Oil Rows in R

“Price charts are great to predict the past.”

Peter Lynch

I somehow never had a chance to deal with time series in practice. Of course, I read about them and had some idea as part of the training course on how the analysis is generally carried out, but it is well known that what is told in the textbooks on statistics and machine learning does not always reflect the real situation.

Probably, many are watching with interest the pirouettes that the oil price curve produces . The schedule looks chaotic or too regular, and making some predictions on it is a very thankless task. Of course, you can bring down the full power of statistical, economic, mathematical and expert methods into time series, but try to deal with technical analysis - of course, based on R.

When working with normal time series, you can use the standard approach:

There is a very convenient data source - Quandl ; it provides an interface to Matlab, Python, R. For R sufficient to establish a single package:

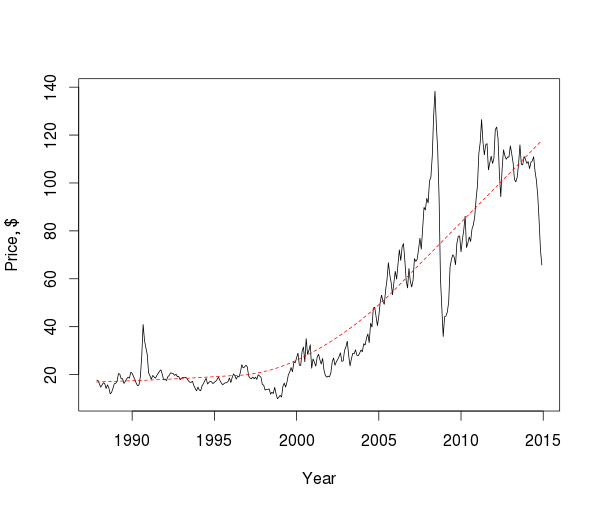

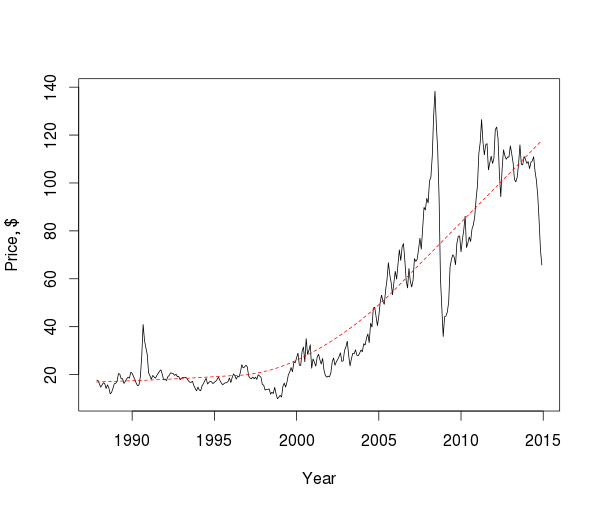

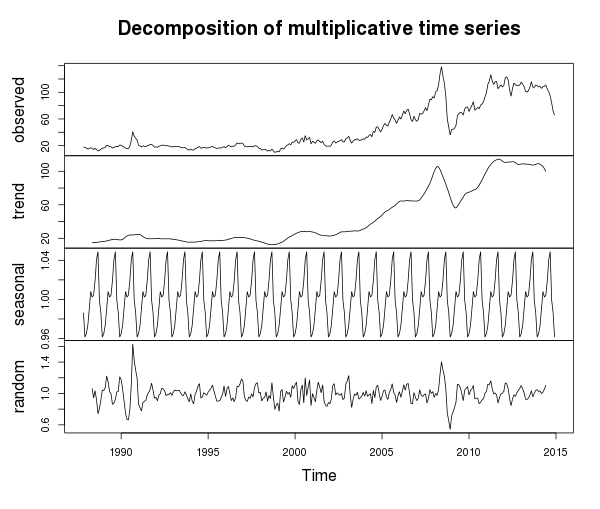

If we consider prices on a decades-wide scale, we can see several peaks and falls and the direction of the trend, but in general it is difficult to draw any significant conclusions, so we examine the components of the series.

Everything seems to be clear with the trend - in the 21st century there has been a steady upward trend until recently (with the exception of interesting years), a number of non - stationary ones - this is proved by the extended Dickey-Fuller test :

On the other hand, with a fairly high degree of certainty, it can be argued that the first-order differences of the series are stationary, i.e. this is an integrated first-order time series (this fact in the future will allow us to apply the Box-Jenkins methodology ).

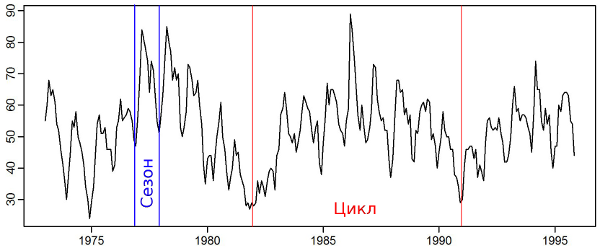

In addition, it turns out that there is also a seasonal component, which is difficult to see on the general chart. If you look closely, in addition to a rather high volatility , you can notice two price hikes during the year (which may be due to increased oil consumption in the winter period and in the holiday season). On the other hand, there is a random component, the weight of which increases especially during critical years (for example, the financial crisis of 2008).

Sometimes it is preferable to work with data after the one-parameter Box-Cox transformation , which allows you to stabilize the variance and bring the data to a more normal form:

As for the most slippery topic, namely extrapolation, the authors of the article “Crude Oil Price Forecasting Techniques: a Comprehensive Review of Literature” note that, depending on the length of the time period, the applicability of the models is as follows:

After all the formalities, we will use the

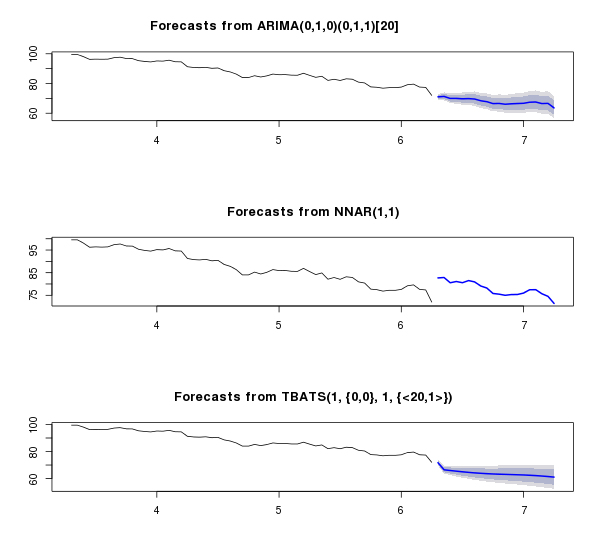

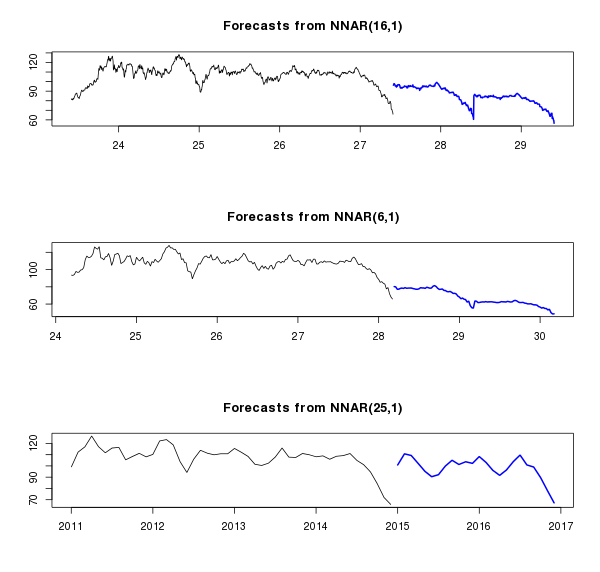

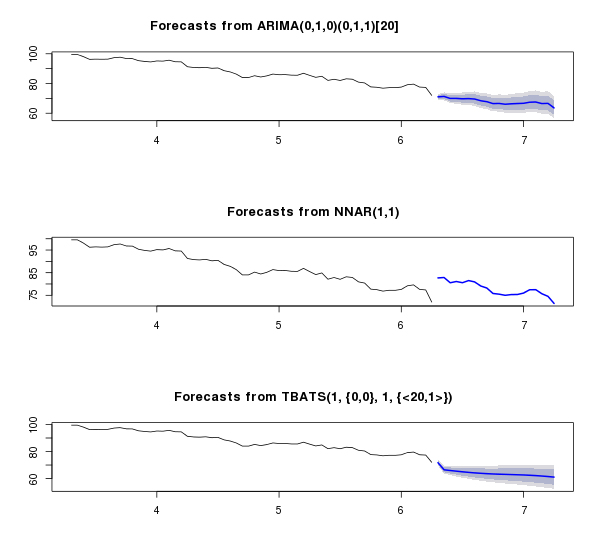

What turned out well in the upper graph is the retraining : the neural network caught the last pattern in the row and began to copy it. On an average chart, the network not only copies the last pattern, but also combines it well with the trend, which gives some realism to the forecast. On the bottom graph it turned out ... some kind of obscure curve. The graphs illustrate well how predictions change depending on data smoothing. In any case, for products with high (for various reasons) volatility, forecasts for such a time period cannot be trusted, therefore, we will immediately turn to the short-term period, and at the same time compare several different models - ARIMA , tbatsand neural network. We will use the data for the last six months and we will especially highlight the month of December in the short.test series for testing purposes.

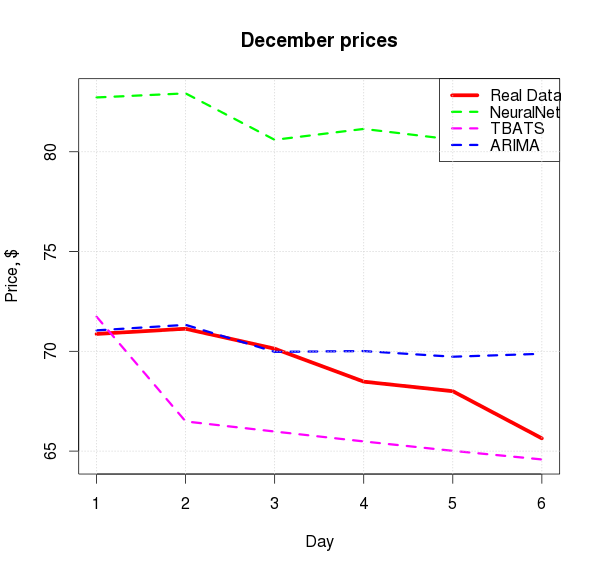

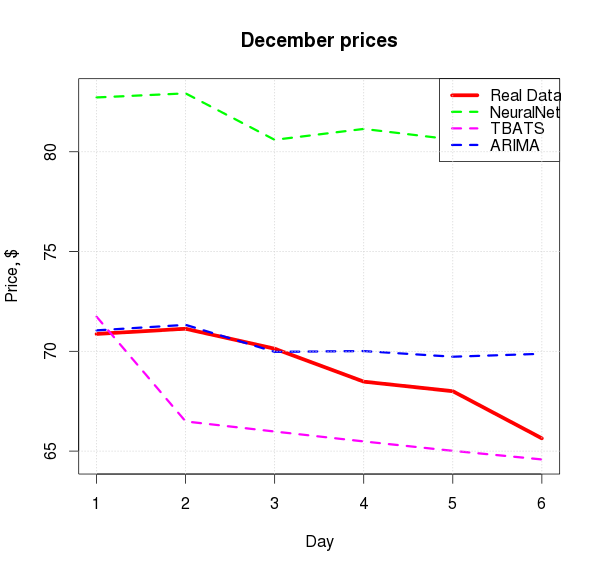

The neural network, having retrained, somewhat went astral, and ARIMA showed a very interesting dependence - interesting in terms of proximity to the real picture. Below is a comparison of the predictions of each model with real data in December and mean absolute percentage error :

I will not comment on long-term forecasts: it is obvious that they are already incorrect and incorrect in this situation. But ARIMA showed very good results for the short term. It is also worth paying attention to the following facts. Oil fell in price:

This seems to hint to us that the process of changing oil prices is far from a process that is regulated by random parameters.

Peter Lynch

I somehow never had a chance to deal with time series in practice. Of course, I read about them and had some idea as part of the training course on how the analysis is generally carried out, but it is well known that what is told in the textbooks on statistics and machine learning does not always reflect the real situation.

Probably, many are watching with interest the pirouettes that the oil price curve produces . The schedule looks chaotic or too regular, and making some predictions on it is a very thankless task. Of course, you can bring down the full power of statistical, economic, mathematical and expert methods into time series, but try to deal with technical analysis - of course, based on R.

When working with normal time series, you can use the standard approach:

- Visual analysis

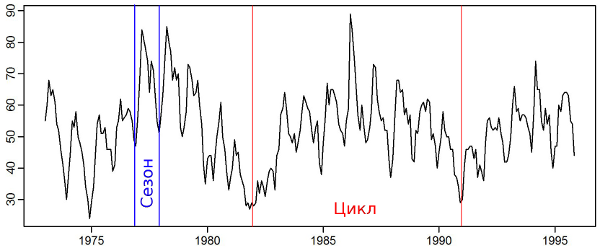

- The expansion of the series and the study of its components: seasonality, cyclicity, trend

- Construction of a mathematical model and forecasting

There is a very convenient data source - Quandl ; it provides an interface to Matlab, Python, R. For R sufficient to establish a single package:

install.packages("Quandl"). I am interested in the Europe Brent Crude Oil Spot Price - the spot price for Brent crude oil (below, three data sets are used in different details).library(Quandl)

oil.ts <- Quandl("DOE/RBRTE", trim_start="1987-11-10", trim_end="2015-01-01", type="zoo")

oil.tsw <-Quandl("DOE/RBRTE", trim_start="1987-11-10", trim_end="2015-01-01", type="zoo", collapse="weekly")

oil.tsm <-Quandl("DOE/RBRTE", trim_start="1987-11-10", trim_end="2015-01-01", type="ts", collapse="monthly")

plot(oil.tsm, xlab="Year", ylab="Price, $", type="l")

lines(lowess(oil.tsm), col="red", lty="dashed")

If we consider prices on a decades-wide scale, we can see several peaks and falls and the direction of the trend, but in general it is difficult to draw any significant conclusions, so we examine the components of the series.

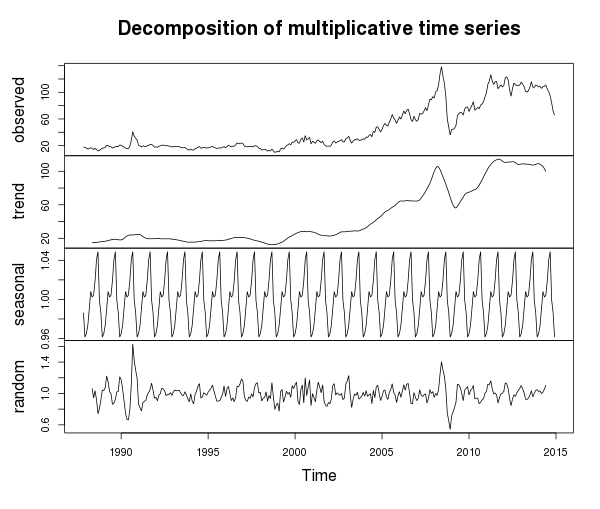

plot(decompose(oil.tsm, type="multiplicative"))

Everything seems to be clear with the trend - in the 21st century there has been a steady upward trend until recently (with the exception of interesting years), a number of non - stationary ones - this is proved by the extended Dickey-Fuller test :

>library(tseries)

>library(forecast)

>adf.test(oil.tsm, alternative=c('stationary'))

Augmented Dickey-Fuller Test

data: oil.tsm

Dickey-Fuller = -2.7568, Lag order = 6, p-value = 0.2574

alternative hypothesis: stationary

On the other hand, with a fairly high degree of certainty, it can be argued that the first-order differences of the series are stationary, i.e. this is an integrated first-order time series (this fact in the future will allow us to apply the Box-Jenkins methodology ).

>adf.test(diff(oil.tsm), alternative=c('stationary'))

Augmented Dickey-Fuller Test

data: diff(oil.tsm)

Dickey-Fuller = -8.0377, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

> ndiffs(oil.tsm)

[1] 1

In addition, it turns out that there is also a seasonal component, which is difficult to see on the general chart. If you look closely, in addition to a rather high volatility , you can notice two price hikes during the year (which may be due to increased oil consumption in the winter period and in the holiday season). On the other hand, there is a random component, the weight of which increases especially during critical years (for example, the financial crisis of 2008).

Sometimes it is preferable to work with data after the one-parameter Box-Cox transformation , which allows you to stabilize the variance and bring the data to a more normal form:

L <- BoxCox.lambda(ts(oil.ts, frequency=260), method="loglik")

Lw <- BoxCox.lambda(ts(oil.tsw, frequency=52), method="loglik")

Lm <- BoxCox.lambda(oil.tsm, method="loglik")

As for the most slippery topic, namely extrapolation, the authors of the article “Crude Oil Price Forecasting Techniques: a Comprehensive Review of Literature” note that, depending on the length of the time period, the applicability of the models is as follows:

- for the medium and long term, non-linear models are more suitable - the same neural networks, reference vector machines;

- for the short term, ARIMA often outperforms neural networks.

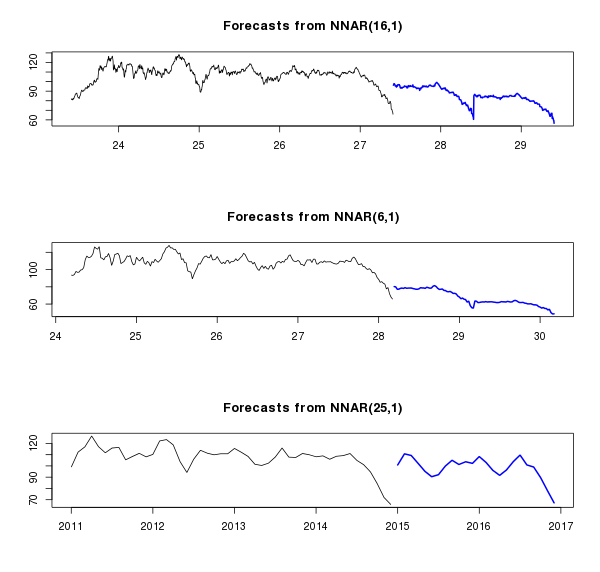

After all the formalities, we will use the

forecastfunction just present in the package nnetar(), with which you can build a neural network model of the series without unnecessary difficulties. At the same time, we will do this for three series - from more detailed (by days) to less detailed (by months). At the same time, let's see what will happen in the medium term - for example, over 2 years (this is shown in blue on the charts).Hidden text

# Fit NN for long-run

fit.nn <- nnetar(ts(oil.ts, frequency=260), lambda=L, size=3)

fcast.nn <- forecast(fit.nn, h=520, lambda=L)

fit.nnw <- nnetar(ts(oil.tsw, frequency=52), lambda=Lw, size=3)

fcast.nnw <- forecast(fit.nnw, h=104, lambda=Lw)

fit.nnm <- nnetar(oil.tsm, lambda=Lm, size=3)

fcast.nnm <- forecast(fit.nnm, h=24, lambda=Lm)

par(mfrow=c(3, 1))

plot(fcast.nn, include=1040)

plot(fcast.nnw, include=208)

plot(fcast.nnm, include=48)

What turned out well in the upper graph is the retraining : the neural network caught the last pattern in the row and began to copy it. On an average chart, the network not only copies the last pattern, but also combines it well with the trend, which gives some realism to the forecast. On the bottom graph it turned out ... some kind of obscure curve. The graphs illustrate well how predictions change depending on data smoothing. In any case, for products with high (for various reasons) volatility, forecasts for such a time period cannot be trusted, therefore, we will immediately turn to the short-term period, and at the same time compare several different models - ARIMA , tbatsand neural network. We will use the data for the last six months and we will especially highlight the month of December in the short.test series for testing purposes.

Hidden text

# Fit ARIMA, NN and ETS for short-run

short <- ts(oil.ts[index(oil.ts) > "2014-06-30" & index(oil.ts) < "2014-12-01"], frequency=20)

short.test <- as.numeric(oil.ts[index(oil.ts) >= "2014-12-01",])

h <- length(short.test)

fit.arima <- auto.arima(short, lambda=L)

fcast.arima <- forecast(fit.arima, h, lambda=L)

fit.nn <- nnetar(short, size=7, lambda=L)

fcast.nn <- forecast(fit.nn, h, lambda=L)

fit.tbats <-tbats(short, lambda=L)

fcast.tbats <- forecast(fit.tbats, h, lambda=L)

par(mfrow=c(3, 1))

plot(fcast.arima, include=3*h)

plot(fcast.nn, include=3*h)

plot(fcast.tbats, include=3*h)

The neural network, having retrained, somewhat went astral, and ARIMA showed a very interesting dependence - interesting in terms of proximity to the real picture. Below is a comparison of the predictions of each model with real data in December and mean absolute percentage error :

Hidden text

par(mfrow=c(1, 1))

plot(short.test, type="l", col="red", lwd=5, xlab="Day", ylab="Price, $", main="December prices",

ylim=c(min(short.test, fcast.arima$mean, fcast.tbats$mean, fcast.nn$mean),

max(short.test, fcast.arima$mean, fcast.tbats$mean, fcast.nn$mean)))

lines(as.numeric(fcast.nn$mean), col="green", lwd=3,lty=2)

lines(as.numeric(fcast.tbats$mean), col="magenta", lwd=3,lty=2)

lines(as.numeric(fcast.arima$mean), col="blue", lwd=3, lty=2)

legend("topright", legend=c("Real Data","NeuralNet","TBATS", "ARIMA"),

col=c("red","green", "magenta","blue"), lty=c(1,2,2,2), lwd=c(5,3,3,3))

grid()

Hidden text

mape <- function(r, f){

len <- length(r)

return(sum( abs(r - f$mean[1:len]) / r) / len * 100)

}

mape(short.test, fcast.arima)

mape(short.test, fcast.nn)

mape(short.test, fcast.tbats)

| ARIMA | NNet | TBATS |

| 1.99% | 18.26% | 4.00% |

Instead of a conclusion

I will not comment on long-term forecasts: it is obvious that they are already incorrect and incorrect in this situation. But ARIMA showed very good results for the short term. It is also worth paying attention to the following facts. Oil fell in price:

- for September by 5%;

- for October - by 10%;

- in November - by 15%;

- for December ...?

This seems to hint to us that the process of changing oil prices is far from a process that is regulated by random parameters.