MAU for Apple

- Transfer

In the post-modern world of computer technology in which we live, success is measured not by the level of income or profit, not by the number of units sold, but by the number of users that the company’s ecosystem is able to attract. For this, now, as a rule, they use the indicator of the number of monthly active users (Monthly Active User - MAU).

I will give some examples:

- According to Facebook, the MAU for their messenger is 200 million.

- The number of monthly active WhatsApp users is 500 million, of which 48 million live in India.

- According to the company, last month [ original article dated April 2014 - approx. perev. ] Line users (both active and inactive) reached 400 million.

- WeChat has 355 million monthly active users.

- Each month, Viber is actively used by 105 million users.

Startups summarize all these millions of active monthly users to get an estimate of the value of the company to attract investment [1]. The faster the growth of the MAU, the more “successful” the company is considered.

When companies are acquired, it is customary to divide their sales value by MAU to get an idea of how much each user costs. They do this because the company has no income that could be measured - instead, they take the MAU indicator. However, the process by which the MAU is converted into dollars of revenue is, to put it mildly, indirect.

For the majority (or maybe for everyone?) It is still unclear how this happens, especially since not all monthly active users are equal and their loyalty is very changeable. If we took into account all the planned income from each active monthly user, then most likely we would get an absurd result. In fact, at the moment, the above listed companies do not receive any income directly from their services.

Despite the violation of the unspoken agreement, somecompanies manage to profit from their users. Among these companies, for example, are Apple and Amazon. According to Apple, in the last quarter the number of accounts in iTunes reached 800 million [2]. They cannot be considered active monthly users, since their activity has not been tracked, but we have an idea of how much is spent on iTunes and other services. In addition, Amazon cites a figure of 244 million monthly active users, taking into account only those accounts from which the last twelve months of purchase were made.

This allows us to compare Apple and Amazon in the course of the study regarding the number of accounts, income from one account, even the profitability of each account.

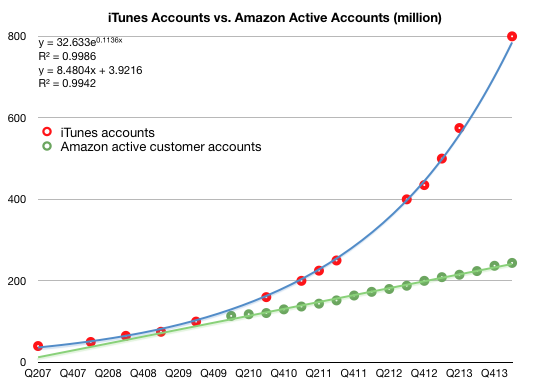

All this is shown in the graphs below. First, the total number of accounts:

Please note that I added trend lines to both charts and their formulas.

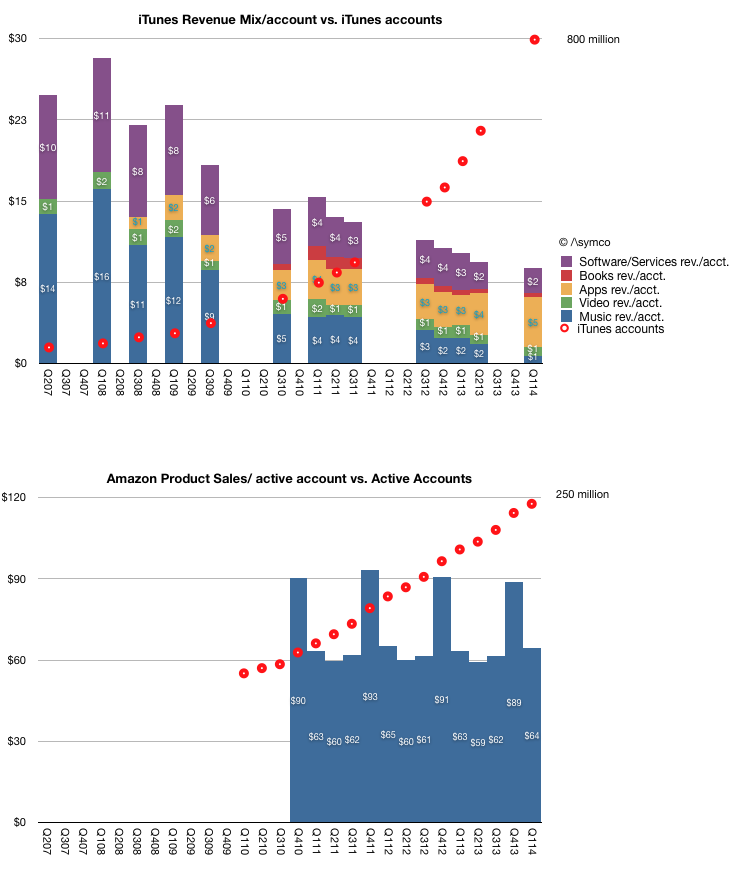

The graphs below show the revenue figures from each account for iTunes (which further break down according to the revenue from each iTunes segment) and for Amazon. Note that the scale on the y-axis is different.

This review demonstrates how the economic value of users can vary. In the case of Apple, the company is expanding its user base (literally) exponentially. The revenue indicator for each user, for obvious reasons, is reduced. This is because new / recent users do not spend as much as old ones. Perhaps, in the later stages of use, the indicator of income from each consumer is somewhat more stable. Another interesting point regarding iTunes data is how in various revenue items music has given way to applications and services. This shows how users can navigate between different sources of revenue in the long run.

As for Amazon, here the company is increasing the contingent of its base users linearly (pay attention to alignment). The revenue per user is still very stable.

If you do not go into details, it may seem logical that the growth rate of the number of users has an effect on the quality of these users. This relationship should lead to further reflection on the quality of hundreds of millions of users attracted over several months.

The growing number of Apple users is a function of expanding the company's portfolio of devices and their distribution. Apple has already shown that there is a limit to this type of growth. IOS device sales reached 830 million or so in seven years. And this is an amazing achievement. You can forgive them that they did not manage to cross the threshold of a few billion more, because they managed to earn income not from the number of units sold, but due to the quality of hardware and service / content, unlike most of those who sold more units for a shorter time, but for whom the rate of revenue for each user remains significantly lower.

The growing number of Amazon users is a function of expanding the range of logistics and merchandising. This is also not easy to do globally. It must be assumed that Amazon simply cannot expand exponentially, like Apple or other MAU aggregators, because it has to depend on trucks, roads and rules to carry out most of its trading transactions.

In conclusion, I will assume that there are no “right” or “wrong” business models for the formation of the basic contingent of consumers. Both Apple and Amazon are doing business successfully, building their user base and building trust that will serve them well in the future. However, although there is no right or wrong revenue structure for each user, it seems to me that such a structure should be. In most cases, this remains a matter of devotion, not objective reason.

[1] - it is believed that with a MAU of 10 million users, funding is difficult to obtain.

[2] - For an unknown reason, Apple adds that most of them are credit card holders.