Peter Thiel: How to Build a Monopoly?

- Transfer

Stanford course CS183B: How to start a startup . Started in 2012 under the leadership of Peter Thiel. In the fall of 2014, a new series of lectures by leading entrepreneurs and experts of Y Combinator took place:

Second part of the course

First part of the course

- Sam Altman and Dustin Moskowitz: How and why to create a startup?

- Sam Altman: How to build a startup team and culture?

- Paul Graham: An Illogical Startup ;

- Adora Chung: Product and honesty curve ;

- Adora Chyung: Rapid startup growth ;

- Peter Thiel: Competition is the lot of the losers ;

- Peter Thiel: How to build a monopoly?

- Alex Schulz: Introduction to growth hacking [ 1 , 2 , 3 ];

- Kevin Hale: Subtleties in working with user experience [ 1 , 2 ];

- Stanley Tang and Walker Williams: Start Small ;

- Justin Kahn: How to work with specialized media?

- Andressen, Conway and Conrad: What the investor needs ;

- Andressen, Conway and Conrad: Seed Investment ;

- Andressen, Conway and Conrad: How to work with an investor ;

- Brian Chesky and Alfred Lin: What is the secret of company culture?

- Ben Silberman and the Collison Brothers: Nontrivial Aspects of Teamwork [ 1 , 2 ];

- Aaron Levy: B2B Product Development ;

- Reed Hoffman: About Leadership and Leaders ;

- Reed Hoffman: On Leaders and Their Qualities ;

- Keith Rabois: Project Management ;

- Keith Rabois: Startup Development ;

- Ben Horowitz: Dismissals, promotions and transfers ;

- Ben Horowitz: Career Tips, Westing and Options ;

- Emmett Shire: How to conduct interviews with users;

- Emmett Shire: How Twitch talks to users ;

- Hossein Rahman: How hardware products are designed at Jawbone;

- Hossein Rahman: The Design Process at Jawbone.

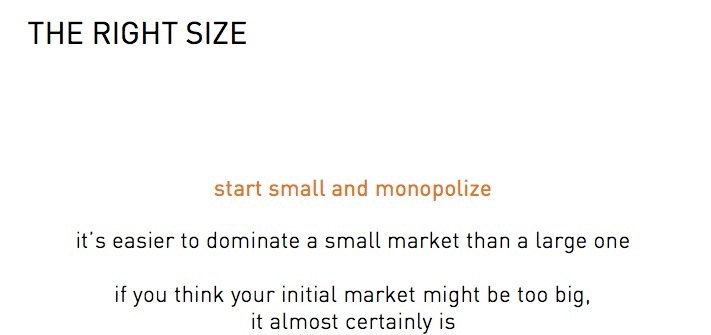

I want to tell you something about how monopolies are created. I think one of the extremely illogical at first glance ideas that are associated with monopolies is that you need to look for small markets. If you work in a startup, you want to eventually come to a monopoly. If you are creating a new company, you want to become a monopoly as a result. Monopolies occupy an overwhelming market share - so how do you get it? You start with a small market and eventually occupy it whole, and after a while you get the opportunity to expand the existing market like diverging concentric circles.

Targeting a huge market from day one is a big mistake, because it is usually evidence that you for some reason did not segment it clearly enough - which means that you will encounter too much competition in one way or another. It seems to me that almost all successful companies in Silicon Valley adhered to the model of entering small markets and subsequent expansion.

Take Amazon, they started by selling books, but they said that they had the best bookstore in the world, and in 1990, when they started a business, that was it. They sold books online, and you, as a buyer, could do things that were previously inaccessible to you - so Amazon has gradually grown to all possible forms of e-commerce and other things that go beyond its borders.

Take Ebay - they started by selling a mechanical dispenser-toy with Pez sweets, then switched to Beanie Babies, and eventually came to an online auction system for all kinds of goods. It remains illogical with respect to all these companies that they started from markets so small that when their business was created, people did not consider these companies to be of any value.

An example of such a development from PayPal

We started with regular sellers on Ebay - there were about 20 thousand of them. When, after the launch in December 1999 - January 2000, we saw interest on their part, it seemed to us that this was the end: the market is small, the customers are terrible - these are people who sell some kind of nonsense via the Internet, for which we owe trying to work with this market?

But we had a chance to give them a product that, in the eyes of this audience, exceeded the capabilities of all our competitors, so that we occupied about 25-30% of the market in the first two to three months of work - from this we could start building a business based on brand recognition . Therefore, it seems to me that these small markets are underestimated.

But we had a chance to give them a product that, in the eyes of this audience, exceeded the capabilities of all our competitors, so that we occupied about 25-30% of the market in the first two to three months of work - from this we could start building a business based on brand recognition . Therefore, it seems to me that these small markets are underestimated.

Facebook followed the same path: I often repeat that if the initial market for Facebook was 10,000 Harvard students, then the company's share in this market soared from zero to 60% in ten days - an impressive start. Business schools often tell you: this is a tiny market, it's just ridiculous, it has no value.

So if we were analyzing examples of Facebook, Ebay or PayPal there, we would conclude that all these companies started from markets so small that they had no value, and if these markets remained so tiny, then no value to companies in the future they wouldn’t bring it - but it turned out that there is an opportunity to “concentrically” increase the potential of these markets, which greatly increased the value of companies.

The opposite option is to work in a super-large market. Over the past ten years, a lot of trouble has happened with clean tech companies, but the vast majority of their problems started with the fact that they initially aimed at huge markets. Each PowerPoint presentation from such a company in 2005-2008 (it was a kind of clean tech bubble in Silicon Valley) began with a description of the energy market, which was measured in hundreds of billions and trillions of dollars. And when you are a small fish in a vast ocean, it does not bode well for you. This means that you have thousands of competitors, and you don’t even know who they are.

Therefore, it is much better to be a one-of-a-kind company within a small ecosystem. No need to become the fourth animal feed company. Or the tenth company to create solar panels. Or the hundredth restaurant in Palo Alto. The restaurant industry is valued at trillions of dollars. And if you conduct an analysis of market volumes, then decide that restaurants are a fantastically lucrative industry.

Very often, large markets are also many competitors. They are very, very difficult to segment. Therefore, the first illogical idea is to look for small markets, such that people may not even notice them, do not think that they make sense. This is your starting point, and if these markets are able to expand, you can become a monopoly.

So, now let's move on to the second of a series of characteristics of monopoly businesses that I would like to dwell on. Most likely, there is no universal recipe for achieving monopoly. But there is a feeling that in the history of technological development not a single bright moment is repeated twice. Therefore, the next Mark Zuckerberg will not create a social network, the next Larry Page will not make a search engine, and the next Bill Gates will not develop an operating system. If you copy these people, you do not learn anything from them.

The potential for creating monopolies is only for unique businesses that create something that has never happened before. “Anna Karenina” begins with the words that “all happy families are alike, each unhappy family is unhappy in its own way” - the opposite is true in business: all happy companies are different from each other because each of them does something unique. And all unlucky companies are similar, therefore they cannot avoid similarity in key issues, which leads to competition.

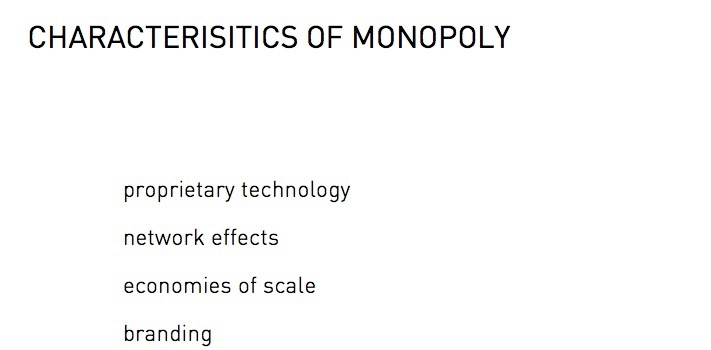

One of the characteristics of a monopolistic technology company is the possession of a kind of “proprietary” technology. My crazy, kind of arbitrarily established practical principle is that you need technology that is an order of magnitude superior to the upcoming “new [technological] hit”. Take Amazon: they had ten times more books [than their competitors] - maybe they did not create the product at the peak of technology, but they found a way to effectively sell ten times more books online.

In the case of purchases on Ebay, an alternative to PayPal was sending a check, which took a week, while using PayPal it was possible to pay for a purchase more than ten times faster. You need to very powerfully improve any key element of the business, improve it by an order of magnitude. And of course, you can offer the market something radically new - it will be a kind of limitless improvement. I would call the iPhone the first truly working smartphone - unlimited or not, but it was an improvement by an order of magnitude. Technologies must be developed to give you the opportunity to far exceed the new "hit" development of competitors.

It seems to me that the network effect can often push the process forward - so it [is also] very useful. From time to time, it can contribute to the creation of monopolies, but the trick is that it is very difficult to achieve. And although everyone understands how important this effect is, there always remains an incredibly difficult question: what network can be useful to the first person who starts using it? [Another] a typical example of a monopoly business is a business in which economies of scale are possible when your fixed costs are very high and your marginal costs are very small.

And besides, [one of the characteristics of monopolies is] branding - an idea that is firmly embedded in the minds of many. I never fully understood how branding works, so I have never invested in companies in which everything is built solely on it, but nevertheless, in my opinion, this is a real phenomenon that creates real value.

I think (until the end of the lecture I will return to this idea) that one of the reasons why businesses based on software “shoot” so often is that they have many of the [above] characteristics. They easily save on scale, because the marginal cost for software is zero. And if you get a working product from the software sector, which turns out to be noticeably better than existing solutions, the economies of scale switch on and you can scale up your business very quickly.

Even if your market is initially relatively small, you can grow your business quickly enough to occupy the same share in it as the market grows and establish monopoly power on it. Monopolies are not enough to remain so in the short run. It is important to create a monopoly that lasts a long time.

In Silicon Valley, it is widely believed that you should be a pioneer in the market, and it always seemed to me that in some cases it would be much better to enter the market last. You need to become one of the last companies in the selected category, those who really have value. Microsoft created the latest operating system - for decades, no one could do anything better. Google has become the latest search engine. Facebook will be valuable if it turns out that after this social network nothing more worthwhile has been created.

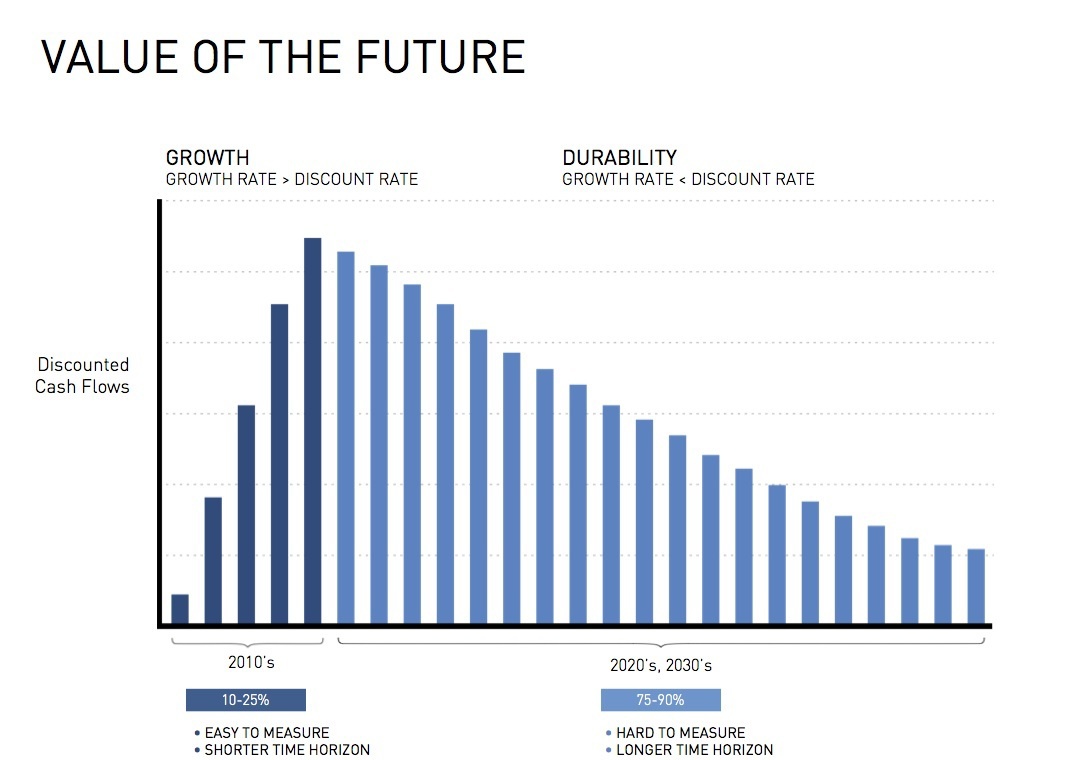

One way to appreciate the significance of this last player is to relate to his value as something that will manifest in the distant future. If you calculate the discounted cash flow for such a business, evaluate all the inflows and calculate its growth rate, it turns out that the growth rate is much higher than the discount rate, which means that the main value of the company can be obtained only in the future.

I made these calculations for PayPal in March 2001 - at that time we worked on the market for about 27 months and grew by 100% per year. We discounted future cash flows at a rate of 30%, and it turned out that about three quarters of the value that our business will generate will be provided by the cash flows that we will receive in 2011 and later.

Which of these [above] technology companies would you analyze, the results will be about the same. So if you try to analyze one of the Silicon Valley IT companies, such as AirBnB, Twitter, Facebook, any of the growing Internet companies, or companies from YCombinator, mathematical calculations show that three quarters of the value of these companies, 85% values will be provided with cash flows for the 2024th and later years.

This is a very long time, and it shows that we in the Valley too much value growth rates and underestimate the survivability of companies.

Growth is something that you can measure here and now, you can track this indicator very accurately. The question is whether the company will exist in ten years - it is he who prevails in assessing the value of companies, and rather refers to quality indicators.

Returning to the characteristics of monopolies: “proprietary” technology, network effect, economies of scale - all these characteristics really exist at the moment when you assess the state of the market, but you need to think about whether these qualities will continue in the future. Therefore, a time indicator is added to all these characteristics .. The network effect, by the way, is very time-dependent - it amplifies as it scales. Therefore, if your business is built on the formation of a network, then over time your monopoly will become only bigger and more powerful.

“Own” technology is not an easy thing. You need something an order of magnitude superior to those achievements that are currently elevated to the rank of "works of art." So you will attract the attention of the audience, so you can get ahead. But you do not want to be pushed out of the market by someone else. There were enough areas in the world in which innovation was actively developing, but not one of them ultimately paid off.

For example, the production of drives in the 1980s: you could create the best drive in the world, you could become a monopolist in the world market, but in a couple of years some competitor could easily squeeze you out. For fifteen years, drive creation technology has improved markedly, it has brought huge benefits to consumers, but has not helped the creators of companies.

It’s not enough to create breakthrough technology in any industry, it is then necessary to justify why your breakthrough will be the last, or at least why competitors will not come to replace you in the coming years. Or you need to figure out how, by creating a breakthrough technology, you can constantly improve it so that other market players cannot get closer to you. If in your future plan, in addition to the product you are working on, there are many other innovative solutions on the market and your competitors are creating alternative products, such a plan is very good for society as a whole, but, as a rule, it does not promise much good to you personally.

And now about economies of scale. It seems to me that in this respect it is very important to enter the market last. It’s hard for me to refrain from overdoing the analogies with chess: White takes the first step in chess, so White has a slight advantage of the first move. You, on the other hand, want to be the one who will make the last move and win the game - remember the statement of the world chess champion Capablanca: “You must start by studying the end of the game”. I would not say that this is the only thing you need to study, but I believe that it is critical for you to try to think through the answers to the questions about why your company will remain a leader in ten, fifteen, twenty years.

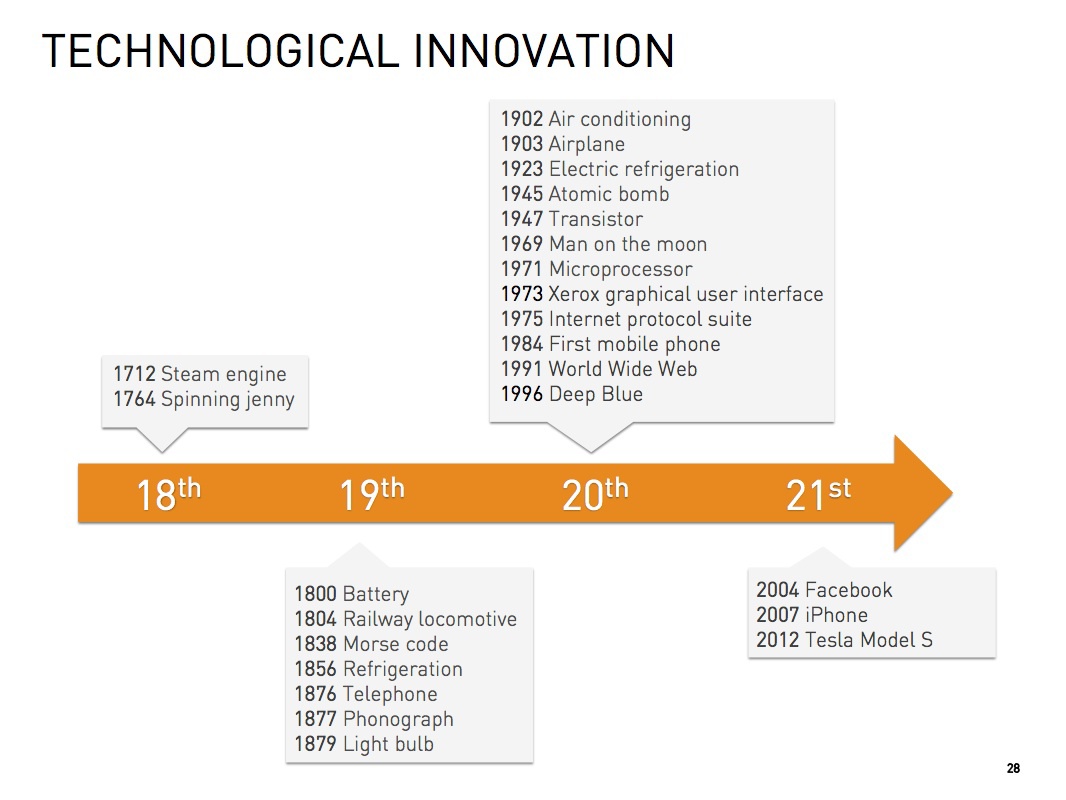

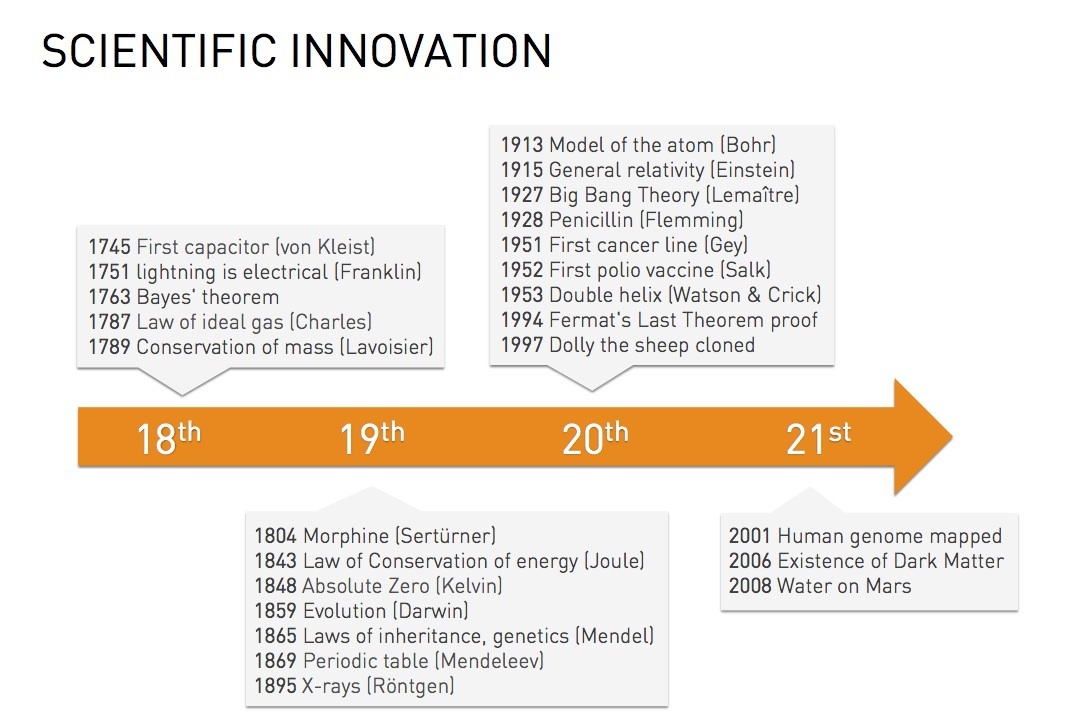

I want to consider two other areas of the idea of opposing monopoly and competition. This confrontation is the essence of my understanding of the business, how to create it, how to evaluate it. It seems to me that this approach allows you to look at the whole history of innovations in technology and science from an unusual angle. We have experienced almost 300 years of incredible technological progress in a wide variety of industries. From steam engines to railways, telephones, refrigerators and household appliances, the computer revolution, airplanes - technological innovations in all areas of activity. About the same thing can be said about science - over hundreds of years incredible discoveries have been made in science.

It seems to me, thinking about this, many lose sight of the fact that since X and Y [read the discussion of the variables X and Y inparts 1 ] are independent variables, some of these innovations can be incredibly valuable, but those who think of them may not receive rewards for them. So back to the beginning [of the lecture]: you need to increase the value of the company to X dollars, of which you will get Y percent of X. It seems to me that in the history of science the value of Y was almost always zero, scientists never earned anything [from the results of their work ]. They are constantly deceived by the thought that they live in a world that will itself reward them for their work and inventions. This is probably the fundamental fallacy that scientists in our society are forced to suffer.

Even in the technology industry, there are many different areas in which outstanding innovations have been created that have provided invaluable services to society, but have not brought any value to their creators. The whole history of science and technology can be stated from the perspective of how much value this or that discovery could give. Certainly, in this industry there are entire sectors in which work did not give scientists anything at all.

You can be the smartest physicist of the twentieth century, create a general and special theory of relativity, and at the same time not only become a billionaire, but even a millionaire. For some reason, this approach [in science] simply does not work. Railways were incredibly valuable, but railroad companies went broke due to excessive competition. The Wright brothers, who made their first flight on an airplane, earned nothing. It seems to me that with regard to this issue it is extremely important to understand the structure of these industries.

Take a look at this gap in the last 250 years

Almost none of the scientists during this period earned anything - neither in the field of science, nor in the field of technology. Very few managed to profit from their work. At the end of the 18th - beginning of the 19th centuries, the first industrial revolution took place at weaving mills, steam engines and production automation appeared. Technology is constantly improving - the efficiency of textile mills and production as a whole is growing by 5-7% annually, year after year, decade after decade.

All 70 years from 1780 to 1850 there has been a continuous improvement in production. But even in the 1850s, most capital in Britain was owned by aristocrats, and the workers practically did not earn. Strange as it may seem, capitalists at that time also received relatively little, almost all of the funds went into competition. Hundreds of people controlled the weaving factories; in this industry, the competition structure did not allow people to earn money.

In the entire history of the last 250 years, in my opinion, there are only two large areas in which people created innovations and made profit from them. One of them is a kind of vertically integrated complex monopolies, within the framework of which the second industrial revolution of the late XIX - early XX century was realized. These are companies like Ford.

There were vertically integrated oil companies, such as Standard Oil, and all these vertically integrated monopolies needed very complicated coordination, many elements had to be adjusted to each other, but if you succeeded, you got an incredible competitive advantage. Now this is practically not happening, but it seems to me that such a business format is of great value - unless, of course, the company's management is able to implement it. This format is also extremely costly.

All 70 years from 1780 to 1850 there has been a continuous improvement in production. But even in the 1850s, most capital in Britain was owned by aristocrats, and the workers practically did not earn. Strange as it may seem, capitalists at that time also received relatively little, almost all of the funds went into competition. Hundreds of people controlled the weaving factories; in this industry, the competition structure did not allow people to earn money.

In the entire history of the last 250 years, in my opinion, there are only two large areas in which people created innovations and made profit from them. One of them is a kind of vertically integrated complex monopolies, within the framework of which the second industrial revolution of the late XIX - early XX century was realized. These are companies like Ford.

There were vertically integrated oil companies, such as Standard Oil, and all these vertically integrated monopolies needed very complicated coordination, many elements had to be adjusted to each other, but if you succeeded, you got an incredible competitive advantage. Now this is practically not happening, but it seems to me that such a business format is of great value - unless, of course, the company's management is able to implement it. This format is also extremely costly.

Our modern culture forms people who are very difficult to get involved in complex tasks, the implementation of which also requires a lot of time. When I think about my colleague and friend Elon [Mask] - from PayPal to Tesla and SpaceX, it seems to me that the key to the success of these companies was to create a complex vertically integrated monopoly structure.

Take a look at Tesla or SpaceX: is the [success] of these companies the result of a single [technological] breakthrough? These companies have developed innovations in several industries at once, and I do not think that their success is due, say, to a single achievement in a tenfold increase in battery power. They can work, for example, on rocket science, but we are not talking about one single innovative breakthrough. What really impresses is how all these processes are integrated there, as well as how they are included in the overall vertical structure, which most competitors do not have.

Tesla integrated car distributors into their business - they are ready to share their success, which the rest of the US car market does not do. And SpaceX, for example, includes all subcontractors, while most other aerospace companies use the services of subcontractors from a single structure that receives monopoly profits from this and does not allow aerospace companies to earn money on their own. Therefore, vertical integration, in my opinion, is a characteristic of technological progress, which has not yet been fully studied, and which is definitely worth a closer look.

[The second direction over the past 250 years, in which the creators of innovations have the opportunity to profit from them - software]. It seems to me that the very essence of software has a very powerful potential [for the formation of monopolies]. The software allows you to save on scale, marginal costs in the process of its creation are extremely small, and the world of zeros and ones can be somewhat opposed to the world of atoms - in the world of bits, the adoption of new technologies is very fast.

Rapid adoption of innovations is crucial for entering and capturing the market, because the low speed of accepting your product, even in a small market, will allow others to take time and enter the same market with competing products. And if, on the other hand, your market is small or medium, and you have a fast rate of acceptance of your product by the audience, then you can become a leader in this market. That is why, in my opinion, Silicon Valley has become a haven for backbone companies, and software development as a whole has become such a phenomenally successful industry.

I would like you to remember the various explanations that people use to try to find the answer to the question of why some things work and others do not. I think that these explanations become extremely vague when it comes to creating a company worth X dollars and get yourself Y percent from X.

The scientific explanation [of why science is extremely rarely able to commercialize their own invention or discovery], which we are constantly told about, is that scientists are not interested in making a profit. They work “for the benefit of the common good,” so if money is important to you, you are a bad scientist. I do not want to say that people should always be motivated by money, but it seems to me that we should be more critical of such explanations. The question must be asked, but is this explanation an attempt to hide the fact that the Y indicator is zero, and scientists work in a world where all innovations are “burned” under the pressure of competition and it is not possible to take advantage of them?

On the other hand, misconceptions related to the topic of software are usually based on the fact that people make huge fortunes from it, from which we conclude that this is the most valuable thing in the world and the point. Since the creators of Twitter have earned billions, then Twitter must be much more valuable than anything that Einstein did.

This explanation "hides" the fact that X and Y are independent variables, and there are areas of business where the value of X can be extremely large, and those areas where the same indicators cannot be achieved. Therefore, I believe that the history of innovation is a story in which microeconomics and the structure of business sectors have a huge impact on the end result: someone earns a lot of money because they work in the industry with the “right” structure, and someone does not earn anything , because it falls into an overly competitive environment.

It is not worth explaining everything with the help of the errors described above. It is better to try to properly understand the issue. And now I want to return to the main topic of our conversation, to the idea that competition is the lot of losers. This name sounds like a provocation, because we used to think that the loser is the one who could not stand the competition. Losers are those who lagged behind in competitions, those who did a little less than others during the tests, those who studied in less successful schools. We always think of losers as those who cannot compete, but I would like you all to try to rethink and overestimate this state: perhaps the fact of competition dooms us to failure .

The point is not only that we do not fully understand this dichotomy of monopoly and competition. We have already talked about why it is difficult for us to assimilate it - because people lie about the state of their business, and our ideas about it are distorted. The history of innovation explains this dichotomy in its rather strange ways.

It seems to me that the matter is not only in the “blind spot” of our intellect, but also in the “blind spot” of our psychology - we are very attracted to competition, one way or another, we are encouraged that others are doing the same thing as us. The word "monkey" already in the time of Shakespeare meant both primacy and the mode of imitation [cf. "Monkey"] - this has something akin to human nature, it is set to imitate, and this is a very problematic area that needs to be understood, a habit that you must try to overcome.

The question remains of the existence of competition as a form of confirmation [of loyalty to the chosen direction] - we strive to where other people strive. But this is not the "wisdom of the crowd." This does not mean that if many people do the same thing, it is the best confirmation of the value of this activity. It seems to me that when many people do the same thing, often this is a confirmation of their madness. Twenty thousand people annually come to Los Angeles in the hope of becoming movie stars, and about twenty people achieve this.

The Olympic Games are a little better in this regard - you can quickly understand whether you can achieve something in sports or not, so this activity does not lie such a dead weight on society. It seems to me that before Stanford you had experience of non-competitive training. [Figuratively speaking, before Stanford] to compete with classmates in middle and high school was the same for you as to go against people armed with a bow and arrow with a machine gun - this cannot be called competition between equals. The question remains: will there be a point in such competitions in your future life?

Does it make sense in the intensity of this competitive activity as you move from higher education to obtaining scientific degrees? There is a classic quote from Henry Kissinger in which he describes his faculty at Harvard: “Battles were all the more furious the less bets turned out” - he describes higher education, but it starts to seem to you that this is a form of madness.

Why would people fight like crazy if the stakes in the battle are small? This is a description of the logic of the situation: when it is difficult to differentiate yourself from the rest, when objective differences are extremely small, you need to compete violently in order to consolidate a certain kind of uniqueness. Such uniqueness is rather far-fetched than real.

I have my own example.

At one time, I furiously tried to break through "upstairs." In eighth grade, one of my friends wrote to me in a school album: "I know that you will go to Stanford." Four years later, I entered Stanford Law School and then got a job at a large law firm in New York: in this world, everyone who was “outside” this system wanted to get there, and those who were “inside” they wanted to leave it - it was a very strange dynamic, and there I realized that, apparently, this is not the best option for me, and quit after 7 months and 3 days.

My colleagues said that my departure was very encouraging: it seemed to them that this work was a prison, which could not be escaped, although it was only necessary to go out the door and not come back. But many associate such a huge part of their self-consciousness with “victories” in such competitions that in this way they lose focus and cease to understand what is important and valuable to them.

My colleagues said that my departure was very encouraging: it seemed to them that this work was a prison, which could not be escaped, although it was only necessary to go out the door and not come back. But many associate such a huge part of their self-consciousness with “victories” in such competitions that in this way they lose focus and cease to understand what is important and valuable to them.

Competition really makes you better no matter what you compete, because when you compete, you compare yourself with others. So I understand how to surpass those around me, how to make them better than what they are doing, and you will succeed. I do not doubt it, I do not deny it, but often competition is given for a very high price: you stop asking more important questions about what is really important and valuable to you. Therefore, do not try to crawl through the tiny door every time, into which everyone is already breaking - perhaps it makes sense to turn the corner and enter through wide open gates that no one notices. Thank you very much for your attention!

[Audience questions:]

Can you determine whether a business will be a monopoly based on an idea?

Peter: I would say that you should always keep in mind the question: what is the real market for this project? Not “what is customary to say about this market” - you can always tell about it that it is much larger or much smaller than in reality - but “how the market is really doing”. You need to constantly study this issue - in the process you will understand that others often have the prerequisites to seriously distort this information.

Which of the characteristics of the monopolies you listed are applicable to Google?

Peter: Well, first of all, they have a network effect, when it comes to the advertising network, they had their own technology that enabled them to get ahead - they created an algorithm for ranking web pages that was an order of magnitude superior in accuracy to any another search engine. They can economize on scale as part of the technical support of all the capabilities of their projects, and at the moment they have their own brand, so Google has all four characteristics. Perhaps today their own technologies are not so good compared to competitors, but this company had all four components, and probably three and a half out of four are preserved to this day.

Are such features applicable to Palantir and, secondly, [what do you think of] Square?

Peter: There are a number of companies that provide payments from mobile phones. This is Square and PayPal - they differentiate themselves with the help of logos - for some squares, for others - a triangle, and so on. But - if we move away from imitation - when we created Palantir, we focused on the Intelligence Community, which is a small part of the market. We had our own technology, which used a very unusual approach: it was based on the synthesis of a computer and human capabilities, and not on replacing a person with a machine - this, in my opinion, is the dominant Palantir paradigm. So a lot depends on the approach to market assessment and the creation of our own technologies.

What do you think of the lean startup concept?

Peter: So, you want to know what my opinion is about “lean” startups and an iterative approach, in which you get a custom feedback and continue to develop as opposed to creating an overly complex product that can fail.

Personally, I am rather skeptical of the Lean Startup Methodology. It seems to me that truly outstanding companies created much more fundamental improvements, they were very different from everyone else. As a rule, they did not conduct user surveys: people who manage such companies sometimes - not always, of course - suffer from mild forms of Asperger’s syndrome [a disease that has some similarities with autism], so it’s not so easy to influence them, not so easy, guided by the opinions of others, to keep from something that they conceived. I am convinced that we are too fixated on an iterative approach, as on a state [in which you can create a successful company], and we are not trying enough to understand and create a virtual emotional connection with the audience.

I would say that the issue of risk always remains a difficult topic in this regard - often you simply don’t have enough time to avoid the risk. If you are going to take a break to find out what your audience wants, by the time you do this, the train will leave. And of course, in this way there is always the risk of doing something that, in the end, turns out to be neither valuable nor significant. You can, for example, say that a career starting at the Faculty of Law is, on the one hand, a safe path, but in this case, you still face the risk of not doing anything meaningful in life. We must think about risk from different, ambiguous points of view. I think risk is generally a complex concept.

Personally, I am rather skeptical of the Lean Startup Methodology. It seems to me that truly outstanding companies created much more fundamental improvements, they were very different from everyone else. As a rule, they did not conduct user surveys: people who manage such companies sometimes - not always, of course - suffer from mild forms of Asperger’s syndrome [a disease that has some similarities with autism], so it’s not so easy to influence them, not so easy, guided by the opinions of others, to keep from something that they conceived. I am convinced that we are too fixated on an iterative approach, as on a state [in which you can create a successful company], and we are not trying enough to understand and create a virtual emotional connection with the audience.

I would say that the issue of risk always remains a difficult topic in this regard - often you simply don’t have enough time to avoid the risk. If you are going to take a break to find out what your audience wants, by the time you do this, the train will leave. And of course, in this way there is always the risk of doing something that, in the end, turns out to be neither valuable nor significant. You can, for example, say that a career starting at the Faculty of Law is, on the one hand, a safe path, but in this case, you still face the risk of not doing anything meaningful in life. We must think about risk from different, ambiguous points of view. I think risk is generally a complex concept.

Does the fact of entering the market last confirm that the company is forced to compete?

Peter: Yes, a lot depends on the terminology. I would say that there are categories within which some concepts can be very closely related. Monopolies can also be called the first companies to enter the market. You could say that Google was not the first search engine. But on the other hand, they were significantly better than everyone else. They were the first to start ranking pages using automated approaches. Facebook was not the first social network in the world.

My friend Ryd Hoffman, created his own social network in 1997 and named it Social Net - the term “social network” was already laid down in the name of his company 7 years before Facebook. According to their idea, it was supposed to be a virtual cyberspace in which I could be a dog, and someone else - a cat, and we would have different rules for interaction in this alternative virtual reality. Facebook was the first network in which people signed with their real names, and I hope that Facebook will remain the last player in this market. He was the first in this very important direction, although people do not think of this social network as the first of its kind, because they tend to mix these concepts.

My friend Ryd Hoffman, created his own social network in 1997 and named it Social Net - the term “social network” was already laid down in the name of his company 7 years before Facebook. According to their idea, it was supposed to be a virtual cyberspace in which I could be a dog, and someone else - a cat, and we would have different rules for interaction in this alternative virtual reality. Facebook was the first network in which people signed with their real names, and I hope that Facebook will remain the last player in this market. He was the first in this very important direction, although people do not think of this social network as the first of its kind, because they tend to mix these concepts.

If someone has worked for six months at Goldman Sachs and enters Stanford, how can he overestimate his competitive advantage?

Peter: I'm not very good at psychotherapy, so I don’t really understand how to answer this question. There are a lot of rather strange studies that were conducted on people attending business schools - one of them was conducted at the Harvard Business School, where an “anti-Asperger” type of personality is cultivated, where everyone is super-extrovert, have no own convictions, ideas, and have been two years in greenhouse conditions. As a result, most of them are systematically engaged in what is not worth doing - they are trying to catch the outgoing trend. In 1999, everyone wanted to work with Mike Milken, and a few years later he went to prison because of the whole “junk bond” story.

These people were never interested in Silicon Valley or technology experts until the dot-com boom happened. In 2005-2007, they were engaged in real estate, private property and other similar issues. This tendency to accept competition for affirming the value of activity sits very deeply in us. I do not think that in order to avoid this, there is some simple psychological formula. I honestly don’t know what to advise.

To begin with (and this will be only the first ten percent of all your efforts) do not try to underestimate the magnitude of this problem. We always think that this is what others [but not us] are subject to. We think that it affects those who study at Harvard Business School or work on Wall Street, but in fact it affects us all to a very large extent. We constantly think that advertising affects others, all these fools who are ready to buy a television clip, but this advertising to a certain extent - and this degree is quite large - affects all of us, and we need to work hard to overcome this condition.

These people were never interested in Silicon Valley or technology experts until the dot-com boom happened. In 2005-2007, they were engaged in real estate, private property and other similar issues. This tendency to accept competition for affirming the value of activity sits very deeply in us. I do not think that in order to avoid this, there is some simple psychological formula. I honestly don’t know what to advise.

To begin with (and this will be only the first ten percent of all your efforts) do not try to underestimate the magnitude of this problem. We always think that this is what others [but not us] are subject to. We think that it affects those who study at Harvard Business School or work on Wall Street, but in fact it affects us all to a very large extent. We constantly think that advertising affects others, all these fools who are ready to buy a television clip, but this advertising to a certain extent - and this degree is quite large - affects all of us, and we need to work hard to overcome this condition.

[ Translation of the next lecture by Alex Schultz ]