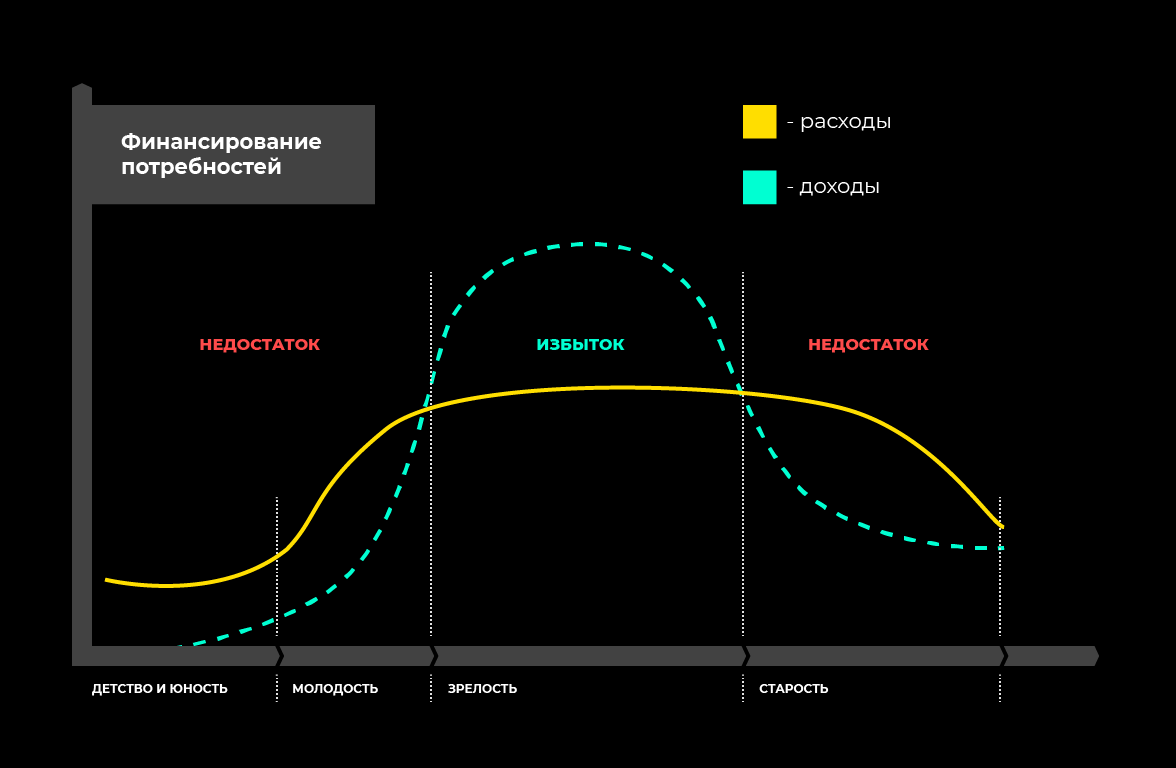

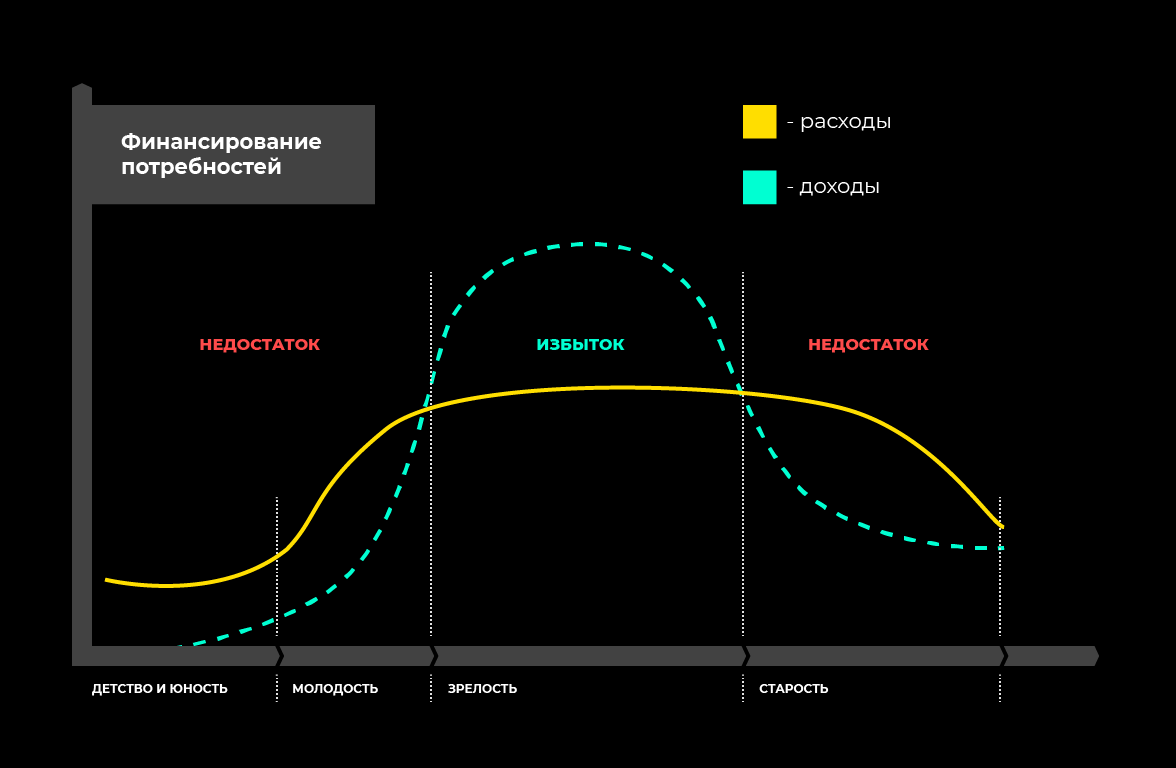

Now almost all of us are at that age when we started earning, the schedule of our incomes crossed the line of expenses, we learn to earn more than we spend, and so we have an excess of money starting to appear (well, and if this is not the case, then I hope that this article will allow to get closer to this). But it was not always the case. When we were little, we also spent money. But not our own =) Our parents provided us with food, shelter, clothes, toys, equipment, pocket expenses, etc. When we become old and lose the opportunity to earn money, expenses will remain with us anyway. We will also need to live somewhere, eat, dress. And in order not to rely on the state, constantly changing pension rules and abstract children and grandchildren, we must now, in the period of our maturity, learn to earn in such a way

What is needed for this?

And a little more theory) The total capital of a person is divided into 3 components:

Current capital is what we earn now and from what we spend on our current needs. The task of current capital is to meet our current needs (housing, food, and other fixed and variable costs).

Reserve capital is accumulated and deferred money or other assets whose task is to provide our current needs in case there will be no income for one reason or another. For example, if you are sick or have lost your job, you will not have a permanent income. For these cases, and need reserve capital, which will allow you not to fall into the financial hole and live at about the same level.

Investment capital is just an excess, which we need to save. It may consist of cash, deposits, tangible and intangible assets.

More on each of the types of capital below.

Financial accounting is boring, monotonous, painstaking, but necessary work. Its main task is very simple - we need to understand where / how much money comes to us, where / how much they leave . And further, having understood where and how much we spend, we must learn how to optimize expenses. But first things first.

Financial accounting is a systematic recording of all transactions.

Convenient and easiest to keep financial records in a mobile application. There are a lot of them now. For example, I use the free app for iOS - Money OK. Free functionality is enough for effective financial accounting, analytics and even budgeting. There is also paid functionality, but I don’t understand why it is needed at all)) There are a bunch of other free and paid analogues. Enter “personal finance” or “cost accounting” on the AppStore or Google Play and choose a product that matches your user experience.

You can also lead in tables (for example, Google Sheets) - I did this for the first year. But when I realized that I could do the same thing more conveniently, faster and more clearly in the application, I immediately set myself “Money OK”.

Systemize items of expenditure and income as you see fit. The articles themselves can be added at any time, when you come across the fact that you spent money on something, you need to put it somewhere, but there is no corresponding article. I have 2 articles “Other” and “Forgotten”. First, I write down some very rare expenses, a separate article for which it is impractical to do. And in “Forgotten”, what I could not remember what I spent on (yes, yes, this happens and this is normal. The main thing is that the percentage of such expenses does not exceed a few percent of all expenses).

If suddenly you download the application right now and configure it, here is a list of possible income / expenses broken down by categories and subcategories.

* if you lend money at interest

** if you are doing some projects (not a business, but projects) that make a one-time payment.

In order for financial accounting to become useful and it was possible to start building financial plans, you need to keep it daily for at least six months. I have been keeping records for more than 4 years and I have already formed a habit.

Several lifehacks that will allow you to keep financial records more efficiently:

As I wrote above, in order to start planning your finances, you first need to accumulate decent statistics on your income / expenses to make analytics. At least six months. But it is better - in a year, that all seasons pass and you have statistics on seasonal expenditures.

Analytics should be carried out in 2 stages:

Fixed costs are expenses that you make every month. As correctly, they are about the same from month to month. As a rule, these are expenses for housing, food, logistics, and so on.

Write them out and put in front of each article an amount equal to the average consumption. Then think about whether to optimize one of these and put in the next column the amount corresponding to your plan. If the cost of housing can not be optimized, put the same. If expenses, say, for logistics, can be optimized, if you travel more by public transport (in which you can read or work in parallel at the same time), and not by taxi, then in the next column put the amount to which you can optimize this item of expenditure.

Congratulations! This is your first fixed cost budget. This budget you must continue to adhere to. It is clear that your lifestyle will change, you will have children, etc., but you still need to adhere to the principle of budgeting. Just as your needs grow, you will expand your budgets. “The more income, the more expenses” - one of the basic principles of the economy.

These amounts can also be added to the budget in your mobile application where you keep financial records. This will allow you to see the current picture every day.

Variable costs are those that are also many, but which are not repeated monthly. These include: auto repair, insurance, gym memberships, educational courses, purchase of equipment, etc.

At the end of the year, you will also understand exactly what variable costs you have, how many they are spent per year and, by dividing by 12 - per month. This amount will also be part of your monthly budget.

I personally, along with fixed and variable costs, also allocate a budget for entertainment. I’m doing this because after the next global analytics I realized that, on the whole, entertainment is a pretty decent amount, but the quality of entertainment can be very different. You can sit several times in a restaurant, and you can go on a mini-weekend trip with a company for the same money. Therefore, I allocate a fixed amount for entertainment to myself for a month and try to spend it on bright, useful and developing things.

Now you have a full understanding of your expenses. Now you are planning them. Now you understand what you have a surplus and how much money you can save.

If you add up all your income, you will get the amount of X. If you

add up all your fixed, variable and other (if you systematize somehow in your own way) expenses, you will get the amount Y.

X - Y = your surplus.

How to deal with this surplus, you decide. I will only give a few common tips on how to effectively apply it.

After you have adjusted the accounting and planning of your finances and clearly understand how much money you need to live in a month, and how much surplus you have left, it is advisable to form a reserve capital .

I mentioned it in the first part of the article. Reserve capital- it is accumulated and deferred money or other assets whose task is to provide our current needs in case there will be no income for one reason or another. For example, if you are sick or have lost your job, you will not have a permanent income. For these cases, and need reserve capital, which will allow you not to fall into the financial hole and live at about the same level.

It is desirable that the size of the reserve capital was approximately equal to the amount of your expenses for 4-6 months. That is,

reserve capital = V * 6

Reserve capital can be stored as a bank deposit, a bundle of money under a mattress or in any other form. The key here is that it is highly liquid (that is, speaking in simple language, so that it can be quickly exchanged for ordinary money without loss). Therefore, it is not recommended to form reserve capital in the form of shares or notorious cryptocurrencies, since on the day when you are in dire need of it, stocks or cryptocurrencies may be in decline and you risk losing a significant portion of your funds.

This is great - if nothing like this happens to you and you do not have to get into your NT. In this case, this capital will simply be added to your investment capital. But it is better that he was. So calmer, safer and safer)

Knowing your monthly surplus and your monthly expenses, you can easily calculate the period for which you can form reserve capital:

t = У * 6 / surplus

Create reserve capital - this is the first thing that a person who has made the decision to be financially conscious needs to do.

Well, after that a huge next level is opened, in which you need to learn to set short-term (up to a year), medium-term (1-10 years) and long-term (more than 10 years) financial goals, invest and diversify. But more on that at the next level. If you like the article, there will be many questions and requests to talk about the next level, I’m happy to write an additional article about it.

nobody has taught them how to handle finances effectively. As a manager, caring not only about my own welfare, but also about the well-being of my colleagues, I tried to take on the role of a financial mentor. And my instructions on how to become financially efficient, you can read under the cut.

Having become almost 6 years ago an entrepreneur, the first thing that became clear: our money is everything. And I'm not talking about the measurement of happiness or power in money. I’m talking about extremely pragmatic facts: to live in our society, you need money. Money is the blood of the modern economy. Realizing this, I also realized that in order to be a happy person in our capitalist world, you need to learn how to effectively manage money. Therefore, I began to actively study financial literacy: both personal and entrepreneurial.

In this article I will try in a concentrated form to give a theoretical basis, my personal experience and practical advice that will allow everyone to improve personal financial performance).

Introduction

Now almost all of us are at that age when we started earning, the schedule of our incomes crossed the line of expenses, we learn to earn more than we spend, and so we have an excess of money starting to appear (well, and if this is not the case, then I hope that this article will allow to get closer to this). But it was not always the case. When we were little, we also spent money. But not our own =) Our parents provided us with food, shelter, clothes, toys, equipment, pocket expenses, etc. When we become old and lose the opportunity to earn money, expenses will remain with us anyway. We will also need to live somewhere, eat, dress. And in order not to rely on the state, constantly changing pension rules and abstract children and grandchildren, we must now, in the period of our maturity, learn to earn in such a way

What is needed for this?

- You need to clearly understand your income and expenses (financial accounting).

- Learn how to plan your income and expenses (financial planning and budgeting).

- Learn to accumulate capital (investment).

And a little more theory) The total capital of a person is divided into 3 components:

- current (current consumption);

- reserve (compensation of losses);

- investment (accumulation and maintenance of the future).

Current capital is what we earn now and from what we spend on our current needs. The task of current capital is to meet our current needs (housing, food, and other fixed and variable costs).

Reserve capital is accumulated and deferred money or other assets whose task is to provide our current needs in case there will be no income for one reason or another. For example, if you are sick or have lost your job, you will not have a permanent income. For these cases, and need reserve capital, which will allow you not to fall into the financial hole and live at about the same level.

Investment capital is just an excess, which we need to save. It may consist of cash, deposits, tangible and intangible assets.

More on each of the types of capital below.

Financial Accounting

Financial accounting is boring, monotonous, painstaking, but necessary work. Its main task is very simple - we need to understand where / how much money comes to us, where / how much they leave . And further, having understood where and how much we spend, we must learn how to optimize expenses. But first things first.

Financial accounting is a systematic recording of all transactions.

| October 12 | +20000 - Salary -4673 - Products -1345 - Communal +674 - Cashback | Tinkoff Card Wallet Sberbank Credit Card |

Convenient and easiest to keep financial records in a mobile application. There are a lot of them now. For example, I use the free app for iOS - Money OK. Free functionality is enough for effective financial accounting, analytics and even budgeting. There is also paid functionality, but I don’t understand why it is needed at all)) There are a bunch of other free and paid analogues. Enter “personal finance” or “cost accounting” on the AppStore or Google Play and choose a product that matches your user experience.

You can also lead in tables (for example, Google Sheets) - I did this for the first year. But when I realized that I could do the same thing more conveniently, faster and more clearly in the application, I immediately set myself “Money OK”.

Systemize items of expenditure and income as you see fit. The articles themselves can be added at any time, when you come across the fact that you spent money on something, you need to put it somewhere, but there is no corresponding article. I have 2 articles “Other” and “Forgotten”. First, I write down some very rare expenses, a separate article for which it is impractical to do. And in “Forgotten”, what I could not remember what I spent on (yes, yes, this happens and this is normal. The main thing is that the percentage of such expenses does not exceed a few percent of all expenses).

If suddenly you download the application right now and configure it, here is a list of possible income / expenses broken down by categories and subcategories.

| Income | Costs |

|---|---|

Patch

Cashback Deposit Interest Borrow Interest * Dividends Projects ** Affiliate Programs | Nutrition

Housing

Logistics

Entertainment

Health

beauty

Subscriptions

Development

Travels

Phone Internet Gifts Projects Taxes Parents Other Forgotten |

** if you are doing some projects (not a business, but projects) that make a one-time payment.

In order for financial accounting to become useful and it was possible to start building financial plans, you need to keep it daily for at least six months. I have been keeping records for more than 4 years and I have already formed a habit.

Several lifehacks that will allow you to keep financial records more efficiently:

- In order not to forget to make transactions, set an alarm-reminder for each day at the same time in the evening. For example, at 22:30, when you are most likely at home and it is convenient for you to do it. This process takes no more than 5 minutes.

- In order not to lose transactions, use a normal plastic. More than 2 years ago, I got a Tinkoff Black card and am still very pleased. I will write about its benefits at the end. And for effective financial accounting, it is useful in that the Tinkoff Bank mobile application very well and conveniently displays transactions: it is clear where, when, how much (up to company logos). Just pay wherever possible with a card and then you will not miss any expenses.

- At the end of each month, see the statistics for the past month. So you will understand your approximate figures, keep them in your head and (I am sure) will try to spend less in the next month on what you can spend less.

- So that you have the motivation to spend less, without spending money on something unnecessary, get yourself a special money box in a mobile bank. And when you are faced with the choice to go to this not very interesting film in a movie or not, buy a beer with snacks or not, etc., make a decision wisely. If you decide to refuse this waste, transfer the money equal to the saved expenses to this piggy bank. When I started to do this, by the end of the year, decent “extra” sums began to appear in this piggy bank.

- Do not hammer. There are many different opinions and excuses, but any rich person will tell you that to treat money carefully is the rule number 1.

Financial planning

As I wrote above, in order to start planning your finances, you first need to accumulate decent statistics on your income / expenses to make analytics. At least six months. But it is better - in a year, that all seasons pass and you have statistics on seasonal expenditures.

Analytics should be carried out in 2 stages:

- Cost optimization. After analyzing all the costs for the year, you need to understand what can be optimized. If you have not done financial accounting before, then you will be surprised to find out how much money you spend on some unnecessary nonsense. This is how our psyche works - at the time of making a decision to buy, you think “yes, this is all only 1000 rubles, but I will get such and such emotions from it”. When analyzing for the year, you will see that all these small unnecessary expenses result in tens of thousands per year that you could spend on travel, development or which could be put off.

- Systematization of expenses. Having understood the average monthly expenses for the year, divide them into fixed and variable.

Fixed costs are expenses that you make every month. As correctly, they are about the same from month to month. As a rule, these are expenses for housing, food, logistics, and so on.

Write them out and put in front of each article an amount equal to the average consumption. Then think about whether to optimize one of these and put in the next column the amount corresponding to your plan. If the cost of housing can not be optimized, put the same. If expenses, say, for logistics, can be optimized, if you travel more by public transport (in which you can read or work in parallel at the same time), and not by taxi, then in the next column put the amount to which you can optimize this item of expenditure.

Congratulations! This is your first fixed cost budget. This budget you must continue to adhere to. It is clear that your lifestyle will change, you will have children, etc., but you still need to adhere to the principle of budgeting. Just as your needs grow, you will expand your budgets. “The more income, the more expenses” - one of the basic principles of the economy.

These amounts can also be added to the budget in your mobile application where you keep financial records. This will allow you to see the current picture every day.

Variable costs are those that are also many, but which are not repeated monthly. These include: auto repair, insurance, gym memberships, educational courses, purchase of equipment, etc.

At the end of the year, you will also understand exactly what variable costs you have, how many they are spent per year and, by dividing by 12 - per month. This amount will also be part of your monthly budget.

I personally, along with fixed and variable costs, also allocate a budget for entertainment. I’m doing this because after the next global analytics I realized that, on the whole, entertainment is a pretty decent amount, but the quality of entertainment can be very different. You can sit several times in a restaurant, and you can go on a mini-weekend trip with a company for the same money. Therefore, I allocate a fixed amount for entertainment to myself for a month and try to spend it on bright, useful and developing things.

Now you have a full understanding of your expenses. Now you are planning them. Now you understand what you have a surplus and how much money you can save.

Capital accumulation

If you add up all your income, you will get the amount of X. If you

add up all your fixed, variable and other (if you systematize somehow in your own way) expenses, you will get the amount Y.

X - Y = your surplus.

How to deal with this surplus, you decide. I will only give a few common tips on how to effectively apply it.

After you have adjusted the accounting and planning of your finances and clearly understand how much money you need to live in a month, and how much surplus you have left, it is advisable to form a reserve capital .

I mentioned it in the first part of the article. Reserve capital- it is accumulated and deferred money or other assets whose task is to provide our current needs in case there will be no income for one reason or another. For example, if you are sick or have lost your job, you will not have a permanent income. For these cases, and need reserve capital, which will allow you not to fall into the financial hole and live at about the same level.

It is desirable that the size of the reserve capital was approximately equal to the amount of your expenses for 4-6 months. That is,

reserve capital = V * 6

Reserve capital can be stored as a bank deposit, a bundle of money under a mattress or in any other form. The key here is that it is highly liquid (that is, speaking in simple language, so that it can be quickly exchanged for ordinary money without loss). Therefore, it is not recommended to form reserve capital in the form of shares or notorious cryptocurrencies, since on the day when you are in dire need of it, stocks or cryptocurrencies may be in decline and you risk losing a significant portion of your funds.

This is great - if nothing like this happens to you and you do not have to get into your NT. In this case, this capital will simply be added to your investment capital. But it is better that he was. So calmer, safer and safer)

Knowing your monthly surplus and your monthly expenses, you can easily calculate the period for which you can form reserve capital:

t = У * 6 / surplus

Create reserve capital - this is the first thing that a person who has made the decision to be financially conscious needs to do.

Well, after that a huge next level is opened, in which you need to learn to set short-term (up to a year), medium-term (1-10 years) and long-term (more than 10 years) financial goals, invest and diversify. But more on that at the next level. If you like the article, there will be many questions and requests to talk about the next level, I’m happy to write an additional article about it.