Tips for startups from Y Combinator: explore "toy" markets

- Transfer

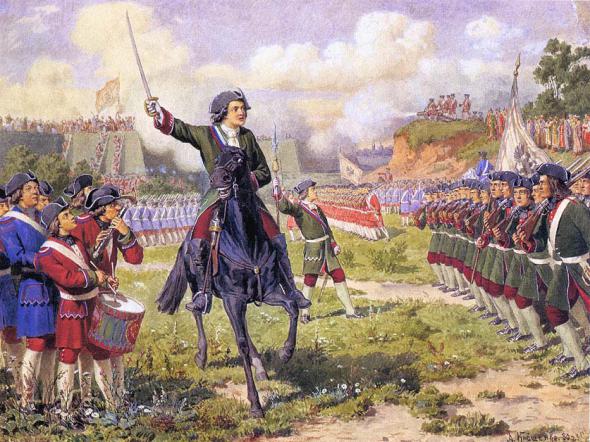

Alexei Kivshenko, "The War Games of the comical troops of Peter the Great near the village of Kozhukhovo." 1882. ( Wikimedia )

Many of the largest companies in the world started out on such small markets that they looked like toys. Over time, each of these companies grew in their markets or created new ones to take a leading position. Despite this, the founders spend time trying to demonstrate that the markets they are aimed at are already huge.

It is clear that the founders will focus on how large their markets are. It is much easier to say that a steeper product will overwhelm the market position of the industry leaders on the static market rather than claiming that something completely new will create or change the market. The first argument is based on logic. The second argument requires faith.

Founders often dissuade themselves from creating new things, because they cannot fully understand the answer to the question “ how big will it be ?” Founders who move forward and build a product without a clear answer to this question are often stopped by investors.

Investors need to know how important it is to bet on toy markets. These are the people who have learned over and over again that the largest companies first look like toys.

Amazon was created to sell books on the Internet, when a relatively small number of people used it. Google was a search engine whose foundation was filled with search engines that were not themselves gigantic enterprises. Ebay was created for the sale of Beanie Babies dolls ("bean kids").

Unfortunately, investors who have achieved similar successes are prone to belated judgments. Now the markets are so large that it is difficult to remember that from the very beginning they were certainly not as such. It is easier for the main investor to pretend that they knew from the very beginning how big something would become, and not to admit that it was a risky venture. At the same time, it is difficult for new investors to believe that markets can grow as fast as they are growing now.

Founders also need to overcome investor's aversion to risk. The idea is that investors are not punished by their bosses or senior partners for what everyone else is doing. When no one else wants to finance social networks, financing one of the social networks is a big risk. If an investor makes a big bet on it, and it does not justify itself, the investor will look stupid because he has done something crazy. An investor may be dismissed or will not be able to attract another fund.

On the other hand, if an investor finances a social network, while no one else will do it, and this company will cost tens or hundreds of billions of dollars, the investor is called great and extraordinary. Many major investors do not want to risk their reputation in this way. Many new investors are unwilling to risk their future careers at such speculative rates.

Founders in toy markets who want to raise money must find the right investors and tell these investors the right story. Finding investors is just a matter of talking to many of them, to find out which of them is optimistic and has the confidence to place bets. Familiarizing yourself with their past investments can help. As soon as the founder finds a suitable investor, there are two different types of stories that can be used to tell how a toy market can become huge: "Adjacent and behavioral change."

Adjacency

Arguments in favor of adjacency are an easier way. The founders describe how their product will dominate a small but valuable set of customers. Once the company gains dominance in this area, it can use this niche as a base to capture another, larger set of users who share characteristics with the original group. The company can repeat it again and again until the actual market in which it operates is huge.

Uber seems to be a good example of this method. At the beginning, Uber was just the way to order a black car on demand. This is a market, but it is not huge. Over time, Uber began to expand, and the real ambitions of the founders were revealed - they wanted to handle all the options for travel on unmarked directions. They did this by moving to adjacent markets: black cars, inactive cars, logistics, international markets, trucks and autonomous vehicles.

Behavior change

Behavior change is a more radical step. It works like this: “There is no market for what I build. However, by creating my own company, I am going to change the way people live. By doing this, I create innumerable demands for what I have created, and as a result I get huge benefits. ”

This is the foundational story of Standard Oil, AT & T, GE, Apple, Google and Facebook. To tell a story of this kind as a founder is not so much a demonstration of evidence, as much as an appeal to faith.

Most of the arguments for behavioral change change significantly over time [ For example, one of Facebook’s early major bets for the future was Wirehog: en.wikipedia.org/wiki/Wirehog]. This is normal. What matters is that the founders determine exactly what will change and are flexible enough to manage the change they create. GE for much of its existence was much more than light bulbs.

Companies that are huge now rarely focus on one story or another. Usually, companies that start as adjacent companies that have relied on, change the behavior of users, and companies that change behavior find new customers in unexpected places. It makes sense to consider both sides of this equation, but, at least from the very beginning, it is better to focus either on one model or on the other.

Stock markets

While most successful startups that provide one of these arguments will ultimately attract large sums of money, the market situation in terms of mobilizing financial resources for setting up a company can have a big impact on its path. One of the weird things happening in the startup world is the ever-increasing amount of capital available to them at all stages of life. This seems to reinforce the danger of markets that everyone thinks too much about, as the founders and investors try to justify the large amounts of investment and the pricing that goes with them.

This infringes upon the founders. An early stage company targeting the toy market does not need a lot of money to start proving that it can either change behavior or dominate a niche. This entails a lower set of expectations at each stage, which is easier to meet, which leads to better growth, which leads to more effective participation of the founders over time.

In contrast, an early stage company focusing on a gigantic initial market — say, insurance — usually has to attract a huge amount of money compared to a progressing company so that founders can ensure that they can compete with well-funded employees who will definitely notice them and try crush. This leads to higher expectations at each stage and a decrease in shareholder equity in the distribution of net income along the way. This is worse for the founders and to maximize the chances of success.

Perfect balance

It would be nice if there was a generally accepted basis for assessing the “optimality” of the market for a startup. This will allow each player in the system to easily map the path from the toy market to the market adapted to the masses. It would also be a bit boring, since creating a startup would no longer require the use of imagination.

Imagination is a necessary feature that allows founders to see how something small can become something big. This is what investors need to believe in a founder who figures out how to build something that does not exist.

The best founders present their own framework for the success of their companies and convince everyone around them that they are right. They use some combination of adjacency and the ways in which they change behavior to succeed. They adapt both to the changes in the market that they catalyze and to those that are being introduced by competitors. These scripts never look the same twice, and from the very beginning they will never be obvious.

Accepting applications to the Filtech-accelerator extended until September 27.

Theme: “Aging: Technological Solutions to a Social Problem” - how to solve social, economic and cultural problems associated with the aging of humanity with the help of technology.

About #philtech

#philtech (технологии + филантропия) — это открытые публично описанные технологии, выравнивающие уровень жизни максимально возможного количества людей за счёт создания прозрачных платформ для взаимодействия и доступа к данным и знаниям. И удовлетворяющие принципам филтеха:

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку

1. Открытые и копируемые, а не конкурентно-проприетарные.

2. Построенные на принципах самоорганизации и горизонтального взаимодействия.

3. Устойчивые и перспективо-ориентированные, а не преследующие локальную выгоду.

4. Построенные на [открытых] данных, а не традициях и убеждениях

5. Ненасильственные и неманипуляционные.

6. Инклюзивные, и не работающие на одну группу людей за счёт других.

Акселератор социальных технологических стартапов PhilTech — программа интенсивного развития проектов ранних стадий, направленных на выравнивание доступа к информации, ресурсам и возможностям. Второй поток: март–июнь 2018.

Чат в Telegram

Сообщество людей, развивающих филтех-проекты или просто заинтересованных в теме технологий для социального сектора.

#philtech news

Телеграм-канал с новостями о проектах в идеологии #philtech и ссылками на полезные материалы.

Подписаться на еженедельную рассылку